The Bank of the Philippine Islands (BPI), led by Ayala, aims to secure a minimum of $150 million through a syndicated loan to partially fund its upcoming foreign obligations within the next two years.

According to Eric Luchangco, the Chief Finance and Sustainability Officer of BPI, the bank has recently engaged HSBC and Standard Chartered Bank, renowned British financial institutions, as the primary organizers of the syndicated loan.

Luchangco mentioned during the “Green and Beyond Sustainability Fair” that the issuance has already commenced and they are committed to proceeding with it.

He stated that their initial target is $150 million, but there is potential for an increase in the loan size.

Loan syndication comes into play when a borrower requires a sum of money that exceeds what a single lender can provide, prompting multiple lenders to pool their resources and form a syndicate to fulfill the borrower’s capital requirements.

Luchangco confirmed that HSBC and Standard Chartered are leading the syndicate, and they have initiated discussions with other potential syndicate banks to join the loan arrangement.

In a strategic move, the 171-year-old BPI decided to postpone its planned return to the offshore debt market and explore the option of a syndicated loan instead, which would serve as a means to refinance its maturing foreign-denominated bonds.

BPI currently faces maturing foreign debt amounting to $600 million in September of this year, followed by an additional $300 million due in September of the following year.

As Luchangco explained, the bank possesses some available funds, reducing the need to raise the entire required amount.

BPI’s most recent venture into the offshore bond market occurred in August 2019, when it issued ASEAN green bonds denominated in 100 million Swiss francs.

Subsequently, in late January, the bank announced its intention to explore the international debt market, after successfully listing peso fixed-rate bonds worth P20.3 billion at the Philippine Dealing and Exchange Corp. (PDEx).

The funds raised from the issuance of BPI Reinforcing Inclusive Support for MSMEs Bonds (BPI RISE Bonds) due in 2024 earlier this year will be utilized by the bank to bolster its lending portfolio for micro, small, and medium enterprises (MSMEs).

To complement its financial inclusion and digitalization efforts, Ginbee Go, Head of Consumer Banking at BPI, revealed that the bank is committed to expanding these initiatives.

Currently, 60% or 5.6 million of BPI’s 9.6 million clients are already enrolled in digital channels.

Go stated that their goal is to increase digital enrollment to 70% this year.

However, their primary focus lies in encouraging clients to utilize digital platforms for their transactions. Out of the digitally enrolled customers, three million conduct 50% of their transactions digitally.

Go further emphasized that the number of clients opening bank accounts digitally has risen significantly, accounting for 43% of new clients, nearly tripling from the previous year.

She emphasized the bank’s commitment to leveraging technology and partnerships to bridge the gap and ensure broader access to sustainable and inclusive financial services, aligning with their pursuit of sustainability.

BPI’s target for this year is to acquire two million new customers, as many clients still prefer branch visits despite the bank’s ongoing rationalization efforts.

Go expressed her belief that facilitating access to financial services and digital solutions is important in fostering economic progress and empowering communities.

