The Maharlika Investment Fund experienced a staggering 154 percent surge in approved investments by the Philippine Economic Zone Authority (PEZA) during the initial five months of this year, reaching an impressive amount of P48.03 billion.

This remarkable increase can be attributed to the exponential growth in investment approvals observed in May.

In a recent statement, Tereso Panga, the director general of PEZA, expressed enthusiasm about the unprecedented rise, emphasizing that the current figure surpasses last year’s recorded amount of P18.928 billion by an astounding 153.74 percent.

Panga highlighted the continuous upward trend in investment approvals, particularly in the first half of the year, while commending President Marcos for his active role in promoting the Philippines through outbound missions.

Panga further asserted that PEZA is committed to facilitating a conducive environment for investors, with the aim of making the Philippines an intelligent choice for their ventures.

PEZA has successfully maintained its trajectory towards achieving a 10 percent increase in investment approvals for the year, thanks to the substantial rise in approvals from January to May.

Notably, during the month of May alone, the PEZA board granted approval to 20 new and expansion projects, which are projected to generate P14.93 billion in investments.

This impressive figure signifies a striking 405.78 percent increase from the P2.95 billion approved in May of the previous year.

Among the projects approved during the PEZA board meeting on May 26, eleven are dedicated to export manufacturing, while seven focus on information technology.

Additionally, one project is centered around facilities, and another involves ecozone development.

The locations of these projects span various regions, including Makati, Pasig, Taguig, Baguio, Pampanga, Cavite, Batangas, Laguna, Cebu, Iloilo, and South Cotabato, as confirmed by PEZA.

According to PEZA, these projects are anticipated to contribute approximately $293.55 million in export revenue and generate 4,480 direct employment opportunities.

Notably, the largest project pre-qualified for Fiscal Incentives Review Board (FIRB) approval, with investments amounting to P11.63 billion, involves the production of solar wafer cells utilizing Maxeon 7 technology.

This significant project will be located in Sto. Tomas, Batangas.

With the recent approvals in May, the total number of approved projects year-to-date has reached 80, projecting exports worth $1.31 billion and providing employment opportunities for 11,949 individuals.

In its ongoing efforts to attract investments, PEZA maintains fruitful collaborations with government agencies and industry associations, focusing on addressing concerns that hinder investors from tapping into the untapped potential of the Philippines.

This approach aligns with the government’s comprehensive strategy to facilitate much-needed foreign direct investments in the country.

Notably, PEZA held meetings with Finance Secretary Benjamin Diokno, Chairman of the Commission on Elections George Garcia, and Secretary of the National Economic and Development Authority Arsenio Balisacan to discuss investor concerns and present initiatives aimed at attracting investments.

Furthermore, discussions were held with Senator Loren Legarda regarding plans to establish additional ecozones in Antique and other provinces across the nation, with the intention of fostering rural development.

To expedite the delivery of services and enhance efficiency, PEZA signed a memorandum of understanding (MOU) with the Department of Information and Communications Technology (DICT) to accelerate digitalization efforts within the government.

This initiative supports Trade Secretary Alfredo Pascual’s directive to adopt digital transformation, ultimately bolstering the country’s competitiveness as an investment destination, particularly for high-tech and innovator accelerator companies.

PEZA locators currently account for a substantial 82 percent of the country’s annual commodity exports and 60 percent of its services exports.

Panga emphasized the organization’s unwavering commitment to fulfilling its mandate to the best of its abilities, while actively supporting the administration’s objective of elevating the country to upper-middle income status during President Marcos’s term.

