Century Properties Group (CPG), a subsidiary of the Antonio Group, has successfully acquired Mitsubishi Corp.’s shares in their joint ventures, PHirst Park Homes Inc. (PPHI) and Tanza Properties Inc. (TPI). The acquisition of Mitsubishi’s 40 percent stake in PPHI, amounting to P1.32 billion, has granted CPG full ownership of the business unit. This strategic move aligns with CPG’s goal of consolidating interests in a robust market segment to create greater value for stakeholders and address the housing backlog in the Philippines.

According to CPG Executive Chairman and Ambassador Jose Antonio, this acquisition marks a significant step in serving the needs of Filipinos by providing decent, quality, and affordable first homes. It also supports the government’s efforts to address the housing backlog. Mitsubishi, on the other hand, plans to redirect its focus toward other market opportunities in both the Philippines and the wider Asian region, as stated by Mitsubishi Executive Vice President and Group CEO for Urban Development Group, Takuya Kuga.

Despite their respective shifts in focus, both CPG and Mitsubishi will continue exploring new asset classes in the real estate sector for potential co-investment opportunities. This underscores their commitment to driving innovation and expansion in their portfolios. Moreover, PPHI, which initially launched as an affordable housing brand in 2017, has expanded to become one of Mitsubishi’s core businesses in the Philippine real estate market.

CPG’s expansion into other markets is evident through its subsidiary, Century PHirst Corp. (CPC), which has ventured into socialized and economic housing, as well as mid-income residential markets. CPC has already opened three flagship projects, including PHirst Sights Bay in Bay, Laguna, which targets the socialized and economic housing segment, PHirst Editions Batulao in Nasugbu, Batangas, as its maiden mid-income development, and PHirst Centrale Hermosa, its first mixed-use township located in Hermosa, Bataan.

Looking ahead, CPG President and CEO Marco Antonio emphasizes the strong fundamentals of the affordable housing market. Despite macro-economic headwinds, the housing backlog remains a reality, providing CPG with favorable prospects. The company remains committed to meeting the housing needs of first-time homebuyers and will actively explore opportunities to expand its portfolio.

