Get my analysis and insights for the 5 top traded stocks s as of November 11, 2022:

- Ayala Land (ALI)

- BDO Unibank (BDO)

- DMCI Holdings (DMC)

- Semirara Mining and Power Corporation (SCC)

- Ayala Corporation (AC)

Subscribe to my stock market consultancy service at Equilyst Analytics. You will learn how to preserve your capital, protect your gains, and prevent unbearable losses in trading and investing in the Philippine Stock Exchange.

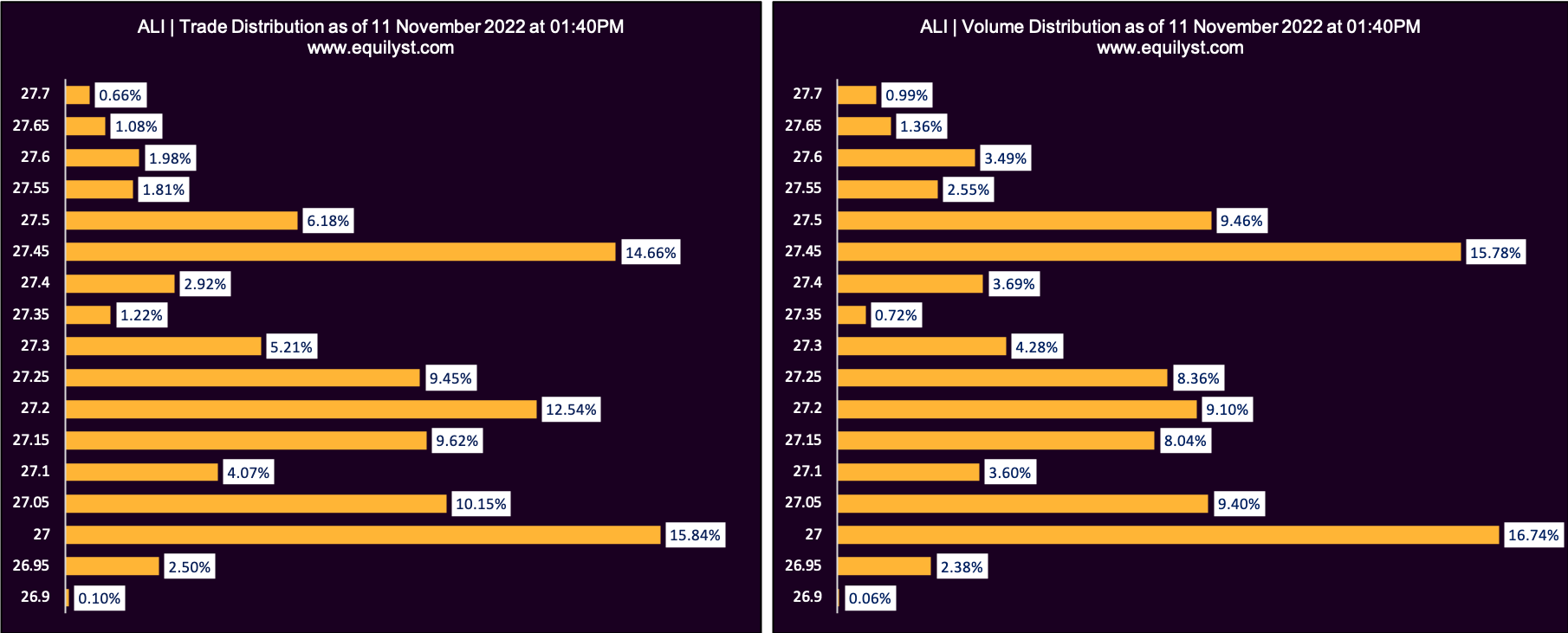

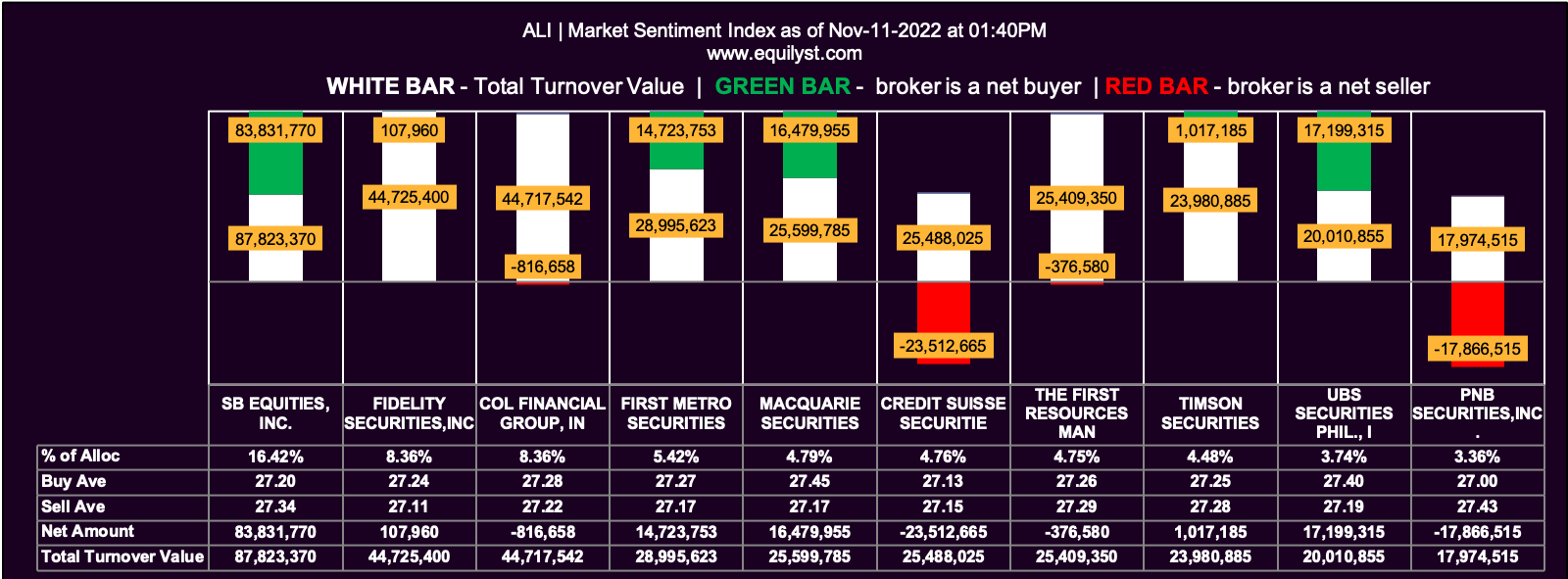

Ayala Land (ALI)

Dominant Range Index: BEARISH

Last Price: 27.05

VWAP: 27.26

Dominant Range: 27 – 27

Market Sentiment Index: BEARISH

15 of the 71 participating brokers, or 21.13% of all participants, registered a positive Net Amount

16 of the 71 participating brokers, or 22.54% of all participants, registered a higher Buying Average than Selling Average

71 Participating Brokers’ Buying Average: ₱27.19367

71 Participating Brokers’ Selling Average: ₱27.28418

2 out of 71 participants, or 2.82% of all participants, registered a 100% BUYING activity

32 out of 71 participants, or 45.07% of all participants, registered a 100% SELLING activity

