Globe Telecom, Inc. and the Aboitiz Group are advocating for the extension of an Anti-Red Tape Authority (ARTA) joint memorandum circular (JMC) that simplifies the permit process.

According to Globe, the streamlined rules have led to notable progress in their cell site construction program.

In a statement, Globe highlighted that the JMC, which is scheduled to expire in September, aims to reduce bureaucracy and expedite government transactions by adopting simpler requirements and procedures.

Ernest L. Cu, the president and CEO of Globe, stressed the significance of extending the JMC beyond September. Cu, a member of the Private Sector Advisory Council (PSAC) chaired by Sabin M. Aboitiz, President and CEO of the Aboitiz Group, expressed pride in collaborating with Globe and the government through the PSAC to improve the country’s telecommunications system. Aboitiz echoed Cu’s sentiments, noting that streamlining telco permitting is one of several initiatives they are working on to enhance efficiency and innovation in digital connectivity for Filipinos.

The advisory council has written a letter to President Ferdinand R. Marcos, Jr., requesting the continuation of the JMC. Established last year, the PSAC aims to foster closer collaboration between the public and private sectors.

Cu attributed the completion of nearly 4,500 Globe cell sites between 2020 and 2022, which was twice as fast as the previous network builds from 2017 to 2019, to ARTA’s efforts in improving and streamlining the permitting process.

He acknowledged the formalization of streamlined procedures as the driving force behind eliminating burdensome local government permit requirements, enabling mobile network operators and tower companies to more efficiently deploy networks and provide effective connectivity.

Globe has divested 447 telecommunications towers to Unity Digital Infrastructure, Inc., a joint venture between Aboitiz InfraCapital, Inc. and Partners Group, for P5.4 billion.

The company invested P101.4 billion in network infrastructure last year, allocating $1.3 billion for capital expenditure in 2023.

Following the tower sale and leaseback agreement between Globe and the Aboitiz Group, both companies are committed to fostering transformative change in the country, aiming to create a more connected and digitally empowered society.

The agreement includes the sale of 447 towers to Unity Digital Infrastructure Inc., which will additionally construct over 200 towers in Visayas and Mindanao.

Cu expressed his belief that the joint effort to build these towers will contribute to the nation and enhance the deployment of digital infrastructure.

The transaction enables Globe to efficiently raise capital, reallocate resources, improve its balance sheet, and leverage the expertise of tower companies, ultimately enhancing customer service.

Globe anticipates a pre-tax net transaction gain of PHP1.8 billion from the deal.

The proceeds from the tower sale will support Globe’s future capital expenditures and debt reduction, ensuring the sustainability of its network and service quality.

Sabin Aboitiz, CEO of the Aboitiz Group, expressed gratitude to Globe for entrusting their towers to the company.

He emphasized that the agreement symbolizes a commitment to collaboration, digital progress, and the future of the Philippines.

Aboitiz, who also leads the Private Sector Advisory Council, expressed optimism that this collaboration could inspire other industries to cooperate and drive transformative change in the country.

Globe has already received PHP47.9 billion from the PHP96.3 billion Tower Sale and Leaseback deal, which covers 7,506 towers.

Subsequent closings will occur once the closing conditions are met.

With fewer towers at their disposal, Globe aims to enhance operational efficiency while maintaining reliable telco services.

After significant capital expenditure over the past two years to establish a robust network backbone, the company is now focusing on optimizing capital efficiency.