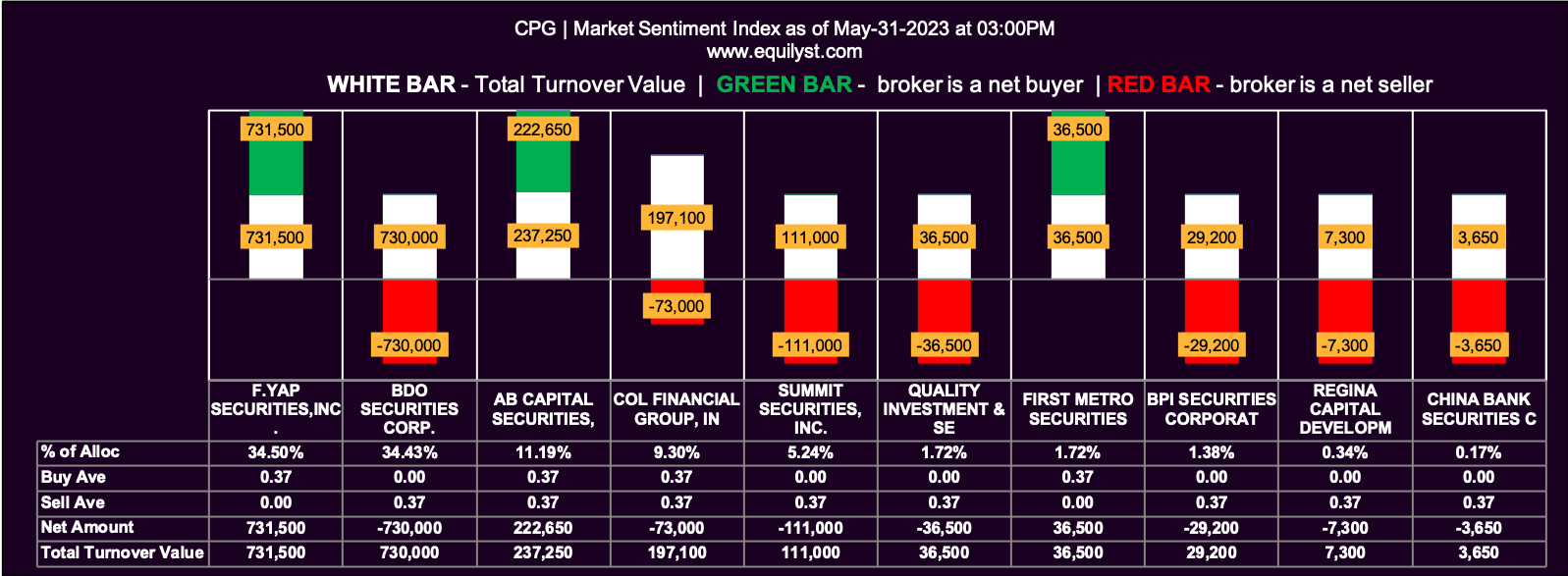

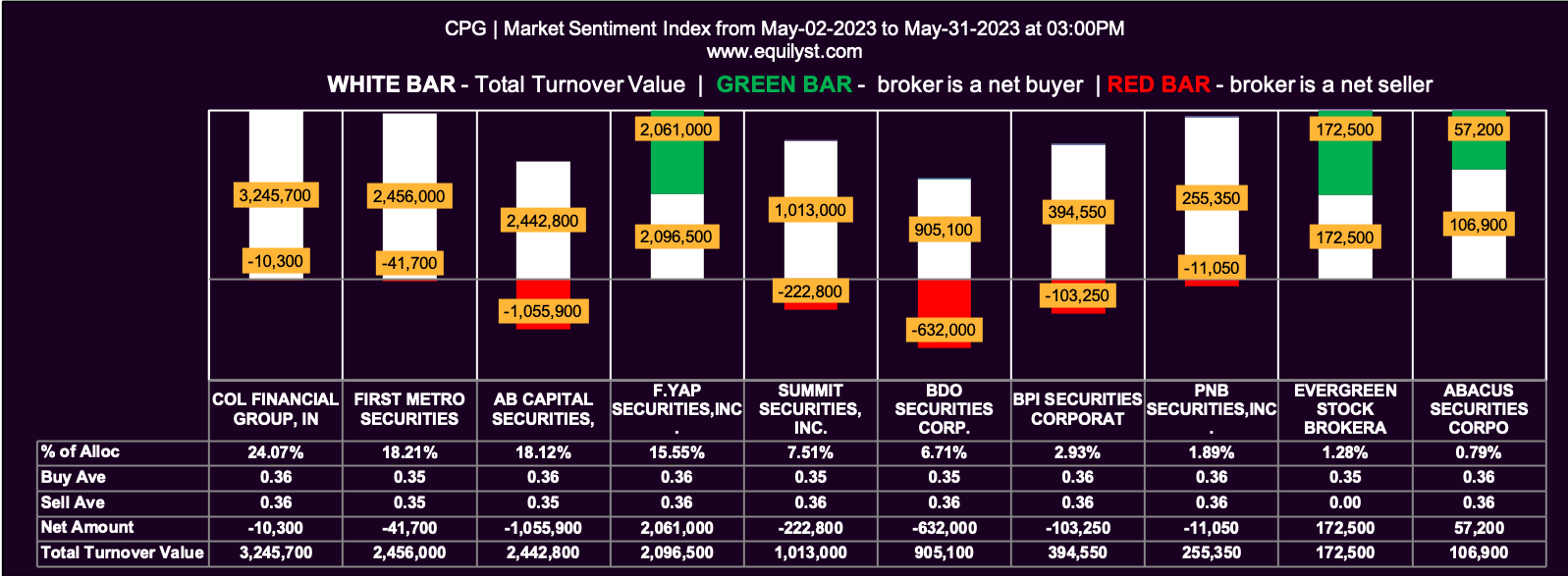

Meanwhile, Equilyst Analytics did a market-sentiment analysis for CPG involving its end-of-day (EOD) data as of closing on May 31, 2023 and its month-to-date data from May 2 to 31.

Sentiment Analysis as of May 31, 2023

Market Sentiment Index: BEARISH

3 of the 10 participating brokers, or 30.00% of all participants, registered a positive Net Amount

2 of the 10 participating brokers, or 20.00% of all participants, registered a higher Buying Average than Selling Average

10 Participating Brokers’ Buying Average: ₱0.36520

10 Participating Brokers’ Selling Average: ₱0.36563

2 out of 10 participants, or 20.00% of all participants, registered a 100% BUYING activity

6 out of 10 participants, or 60.00% of all participants, registered a 100% SELLING activity

Sentiment Analysis from May 2 to 31

Market Sentiment Index: BEARISH

5 of the 20 participating brokers, or 25.00% of all participants, registered a positive Net Amount

5 of the 20 participating brokers, or 25.00% of all participants, registered a higher Buying Average than Selling Average

20 Participating Brokers’ Buying Average: ₱0.35256

20 Participating Brokers’ Selling Average: ₱0.35646

2 out of 20 participants, or 10.00% of all participants, registered a 100% BUYING activity

6 out of 20 participants, or 30.00% of all participants, registered a 100% SELLING activity

Fundamentally speaking, the acquisition of Mitsubishi’s shares in PPHI and TPI bolsters CPG’s market position and exemplifies its dedication to addressing the housing demands of Filipinos. With a strategic realignment and continued focus on the affordable housing market, CPG is poised for growth and sustained success.

Ready to preserve your capital, protect your gains, and prevent losses in the Philippine stock market? Discover how Equilyst Analytics’ expert consultancy service can guide you strategically. Take control of your investments today! Click here to learn more.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025