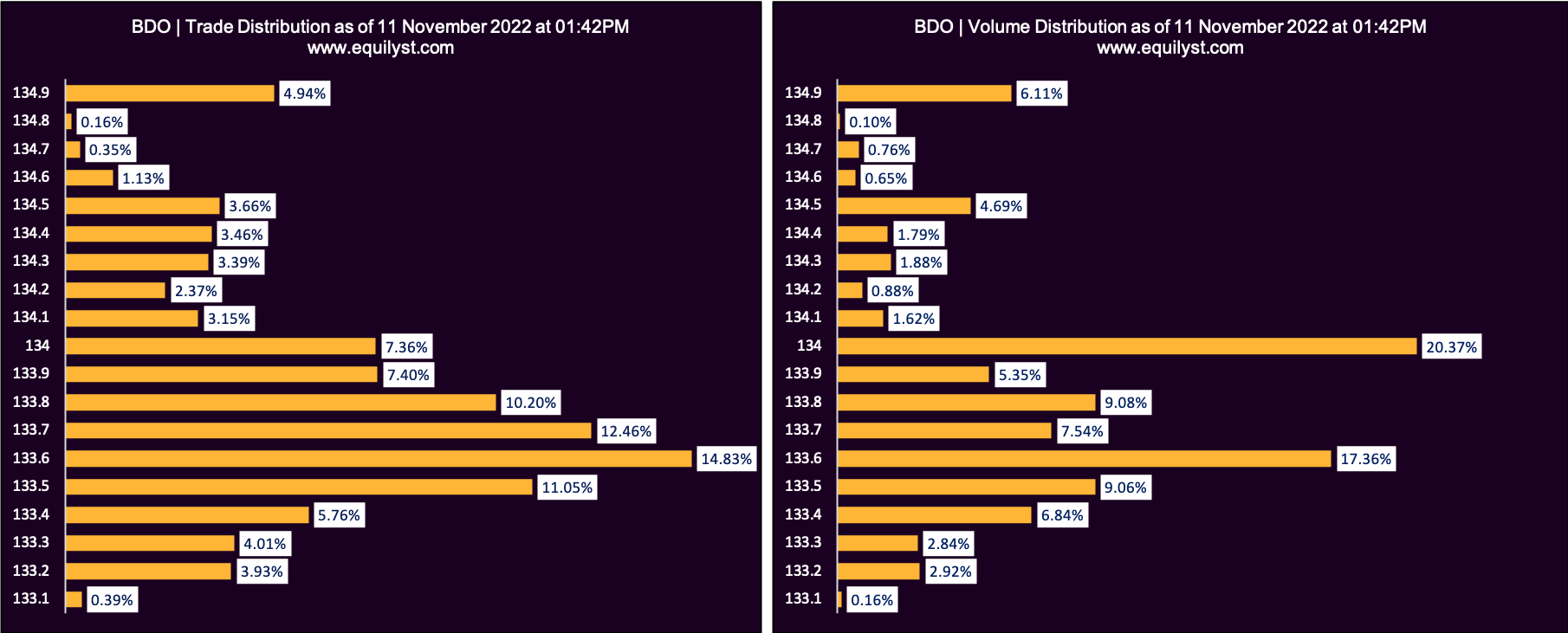

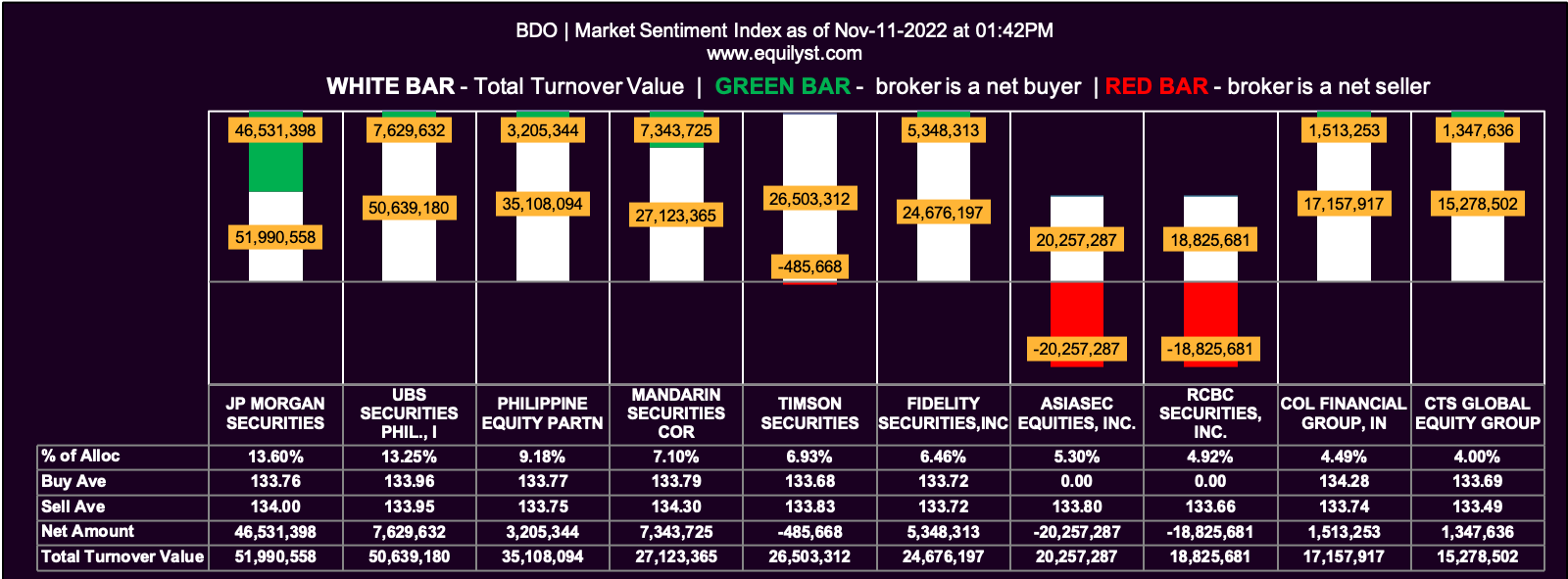

BDO Unibank (BDO)

