The renowned Maharlika Investment Fund, under the astute leadership of former Socioeconomic Planning Secretary Karl Kendrick Chua, will soon witness a noteworthy addition to its esteemed board.

D&L Industries, a prominent player in the chemicals manufacturing industry, recently made a groundbreaking revelation by announcing Chua’s appointment as an independent director.

This pivotal decision was officially disclosed to the stock exchange on a momentous Monday.

A significant shift is expected in the board dynamics as Chua assumes the position formerly held by the late Filemon Berba, a dedicated member of D&L’s esteemed Board from 2012 until his untimely demise on April 4.

As this momentous transition takes place, it is noteworthy that four out of the seven board seats will continue to be occupied by independent directors, further strengthening the company’s commitment to effective governance.

Karl Kendrick Chua’s illustrious background brings a wealth of experience to the table.

He previously served as the secretary of the National Economic and Development Authority (NEDA) during the Duterte administration, demonstrating his exceptional capabilities in shaping economic policies.

Prior to that, his invaluable contributions as an undersecretary at the Department of Finance were instrumental in the successful creation and passage of the groundbreaking Tax Reform for Acceleration and Inclusion Law, which paved the way for much-needed adjustments in income tax rates.

The appointment of Chua has been hailed as a significant step toward maintaining good governance and fostering transparency within the company.

Alvin Lao, president and CEO of D&L Industries, expressed his confidence in this decision, emphasizing the continued majority representation of independent directors on the Board.

This resolute commitment to upholding the highest standards of governance underscores the company’s dedication to achieving sustainable growth and success under the guidance of the Maharlika Investment Fund.