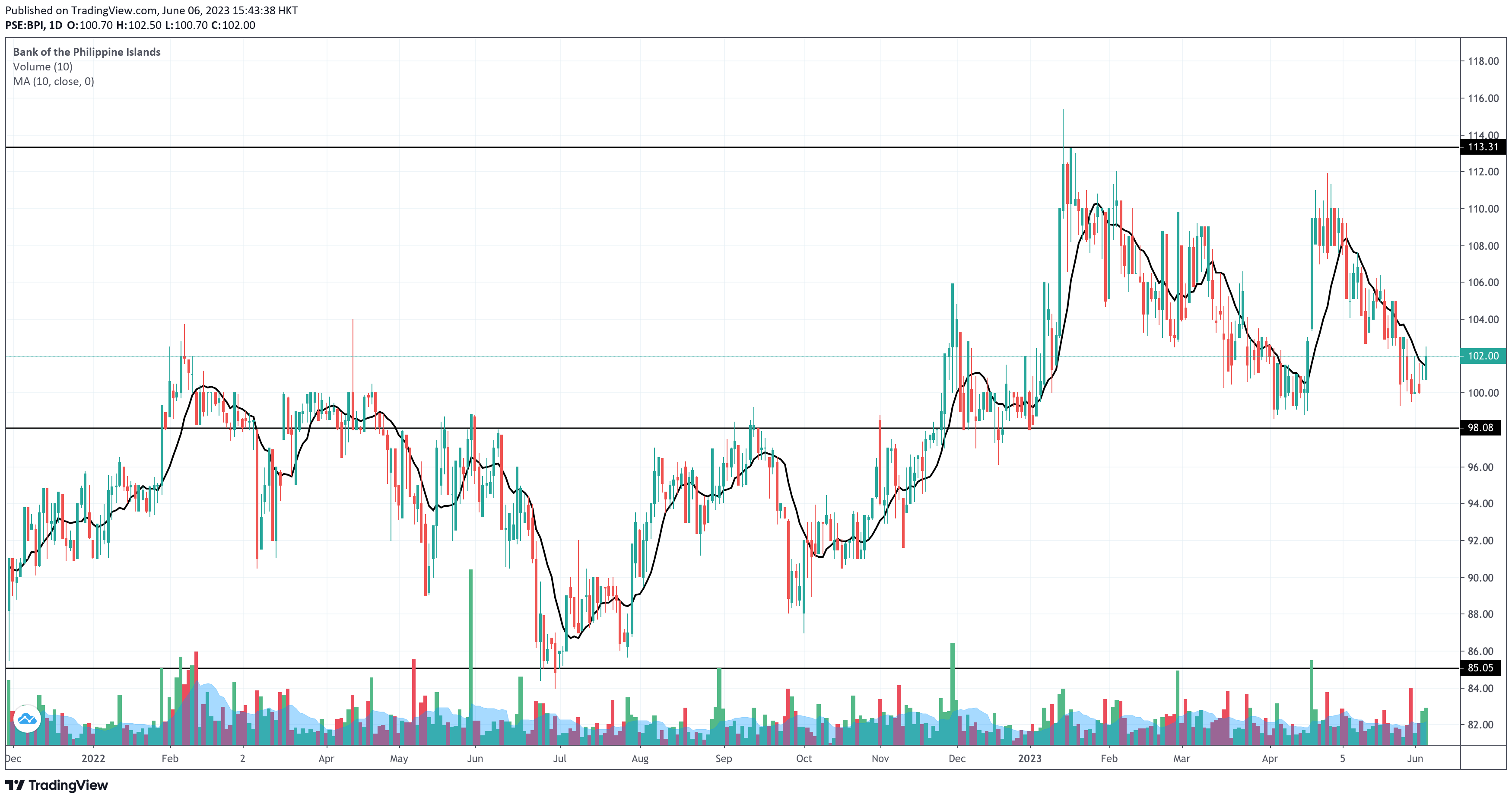

Meanwhile, BPI closed on June 6, 2023 at P102.00 per share, up by 1.29%. Volume is above 100% of BPI’s 10-day volume average, which is a good push for today’s green candlestick. The stock also managed to close higher than its 10-day volume average today.

Support is near P98.00, while resistance is at P113.30.

Foreign investors have a topsy-turvy sentiment toward BPI as they show an inconsistent pattern on their Net Foreign Buying and Selling days.

BPI’s moving average convergence divergence line already bent its direction toward the north, but it’s still trading below the signal line. We may have to see BPI trade above P103.00 per share before seeing a golden cross between the MACD and the signal line.

