Under the leadership of Ayala, Bank of the Philippine Islands (BPI) faced a P1 million penalty from the Bangko Sentral ng Pilipinas (BSP) for non-compliance with regulations concerning the disposal of treasury shares valued at P33.04 billion.

These shares originated from the merger with its thrift banking arm in early 2022.

BPI publicly disclosed to the Philippine Stock Exchange (PSE) that a letter had been received from the BSP, informing them of the imposed monetary fine due to their failure to follow Section 10 of Republic Act 8791, commonly known as The General Banking Law of 2000, which deals with the disposal of treasury shares.

During the merger between BPI and BPI Family Savings Bank Inc., there was a requirement to dispose of the treasury shares within six months.

However, BPI’s request to retire these shares as a means of disposal was not approved by the BSP, as it was deemed inconsistent with the law.

In September of the previous year, BPI had made a public announcement stating their decision to no longer pursue the proposed amendment to their Articles of Incorporation, which aimed to decrease the authorized capital stock by retiring the treasury shares.

In subsequent communications with the BSP, BPI informed them about the approval of the property dividend declaration as an alternative method for disposing of the treasury shares.

However, regulatory approvals were still pending, and it was only on June 13 of the current year that BPI obtained the endorsement of the property dividend declaration from the Securities and Exchange Commission.

This was indicated by the issuance of the Certificate of Filing the Notice of Property Dividend Declaration.

The distribution of the property dividends involves 406.18 common shares of BPI, held in the treasury and valued at P33.08 billion, being distributed to eligible stockholders based on the record date of March 29.

BPI will release further information regarding the payment date and provide additional details on the distribution of the property dividend, excluding the relevant final withholding tax, at an appropriate time.

Due to the delay in securing SEC approval for the property dividend declaration, it remains uncertain whether BPI will choose to pay the fine or contest the penalty.

BPI aims to conclude its merger with Robinsons Bank Corp. (RBC), led by Gokongwei, at an earlier date.

After the completion of the merger, JG Summit Capital Services Corp. and Robinsons Retail Holdings Inc., who are shareholders of RBC, will collectively hold approximately six percent of BPI’s capital stock by the end of this year.

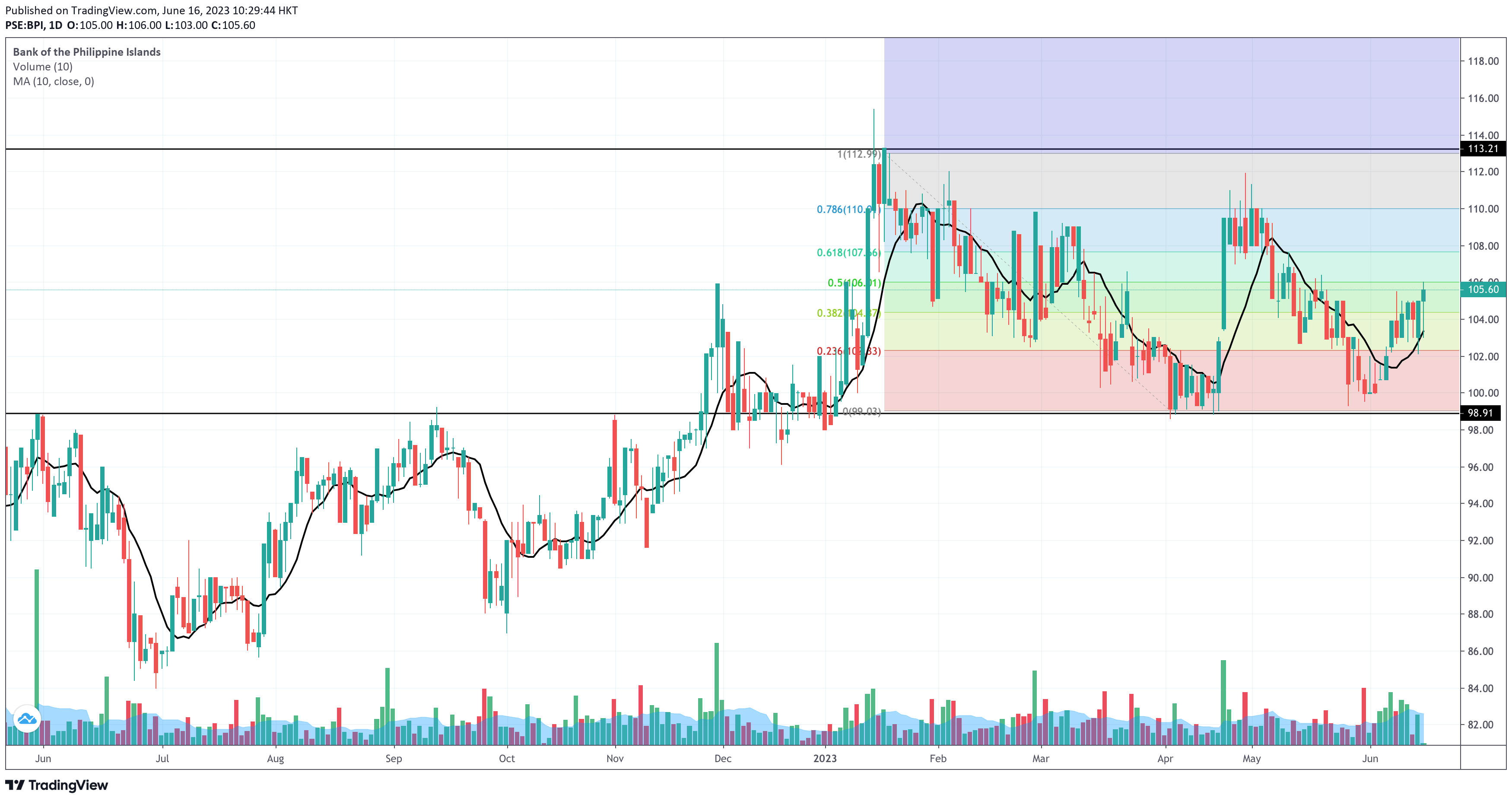

Meanwhile, BPI trades at P105.40 per share, up by 0.38%. Support is at P104.40, confluent with the 38.2% Fibonacci retracement, while resistance is at P106.00, aligned with the 50% Fibonacci retracement.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025