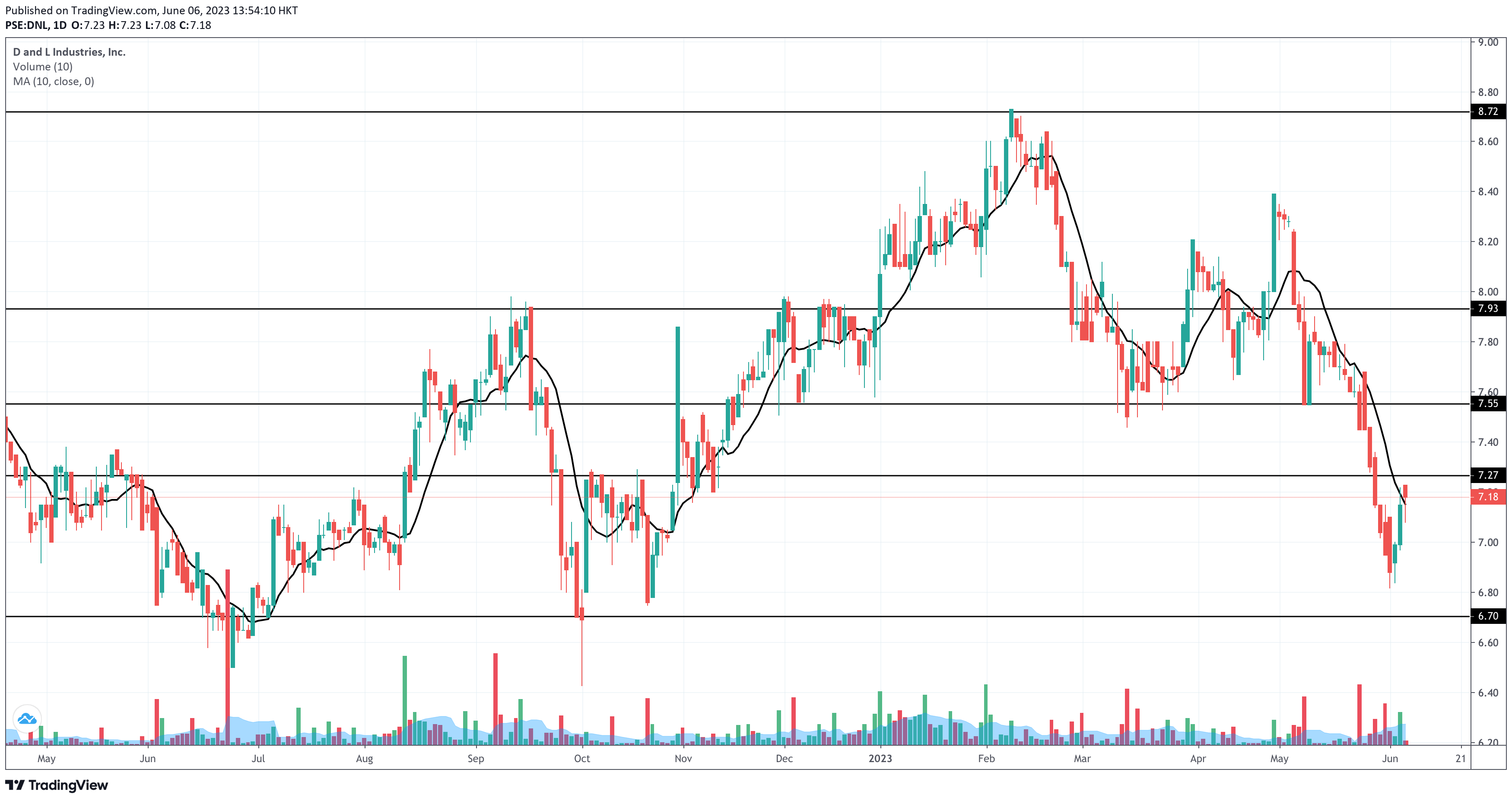

As of 1:54PM on June 6, 2023, DNL trades at P7.18 per share, down by 0.42%. Volume is less than 50% of DNL’s 10-day volume average.

The immediate support is planted near P6.70, while the resistance is fenced near P7.30. The higher resistance levels are plotted on the daily chart already.

The foreign investors have been registering Net Foreign Selling amounts on DNL for the past 13 consecutive trading days. As of the time of writing this report, DNL garners another Net Foreign Selling worth P3 million.