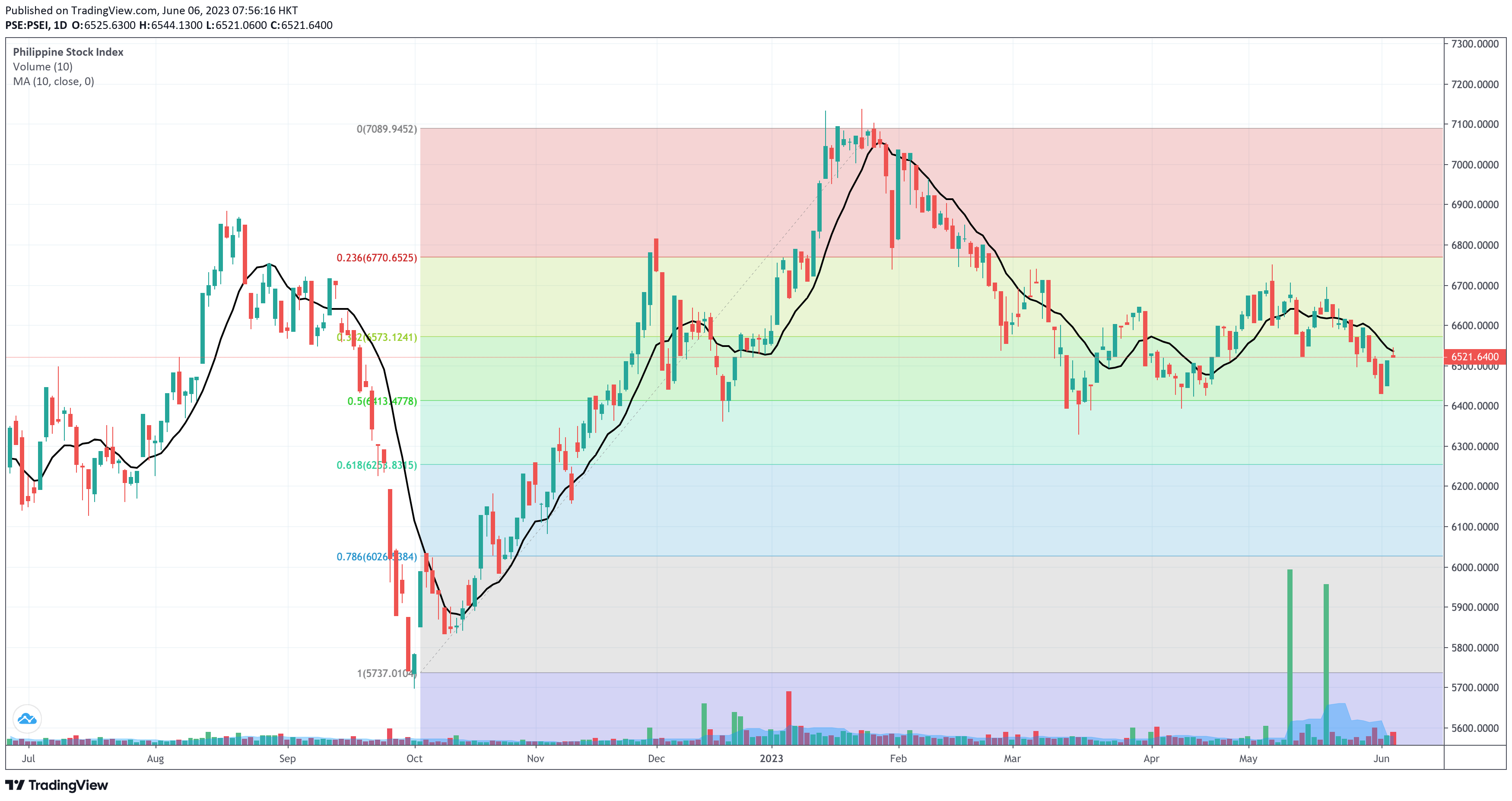

Meanwhile, the Philippine Stock Exchange Index (PSEi) still struggles to break its immediate resistance near 6,570, confluent with the 38.2% of retracement of the Up Fibonacci. Support is near 6,400. Foreign investors continue to register more Net Foreign Selling days than Net Foreign Buying days.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025