Ayala Land Inc. (ALI) has raised P15 billion by issuing fixed-rate bonds due in 2028 and 2023, strengthening its financial resources.

The net proceeds from the offering will be utilized to partially finance ALI’s capital expenditures and refinance short-term borrowings for the year, in line with its goal of reinforcing its balance sheet and implementing its recovery and growth plans, as stated by Augusto Bengzon, ALI’s CFO, treasurer, and chief compliance officer.

The bonds, with a total value of P10.1 billion for the 2028 bonds and P4.9 billion for the 2033 bonds, have been listed at the Philippine Dealing and Exchange (PDEX).

Featuring a coupon rate of 6.0253 percent per annum (p.a.), the 2028 bonds provide investors with a fixed return, while the 2033 bonds, with a coupon rate of 6.2948 percent p.a., offer an attractive investment opportunity.

According to Bengzon, this recent bond issuance is the second largest undertaken by the company, indicating its strong financial position and growth potential.

He emphasized Ayala Land’s resilience and its current trajectory toward recovery and renewed growth over the past three years.

Emilio Aquino, chairman of the Securities and Exchange Commission, acknowledged Ayala Land as a prominent and diverse real estate conglomerate in the Philippines.

The company engages in various activities, including developing sustainable estates, industrial estates, residential and office condominiums, residential properties, commercial lots, retail and office spaces, hotels and resorts, warehouses and factory buildings.

Aquino highlighted the alignment of Ayala Land’s real estate expertise with the government’s 10-point agenda for economic renewal and long-term growth, known as the Build Better More program.

Antonio Nakpil, president and CEO of the Philippine Dealing and Exchange Corp., referred to ALI’s bond listing as a model for other companies seeking to raise funds through bond issuances, public offerings or institutional buyers. Nakpil encouraged firms to emulate Ayala Land’s successful example as they strive to elevate their financing capabilities.

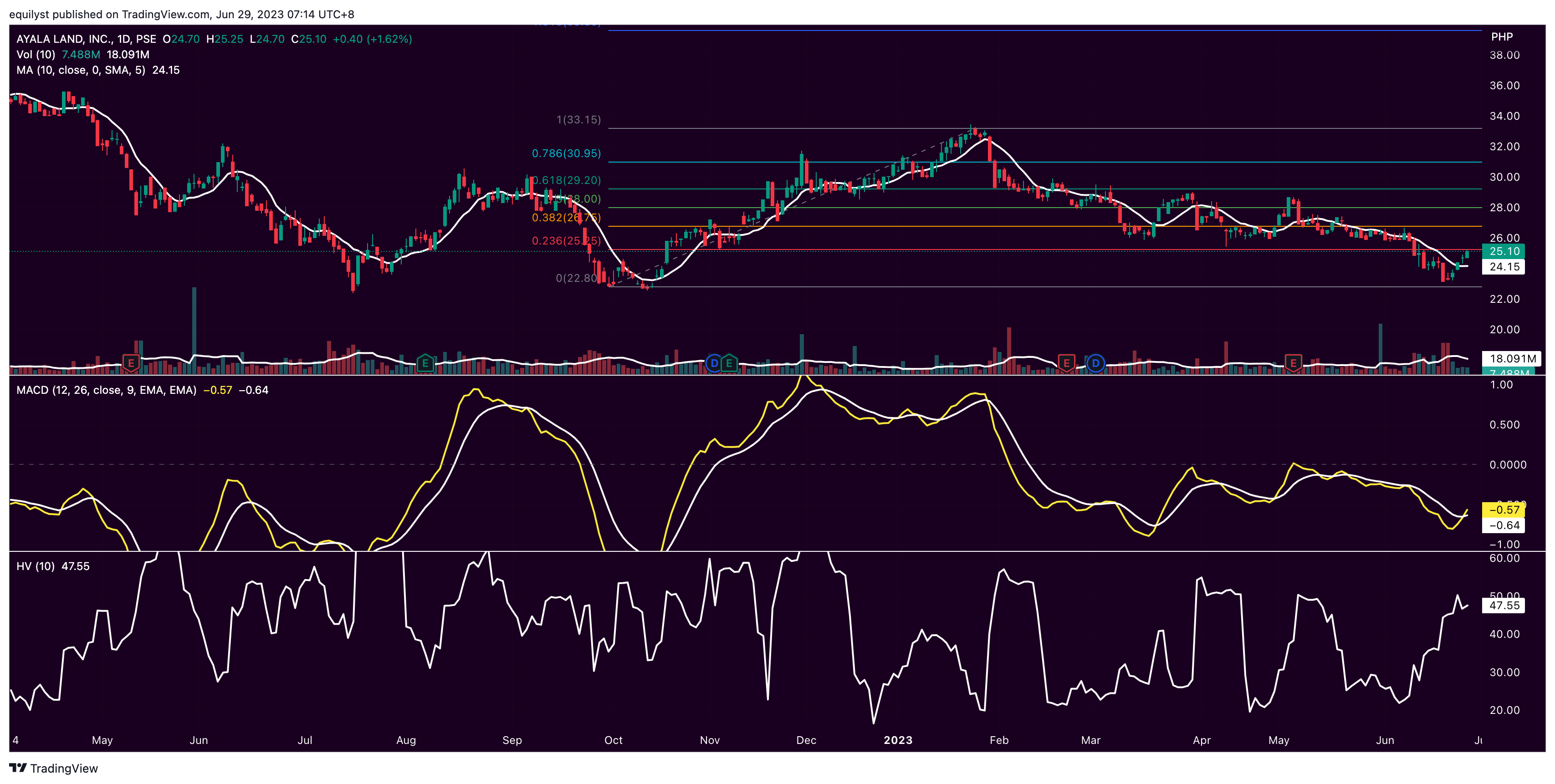

PSE:ALI closed on Tuesday, June 27, 2023, at P25.10, up by 1.62%, but down by 18.51% year-to-date.

Support is at P22.80 while resistance is at P25.25, confluent with the 23.6% Fibonacci retracement. The second resistance is at P26.75, confluent with the 38.2% Fibonacci retracement.

PSE:ALI’s moving average convergence divergence (MACD) already registered a golden cross above the signal line last Tuesday.

The risk-level of PSE:ALI based on its 10-day historical volatility remains low, but it is poised to enter the moderate risk category as it is just a few percentages away from breaching the 50-percentage mark.

Be a PLATINUM client of Equilyst Analytics to request for our in-depth analysis of PSE:ALI with recommendations tailored-fit to your entry price, average cost, buy case, and risk tolerance percentage.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025