Security Bank Corp. aims to bolster its funding base and support lending activities by reentering the domestic bond market. Their strategy involves issuing fixed-rate peso bonds, aiming to raise at least P8 billion.

The bank’s fundraising endeavor includes an oversubscription option under the broader P100-billion peso bond and commercial papers program.

These peso bonds will be offered with a fixed interest rate of 6.4250 percent per annum and a term of 1.5 years. Interested investors can participate in the bond offering until July 7, and the bonds will subsequently be listed on the Philippine Dealing and Exchange Corp. on July 13.

Security Bank has selected Philippine Commercial Capital Inc. (PCCI) as the exclusive book-runner to manage and oversee this initiative. SB Capital Investment Corp. and PCCI will collaborate as joint lead arrangers and selling agents.

In the preceding year, Security Bank successfully raised P30.6 billion through two separate issuances in the domestic bond market.

The initial issuance in July involved fixed-rate bonds worth P16 billion with a maturity date in 2024. This was followed by another issuance of P14.6 billion in November.

During the first quarter of the present year, Security Bank witnessed an 11 percent decline in earnings, amounting to P2.4 billion, compared to the corresponding period in the previous year, which reported earnings of P2.7 billion.

This decrease was primarily attributed to allocating higher provisions for potential loan losses.

Despite a six percent growth in total revenues during the first quarter, the bank faced a 12 percent surge in operating expenses, primarily driven by investments in manpower and technology.

From January to March of the ongoing year, the provision for credit losses reached P616 million, marking a 7.7-fold increase compared to the P80 million recorded during the same period in the previous year.

Notwithstanding the increased provisions, Security Bank consistently improved its gross non-performing loan (NPL) ratio, which declined from 3.65 percent to 3.12 percent over the year.

Furthermore, the NPL reserve cover rose from 90 percent to 99 percent.

The bank’s loan book experienced a marginal growth of five percent, reaching a total of P489 billion, while its deposit base amounted to P525 billion.

The total assets of the Security Bank saw a substantial 12 percent increase, reaching a value of P794 billion, with shareholders’ capital rising by five percent to reach P128.7 billion.

With a history of 72 years, the bank presently operates 316 branches alongside 663 ATMs, cash recycler machines, and cash acceptance machines.

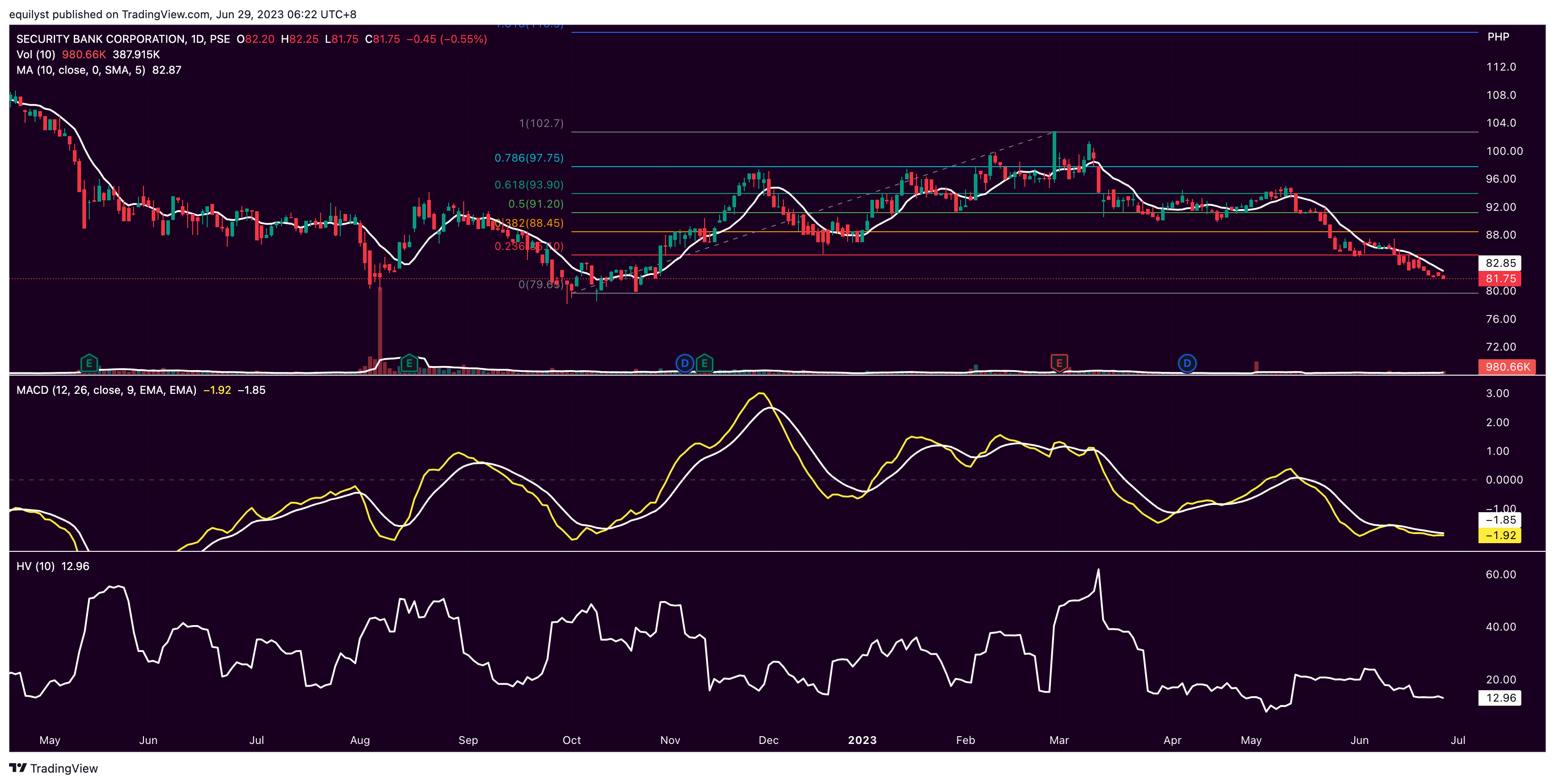

PSE:SECB closed on Tuesday at P81.75 per share, down by 0.55%. It’s also down by 6.03% year-to-date and down by 20.48% from its intrayear high of P102.80.

The stock has been trading below its 10-day simple moving average for 13 consecutive trading days. In the same way, it’s been bearishly moving below its moving average convergence divergence for more than a week already.

PSE:SECB’s risk-level remains relatively low relative to its 10-day historical volatility score of nearly 13% due to the absence of huge engulfing candlesticks and price gaps over the past few trading days.

Be a PLATINUM client of Equilyst Analytics to get an in-depth technical analysis of PSE:SECB with recommendations relative to your entry price, average cost, initial reasons for buying the stock, and risk tolerance percentage.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025