Manila, Philippines – DoubleDragon Corp., the listed holding company chaired by tycoon Edgar “Injap” Sia II, has recently formed an exclusive master sales agency agreement with H2 Christie’s International Real Estate to develop Hotel101-Niseko.

This agreement grants H2 Christie’s the authority to market hotel units within the 1.17-hectare freehold titled land of Hotel101-Niseko, with the possibility of appointing sub-agents for this purpose.

Hotel101 Global, the subsidiary responsible for the global expansion of DoubleDragon’s hotel ventures, anticipates that the unit sales revenue from Hotel101-Niseko will reach around $128.88 million or P7.12 billion.

According to Sia, the ownership of Hotel101-Niseko units presents a promising investment opportunity, providing individuals with direct and perpetual real estate asset ownership through condominium titles.

As part of its global expansion strategy, Hotel101 Global, headquartered in Singapore, aims to secure a listing on the NASDAQ (US Stock Exchange).

The company expects over 95 percent of its revenues to be generated from operations outside the Philippines.

The initial three international projects under the Hotel101 brand will be in Niseko, Japan; Madrid, Spain; and California, USA.

These projects are key milestones in Hotel101’s journey towards becoming a global brand, with extensive plans to expand its presence across more than 100 countries.

By 2026, Hotel101 Global targets operating in 25 countries, including the Philippines, Japan, Spain, USA, United Kingdom, UAE, India, Thailand, Malaysia, Vietnam, Indonesia, Saudi Arabia, Singapore, Cambodia, Bangladesh, Mexico, South Korea, Australia, Canada, Switzerland, Turkey, Italy, Germany, France, and China.

In addition to its involvement in the hotel industry, DoubleDragon engages in various sectors such as office leasing through Jollibee Tower and DoubleDragon Plaza at the DD Meridian Park complex, community retail through CityMall community centers, and warehousing through CentralHub warehouse complexes.

These ventures have enabled DoubleDragon to amass a recurring income portfolio of 1.2 million square meters across its assets.

