What Is the COL Financial Investment Guide?

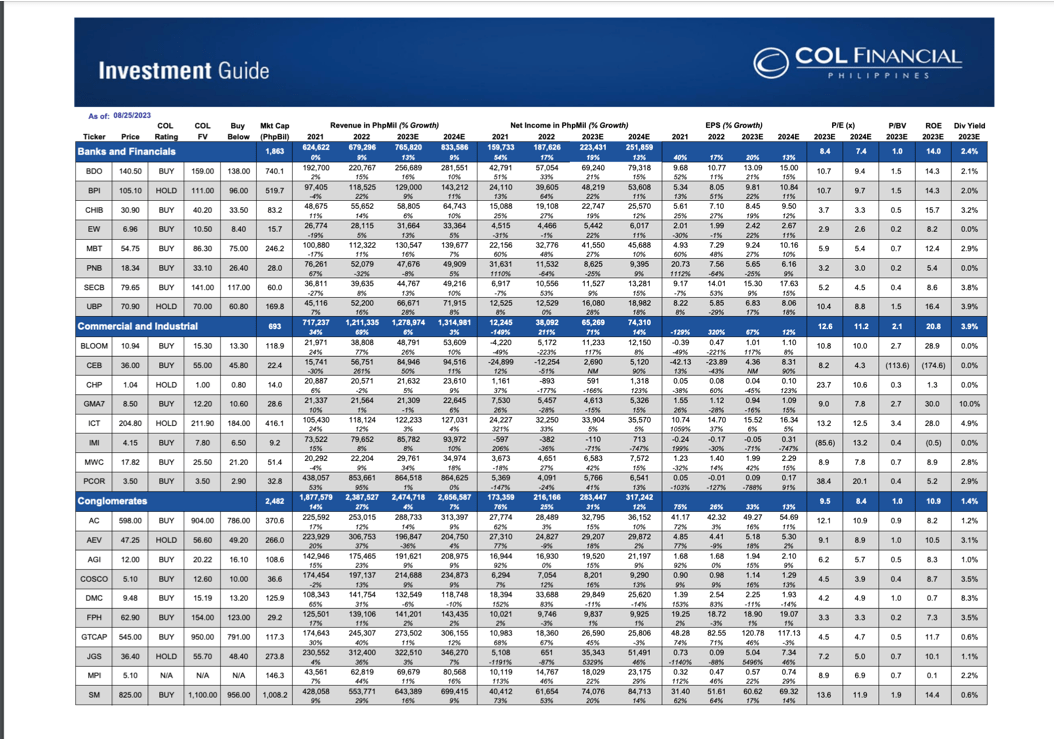

The COL Financial investment Guide is based on fundamental analysis (financial performance of the company). They check the company’s earnings-per-share ratio (EPS), price-to-earnings ratio, price-to-book value ratio, and dividend yield.

Then, they come up with their own Fair Value based on their valuation criteria. That Fair Value serves as their recommended or Target Selling Price.

They also provide a Buy Below Price. According to COL Financial, you can continue peso-cost averaging on the stock as long as its current price remains below their Buy Below Price.

COL Financial also provides a Buy, Hold, or Sell rating.

How to Find the COL Financial Investment Guide?

Here’s how to find the COL Financial Investment Guide:

1. Log in to your COL Financial account.

2. Click RESEARCH.

3. Click INVESTMENT GUIDE.

Why I Don’t Depend on the COL Financial Investment Guide?

While COL Financial knows the financial performance of any publicly-listed company in the Philippine Stock Exchange, it doesn’t know my financial DNA.

COL Financial doesn’t know the events in my life that concern money. It doesn’t know my mood for the day. It doesn’t know the percentage of risk that I am only willing to apply to a particular stock.

There are psychological factors in decision-making that you cannot get from fundamental analysis or technical analysis.

Only I can tell myself if I should buy, hold, or sell a stock relative to those factors that are unique to my financial DNA and investment psychology.

Don’t I know the financial performance of any PSE-listed company?

I do!

The financial reports of all PSE-listed company are publicly available on PSE Edge.

Since I also have access to the same financial information COL Financial has, I am capable to make a tailored-fit investment recommendation for myself.

This is the reason why I don’t offer a stock recommendation service. If I were to offer one, it would make me feel like I was telling you to forget that only you knew all your financial circumstances in your life. It would make me feel like I was demoting you from a rational being to a monkey.

I don’t believe that stock recommendation services exist for the busy people. That’s just a convenient excuse for the lazy. Some stock market-related services are exploiting investors’ laziness by providing ready-to-eat buy-hold-sell recommendations.

For your information, outsourcing is not an alien concept to me. I’ve been running my own content outsourcing company for more than two decades now.

An investment decision is not one you should outsource because nobody understands the events in your life that concern money more than you do. What you can outsource, as far as stock investing is concerned, is the training on how you can independently make data-driven decisions like I do. That’s what my stock investment consultancy service is about.

Is the COL Financial Investment Guide Bad for Me?

I thought about phrasing that subheading as “Is the COL Financial Investment Guide Bad for You?” but I decided not to because I only want to answer a question on my behalf.

If it were the early 2000s, the COL Financial Investment Guide would be very helpful for me. But I’ve been into stock investing for more than a decade, and I already know how and where to find the data and compute the numbers COL Financial provides in its Investment Guide.

For beginners, you may find the COL Financial Investment Guide helpful, particularly the computation of the financial ratios. However, I would recommend not to make investment decisions based on anyone’s Buy Below Price or Fair Value (or Target Selling Price). Read 4 Reasons to Stop Using Buy Below and Target Selling Price to know why.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025