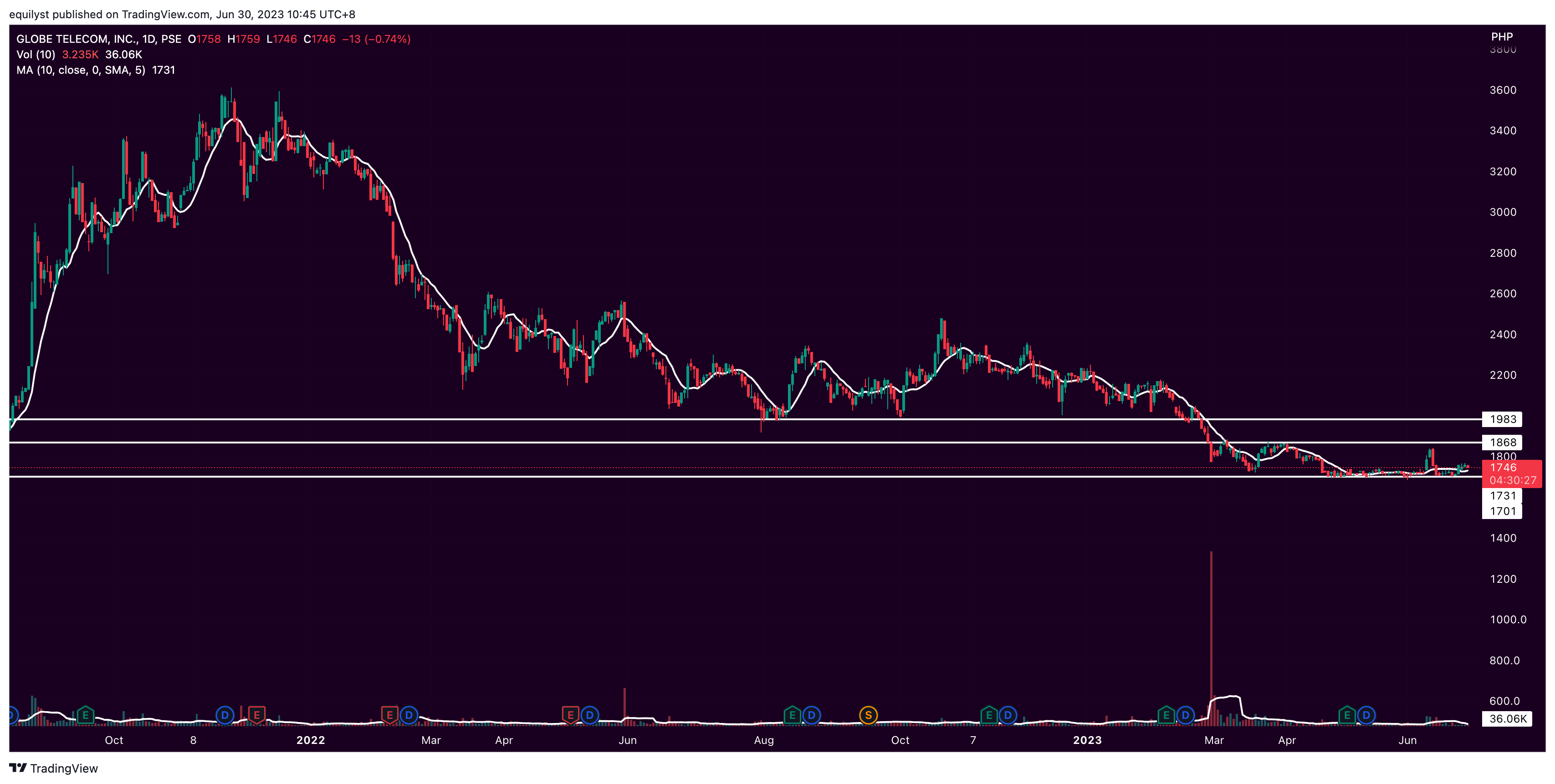

As of this time of writing, PSE:GLO trades at P1,750.00 per share, down by 0.51%. GLO is also down by 19.72% year-to-date and down again by 51.55% from its all-time high of P3,612 per share.

GLO has been trading between the support at P1,700 and resistance at P1,870 for four months already. Volume is quite flimsy, adding to the reason why the share price struggles to inch closer to the resistance area. GLO’s daily volume has been less than 50% of the stock’s 10-day volume average since June 23, 2023, Friday.

