Despite facing coordination issues and engineering challenges, the Metro Pacific Group maintains hope of securing the contract for two major projects in the Visayas.

As they pursue the Metro Cebu Expressway (MCE) worth P94.07 billion and the Cebu-Bohol Bridge valued at P90 billion, the company responsible for constructing and operating the Cebu-Cordova Link Expressway (CCLEX) will forge ahead with their plans.

Allan Alfon, president and general manager of CCLEX Corp. (CCLEC), mentioned that the firm is patiently waiting for the government to bid out the operations and maintenance contract for the proposed toll road project.

Alfon emphasized that despite the Department of Public Works and Highways (DPWH) falling behind the project timeline, the MCE remains a priority for the Metro Pacific Group.

The DPWH was initially expected to issue the privatization contract for the MCE in the first quarter.

According to Alfon, the selection of the expressway’s concessionaire must occur before the DPWH initiates any supplementary study on the project.

The DPWH’s supplemental study is scheduled to take place from September to February 2024.

In an interview with The STAR, Alfon conveyed that investors like them will seriously consider the MCE as long as they see financial viability.

The MCE, which spans 56.94 kilometers and is divided into three segments, will necessitate a budget of P94.07 billion, with the majority of P61.48 billion allocated for civil works.

Regarding the Cebu-Bohol Bridge, Alfon highlighted that constructing it as a floating bridge is the only feasible option, given the challenges posed by the deep waters and strong undercurrents.

CCLEC acknowledges the potential difficulties in completing the Cebu-Bohol Bridge, particularly the section that connects Cordova, Cebu, with Olango Island.

The firm anticipates receiving recommendations from a consultant on how to proceed with the project.

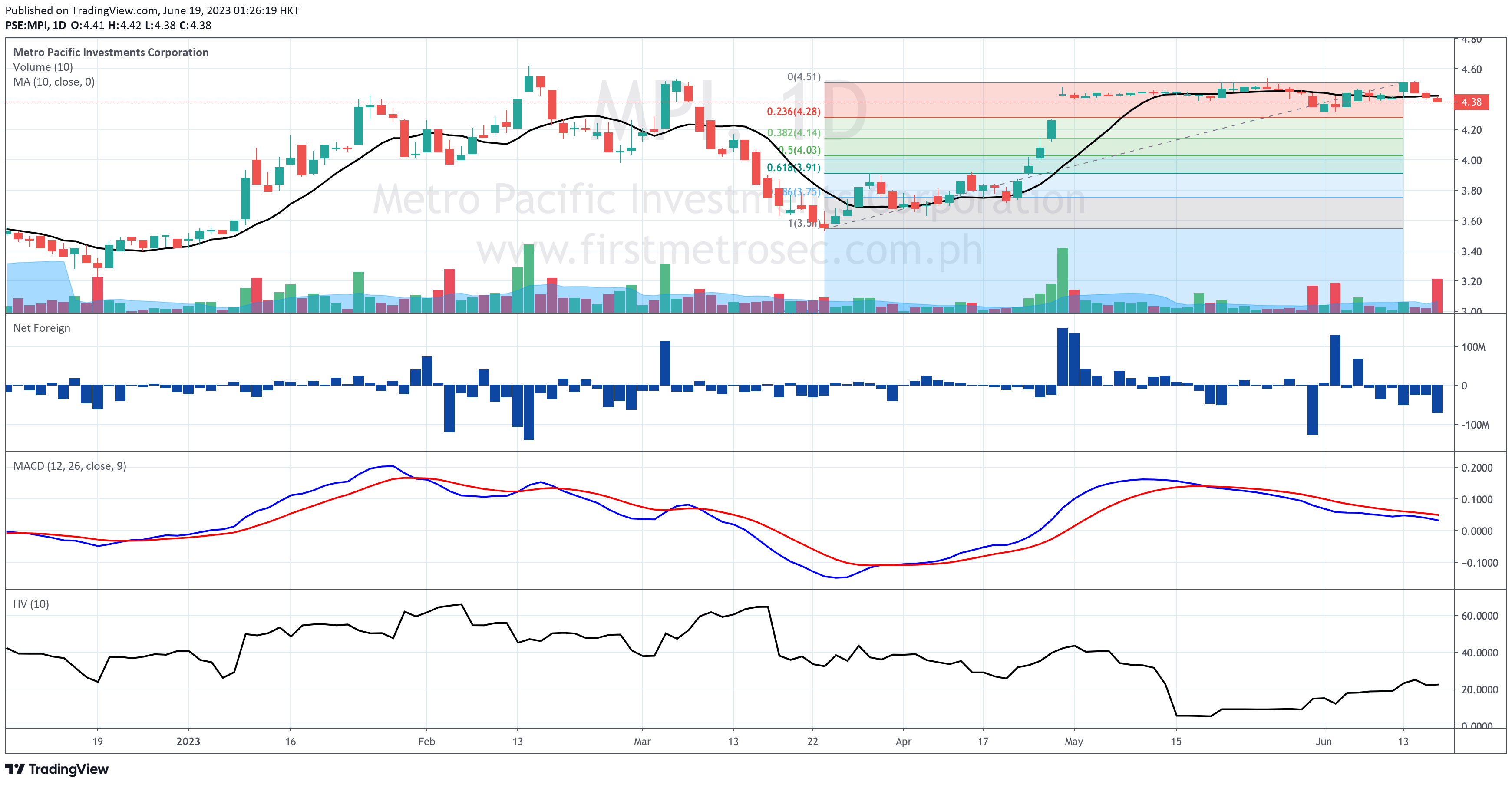

Meanwhile, PSE:MPI closed at P4.38 per share on Friday, slipped by 0.68%.

The volume exceeded 100% of the stock’s 10-day volume average, signifying the continuation of the bearish price action.

The foreign investors registered a net foreign selling worth P70 million.

As PSE:MPI trades below its 10-day simple moving average, its moving average convergence divergence shows no sign of a reversal from its bearish position.

Technical analysis shows that the trend is likely to test the support at P4.28 per share, confluent with the 23.6% Fibonacci retracement.

Resistance is near P4.50.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025