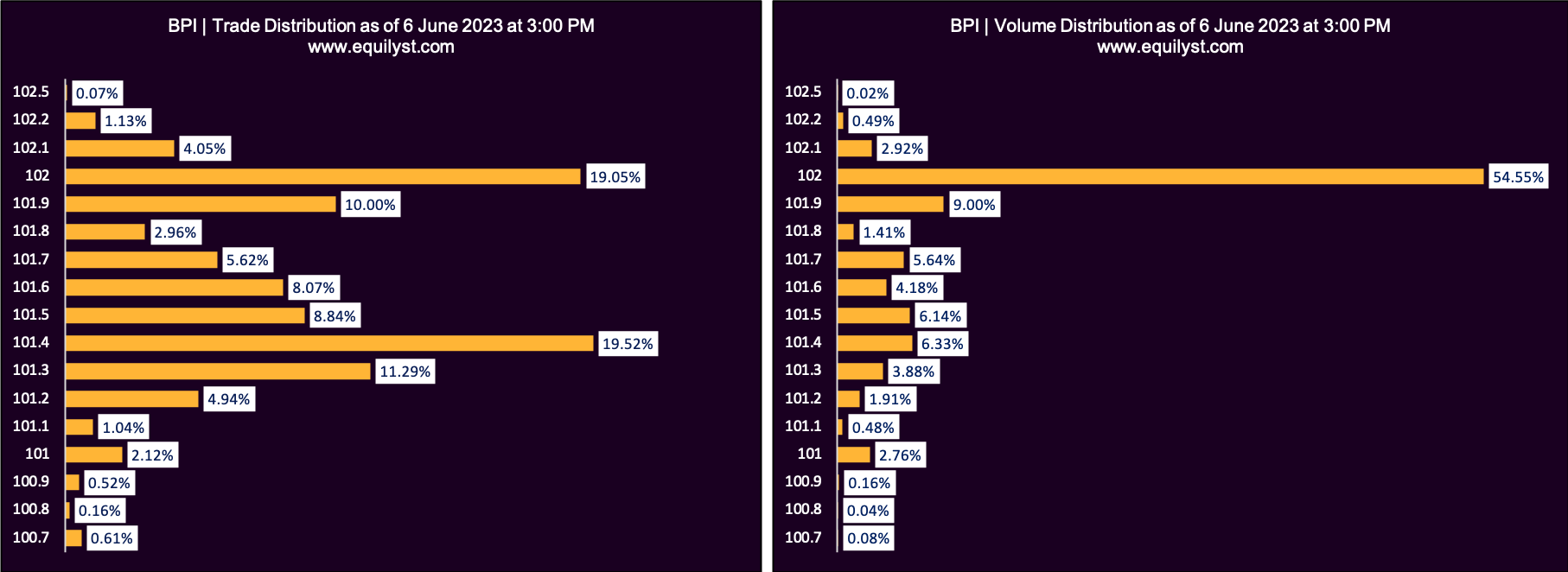

Dominant Range Index: BULLISH

Last Price: 102

VWAP: 101.81

Dominant Range: 101.4 – 102

Market Sentiment Index: BEARISH

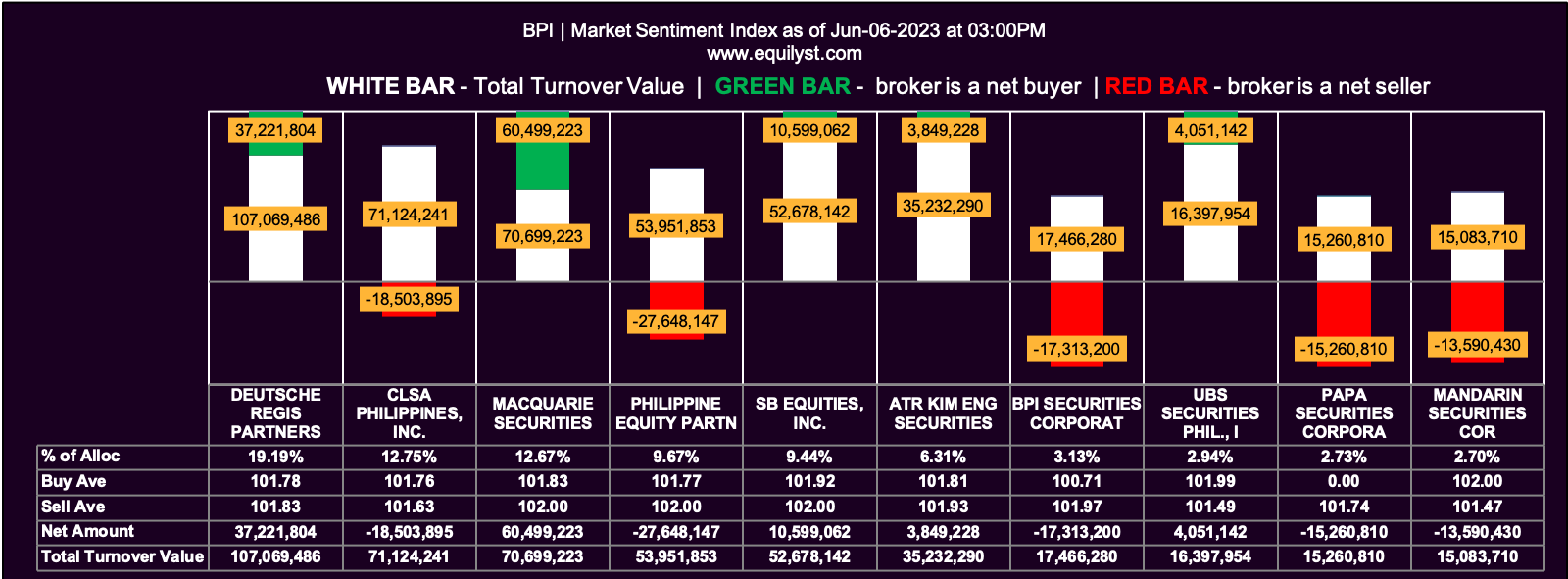

14 of the 38 participating brokers, or 36.84% of all participants, registered a positive Net Amount

10 of the 38 participating brokers, or 26.32% of all participants, registered a higher Buying Average than Selling Average

38 Participating Brokers’ Buying Average: ₱101.69242

38 Participating Brokers’ Selling Average: ₱101.81298

3 out of 38 participants, or 7.89% of all participants, registered a 100% BUYING activity

13 out of 38 participants, or 34.21% of all participants, registered a 100% SELLING activity

While our trade and volume analysis for BPI issued a bullish rating, our market sentiment analysis hinted that some traders translated today’s price action as an opportunity to sell on strength, as evidenced by the higher selling average than buying average.

If you need a tailored fit recommendation according to your entry price, average price, and risk tolerance percentage, consider subscribing to our stock market consultancy services. Here are our packages.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025