Based on a survey conducted by Asiamoney, Metropolitan Bank & Trust Co. (Metrobank) emerges as the preferred choice for trade finance in the Philippines.

Metrobank, the country’s second largest private bank, clinched the top spot in the Best Services (Asian Banks) category in the Philippines and secured the third position in the broader Best Services category. These rankings further solidify the bank’s position as an industry leader.

The 2023 Euromoney-Asiamoney Trade Finance Survey highlights the leading providers of trade finance products and services in Asia. The rankings are derived from feedback provided by more than 12,000 clients globally.

Clients were requested to evaluate the quality of service rendered by the providers, and those who received top ratings across various categories were honored with the Best Service award.

Conversely, the Asian Banks category specifically focuses on recognizing exceptional providers in Asia, excluding international banks.

Mary Mylene Caparas, Metrobank’s EVP and head of Institutional Banking Sector, emphasizes their unwavering commitment to supporting clients’ trade business. She expresses that their aim is to deliver outstanding trade finance products and services tailored to their clients’ specific requirements. Furthermore, she asserts that their constant endeavor has always been to ensure the well-being of their clients.

Caparas expresses gratitude for the acknowledgment received as the country’s Best Service Trade Finance provider, which she believes truly reflects their unwavering dedication to fostering the growth of their clients’ businesses.

Metrobank consistently prioritizes the convenience and efficiency of their clients’ international and domestic trade transactions. To achieve this, the bank has implemented electronic channels, streamlined internal processes, and established trade hubs staffed by experts at strategic locations throughout the country. These measures guarantee prompt processing of trade transactions, while adhering to international standards.

Over the past year, Metrobank has garnered numerous accolades from esteemed institutions in recognition of its exceptional performance. Asiamoney recently conferred the bank with the titles of Best Bank for ultra-high-net-worth clients and Best Domestic Private Bank in the Philippines. Additionally, Metrobank received six significant awards at the Philippine Dealing System Awards Night, including the highly esteemed Cesar E.A. Virata Award.

In the preceding year, Metrobank also received substantial recognition from leading global financial publications. Euromoney and the Banker proclaimed it as the Best Bank in the Philippines for 2022. The Asian Banker acknowledged Metrobank as the Strongest Bank in the Philippines for both 2021 and 2022.

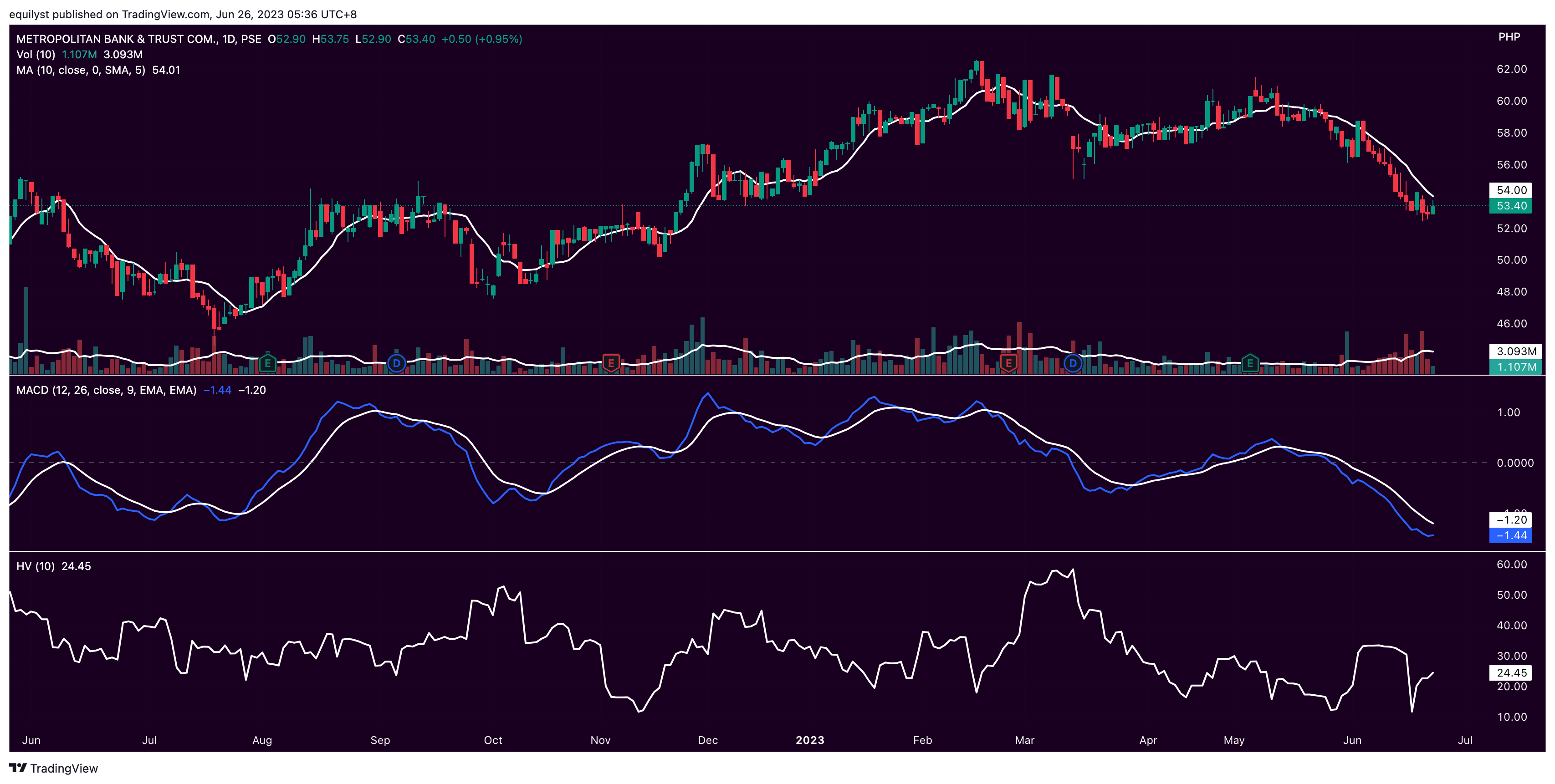

Meanwhile, PSE:MBT closed on Friday at P53.40 per share, up 0.95% but down by 1.11% year-to-date.

The stock has been bearishly trading below its 10-day simple moving average (SMA) for 14 consecutive trading days already.

Its risk level, according to its 10-day historical volatility, remains low due to the absence of significant engulfing candlesticks and price gaps for the past 10 trading days.

Last Friday’s volume was lower than 50% of PSE:MBT’S 10-day volume average. Odds are in favor of the bears.

Support is at P52.00, aligned with the 61.8% Fibonacci retracement. Resistance is at P54.00, aligned with the 50% Fibonacci retracement. The higher and lower support and resistance levels, respectively, are visible on the Fibonacci retracement plotted on the chart above.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025