The Philippine economy is anticipated to face a deceleration in its expansion this year due to global uncertainties, despite the easing of commodity prices.

Sun Life Investment Management and Trust Corp. (SLIMTC) provided a positive overall economic outlook in a recent briefing, acknowledging the presence of lingering headwinds driven by fears of a global recession.

According to SLIMTC’s President and Chief Investment Officer, Mike Enriquez, the projected growth rate for the gross domestic product (GDP) is expected to be 5.4 percent for this year, representing a significant slowdown compared to the 7.6 percent expansion witnessed in 2022.

This figure falls below the six to seven percent assumption established by the Cabinet-level Development Budget Coordination Committee (DBCC).

Enriquez attributed this slowdown to base effects and highlighted the robust growth in consumer spending, particularly in non-food sectors.

However, he acknowledged the existence of headwinds stemming from concerns about a global recession.

Despite these challenges, Enriquez expressed optimism for continued growth in consumption and capital outlay, although it is expected that the slowdown in global growth may dampen business and consumer sentiment.

Enriquez also emphasized the need for caution regarding the recession fears in the US, as their potential impact on consumption cannot be disregarded.

However, he noted that the positive momentum from the reopening story in the previous year is expected to persist, providing further support to the services and tourism sectors.

Furthermore, SLIMTC observed a sustained deceleration in inflation, following a period of stability in recent months, accompanied by a decline in commodity prices compared to the previous year.

According to Enriquez, inflation is projected to taper off to five percent in 2023, which is considerably more optimistic than the DBCC’s assumption range of five to seven percent.

He also acknowledged that risks such as weather-related events, including a weak El Niño, could impact inflation. Early importation of essential commodities like rice, grains, and livestock could help mitigate these risks.

Additionally, he highlighted other factors such as persistent inflation and geopolitical risks that could lead to supply chain disruptions and potentially drive commodity prices higher.

Given the expectation of further cooling inflation, the Bangko Sentral ng Pilipinas (BSP) is anticipated to maintain its pause in key interest rates.

Enriquez indicated that the BSP is currently at an inflection point, with the rate pause expected to persist until the fourth quarter, after which the BSP may consider rate cuts.

Notably, the central bank recently decided to keep the overnight reverse repurchase facility at 6.25 percent. This marks the BSP’s first pause in its series of nine key policy rate hikes since May of the previous year, totaling a cumulative increase of 425 basis points.

