In its plans for divestment, the Philippine National Bank (PNB) aims to sell a minority stake in its holding company, which focuses on the investment, development, and sale of high-value real estate properties.

The PNB, under the ownership of Lucio Tan, has obtained board approval for a private placement of a 14 percent share in PNB Holdings Corp, as disclosed to the Philippine Stock Exchange (PSE).

PNB Holdings Corp, a fully owned subsidiary of PNB, acts as the holding company for Tan’s desirable real estate assets, including the PNB Financial Center on Diosdado Macapagal Avenue in Pasay City, the PNB Center on Ayala Avenue in Makati City, and an 8,000-square-meter property situated at the intersection of Makati Ave. and Gil Puyat Ave., also in Makati.

Through a property-for-share swap, these assets have been transferred from PNB to PNB Holdings, resulting in a substantial gain of P33.2 billion, which significantly bolstered the bank’s net income to P31.7 billion in 2021.

This increase marks a twelve-fold rise compared to the end-2020 level of P2.6 billion.

Furthermore, PNB has successfully augmented its capital base by an additional P10 billion through another property-for-share swap, with the aim of maximizing the value of its premier real estate properties.

The properties that were exchanged for shares of PNB Holdings Corp. carry an estimated value of around P34 billion, encompassing a market value of P46.68 billion and a book value of P12.6 billion.

PNB Holdings has its sights set on leveraging its existing high-value assets, which generate consistent and reliable cash inflows, while also seizing future development prospects.

The holding company aspires to become the leading luxury and sustainable developer in the country, with a primary objective of setting new industry standards and revitalizing its prime property portfolio.

By pushing the boundaries, the holding company embarks on an endeavor to redefine innovation, constructing iconic structures and world-class mixed-use developments that will reshape the Manila skyline.

Initially, Lucio Tan had intentions to introduce the holding company at the PSE as a means to strengthen its capital position.

The listing by introduction allows a company to list its shares on the PSE without an immediate public offering.

According to the rules, this listing method is suitable when an unlisted issuer distributes securities as a property dividend to its shareholders, by a listed issuer.

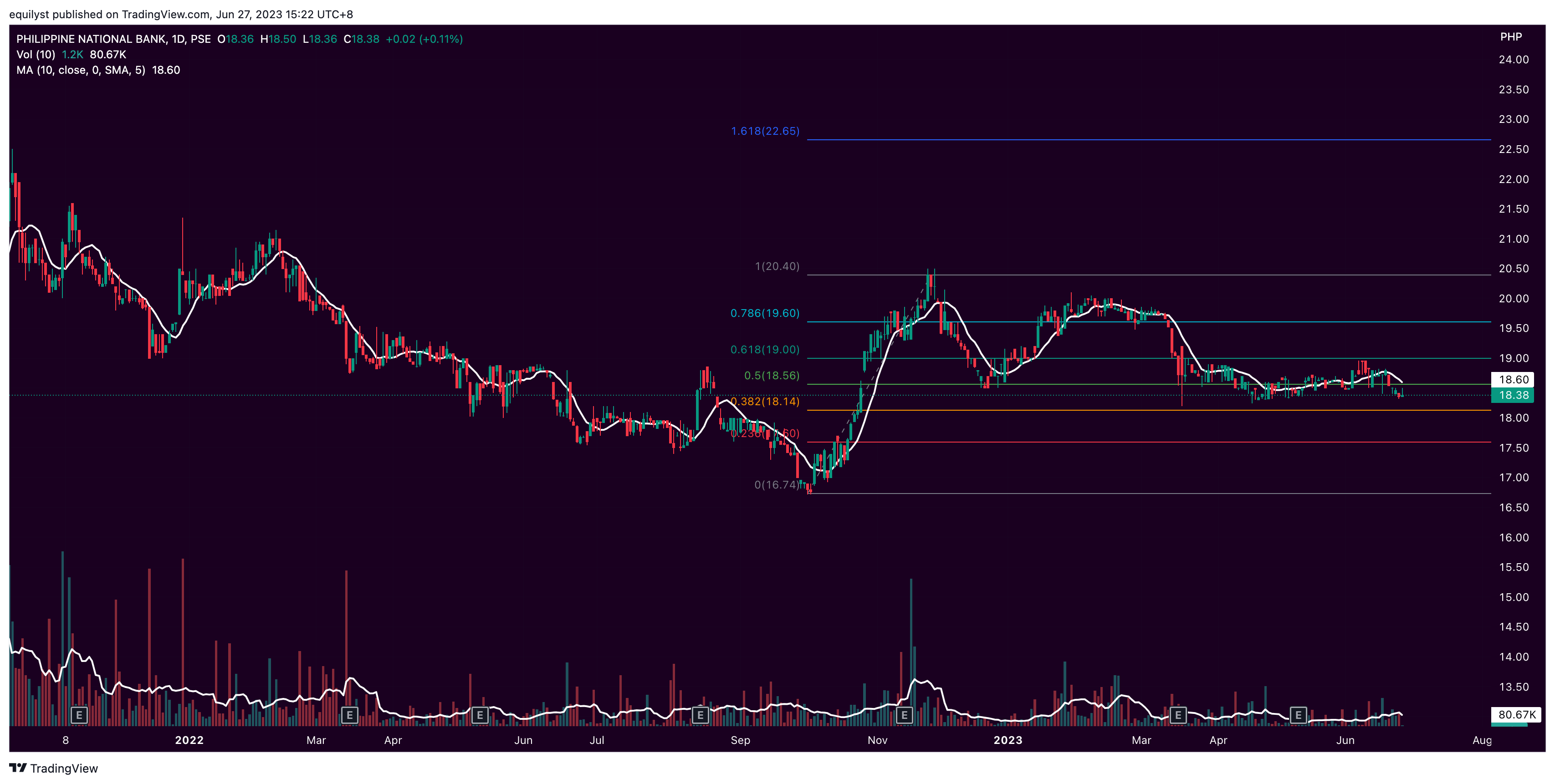

Philippine National Bank (PNB) closed on Tuesday at P18.38 per share, up by 0.11%, but with a volume that’s only 0.15% of PNB’s 10-day volume average.

The last price sits between the support at P18.14 and the resistance at P19.00, confluent with the 38.2% and 61.8% Fibonacci retracements, respectively.

The stock has been trading below its 10-day simple moving average for five consecutive trading days.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025