The latest analysis from Manulife Investment Management and Trust Corp., a subsidiary of insurance firm Manulife, suggests that inflation in the country has already reached its peak and is expected to follow a downward trajectory in the coming months. This aligns with the view of the Bangko Sentral ng Pilipinas (BSP), which anticipates a further easing of inflation in May, settling within the range of 5.8 to 6.6 percent.

According to Jean de Castro, Manulife’s head of fixed income, the decline in inflation can be attributed to negative base effects that will likely lead to slower inflation data, consistent with the BSP’s May inflation forecast.

Looking ahead to the fourth quarter, de Castro predicts that local inflation will fall within the BSP’s target range of two to four percent, unless there are significant increases in global oil prices.

In April, inflation reached its lowest point in eight months, standing at 6.6 percent, signifying a downward trend over the past three months.

However, despite this positive development, the average inflation for the four-month period remains at 7.9 percent, exceeding the five to seven percent full-year assumption of the Development Budget Coordination Committee.

The BSP aims to achieve its inflation target of two to four percent as early as September or October. De Castro believes that the current environment of moderating inflation, combined with the monetary policy pause, supports a positive outlook for local bonds in the second half of the year.

On the other hand, Mark Canizares, Manulife’s head of equities, emphasizes that the easing inflation should provide support to local share prices in the coming months.

Canizares highlights that rate-sensitive sectors, particularly residential property, are likely to benefit from the favorable conditions. Moreover, he expects that the easing prices, as raw material and input costs moderate, will provide support to domestic consumption, which has already seen positive growth as the country reopened.

Canizares concludes that if the trend of deceleration continues in the second half, market attention will likely shift to the timing of peak interest rates and their eventual decline, which historically has driven equity market rallies.

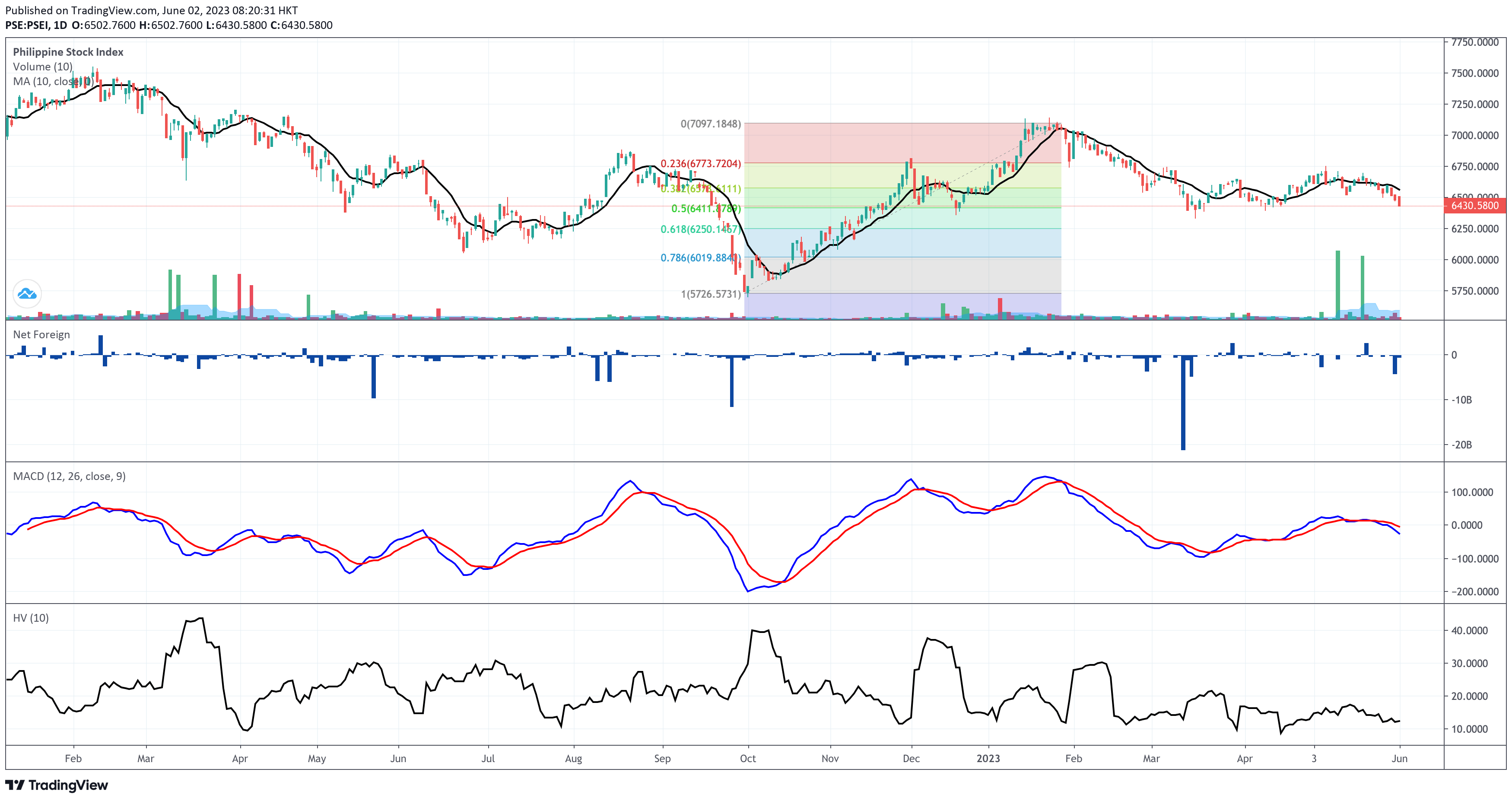

Meanwhile, the Philippine Stock Exchange Index (PSEi) is poised to break below its immediate support at 6,400 as of market closing on June 1, 2023. If and when that happens, the main bellwether index is positioned to test the support at 6,250. The foreign investors still don’t exhibit significant buying interest.

Check out the stock market consultancy service of Equilyst Analytics to preserve your capital, protect gains, and prevent unbearable losses when trading and investing in the Philippine stock market.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025