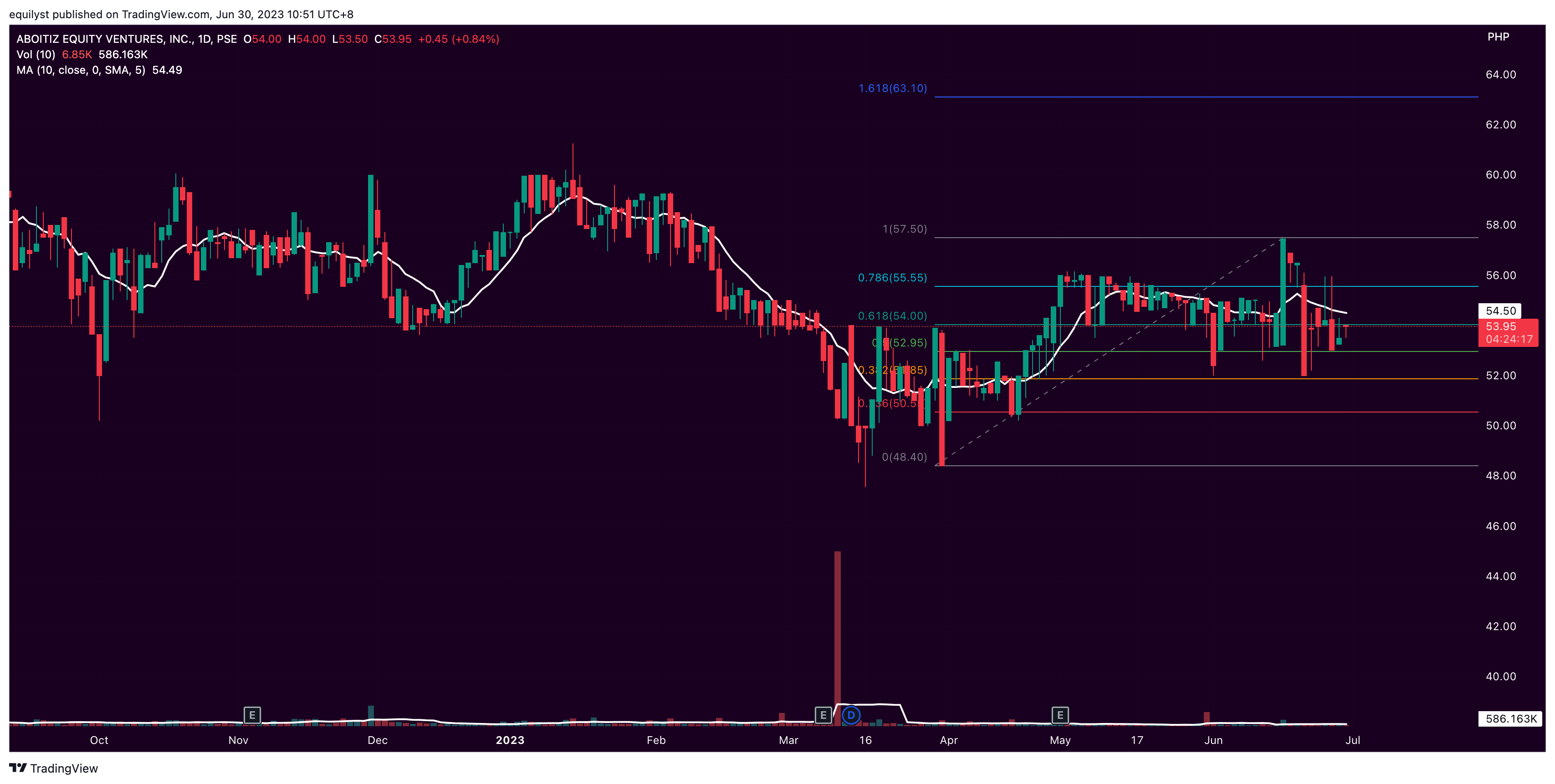

On the other hand, PSE:AEV trades at P53.95 per share, up by 0.84%. AEV is down by 6.5% year-to-date and down again by 36% from its all-time high of P84.30.

AEV’s support sits at P52.95, aligned with the 50% of its Fibonacci retracement. Resistance is at P54.00, confluent with the golden ratio (61.8%) of its Fibonacci retracement. The secondary resistance awaits at P55.55, leveled to its 78.6% Fibonacci retracement.

AEV displays a lackluster volume to which we can attribute the sideways movement of the stock with a bearish bias.

Do You Need Help Trading or Investing in the Stocks Mentioned in this Report?

Fix and rebalance your stock portfolio for optimal returns through our Stock Portfolio Rehabilitation Program.

Be a TITANIUM client to learn how to preserve capital, protect gains, and prevent unbearable losses when trading and investing in the Philippine stock market.

Be a PLATINUM client to request our in-depth technical analysis with recommendations tailored-it to your entry price, average cost, buy case, and risk tolerance.

Be a GOLD client to have a teleconsultation with us over the phone as trading happens.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025