Shareholders of Metro Pacific Investments Corp. (MPIC), with the intention of privatizing the tollways conglomerate, have submitted a request to postpone a critical vote concerning the plan to delist the company from the Philippine Stock Exchange (PSE).

The shareholders are currently awaiting the fairness opinion and valuation report. This follows the rejection of the original valuation provider chosen by the MPIC shareholders by the PSE, in consultation with the Securities and Exchange Commission (SEC).

In recent developments, both the PSE and the SEC have declined to verify the independence of the MPIC valuation provider, citing reasons related to engagement with other departments of the conglomerate or the consortium members.

As a result, the MPIC shareholders, in collaboration with the bidding consortium, have engaged a new provider of fairness opinion and valuation reports. These reports are essential prerequisites for the majority of the company’s shareholders to participate in the voting process on the delisting proposal.

The consortium of MPIC shareholders, including Metro Pacific Holdings, MIG Holdings, GT Capital Holdings, and Mit-Pacific Infrastructure Holdings Corp., has made a tender offer of P49 billion for the 10.5 billion publicly held shares, valuing each share at P4.63.

Against this backdrop, the consortium has formally requested the scheduling of a special shareholders’ meeting (SSM) for a later date, subsequent to the finalization of the report, which may take approximately a month to complete.

In its notice, the consortium explained that the deferral of shareholder approval would allow ample time for the report to be accessible prior to the SSM. This, in turn, would provide shareholders with an opportunity to thoroughly analyze the report and gain a better understanding of the basis for the tender offer price and the proposed voluntary delisting.

Once the report is finalized, the consortium will proceed by issuing a new notice of intent, signaling its intention to carry out a tender offer.

The decision to proceed with the delisting plan is contingent upon meeting the 95 percent acceptance threshold for voluntary delisting through the tender offer process or obtaining exemptive relief from the PSE.

Importantly, shareholders who vote in favor of delisting retain the freedom to decide whether or not to tender their shares based on their assessment of the terms outlined in the tender offer.

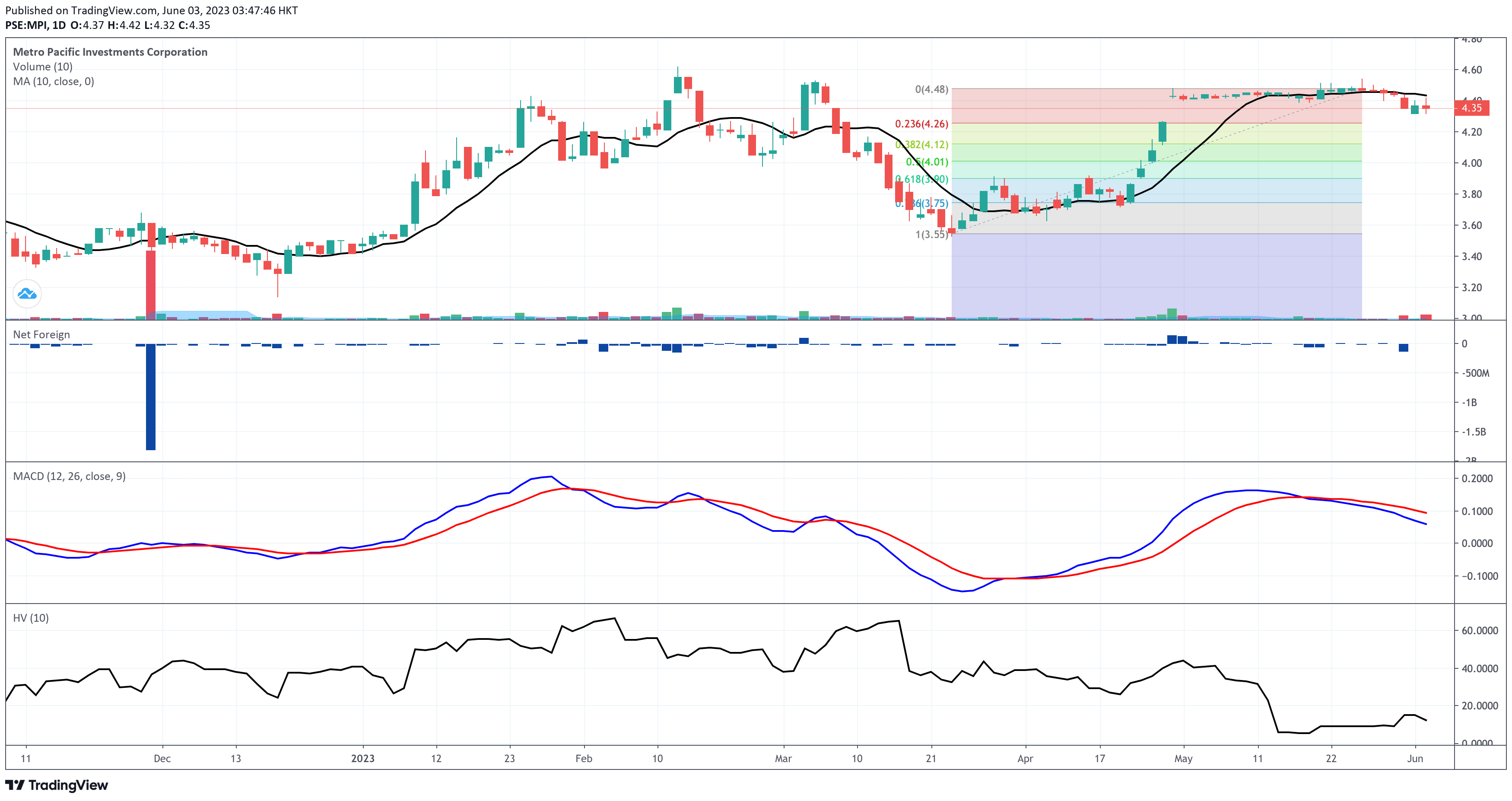

As of market closing on June 2, 2023, MPI closed at P4.35 per share, down by 0.46%. Volume was higher than 100% of MPI’s 10-day volume average, which signifies that the downtrend is likely to continue. The main support is spotted near P4.26, confluent with the 23.6% retracement of the Up Fibonacci. The resistance is pegged near P4.50.

MPI’s moving average convergence divergence (MACD) is in a bearish divergence with the signal line, seconding the motion of the bearishness of the stock as its current price moves lower than its 10-day simple moving average (SMA). On the other hand, MPI has a low risk score based on its 10-day historical volatility.

Need Help?

Improve your stock trading and investing journey with Equilyst Analytics’ unrivaled stock market consultancy service. Gain access to expert insights, comprehensive analysis, and personalized guidance, empowering you to make informed decisions, maximize profits, and conquer the stock market like never before.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025