The US Securities and Exchange Commission (SEC) has filed a lawsuit alleging that Binance, the world’s largest cryptocurrency exchange, and its founder, Changpeng Zhao, have mishandled funds and violated US securities laws.

US regulators have accused Binance and Changpeng Zhao of misusing investor funds, operating as an unregistered exchange, and committing multiple violations of US securities laws. The lawsuit, filed in a federal court in Washington DC, lists 13 charges against the company, including the commingling and diversion of customer assets to an entity owned by Zhao called Sigma Chain.

As a result of this news, Bitcoin, the most valuable cryptocurrency in circulation, with a worth exceeding $500 billion (€468 billion), experienced a rapid decline, losing nearly 2% in just a few minutes.

Binance, a limited liability company based in the Cayman Islands, was founded by Zhao. The charges brought against them are reminiscent of the practices that were revealed after the collapse of FTX, the second-largest cryptocurrency exchange, last year.

The lawsuit provides detailed information about the extent to which the owners of Binance were aware of the alleged legal violations. It cites an instance where Binance’s Chief Compliance Officer candidly admitted to another compliance officer in December 2018, “we are operating as an unlicensed securities exchange in the USA, bro.”

Gary Gensler, the Chair of the SEC, stated in a written statement that Zhao and Binance were involved in a complex web of deceit, conflicts of interest, lack of disclosure, and intentional evasion of the law. Gensler warned the public to be cautious about investing their hard-earned assets on platforms that operate unlawfully.

In response to the SEC’s investigation, Binance claimed to have been cooperating but criticized the agency for choosing to litigate unilaterally. The company emphasized its intention to vigorously defend its platform and criticized the SEC for failing to provide clarity and guidance to the digital asset industry.

This lawsuit comes as another blow to the cryptocurrency market following the collapse of FTX. FTX faced similar allegations of co-mingling customers’ funds and investing them in high-risk ventures without customers’ knowledge.

Binance’s current legal predicament echoes the concerns expressed by members of the Bitcoin and crypto communities for years. Cory Klippsten, the CEO of Swan Bitcoin, a Bitcoin financial services company, stated that the SEC’s charges against Binance align with the claims that have long circulated within the industry.

It is worth noting that this is not the first time US regulators have taken action against Binance. In March, the Commodity Futures Trading Commission filed an enforcement action in the US District Court for the Northern District of Illinois, charging Binance and Zhao with various violations. Additionally, Samuel Lim, Binance’s former chief compliance officer, has been charged with aiding and abetting the company’s violations.

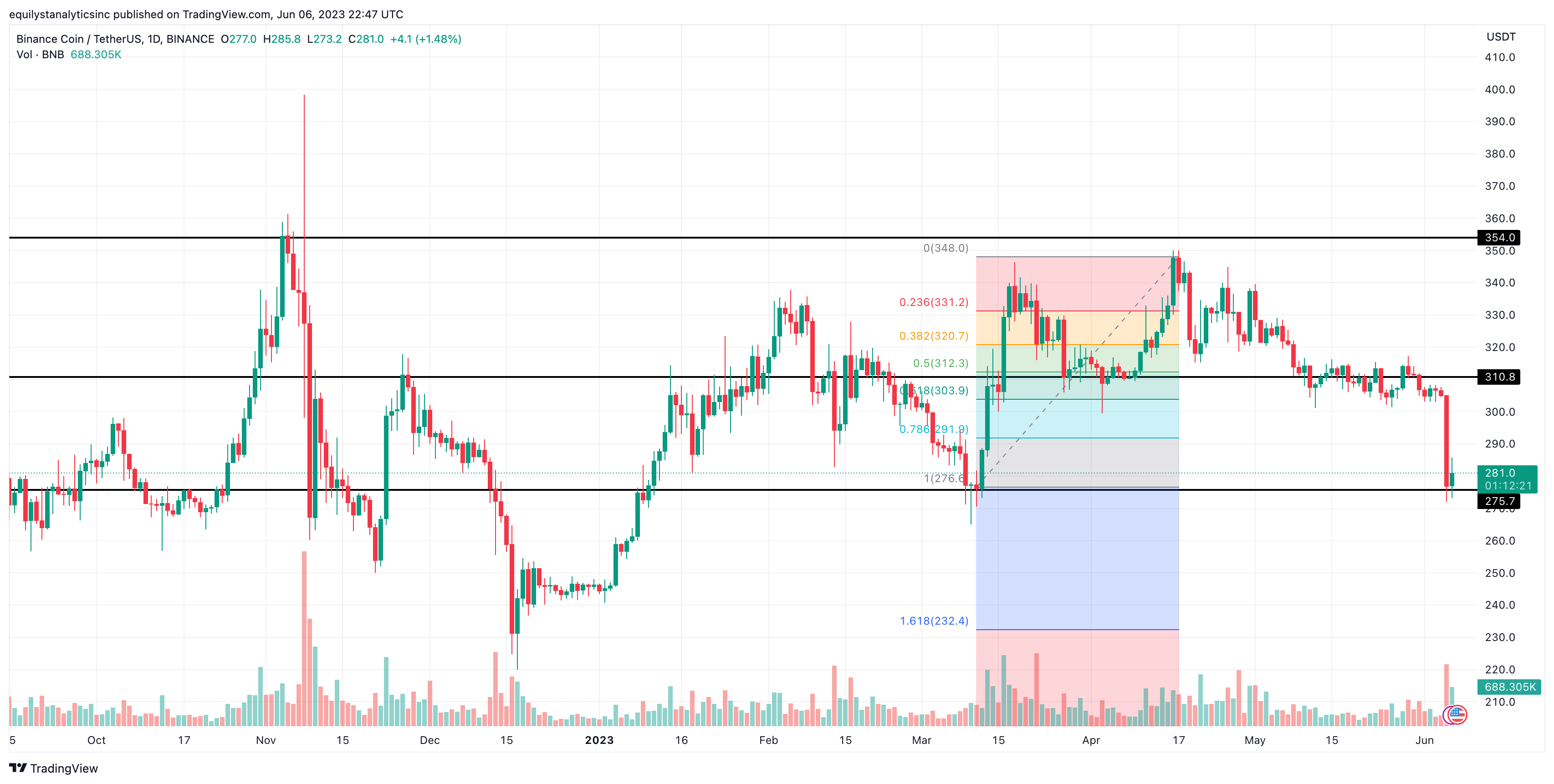

Meanwhile, Binance Coin (BNBUSD) closed at $276.90 per token on June 5, 2023, down by 9.21%. As of 10:47PM UTC on June 6, 2023, the said coin recovered by 1.48% at $281 per token. Support lies at $276.60, while resistance is near $292.00, confluent with the 78.6% retracement of the Up Fibonacci.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025