PLDT Inc. reported connectivity issues with its submarine cable partners on Monday, which caused a slowdown in internet browsing for certain users.

In an official statement, the telecommunications giant acknowledged the need to restore normal browsing experiences for affected customers, some of whom encountered difficulties accessing popular Google services like Gmail and Youtube.

According to PLDT, one of its submarine cable partners experienced a decrease in internet bandwidth capacity, resulting in slower internet browsing observed by users.

Efforts are currently underway as PLDT collaborates with its partners to establish alternative capacity that will restore optimal browsing experiences within a few hours.

Notably, PLDT made a substantial investment of $75 million (equivalent to around P4.4 billion) last year to expand its international capacity. This investment involved the deployment of a 9,400-kilometer subsea cable across East and Southeast Asia, known as the Maharlika Investment Fund.

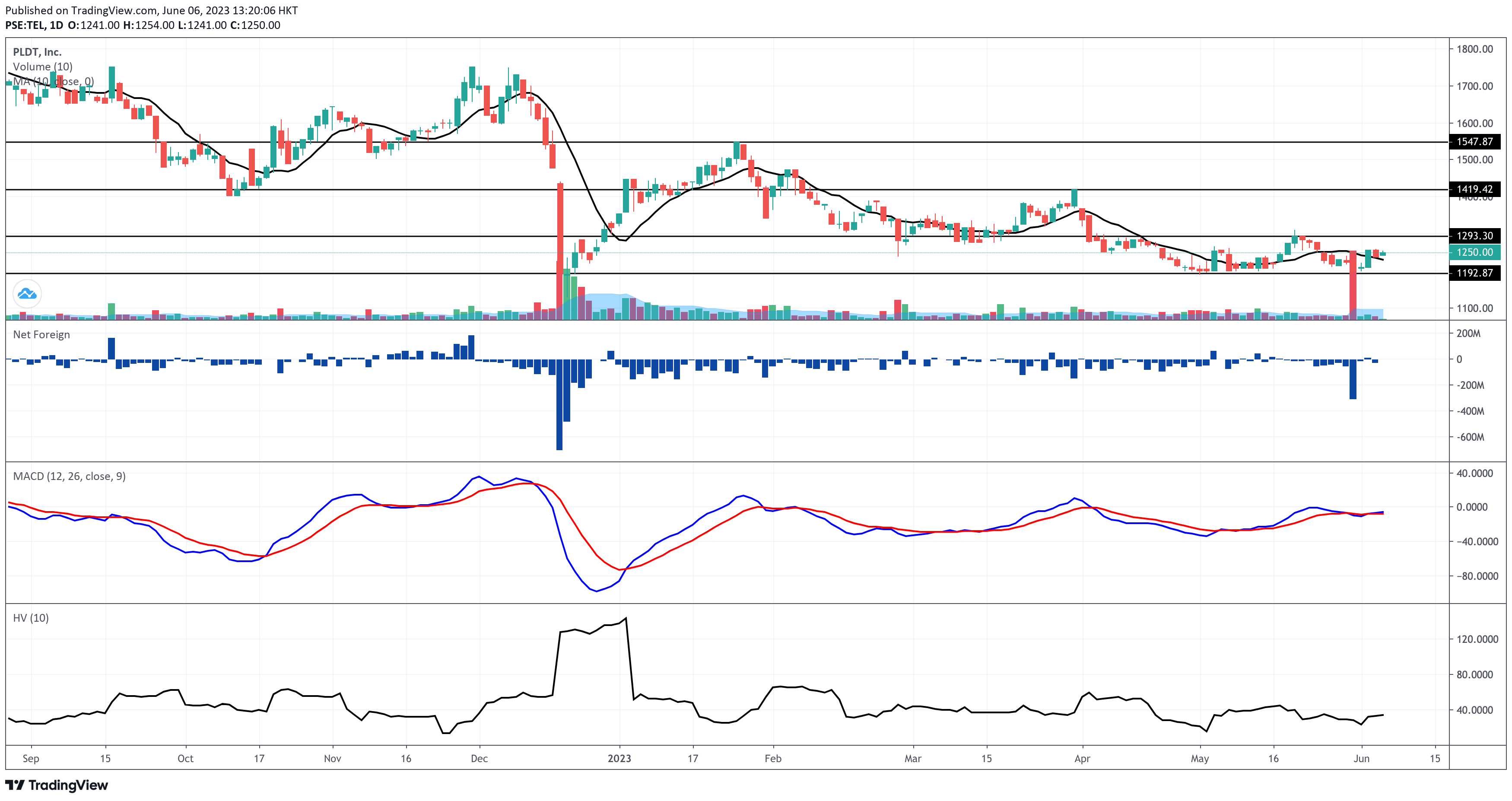

Meanwhile, TEL trades at P1,250.00 per share, up by 0.97%, as of 1:20PM on June 6, 2023. The stock is still trading above its 10-day simple moving average, but is still playing sideways inside the P1,190-P1,290 support-resistance band.

The foreign investors still have a lackluster sentiment for TEL as they continue to register Net Foreign Selling each trading day.

On the other hand, the positioning of the moving average convergence divergence (MACD) above its signal line shows present holders a technical reason to hold their position if their trailing stop is still intact.

The Dominant Range Index and Market Sentiment Index second the motion to the bearish take of the MACD.

