Puregold Price Club Inc. (PSE:PGOLD) has successfully acquired multiple DiviMart supermarkets to convert additional locations into their own chain of grocery stores.

This significant development was disclosed to the Philippine Stock Exchange on Wednesday.

The acquisition comprises 14 DiviMart supermarkets, encompassing various assets like leasehold improvements, furniture, fixtures, equipment, and inventory.

DiviMart, a well-established Filipino supermarket chain founded in 1989 by Harry Uy and Vivian Ong Juanitas, currently operates 30 branches nationwide.

By acquiring DiviMart, Puregold gains access to all existing supermarket locations, allowing for the potential transformation of these sites into Puregold stores through a sublease transaction.

Furthermore, Puregold is evaluating an additional 18 DiviMart locations, exploring the possibility of converting them into Puregold stores.

These prospective store conversions are scattered across regions, including Bulacan, Bataan, Nueva Ecija, Olongapo City, Rizal, Laguna, Manila, and Cavite.

The disclosure indicates that the parties involved are still in the process of finalizing the specific terms and conditions of the transaction.

This involves comprehensively evaluating store locations, improvements, furniture, fixtures, equipment, and merchandise inventory.

Notably, Puregold underscored that the transaction constitutes less than 10% of the company’s book value.

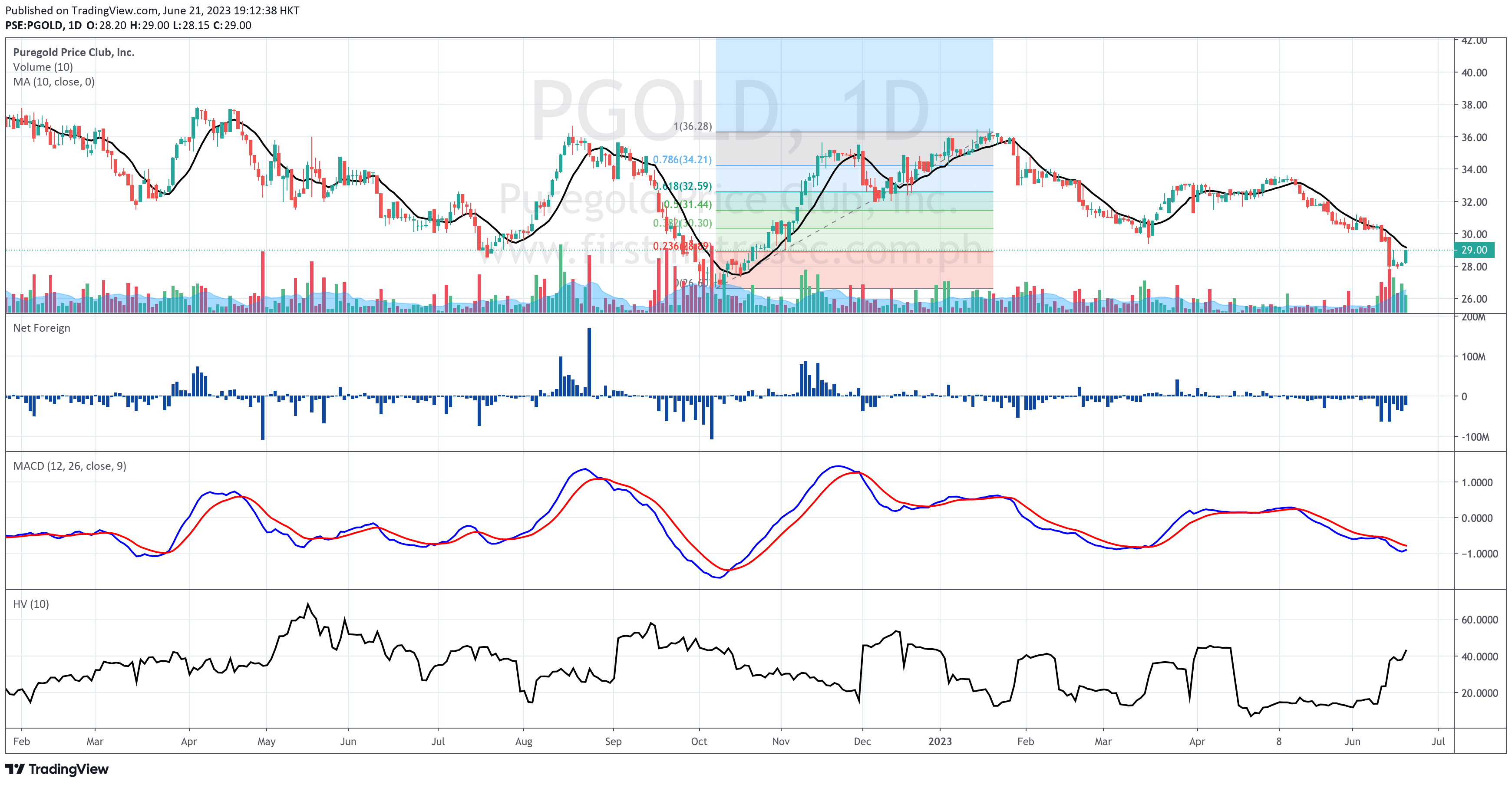

As of closing on Wednesday, June 21, 2023, PGOLD closed P29.00 per share, up by 2.84%.

The foreign investors registered a net foreign selling worth P21.3 million despite this acquisition. PGOLD has been experiencing daily net foreign selling for 30 consecutive trading days.

PGOLD’s support is at P28.90, aligned with the 23.6% Fibonacci retracement. Resistance is at P30.30, confluent with the 38.2% Fibonacci retracement.

Based on its 10-day historical volatility score, its risk level remains low. However, our Evergreen Strategy (our proprietary investment methodology) is yet to issue a confirmed buy signal.

For more assistance in planning your entry or managing your present holdings on PGOLD, check our stock market consultancy service here.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025