Dominant Range Index: BEARISH

Last Price: 133.6

VWAP: 133.86

Dominant Range: 133.6 – 134

Market Sentiment Index: BEARISH

15 of the 49 participating brokers, or 30.61% of all participants, registered a positive Net Amount

14 of the 49 participating brokers, or 28.57% of all participants, registered a higher Buying Average than Selling Average

49 Participating Brokers’ Buying Average: ₱133.88279

49 Participating Brokers’ Selling Average: ₱134.06425

5 out of 49 participants, or 10.20% of all participants, registered a 100% BUYING activity

22 out of 49 participants, or 44.90% of all participants, registered a 100% SELLING activity

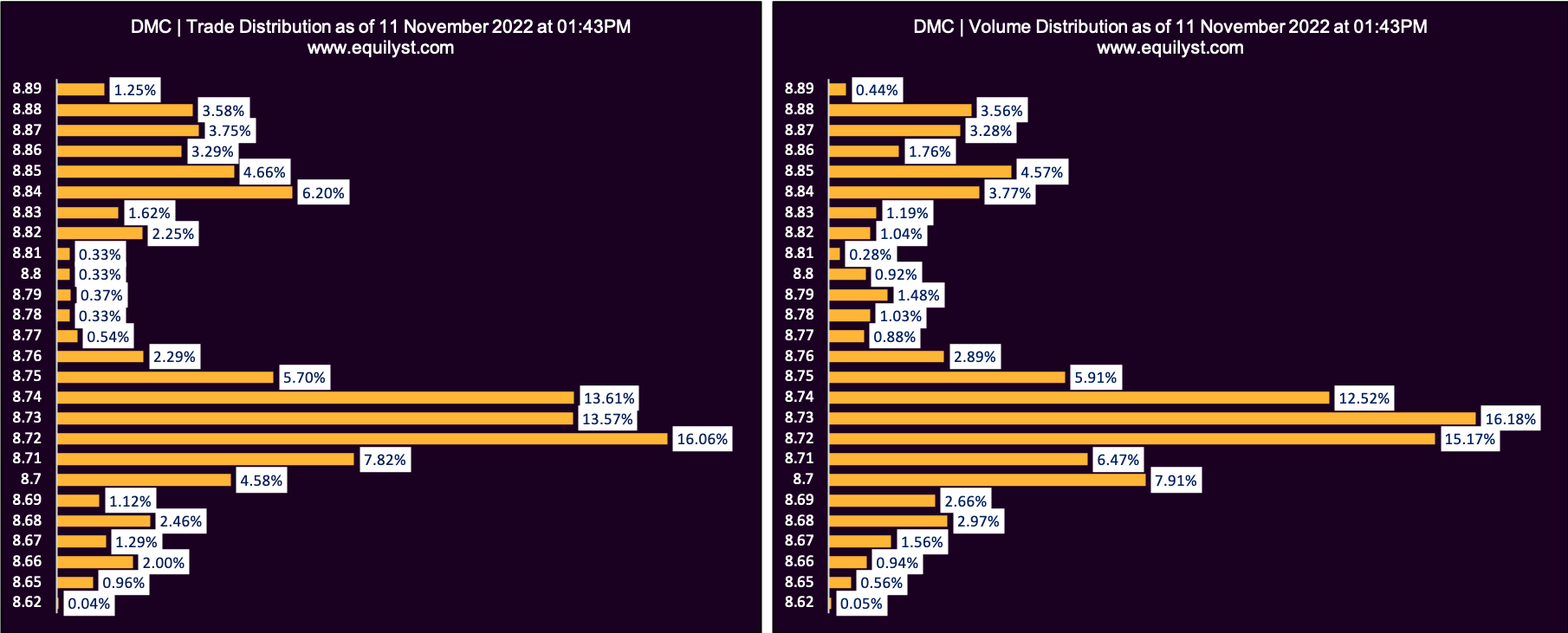

