ACEN Corporation (PSE:ACEN), an energy sector company, is making progress towards finalizing the acquisition of Super Energy Corporation Public Company Limited’s solar power business in Vietnam.

Currently, they are in the process of signing the Shareholders’ Agreement and other definitive agreements, which builds upon the share purchase agreement made in 2022 by both companies.

Super Energy Corporation (SUPER), the present owner and operator of solar projects in Vietnam generating 837 MW of power under the name Solar NT, will gradually transfer 49% ownership of Solar NT to ACEN.

The initial phase of the transaction has recently concluded, and the remaining phases are expected to wrap up within this year. The acquisition is estimated to amount to approximately $165 million.

Patrice Clausse, the CEO of ACEN, expressed enthusiasm for the partnership with SUPER, emphasizing its long-term nature and the potential to expand their portfolio and jointly develop renewable energy projects across ASEAN.

The shared commitment of ACEN and SUPER towards a sustainable future, combined with their strengths and extensive experience in renewable energy development, will open up new possibilities for the strategic partnership.

This collaboration aims to grow their portfolio, create employment opportunities, and expedite the transition towards cleaner energy sources.

Jormsup Lochaya, the chairman and CEO of SUPER, highlighted the synergies that will result from this partnership, enhancing SUPER’s potential for growth and strengthening its renewable energy business structure.

He emphasized the collaborative support in areas such as capital, personnel, technology, and networks, enabling both companies to explore additional investment opportunities in the future.

Upon completion, this strategic investment will bolster ACEN’s renewable capacity in Vietnam-Lao PDR to approximately 1,200 MW, cementing its position as a prominent player in the renewable energy sector in Southeast Asia.

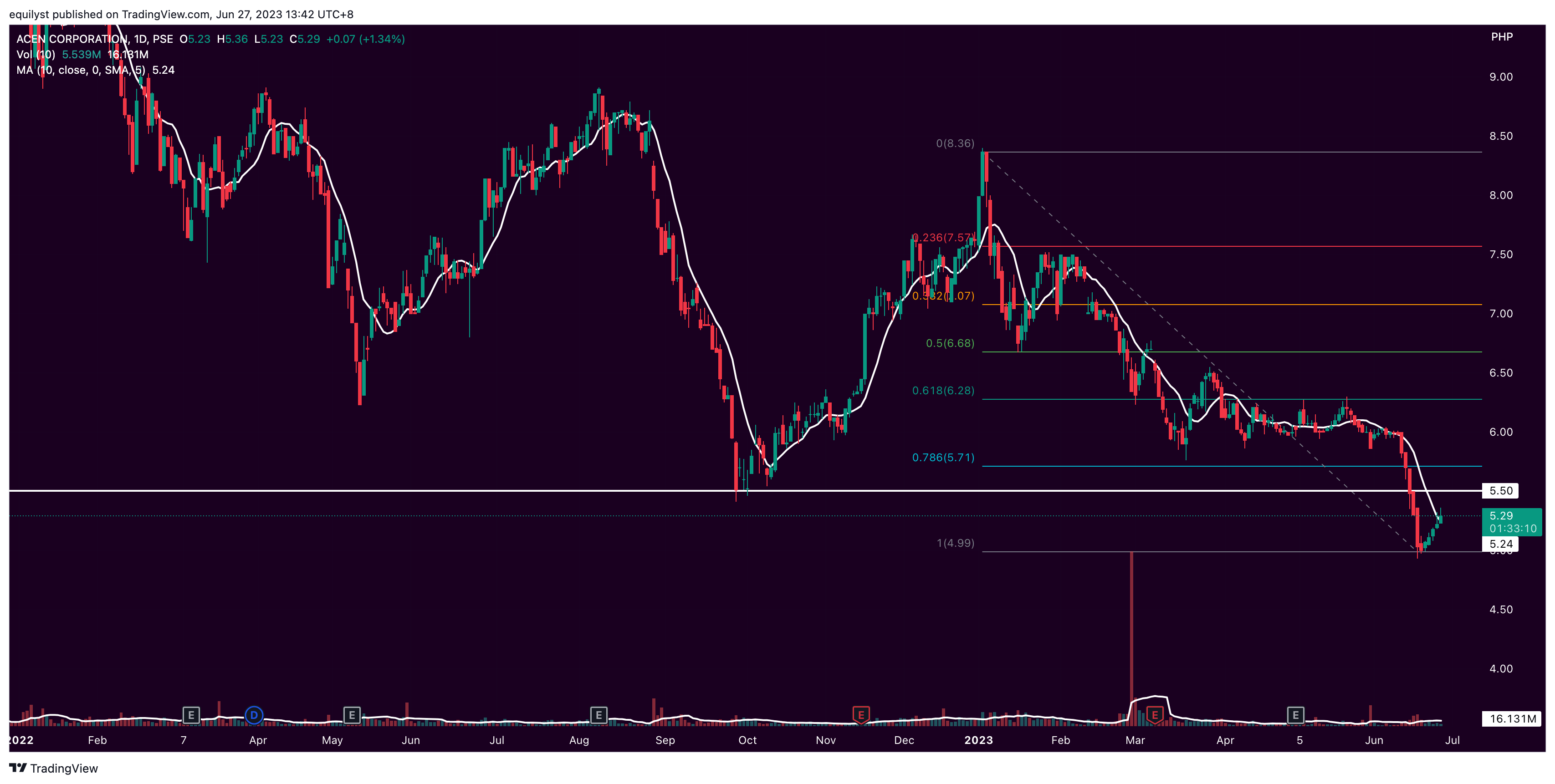

As of the time of writing this, PSE:ACEN trades at P5.29 per share, up by 1.34%, but down by 30.58% year-to-date.

Support is at P5.24 per share while resistance is between P5.50 and P5.70.

Even though PSE:ACEN has consistently registered green candlesticks for five consecutive trading days, its daily volume within that period never exceeded 100% of ACEN’s 10-day volume average.

If ACEN cannot breach the 100% of its 10-day volume average, it should at least consistently print a daily volume above 50% of its 10-day volume average for its daily ascent to be sustainable.

Be a PLATINUM client of Equilyst Analytics to receive our comprehensive and in-depth technical analysis with a customized recommendation relative to your entry price, average cost, and risk appetite. You’ll find our sample reports here.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025