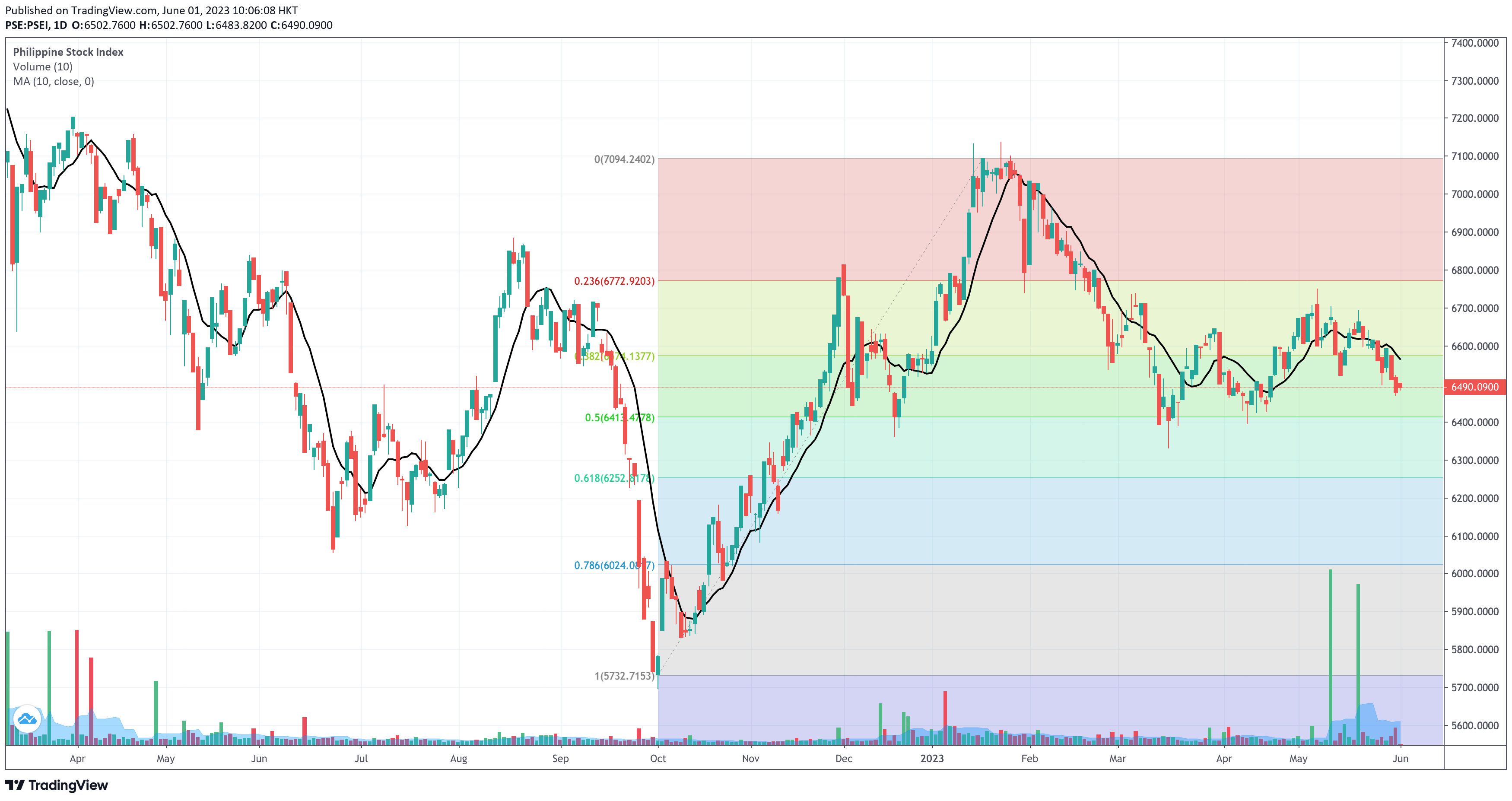

Philippine Stock Exchange Index

As of the date and time indicated on the chart below, the Philippine Stock Exchange Index (PSEi) trades above the immediate support level at 6,400, confluent with the 50% retracement of the Up Fibonacci. The immediate resistance is pegged near 6,575, confluent with the 38.2% Fibonacci retracement. If the fall continues to go south, we’re expecting the PSEi to retest the next support at 6,250, confluent with the 61.8% retracement (golden ratio) of the Fibonacci.

Equilyst Analytics Advice

Here are three investment tips you may want to consider when the local economy is projected to slow down:

- Diversify Your Portfolio: During a period of economic slowdown, it’s important to diversify your investment portfolio across different sectors and asset classes. By spreading your investments, you can mitigate the risks associated with a slowing local economy. Look for sectors that are more resilient to economic downturns, such as essential consumer goods, healthcare, and utilities. Additionally, consider allocating a portion of your portfolio to defensive assets like dividend-paying stocks, which tend to be more stable during economic slowdowns.

- Focus on Quality Stocks: When the local economy is expected to slow down, it becomes even more important to focus on investing in high-quality stocks. If you’re a fundamentalist, look for companies with strong fundamentals, including stable earnings, low debt levels, and a track record of weathering economic downturns. These companies are more likely to withstand the challenges posed by a sluggish economy. If you’re a technician, you may refer to the six indicators that comprise the Evergreen Strategy (a proprietary methodology) of Equilyst Analytics. Conduct thorough research, analyze financial statements, and consider the company’s competitive advantages and market positioning before making investment decisions.

- Seek Dividend-Yielding Investments: Investing in dividend-paying stocks can be advantageous during an economic slowdown. Companies that consistently pay dividends provide a regular income stream to investors, irrespective of short-term market conditions. Dividends can serve as a reliable source of cash flow, helping to offset potential losses during periods of economic weakness. Look for companies with a history of increasing dividends over time, as this indicates a commitment to shareholder returns. However, exercise caution and evaluate the sustainability of dividend payments by assessing the company’s cash flow and dividend payout ratios. Be warned, however, that there are generous dividend-issuing stocks with a share price that consistently break one support level after another. The dividend you’ll receive may not offset the capital depreciation.

Remember, these tips are general guidelines and it’s essential to conduct thorough research and consider your own financial goals, risk tolerance, and investment horizon before making any investment decisions. Consulting with Equilyst Analytics can provide personalized advice tailored to your specific circumstances.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025