In this article, I’ll tell you what happens to your shares if you do not accept the Tender Offer of a company that is about to be delisted from the Philippine Stock Exchange. I will also give you the steps to liquidate your shares once the company is delisted from the Exchange.

To present an example of the procedures, I’ve assumed that your online stockbroker is COL Financial. If COL Financial is not your broker, contact your stockbroker and ask them for their version of the procedures I will share. This is not a paid advertisement by COL Financial. I’m citing their procedures so I can give you an example.

Suppose one of the stocks in your portfolio announced its intention for voluntary delisting.

That company will announce and issue a Tender Offer to its shareholders. This means only those who hold shares of this tender offer-issuing company are entitled to the Tender Offer.

Why Does a Company That’s About to Be Delisted from the Philippine Stock Exchange Offer a Tender Offer?

The company issues a tender offer to provide an exit opportunity for its shareholders. Delisting from the Philippine Stock Exchange (PSE) means the company’s shares will no longer be traded in the local bourse or market. By offering to buy back shares through a tender offer, the company allows shareholders to sell their shares and convert them into cash if they no longer wish to hold them.

What will you do as a shareholder of that company that is about to be delisted?

Will you accept the tender offer or not? Opting out of a tender offer signifies your intention to retain your shares.

When a publicly listed company voluntarily delists from the Philippine Stock Exchange (PSE) and issues a Tender Offer, three options become available to you.

Option 1: Accepting the Tender Offer becomes the preferred course of action if the offer price surpasses the market price. Your shares will be removed from your COL Financial account and sold at the offer price.

Option 2: Rejecting the Tender Offer allows your shares to remain in your COL Financial account. Complying with the Tender Offer’s purpose, which involves voluntary delisting from the PSE, completing necessary requirements and paying fees are required to convert shares into physical stock certificates. The question arises: Why retain shares when it involves additional effort and fees?

Option 3: Trading your shares in the market becomes the best alternative when the market price exceeds the offer price. You can independently sell your shares at the prevailing market price. If you’re one of our PLATINUM clients, use one of your analysis request credits so we can do a trade and volume distribution analysis for you. This will allow you to position at the optimal prices. We will tell you the price or range of prices where it is best to sell.

Delisting refers to a company’s plan to remove itself from the stock exchange on a specified date. Holding shares after the delisting date necessitates converting scripless or electronic shares into physical stock certificates, which entails form submission, fee payment, and potential visits to the company’s stock transfer office.

What Does Scripless Mean?

Scripless shares refer to the shares of stocks you currently have in your stock portfolio. Scripless trading operates through the book-entry system (BES), settling trades without needing physical certificates or documents. Scripless trading is what we all do when we normally buy and sell shares of stocks through our online stockbroker’s platform.

Returning to my advice, shareholders of delisted companies will keep stock certificates, which will no longer appear in your COL Financial portfolio and may pose challenges for selling. Stock certificates will be sold through the stock transfer office instead of the Philippine Stock Exchange.

How to Convert Your Shares (Scripless) Into Stock Certificates

Here are the guidelines for converting scripless shares into stock certificates:

- Upliftment refers to converting electronic shares into physical stock certificates, thereby removing visibility in your COL Financial account and preserving them as stock certificates.

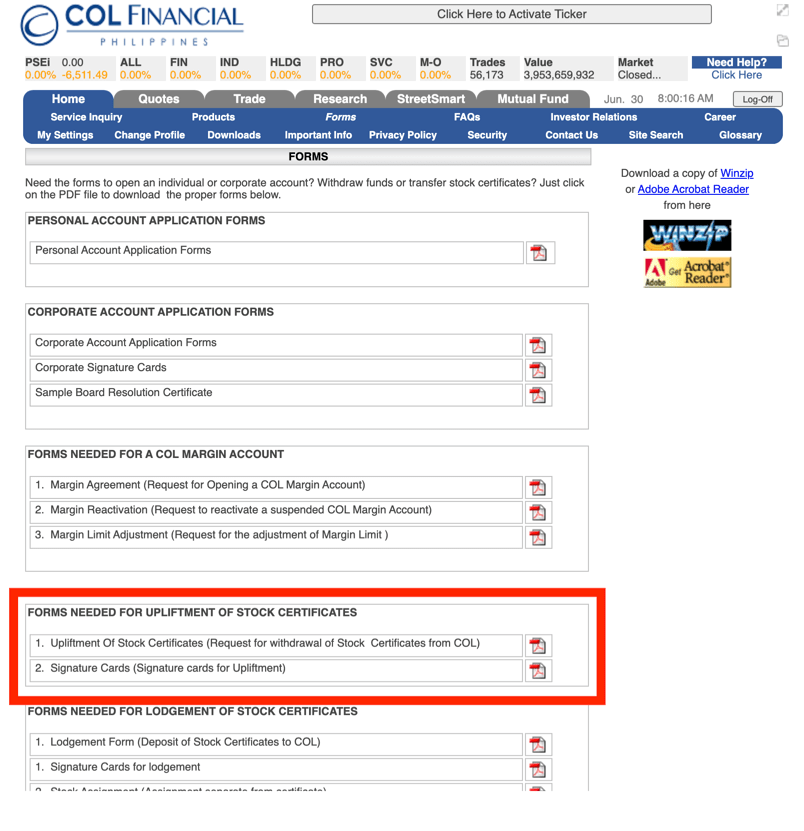

- To initiate the withdrawal (or upliftment) of stock certificates, visit COL Financial’s website at www.colfinancial.com and access the “Request for Upliftment of Stock Certificate” form under HOME>Forms>Form Needed for Upliftment of Stock Certificate. Refer to the screenshot below.

- Complete the form and send the original signed copy to the COL FINANCIAL GROUP, INC. Business Center located at 2403-B East Tower, Tektite Towers, Exchange Road, Ortigas Center, Pasig City.

Additionally, you must provide a signature card for each company to fulfill this request. The upliftment process may take 1 to 3 months to generate the certificate.

How to Withdraw PSE-Delisted Stocks from Your COL Account and Turn Them into Stock Certificates

To withdraw stocks from your COL Financial account, follow these steps:

- Complete the required request form titled “Upliftment of Stock Certificates.”

- Obtain a signature card from our business center. Sign the card twice and attach it to your upliftment form (one signature card per stock, regardless of the number of shares).

- Prepare clear copies of 2 valid government-issued IDs with visible pictures and signatures for submission to the transfer office.

- The transfer office may request a personal appearance in some cases. COL Financial will be informed if your presence is required.

A processing fee will be applicable:

- P150 for transfer agent banks.

- P162 for transfer agents that are non-banks (charged per certificate).

If your COL Financial account has sufficient available cash balance, the processing fee can be deducted accordingly.

Equilyst Analytics’ Advice

It’s worth noting that if a stock announces its delisting intent, choosing the tender offer or selling shares in the market becomes more preferable.

Share this article if you find it helpful so you can help your fellow stock traders and investors seeking answer for the same question.

Do You Need Our Help?

Fix and rebalance your stock portfolio for optimal returns through our Stock Portfolio Rehabilitation Program.

Be a TITANIUM client to learn how to preserve capital, protect gains, and prevent unbearable losses when trading and investing in the Philippine stock market.

Be a PLATINUM client to request our in-depth technical analysis with recommendations tailored-it to your entry price, average cost, buy case, and risk tolerance.

Be a GOLD client to have a teleconsultation with us over the phone as trading happens.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025