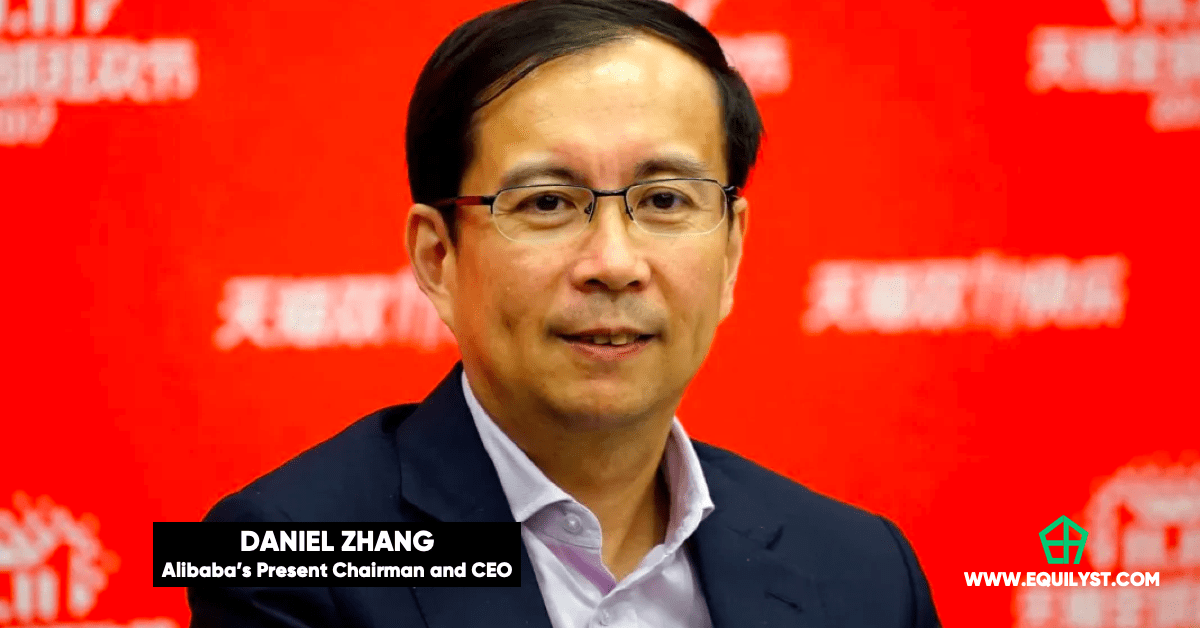

Alibaba, the Chinese tech giant, is gearing up for a significant transformation by replacing its chairman and CEO, Daniel Zhang, in the most momentous shakeup in its history.