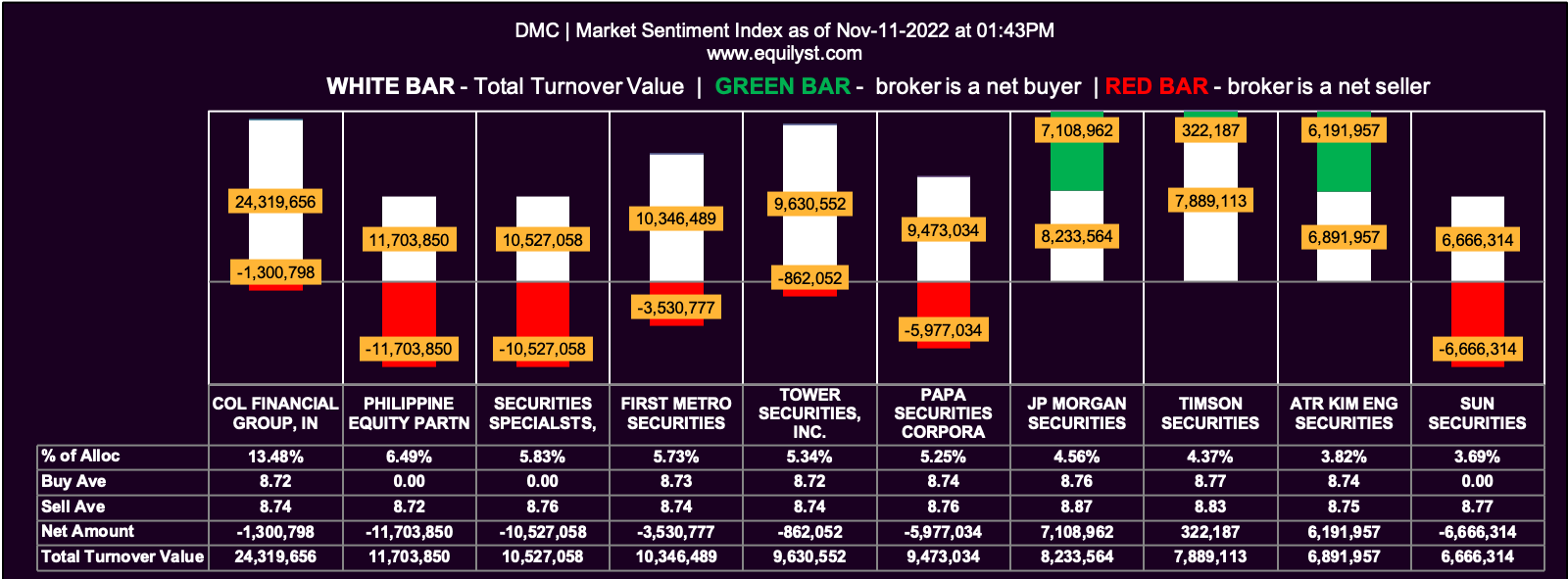

DMCI Holdings (DMC)

Dominant Range Index: BEARISH

Last Price: 8.82

VWAP: 8.75

Dominant Range: 8.72 – 8.73

Market Sentiment Index: BEARISH

37 of the 61 participating brokers, or 60.66% of all participants, registered a positive Net Amount

29 of the 61 participating brokers, or 47.54% of all participants, registered a higher Buying Average than Selling Average

61 Participating Brokers’ Buying Average: ₱8.73867

61 Participating Brokers’ Selling Average: ₱8.75500

19 out of 61 participants, or 31.15% of all participants, registered a 100% BUYING activity

15 out of 61 participants, or 24.59% of all participants, registered a 100% SELLING activity

