Alliance Global Group Inc. (PSE:AGI) is gearing up for expansion as it aims to boost its hotel capacity to accommodate 11,000 rooms by 2028.

The company’s objective involves the addition of six new hotels under the Megaworld Hotels & Resorts brands.

According to Kevin Tan, the CEO of AGI, the company retains its position as the leading player in the Philippine tourism sector.

Tan highlighted the surge in domestic and international tourism, resulting in high occupancy rates and improved average daily room rates for their hotels.

The tourism segment now represents 20 percent of AGI’s business, experiencing growth from around 16 percent five years ago.

AGI presently operates 19 hotel properties across the Philippines, encompassing both international and home-grown establishments, providing approximately 7,500 rooms.

Through this expansion, AGI aims to strengthen its dominant market presence in the fast-growing Philippine tourism sector, solidifying its position as the country’s largest hotel developer and operator.

A subsidiary of AGI, Travelers International Hotel Group, manages six international hotel brands, including Marriott Hotel, Hilton Hotel, Sheraton Hotel, Hotel Okura, and Holiday Inn Express in Pasay City, as well as Courtyard by Marriott in Iloilo City.

On the other hand, Megaworld manages 12 hotel properties nationwide under the Megaworld Hotels & Resorts brands.

These encompass Richmonde Hotel Ortigas in Pasig City, Eastwood Richmonde Hotel in Quezon City, Richmonde Hotel in Iloilo City, Savoy Hotel and Belmont Hotel in Pasay City, Savoy Hotel in Boracay, Aklan, Savoy Hotel Mactan Newtown in Lapu-Lapu City, Cebu, Belmont Hotel in Boracay, Aklan, Belmont Hotel Mactan in Lapu-Lapu City, Cebu, Kingsford Hotel in Parañaque City, Twin Lakes Hotel in Laurel, Batangas near Tagaytay, and Hotel Lucky Chinatown in Binondo, Manila. Megaworld Group’s subsidiary, Global-Estate Resorts, Inc. (GERI), operates Fairways & Bluewater in Boracay, Aklan.

The upcoming hotels, slated for completion by 2028, will be strategically located in various cities and towns across the Philippines, including Parañaque City, Laguna, Bacolod City in Negros Occidental, City of San Fernando in Pampanga, Boracay Island in Malay, Aklan, and San Vicente, Palawan.

Tan mentioned that as the Philippine economy, along with the global economies, continued to reopen, there has been an increase in expenditure on staycations, travel, leisure, entertainment, and MICE activities (meetings, incentives, conferences, and exhibitions) throughout the country.

In 2022, AGI’s tourism segment achieved a historic milestone, generating P38.6 billion in revenue, representing an impressive 84 percent year-on-year growth.

This figure even exceeded the pre-pandemic levels of 2019 by 10 percent.

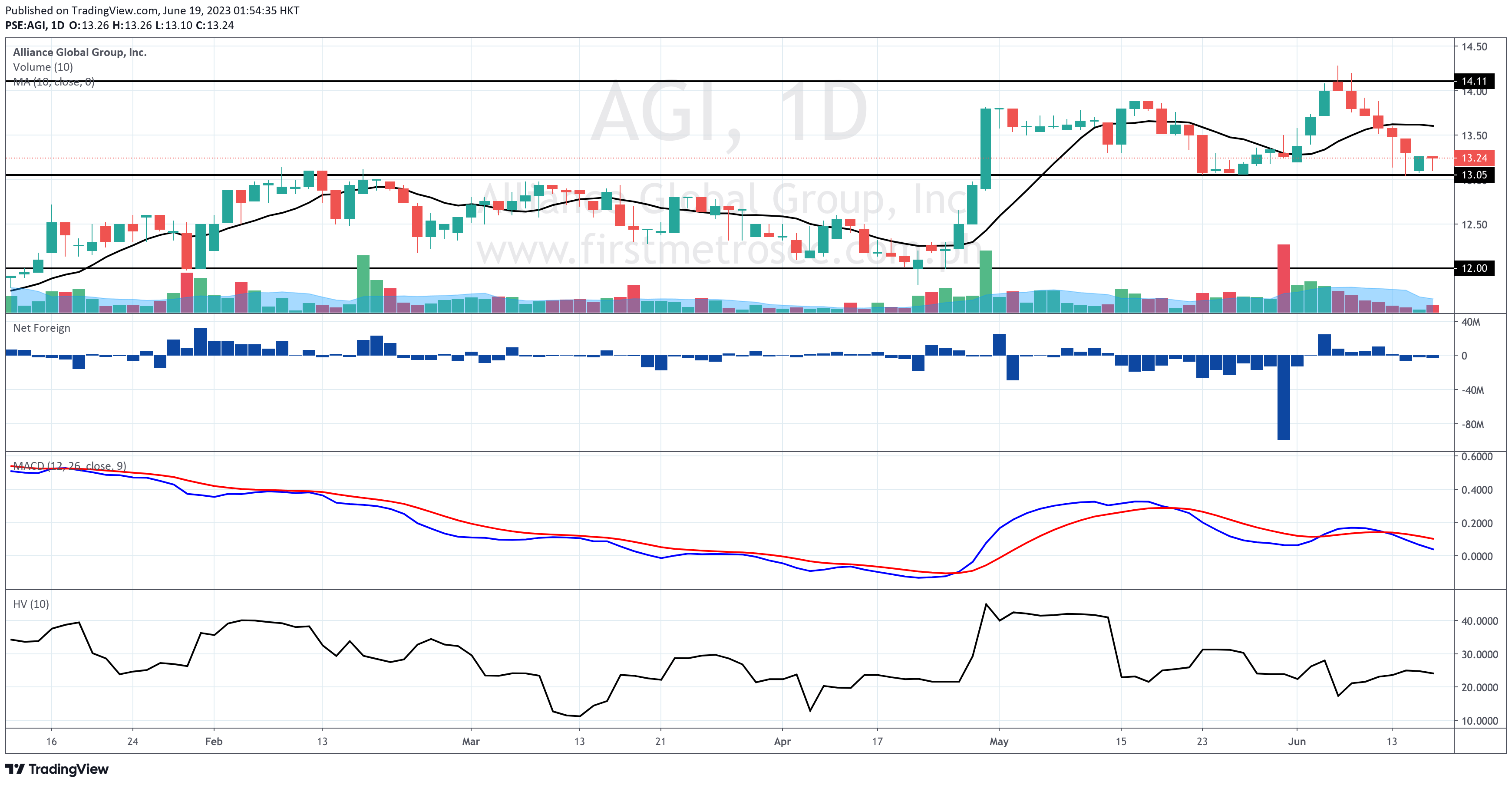

While PSE:AGI closed in the red last Friday at P13.24 per share, down by 0.15%, it is still up by 11.26% year-to-date.

PSE:AGI is on the brink of testing the support at P13.00 as it continues to trade below its 10-day simple moving average (SMA).

Its bearish moving average convergence divergence (MACD) shows no sign of a formation of a reversal.

On the other hand, its daily volume continues to go slimmer each day, signifying selling exhaustion.

Trades are advised to keep an eye on the support at P13.00 as the price might rebound near that level.

Resistance is near P14.10.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025