from the present year until 2027, with the aim of expanding its presence nationwide, as shared by Kevin Tan, Megaworld’s chief strategy officer.

The company intends to create townships in new growth areas outside of Metro Manila, including CALABARZON, MIMAROPA, Northern Luzon, and select regions in Visayas and Mindanao.

Tan emphasized that this capital expenditure program will empower Megaworld to explore opportunities in constructing townships or mixed-use lifestyle communities, which already represent the company’s core strength.

Alongside residential, office, malls, and hotels, Megaworld seeks to provide additional offerings to ensure the relevance and sustainability of each township for future generations of Filipinos.

In response to the increased business activities following the pandemic, Megaworld plans to bolster its hotel infrastructure.

Leveraging the surge in tourism, particularly in MICE (meetings, incentives, conventions, exhibitions), the company will construct additional hotels and MICE facilities, including convention centers, in key cities over the next five years.

Moreover, Megaworld aims to expand its workspace offerings to cater to emerging businesses and industries, while also acknowledging the persistent demand from BPOs.

These new office towers will be strategically located across various townships, encompassing Metro Manila, Pampanga, Bulacan, Cavite, Cebu, Iloilo, Bacolod, and Davao.

The company’s plans also encompass the expansion of its Megaworld Lifestyle Malls portfolio.

Over the next five years, Megaworld will construct new malls and commercial developments, targeting specific locations in Pampanga, Bulacan, Cavite, Rizal, Cebu, Bacolod, and Davao.

Furthermore, a portion of the allocated capital expenditure will be utilized for land acquisition during this period.

Tan clarified that the budget will primarily serve to enhance and expand existing townships, while facilitating the development of additional residential, office, mall, and hotel properties.

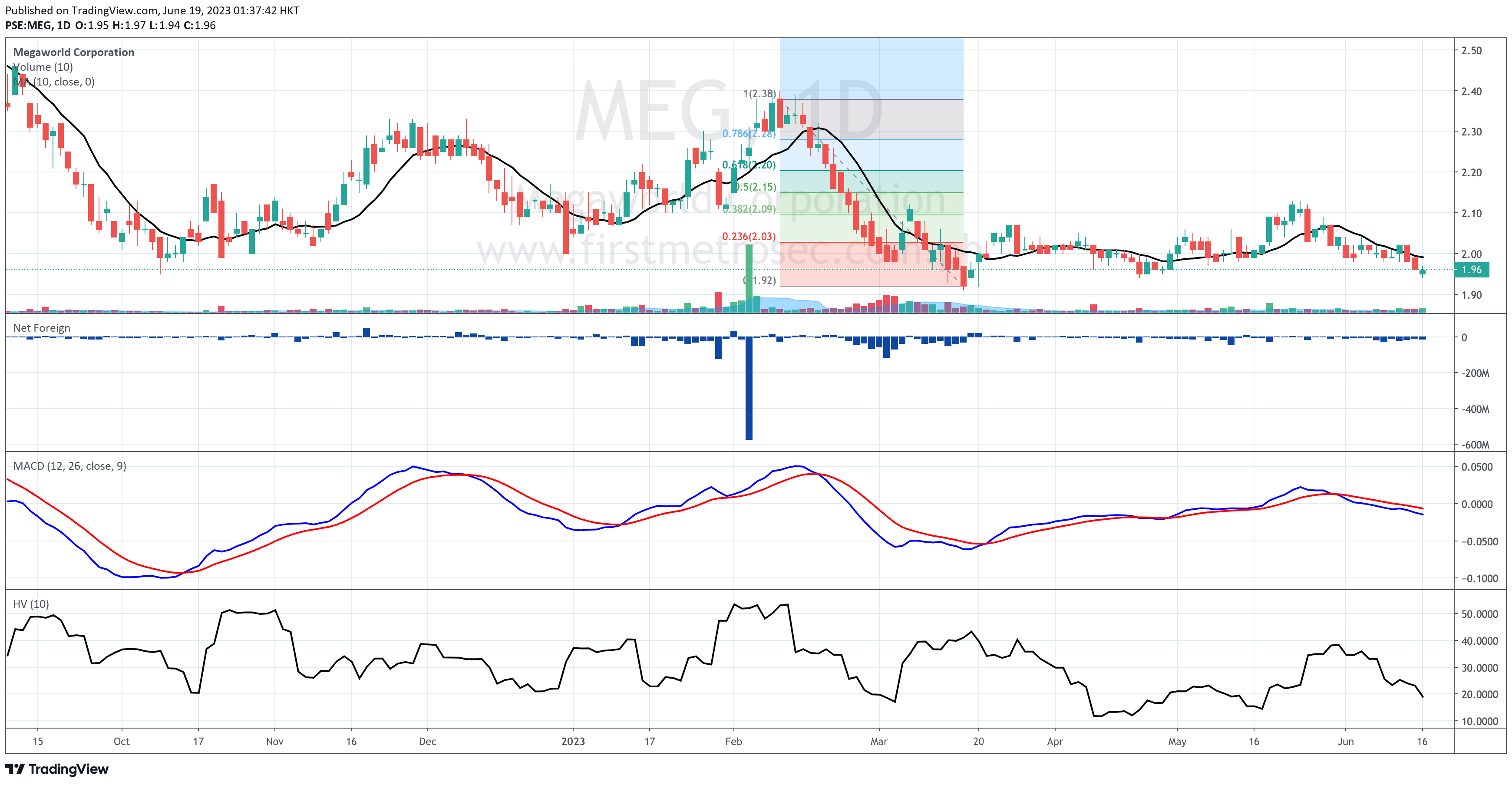

PSE:MEG closed on Friday at P1.96 per share, unchanged from its previous closing price.

While the volume was heavier than 100% of the stock’s 10-day volume average, the stock was hit by a nearly P14M net foreign selling on the same day.

PSE:MEG’s only net foreign buying month this 2023, so far, is March at a negligible amount of P1.83M.

PSE:MEG’s risk level remains low based on its 10-day historical volatility score due to the absence of engulfing candlesticks and price gaps for the past 10 trading days.

My Evergreen Strategy’s algorithm issues no confirmed buy signal for PSE:MEG as of closing on June 16, 2023.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025