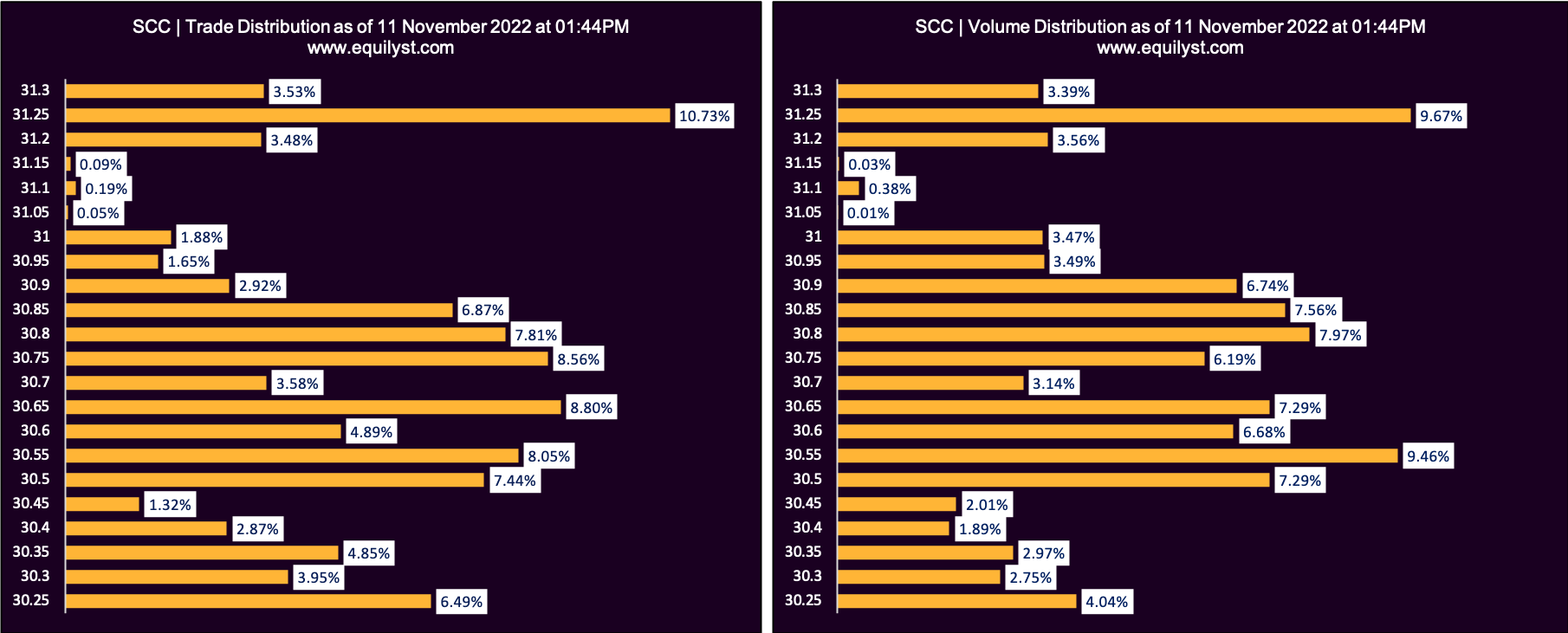

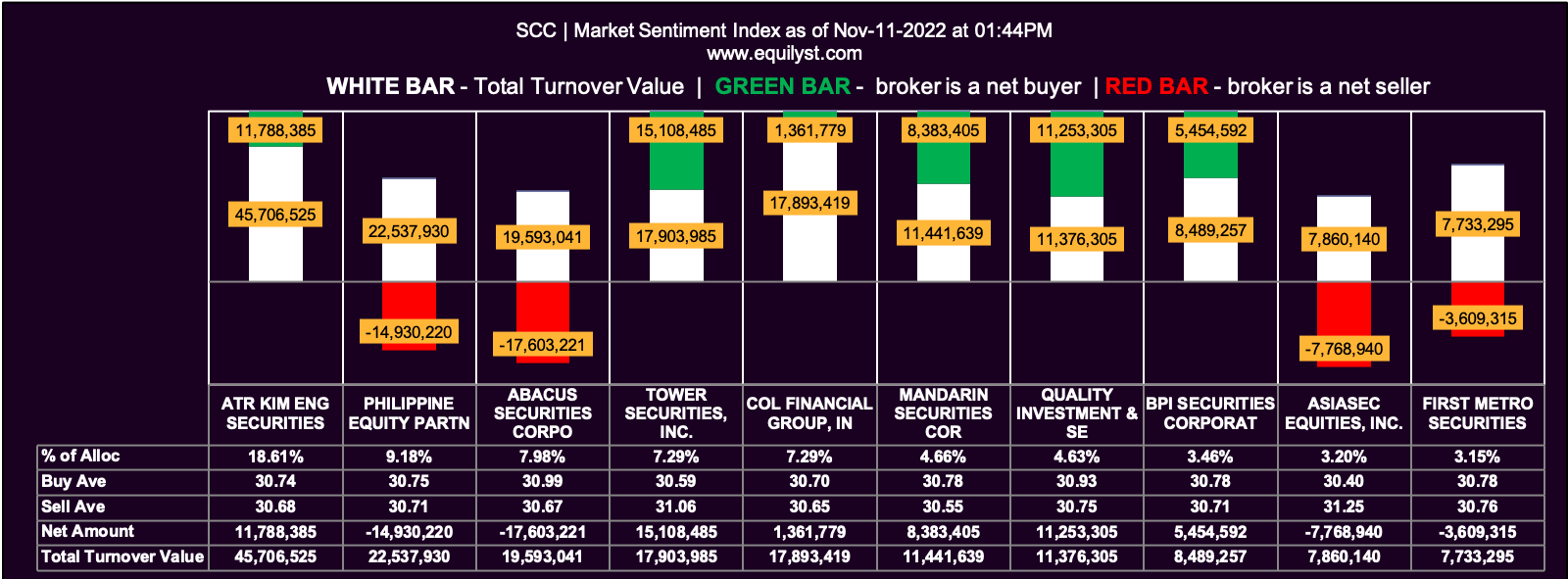

Semirara Mining and Power Corporation (SCC)