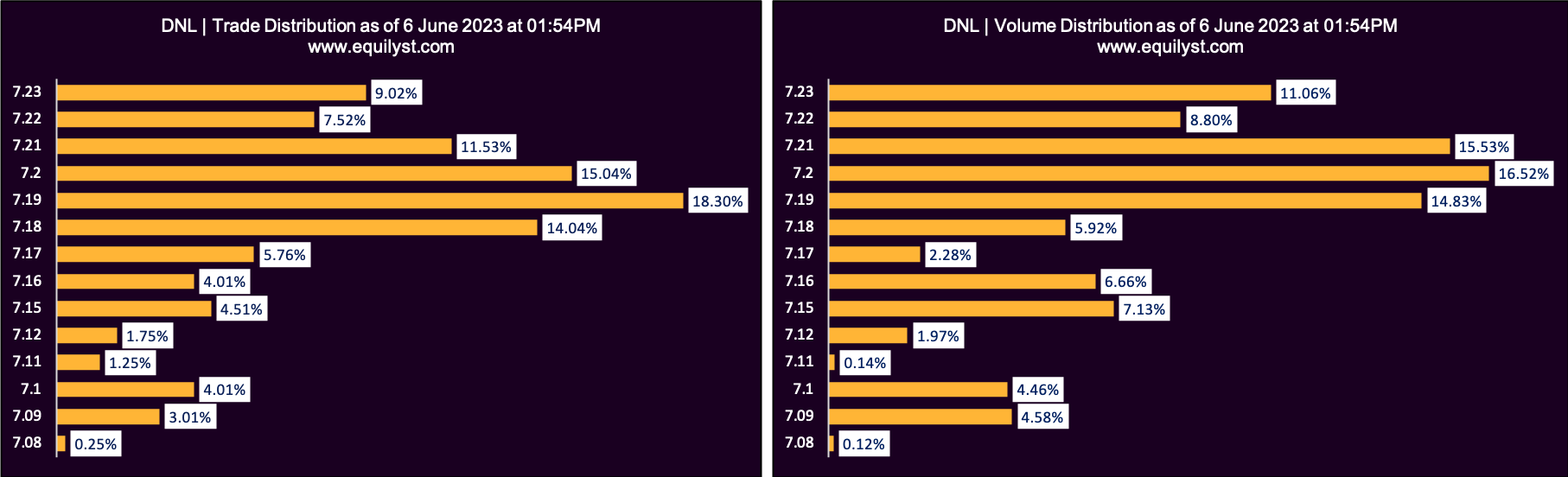

Trade-Volume Analysis

Dominant Range Index: BULLISH

Last Price: 7.18

VWAP: 7.19

Dominant Range: 7.19 – 7.2

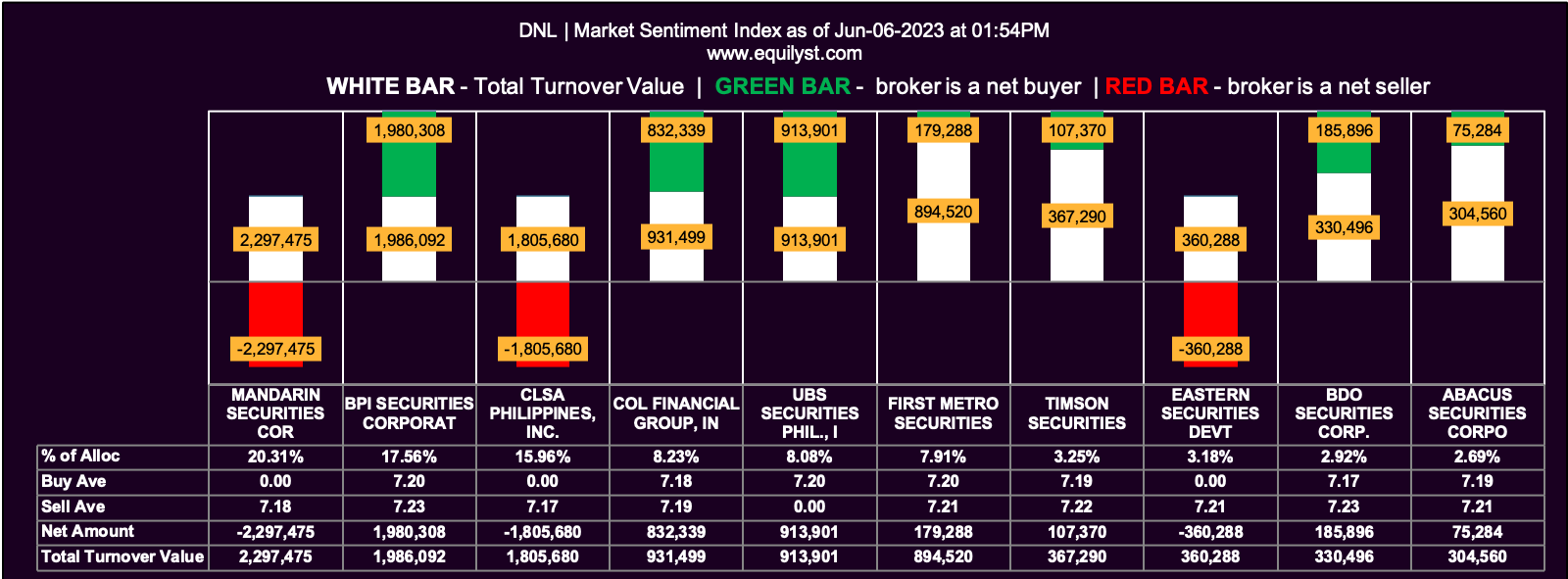

Market Sentiment Analysis

Market Sentiment Index: BEARISH

16 of the 23 participating brokers, or 69.57% of all participants, registered a positive Net Amount

9 of the 23 participating brokers, or 39.13% of all participants, registered a higher Buying Average than Selling Average

23 Participating Brokers’ Buying Average: ₱7.16725

23 Participating Brokers’ Selling Average: ₱7.20371

9 out of 23 participants, or 39.13% of all participants, registered a 100% BUYING activity

7 out of 23 participants, or 30.43% of all participants, registered a 100% SELLING activity

There are some indicators in our Evergreen Strategy that are bearish on DNL as of the time of this report. That means we see no buy signal to do a test-buy or top-up on existing positions as far as our methodology is concerned. However, please know that this synthesis is subject to change since trading is still ongoing.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025