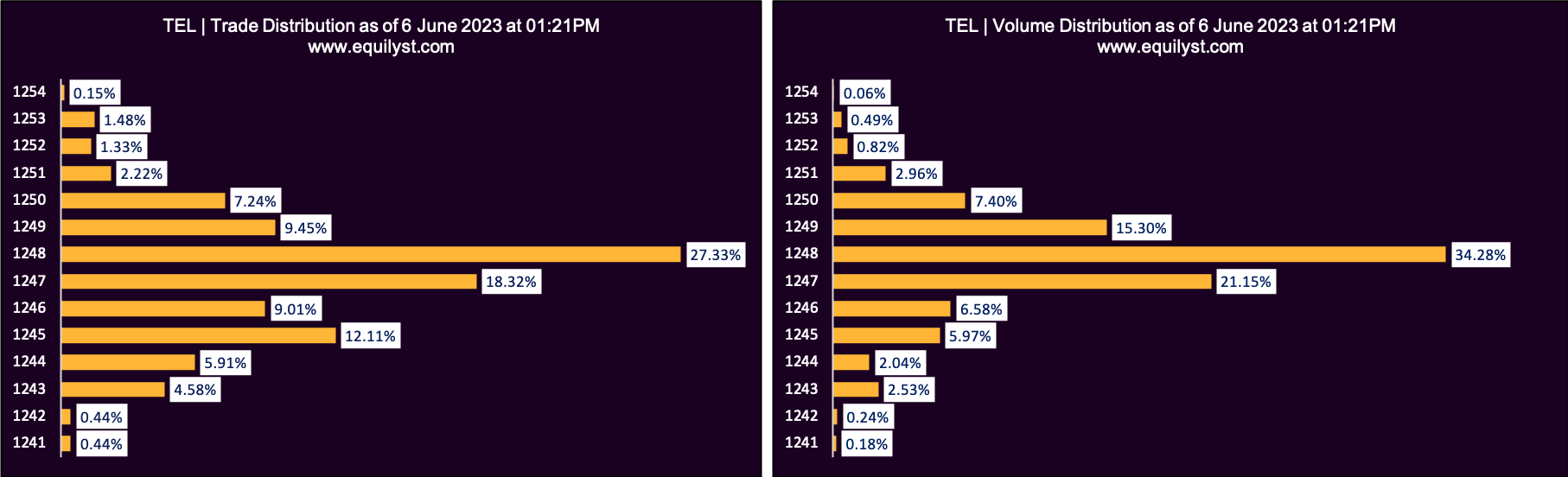

Trade-Volume Analysis

Dominant Range Index: BULLISH

Last Price: 1250

VWAP: 1,247.69

Dominant Range: 1248 – 1248

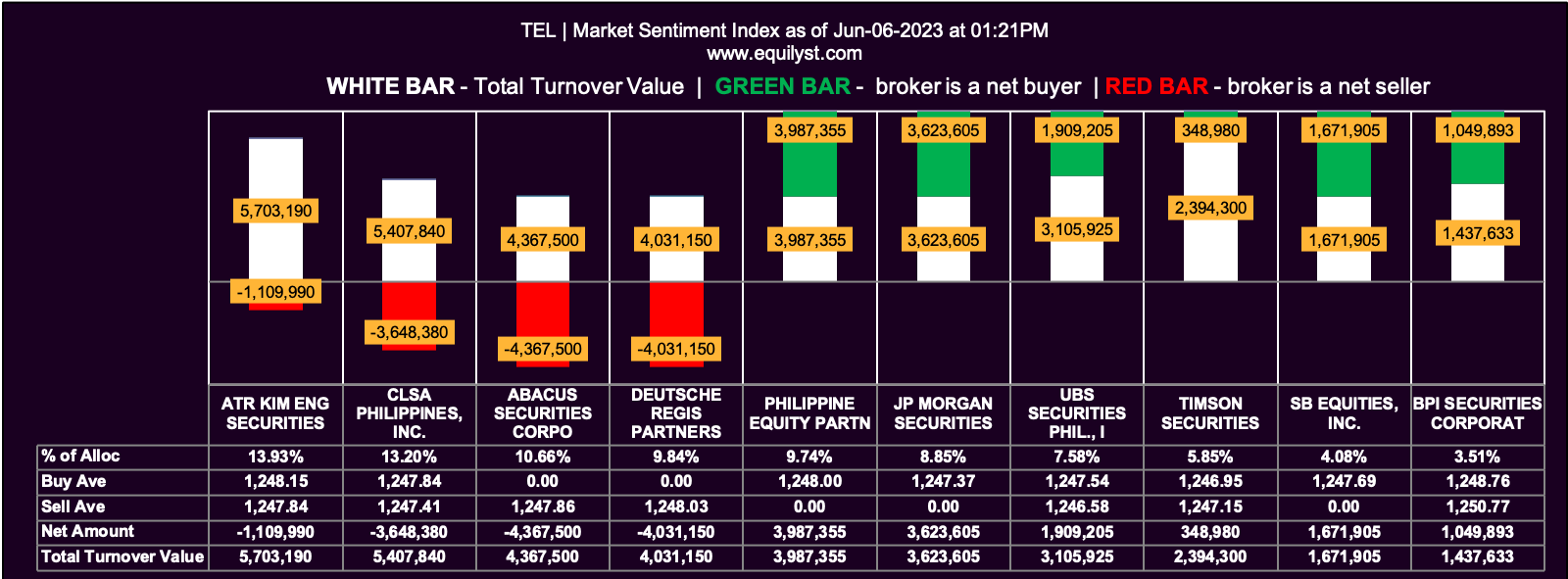

Market Sentiment Analysis

Market Sentiment Index: BULLISH

13 of the 25 participating brokers, or 52.00% of all participants, registered a positive Net Amount

11 of the 25 participating brokers, or 44.00% of all participants, registered a higher Buying Average than Selling Average

25 Participating Brokers’ Buying Average: ₱1247.59986

25 Participating Brokers’ Selling Average: ₱1247.77721

7 out of 25 participants, or 28.00% of all participants, registered a 100% BUYING activity

9 out of 25 participants, or 36.00% of all participants, registered a 100% SELLING activity

There’s no confirmed buy signal for TEL as of this time of writing this analysis since not all indicators of our Evergreen Strategy are bullish. For one, TEL’s volume is less than 50% of the stock’s 10-day volume average.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025