According to Refinitiv data, the shares of the world’s most valuable company witnessed a 2.3% surge, reaching $193.97 and resulting in a market capitalization of $3.05 trillion.

Apple accomplished its fourth consecutive record-high closing, briefly surpassing the $3 trillion market capitalization during intra-day trading on January 3, 2022, before closing slightly below that threshold.

Significant increases were observed in heavyweight growth stocks like Apple, Nvidia Corp, and Tesla Inc, following a Commerce Department report indicating a lower advancement of the Personal Consumption Expenditure price index in May than in April.

This report indicates the Federal Reserve’s progress in combating inflation.

Throughout 2023, Apple has experienced a remarkable 48.93% surge year-to-date, joining other highly valuable companies on Wall Street.

This surge is attributed to the belief that the Federal Reserve is nearing the conclusion of its interest rate hike campaign and a positive outlook on the potential of artificial intelligence.

In May, Apple released its most recent quarterly report, which revealed a decline in revenue and profits. However, these results still exceeded analysts’ expectations.

Alongside a consistent history of stock buybacks, these financial outcomes further solidified Apple’s reputation as a secure investment during global economic uncertainty.

Art Hogan, the Chief Market Strategist at B Riley Wealth, praised Apple as one of the most exceptional publicly traded companies ever.

He emphasized its continuous growth, diversified revenue streams, shareholder-friendly management, stock buybacks, dividends, and robust balance sheet with secure and sustainable cash flows.

Apple’s accomplishment of the $3 trillion milestone coincided with the launch of an expensive augmented-reality headset on June 5.

This move represents Apple’s riskiest venture since introducing the iPhone a decade ago.

Since the headset launch, Apple’s stock has experienced approximately a 7% increase, surpassing the 4% rise of the S&P 500.

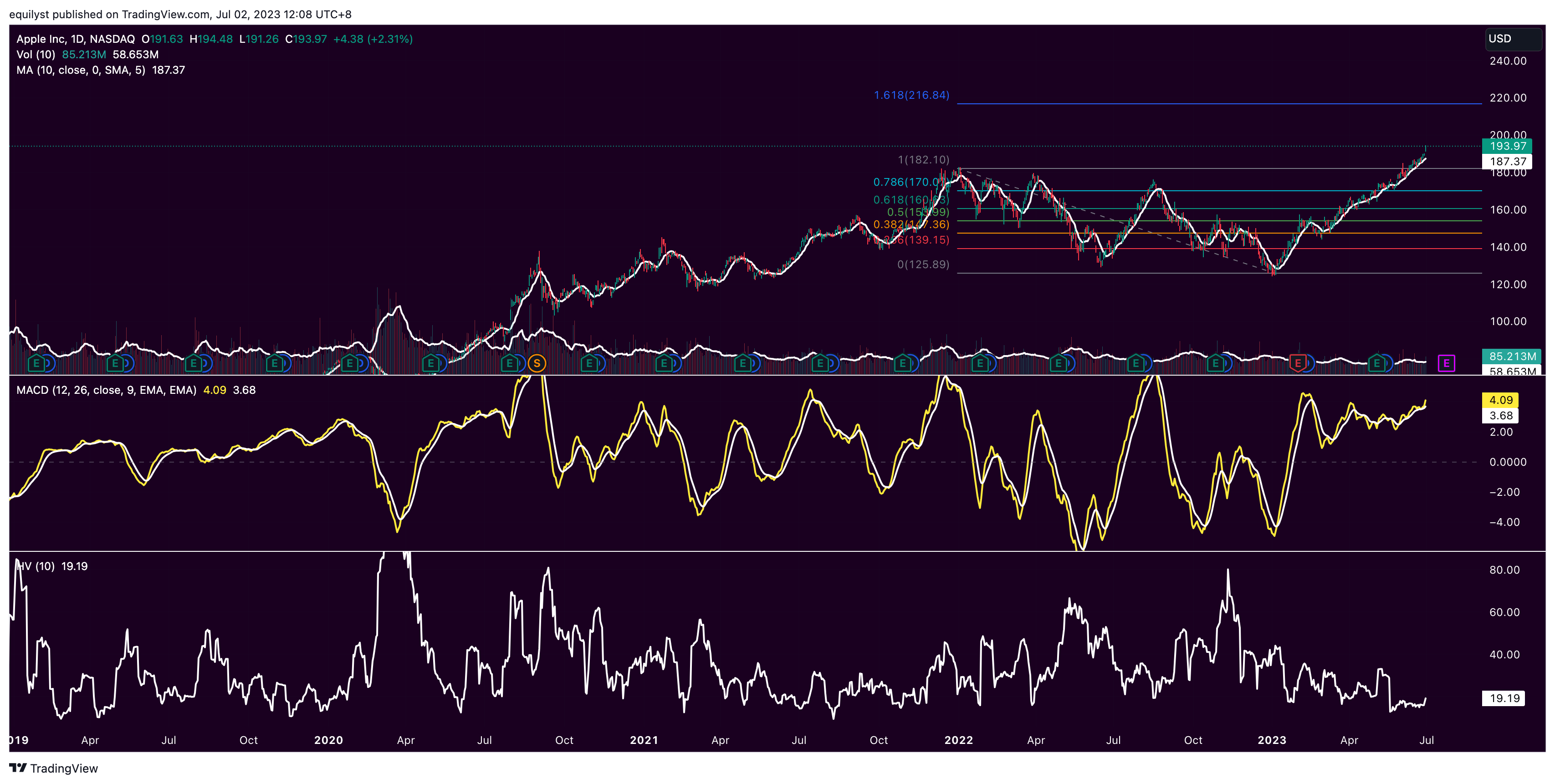

AAPL’s support is near $182 while resistance is at $217.

The price surged was backed with a strong volume as last Friday’s volume was higher than 100% of the stock’s 10-day volume average.

The tech’s company has a moving average convergence divergence (MACD) that bullishly moves above the signal line.

AAPL’s risk level remains low based on its 10-day historical volatility score of 20%.

The recent gains in Apple’s shares have surpassed analysts’ expectations for the company’s future earnings.

According to Refinitiv data, Apple is trading at a price-to-earnings ratio exceeding 29, its highest since January 2022. The S&P 500 technology index has a median PE ratio of approximately 13.

Additionally, Alphabet Inc, Amazon.com Inc, Nvidia, and Microsoft Corp are four other US companies with valuations surpassing $1 trillion.

Microsoft closely follows Apple with a market value of $2.5 trillion.

Do You Need Help Trading or Investing in the Stocks Mentioned in this Report?

Fix and rebalance your stock portfolio for optimal returns through our Stock Portfolio Rehabilitation Program.

Be a TITANIUM client to learn how to preserve capital, protect gains, and prevent unbearable losses when trading and investing in the Philippine stock market.

Be a PLATINUM client to request our in-depth technical analysis with recommendations tailored-it to your entry price, average cost, buy case, and risk tolerance.

Be a GOLD client to have a teleconsultation with us over the phone as trading happens.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025