JAYCEE S. DE GUZMAN

Experience the expertise of Jaycee De Guzman, the brain of Equilyst Analytics, renowned for his unique data analysis. He is a computer scientist and a self-taught digital marketing strategist and agriculturist. Since Equilyst Analytics’ founding in 2012, over 10,000 local and foreign clients have consulted with Jaycee de Guzman on stock investments.

They are victims of hype on social media platforms.

Non-data-driven and often comical posts are more believable, while lengthy but data-driven analyses are almost invisible for them.

Sadly, those who know how to compute a trailing stop would rather add more prayers than cut losses when it is hit.

They have knowledge, but not discipline.

No consultant can ever fix someone’s lack of self-regulation.

I can bring a pail of water with molasses to a cattle, but I cannot make it drink.

Their loyalty to the original strategy persists to the extent that their primary focus shifts from pursuing financial gain to the realization of their original plan.

What’s worse, they remain unaware during that period that they have already transitioned into the wrong mindset or investment psychology.

Ego becomes more important than making money.

As a computer scientist by profession, none of the systems I develop will be useful without data.

What’s the use of a bug-free, memory-efficient, highly reliable, scalable, and maintainable system if it doesn’t have any data to process?

I don’t need to motivate myself to become data-driven.

Data curation is my concern.

It is the process of selecting appropriate, high-quality, and relevant data suitable for the intended use case.

I use what I choose to use because they are the best terms that will complete the expressions of my equation.

I was already aware of its importance even before I discovered Philippine stock investing.

Enterprise risk management is a non-negotiable business process acumen a C-suite executive must have.

Equilyst Analytics is my outlet for my passion for data science.

Risk management is one of the steps of the ladder toward profitability in Philippine stock trading.

You don’t think about risk management only when you have an unrealized negative profit.

In fact, your sound risk management plan must be established in your mind prior to your possession of Philippine stocks.

This sequence is crucial.

The Philippine stock market doesn’t oblige anyone’s analysis.

Don’t mistake following the process for rigid adherence.

Know when to adjust the data-driven plan according to prevailing market conditions.

Knowing when to change the plan should be part of the process you’re following.

I can teach you that.

I’ll teach you my entire investment process from filtering to buying to selling.

Choose a theme, whether you want it to focus on Philippine stock investing.

Only one theme can be discussed in four hours.

You need to have basic knowledge of Philippine stock investing, depending on your chosen theme.

I don’t teach how to open an online stockbroker’s account, what to click to buy stocks, or who to call if you forget your password – topics like that.

My service is intended for investors who have been engaged in Philippine stock investing for at least a year and are looking to advance their skills.

You can watch the replay video within 30 days from the training date.

Downloading, recording, or reproducing it in any manner without my consent is prohibited.

Learning Fee: P15,000.00

This option is most suitable for those who have already attended my masterclass, as it will enable you to quickly grasp the rationale behind my analyses and interpretations.

You can also watch the replay video within 7 days from the consulting date.

Unauthorized downloading, recording, or reproducing it in any form without my consent is strictly prohibited.

Learning Fee: P5,000.00 per hour

Suppose you have P5 million portfolio.

Let’s say you availed of the 4-hour masterclass that costs P15,000.00.

P15,000.00 is 0.3% of P5 million or 1.5% of P1 million.

Would you prefer to learn the ropes through trial and error, saving P15,000.00, but at the risk of joining those who experience an average loss of 37%, or would you rather invest a learning fee of 0.3% or 1.5% of the size of your portfolio to avoid a potential loss of 37% or higher?

Do you guarantee that I will be profitable if I avail of your service?

Getting my guidance is like having access to Google Maps on your way to an uncharted territory. How fast you’ll get to your intended destination depends on how you drive and the circumstances you’ll encounter along the way.

If that’s the case, does it still make sense to avail of my service?

Which one will make you reach your destination much faster? Rolling your window down to ask for directions every five kilometers or having access to Google Maps?

If you're really a good analyst, why not keep your smarts all by yourself?

If I were to invest the effort in educating you, even though I’m under no obligation to do so, it would only be fair if I also benefited proportionately. Visiting my website means you need me more than I need you.

Are you always available to accommodate consulting work?

Not always. I have a main business. Equilyst Analytics is my hobby. I am available to attend to booked stock investment consultations on Saturdays only.

Can I ask follow-up questions a day after the consultation or training?

You may email your questions within seven (7) days from the consulting or training date. Consider availing my hourly consulting service if you still have more questions after that 7-day period.

Do you offer a refund if I’m not happy with the training or consultation?

Will McDonald’s offer a refund to someone who claims to have an unsatisfied taste palate after consuming three Quarter Pounders with Cheese?

Why don't you have a phone number I can call?

Given that Equilyst Analytics is solely my hobby, I independently manage all aspects, encompassing writing, verbal communication, and more. Frequently, phone conversations prior to finalizing a scheduled consultation inadvertently extend into pro bono advisory sessions. Should inquiries arise pertaining to my Philippine stock investment consultancy services, I kindly encourage you to respond via email subsequent to completing the consultation form available on this webpage.

Why do you charge a fee instead of teaching for free?

I don’t rely on Equilyst Analytics as my main source of income; it’s more of a hobby for me. So, when I decide to allocate time from my hobby to teach you what I know, it needs to be worthwhile for me. Besides, I don’t really want to productize my strategy in Philippine stock investing. I charge a fee just to motivate myself to share what I know.

I'M SOLD! LET'S DO THIS.

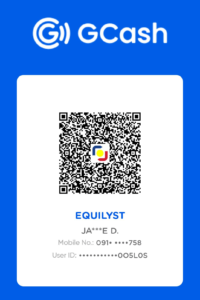

STEP 1: PAY

STEP 2: REGISTER

STEP 1: PAY

STEP 2: REGISTER

- CREDIT CARD/PAYPAL

-

STEP 1: PAY

STEP 2: REGISTER

- GCASH