Manila Philippines – On July 12, 2023, the local stock market, along with other Asian bourses, maintained its positive trajectory as investors eagerly awaited a significant US inflation report.

The report aims to provide insights into the potential conclusion of the Federal Reserve’s aggressive rate hiking policy.

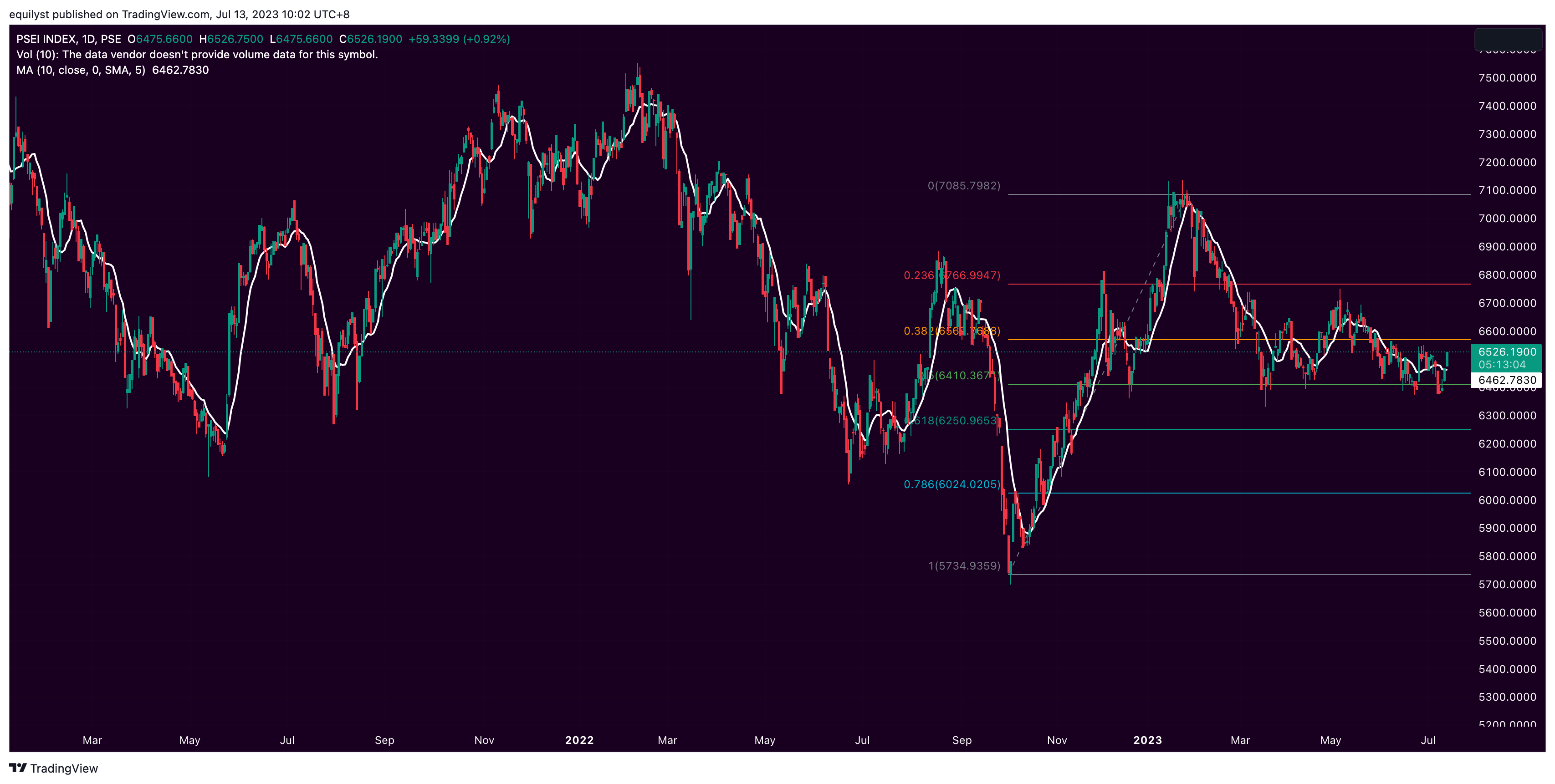

The benchmark Philippine Stock Exchange index (PSEi) concluded the day higher at 6,466.85, showing a notable increase of 68.21 points or 1.07 percent.

Similarly, the broader All Shares index reached 3,457.33, gaining 27.46 points or 0.80 percent.

The total value turnover improved to P5.248 billion.

However, the market breadth displayed a negative trend as 92 stocks declined, 84 advanced, and 49 remained unchanged.

Luis Limlingan, an analyst from Regina Capital, explained that local equities rose in anticipation of the forthcoming US inflation report, which is scheduled to be released on Wednesday night in Manila.

Investors closely monitored the inflation report, with economists surveyed by Reuters predicting a 3.1 percent increase in the consumer price index for June, following a four percent surge in May.

Although the core rate is expected to decline for the third consecutive month to five percent from 5.3 percent, it remains above the Federal Reserve’s two percent target.

Shane Oliver, head of investment strategy at AMP Capital, expressed that there was some nervousness leading up to the CPI.

He mentioned that there was optimism regarding the expectation of a further fall in CPI, but there was also an awareness of the stickiness of core inflation.

Oliver noted that the market experienced a robust rally in June, particularly in the United States, which makes it vulnerable to a potential pause or consolidation.

According to the CME FedWatch tool, the market has already factored in a 92 percent likelihood of a 25-basis-point Federal Reserve hike later this month.

However, doubts persist regarding additional hikes in the future.

Saxo Markets strategists suggested that traders will likely maintain conservative expectations for rate hikes in September and November if the core rate decelerates as expected.

Federal Reserve officials have signaled their intention to raise interest rates by at least 50 basis points to address persistent price pressures.

Market attention will also be focused on the Bank of Canada’s policy decision, with expectations pointing towards a second consecutive quarter-point interest rate hike.

PSEi Market Summary

Date: July 12, 2023, Wednesday

Closing: 6,466.85 (+68.21 points, +1.07%)

Turnover Value: P3.84 billion

Net Foreign: P100 million (NFS)

Market Breadth: -0.91

Support: 6,400 | Resistance: 6,600

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025