In a collaborative effort with Philippine Seven Corp. (PSC), the Philippine division of Seven Bank Ltd, a Japanese company, plans to extend its ATM network to 7-Eleven stores nationwide.

Their objective is to make safe and convenient banking services more accessible to Filipinos by adding 500 new ATMs.

By the end of 2023, Pito AxM Platform Inc. (PAPI), a wholly owned subsidiary of Seven Bank and PSC, aims to encompass more than 3,000 7-Eleven stores across the country.

Having achieved a significant milestone with the completion of installation at the 7-Eleven Avida Atria Tower 1 in Iloilo City, the partnership has already deployed 2,500 ATMs throughout the nation.

Expressing his contentment with this accomplishment, Jose Victor Paterno, the President and CEO of PSC, underscored their dedication to providing accessible financial services.

He conveyed appreciation to Seven Bank for the prompt deployment of ATMs in their stores and expressed confidence in the suitability of their locations for these advanced cash recyclers.

Paterno anticipates that expanding the ATM presence nationwide will enhance the overall customer experience.

He stressed that at 7-Eleven, convenience extends beyond meeting immediate needs, envisioning the creation of an effortless ecosystem where customers can effortlessly access essential services.

In February 2020, PSC and PAPI forged a partnership with the goal of installing, operating, and maintaining ATMs at 7-Eleven stores throughout the Philippines.

These innovative ATMs, designed as cash recyclers, enable customers to deposit cash at 7-Eleven stores and subsequently withdraw funds.

Moreover, each ATM offers a distinctive functionality, adapting its interface to align with the customer’s bank, ensuring familiarity and convenience during transactions.

Through these initiatives, 7-Eleven reinforces its position as a frontrunner in the convenience store industry, continuously innovating to meet the ever-evolving needs of its customers.

Similar to the existing ATMs at 7-Eleven, cardholders of BDO Unibank Inc., led by Sy, and the state-run Land Bank of the Philippines continue to benefit from zero transaction fees.

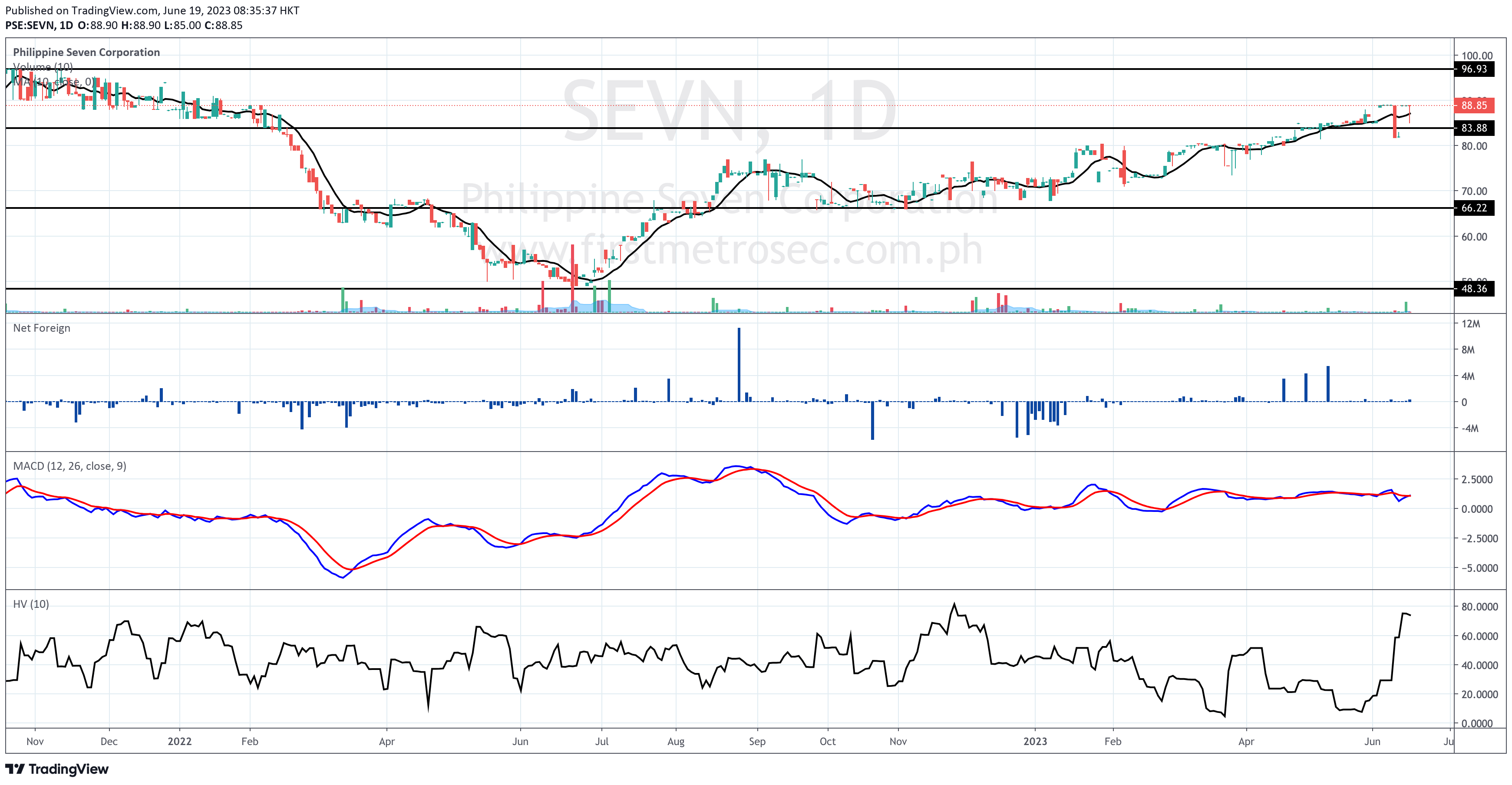

Meanwhile, Philippine Seven Corporation (PSE:SEVN) closed on Friday at P88.85 per share, down by 0.06%.

This stock has made several attempts to break P89.00 for more than a week already.

Volume was relatively slim last Friday as it only registered a volume below the 50% of SEVN’s 10-day volume average.

SEVN’s moving average convergence divergence (MACD) shows a golden cross above the signal line, but our Evergreen Strategy’s algorithm hasn’t issued a confirmed buy signal for this stock as of Friday’s closing.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025