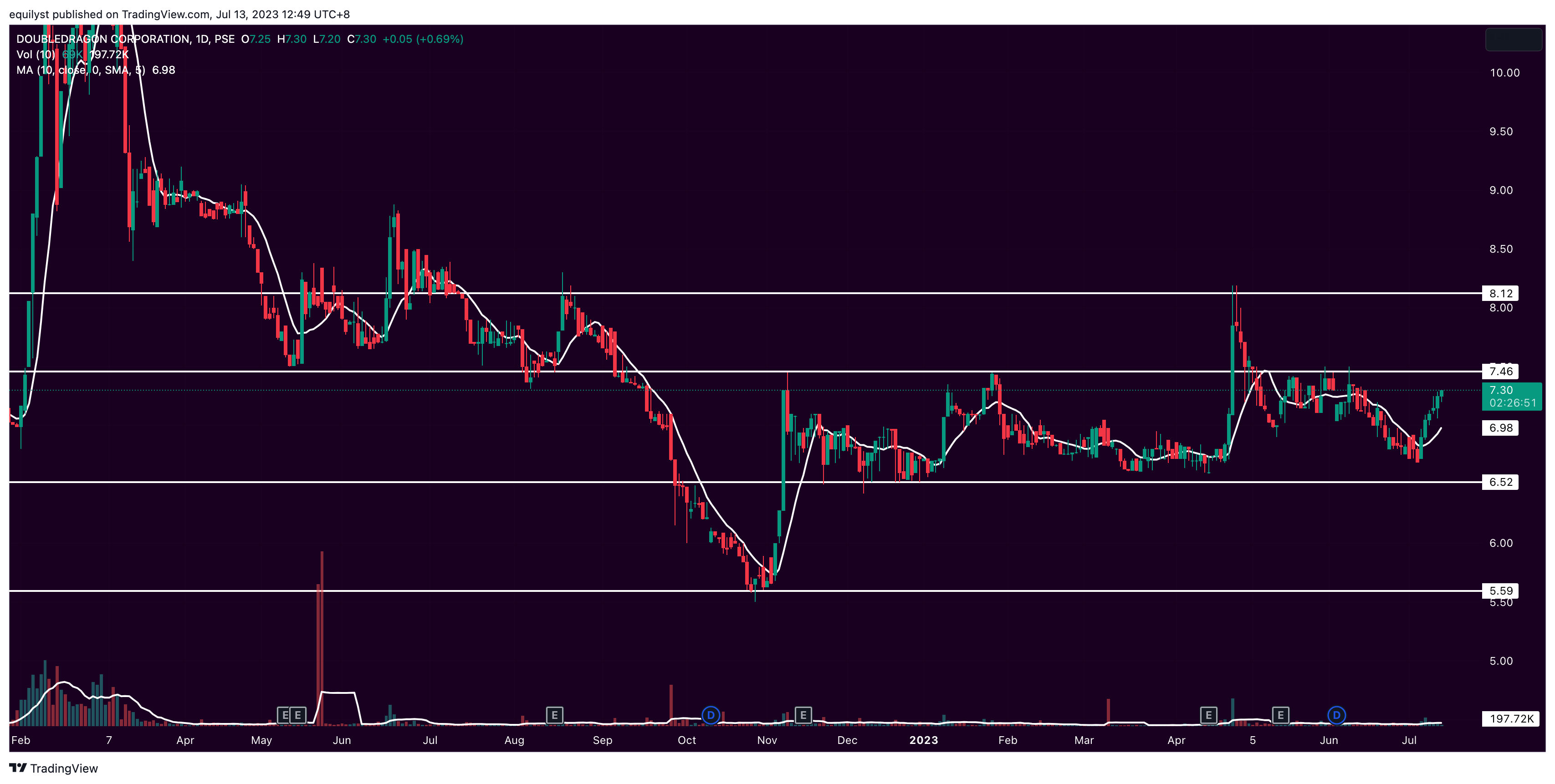

PSE:DD trades at P7.30 per share as of the time of writing. Support is at P6.50 while the resistance is at P7.50. The stock moves above its 10-day simple moving average. Current price is closer to the resistance than the support level. Volume for the past five trading days is almost always higher than 100% of DD’s 10-day volume average.