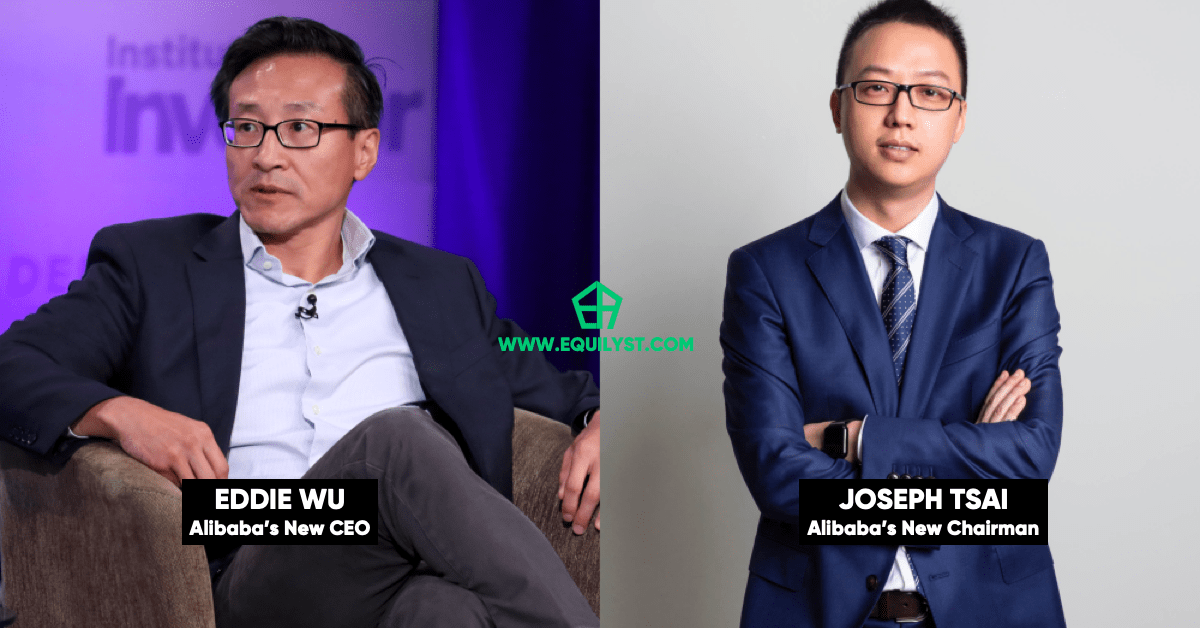

According to an announcement on Tuesday, Joseph Tsai, a co-founder and executive vice chairman of Alibaba (BABA), will take over as chairman, while Eddie Wu, the current chairman of e-commerce unit Taobao and Tmall Group, will assume the role of chief executive officer.

These leadership changes are slated to come into effect in September, with Zhang continuing to hold the positions of chairman and CEO for Alibaba’s cloud unit.

This marks the second instance of a major shift in executive leadership for Alibaba within a brief period, following the departure of co-founder Jack Ma in 2019.

It also comes just a few months after the company underwent a substantial restructuring, the most extensive in its 24-year existence.

In March, Alibaba unveiled a plan to divide into six distinct units, each led by its own CEO and board directors.

These units encompass cloud, e-commerce, logistics, media, and entertainment, granting them the autonomy to pursue separate listings or fundraising ventures.

In the announcement, Zhang expressed his belief that the timing is right for him to step aside, emphasizing the importance of Alibaba Cloud Intelligence Group’s progress toward a full spin-off.

Serving as Alibaba’s CEO since 2015, Zhang displayed enthusiasm for the new opportunities arising from generative AI in the company’s cloud business.

Wu, another co-founder of Alibaba who assumed the role of technology director when he joined the company in 1999, emphasized that despite recent changes in organization and governance, Alibaba’s mission remains unwavering.

Zhang, who became part of Alibaba in 2007 and assumed the position of CEO in May 2015, took on the role of executive chairman in 2019, succeeding Jack Ma, who retired on his birthday coinciding with the company’s 20th anniversary.

Alibaba holds the distinction of being China’s largest e-commerce company, attracting over 900 million active users annually to its Taobao and Tmall platforms.

Alibaba holds the distinction of being China’s largest e-commerce company, attracting over 900 million active users annually to its Taobao and Tmall platforms.

Additionally, the company operates the leading cloud computing and digital payment platforms in the country.

However, both Alibaba and its co-founder, Jack Ma, have faced significant scrutiny from Chinese authorities in recent years.

After Ma publicly criticized Chinese financial regulators in late 2020, the highly anticipated IPO of Ant Group, an Alibaba affiliate that owns Alipay, was abruptly halted.

This incident marked the beginning of a rigorous regulatory crackdown on China’s internet industry and private sector.

As a result, Alibaba Group incurred a record-breaking $2.8 billion fine for violating antitrust rules.

Since then, Ma has largely retreated from public view, reportedly spending more time abroad, particularly in Hong Kong and Japan, where SoftBank CEO Masa Son, an Alibaba investor and Ma’s friend, resides.

In March, Ma made an unexpected appearance in mainland China, shortly before Alibaba announced its restructuring plan. Analysts interpreted his return as a strategic move by Beijing to address concerns within the private sector.

Lately, Ma has increased his public engagements, focusing on research and teaching.

In April, the University of Hong Kong disclosed that Ma would join its business school for a three-year period.

Last week, Ma delivered his inaugural lecture as a visiting professor at the University of Tokyo, according to a statement from the university.

