Wilcon Depot, Inc. (PSE:WLCON) conveyed confidence in exceeding its store network expansion target this year, despite potential hurdles that could hinder its growth trajectory.

Per a disclosure sent to the Philippine Stock Exchange on Monday, the company clarified its possibility of surpassing the goal of opening eight to 10 new stores in 2023, despite the expectation of subdued growth.

This information was shared during the company’s annual stockholders’ meeting.

The retailer of home improvement products emphasized its reliance on a strong foundation, evident from its impressive financial performance in 2022.

During the said year, its net income witnessed a substantial 50.2% increase compared to the previous year, reaching P3.85 billion, driven by elevated sales across its Metro Manila branches.

Despite the challenges posed by inflation, which burdened the Filipino population in 2022, consumer spending exhibited resilience, contributing to the robust domestic economy.

Furthermore, Wilcon expressed its intention to prioritize the establishment of more depot-formats in the medium-term, redirecting attention from smaller store formats scheduled to open in the forthcoming years.

This strategic direction became apparent in their disclosure, where they acknowledged the relaxation of mobile restrictions that would facilitate heightened expenditure on home improvements.

Nevertheless, as outlined in the disclosure, the company maintains its steadfast commitment to expanding its store networks, underscoring its long-term vision and dedication to adapting store formats and merchandise offerings to cater to diverse markets.

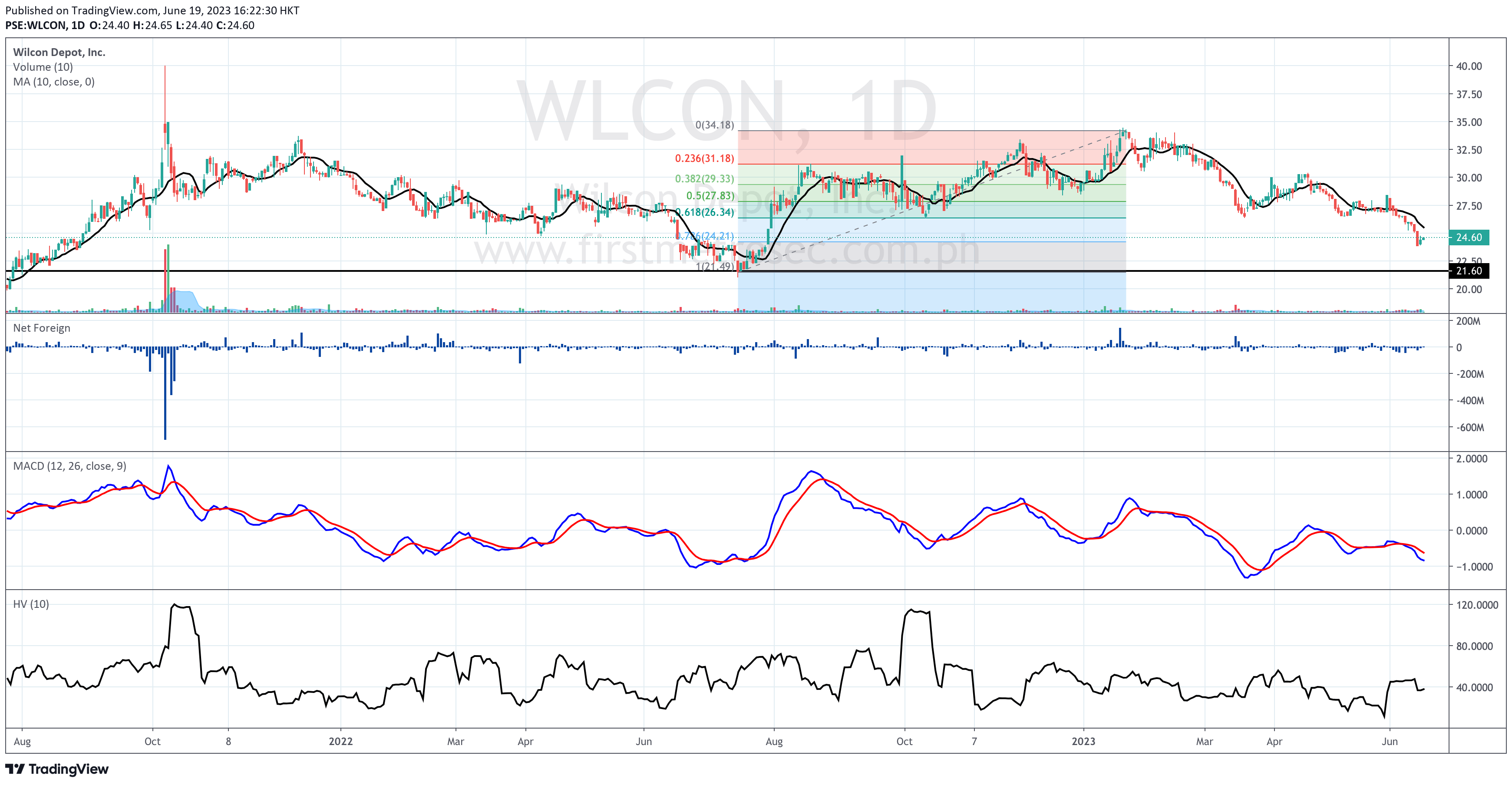

Wilcon Depot (PSE:WLCON) closed on June 19, 2023 at P24.60 per share, up by 0.82%.

However, it is down by 16.61% year-to-date.

PSE:WLCON managed to recover above its immediate support at P24.20, confluent with the 78.6% Fibonacci retracement.

Resistance is at P26.34, aligned with the 61.8% Fibonacci retracement.

Today’s volume is below 50% of WLCON’s 10-day volume average, signifying today’s ascent is less likely to continue by the next trading day.

Foreign investors registered a net foreign selling worth P1 million. Today’s the 12th consecutive Net Foreign Selling Day of WLCON.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025