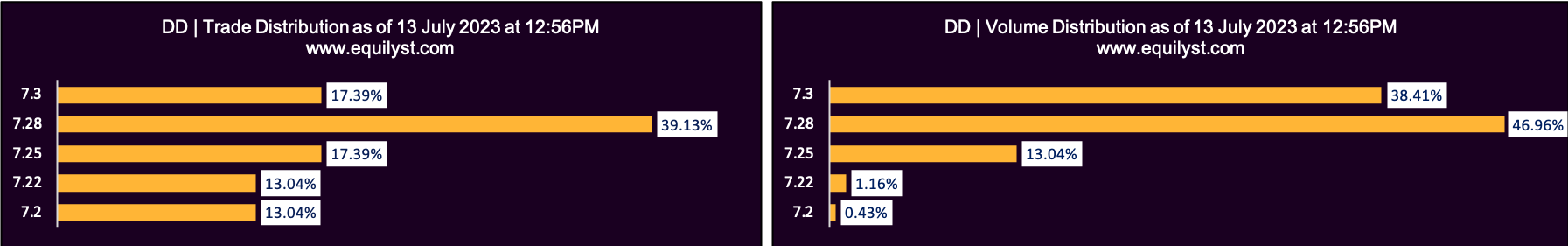

Trade-Volume Distribution

Dominant Range Index: BULLISH

Last Price: 7.3

VWAP: 7.28

Dominant Range: 7.28 – 7.28

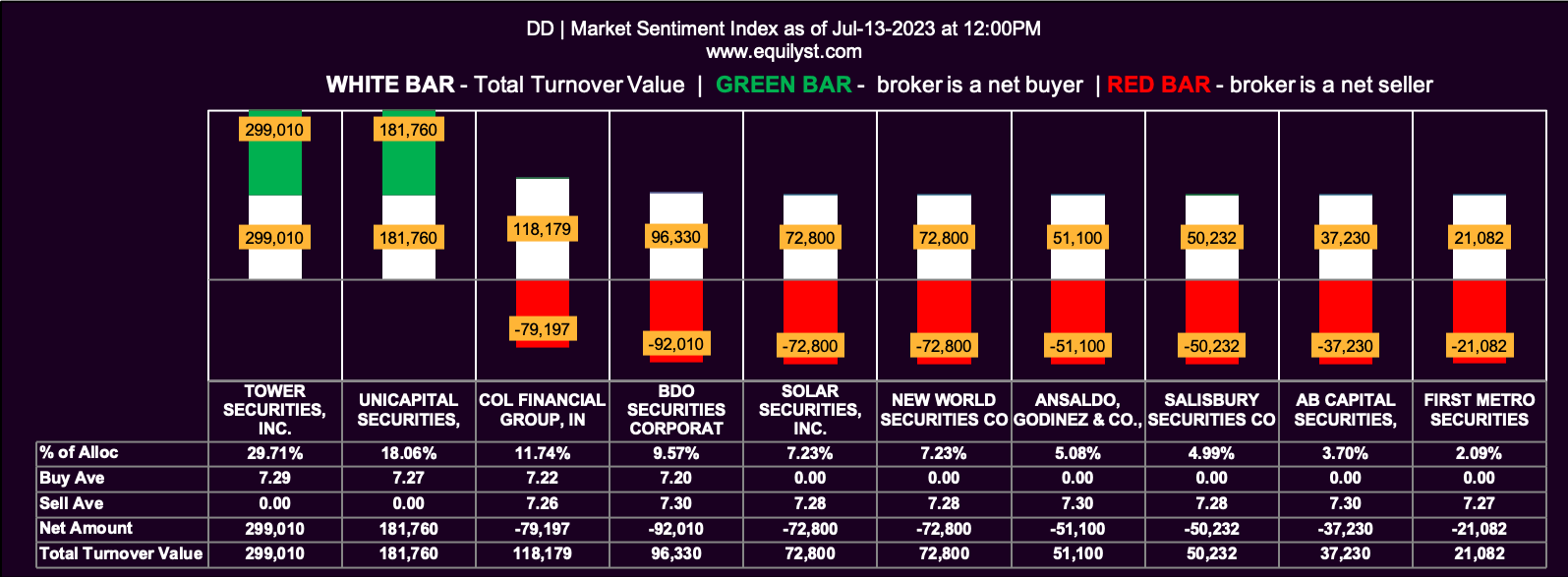

Market Sentiment

Market Sentiment Index: BEARISH

4 of the 13 participating brokers, or 30.77% of all participants, registered a positive Net Amount

4 of the 13 participating brokers, or 30.77% of all participants, registered a higher Buying Average than Selling Average

13 Participating Brokers’ Buying Average: ₱7.12292

13 Participating Brokers’ Selling Average: ₱7.27672

4 out of 13 participants, or 30.77% of all participants, registered a 100% BUYING activity

7 out of 13 participants, or 53.85% of all participants, registered a 100% SELLING activity

Stock Market Consultancy Servicre

Optimize your stock portfolio for maximum returns with our Stock Portfolio Rehabilitation Program.

Become a TITANIUM client to gain knowledge on capital preservation, protecting gains, and minimizing losses while trading and investing in the Philippine stock market.

Become a PLATINUM client to receive comprehensive technical analysis and personalized recommendations based on your entry price, average cost, investment goals, and risk tolerance.

Become a GOLD client to engage in teleconsultations with our team while trading occurs, providing real-time guidance over the phone.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025