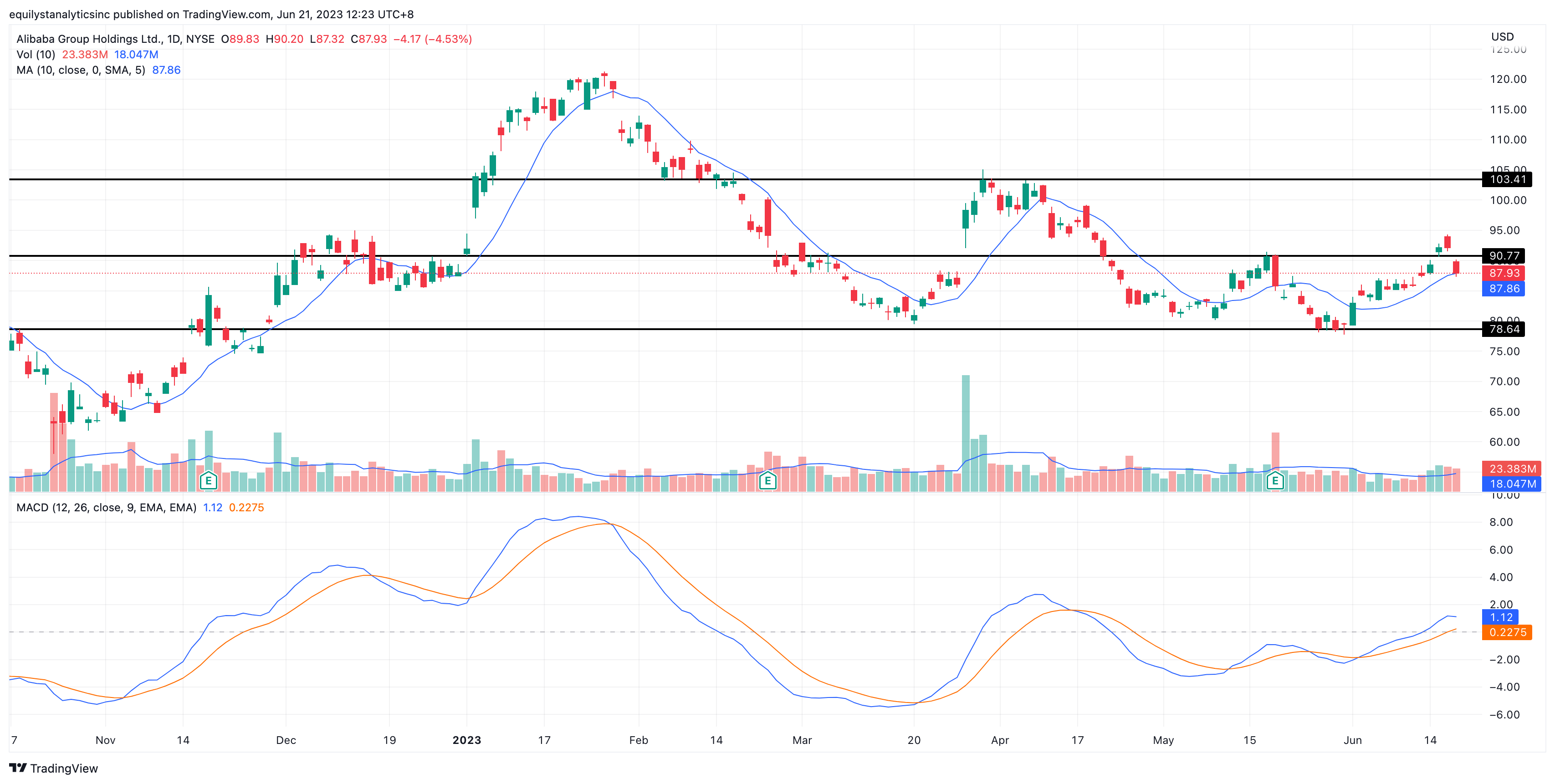

Meanwhile, NYSE:BABA closed on Tuesday, June 20, 2023, at $87.93 apiece, down by 4.53% following the release of this news.

NYSE:BABA broke above its resistance near $91.00 two days ago. Not for long, we see $91.00 again as its immediate resistance, while the immediate support is pegged near $78.60.

Volume exceeded 100% of its 10-day volume average, signalling that the price might continue to move away from $91.00 toward $78.60 unless the bearish sentiment brought about by the news on the change in leadership would die down immediately.

Expect NYSE:BABA’s price to continue traversing the downtrend channel as investors also continue to eavesdrop with one another’s sentiment.

Get Our Latest Technical Analysis with Recommendations for NYSE:BABA

Subscribe to one of the stock market consultancy services of Equilyst Analytics to get our latest analysis, with tailored fit recommendations relative to your entry price, buy case, percentage of risk tolerance. Click here to learn more about our services.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025