Dominant Range Index: BULLISH

Last Price: 31.25

VWAP: 30.76

Dominant Range: 31.25 – 31.25

Market Sentiment Index: BEARISH

21 of the 56 participating brokers, or 37.50% of all participants, registered a positive Net Amount

25 of the 56 participating brokers, or 44.64% of all participants, registered a higher Buying Average than Selling Average

56 Participating Brokers’ Buying Average: ₱30.73683

56 Participating Brokers’ Selling Average: ₱30.80702

9 out of 56 participants, or 16.07% of all participants, registered a 100% BUYING activity

17 out of 56 participants, or 30.36% of all participants, registered a 100% SELLING activity

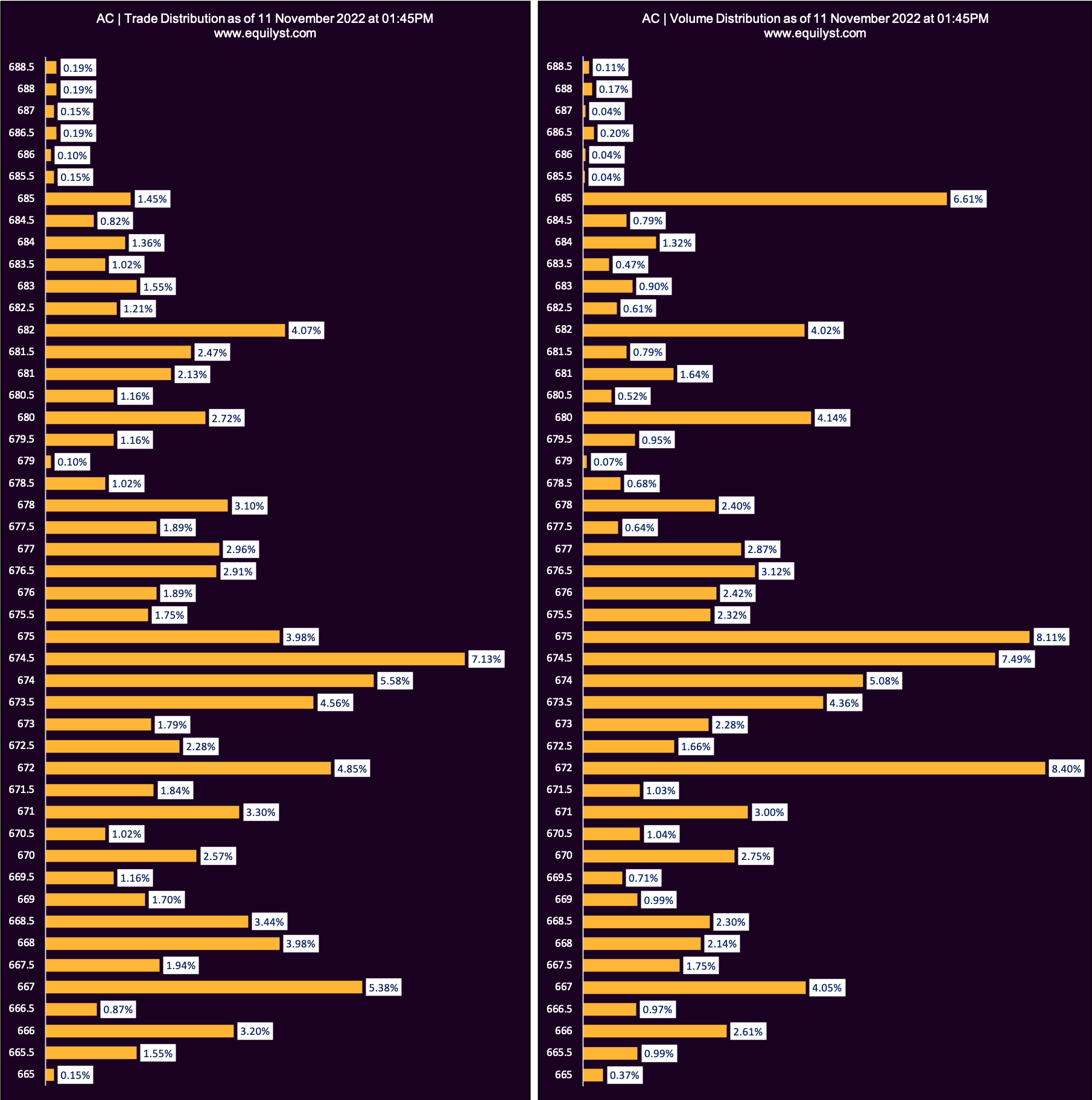

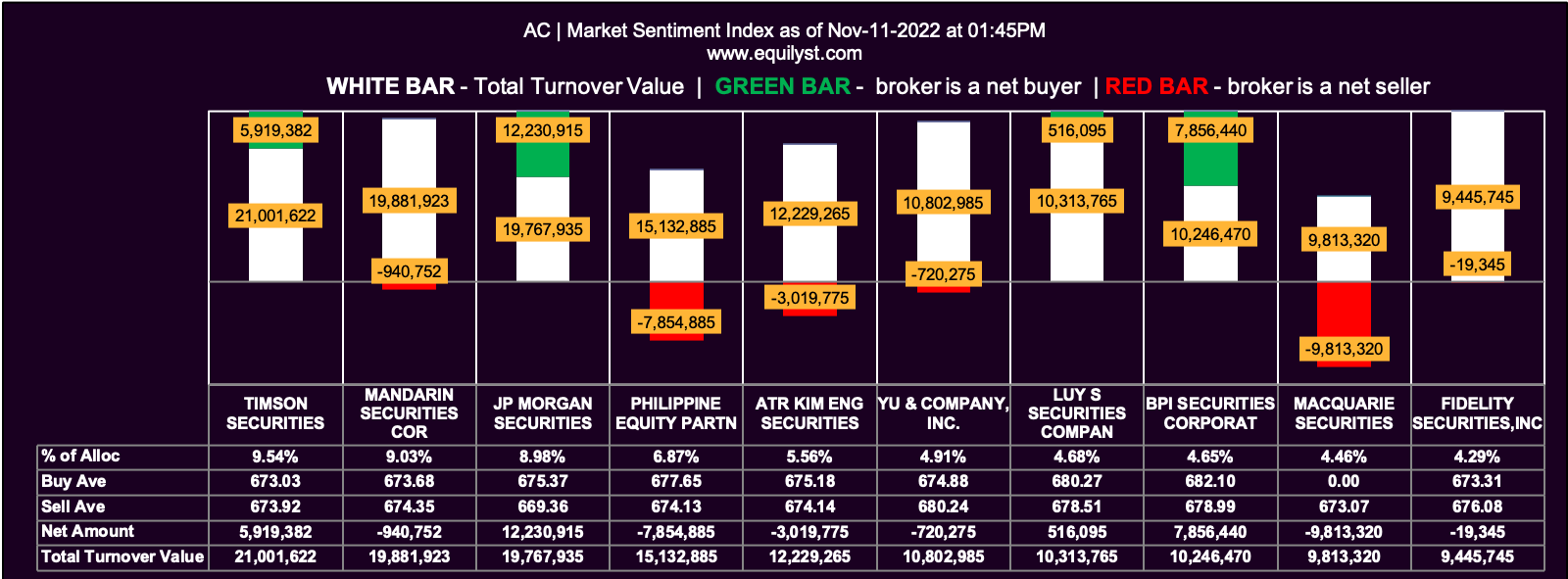

Ayala Corporation (AC)

Dominant Range Index: BEARISH

Last Price: 676

VWAP: 674.92

Dominant Range: 672 – 674.5

Market Sentiment Index: BEARISH

17 of the 46 participating brokers, or 36.96% of all participants, registered a positive Net Amount

16 of the 46 participating brokers, or 34.78% of all participants, registered a higher Buying Average than Selling Average

46 Participating Brokers’ Buying Average: ₱673.51812

46 Participating Brokers’ Selling Average: ₱675.46600

5 out of 46 participants, or 10.87% of all participants, registered a 100% BUYING activity

18 out of 46 participants, or 39.13% of all participants, registered a 100% SELLING activity

Insightful?

Go ahead and share this free report with anyone you know who trades or invests in the Philippine stock market.

If you want to hire me as a personal mentor in stock trading and investing, subscribe to my stock market consultancy service.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025