I saw an anonymous post on a stock market-related Facebook Group. This was the post:

“What can you say about [sic] converge? My entry was 19.80 na stuck na ako from almost a month.”

Here’s my response:

—

What’s the percentage of risk you have for CNVRG?

Your next step is predicated on your answer to that question.

If you applied a 15% risk on CNVRG, that means your initial trailing is at 16.83.

Under the assumption that you identified a confirmed buy signal according to your methodology when you bought CNVRG at 19.80 apiece and you applied a 15% risk, the downtrend should still be relatively tolerable for you.

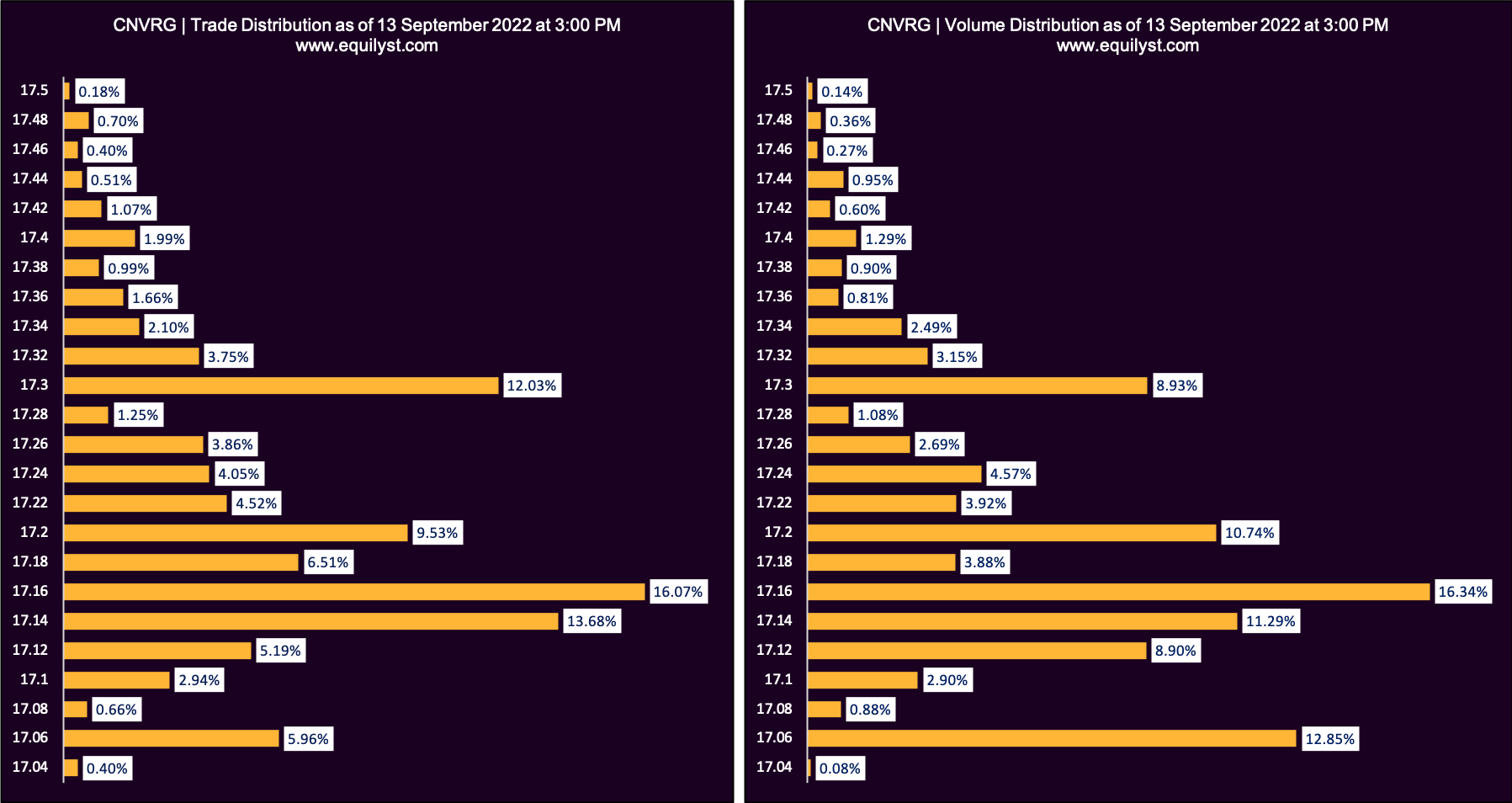

Dominant Range Index: BEARISH

Last Price: 17.06

VWAP: 17.19

Dominant Range: 17.16 – 17.16

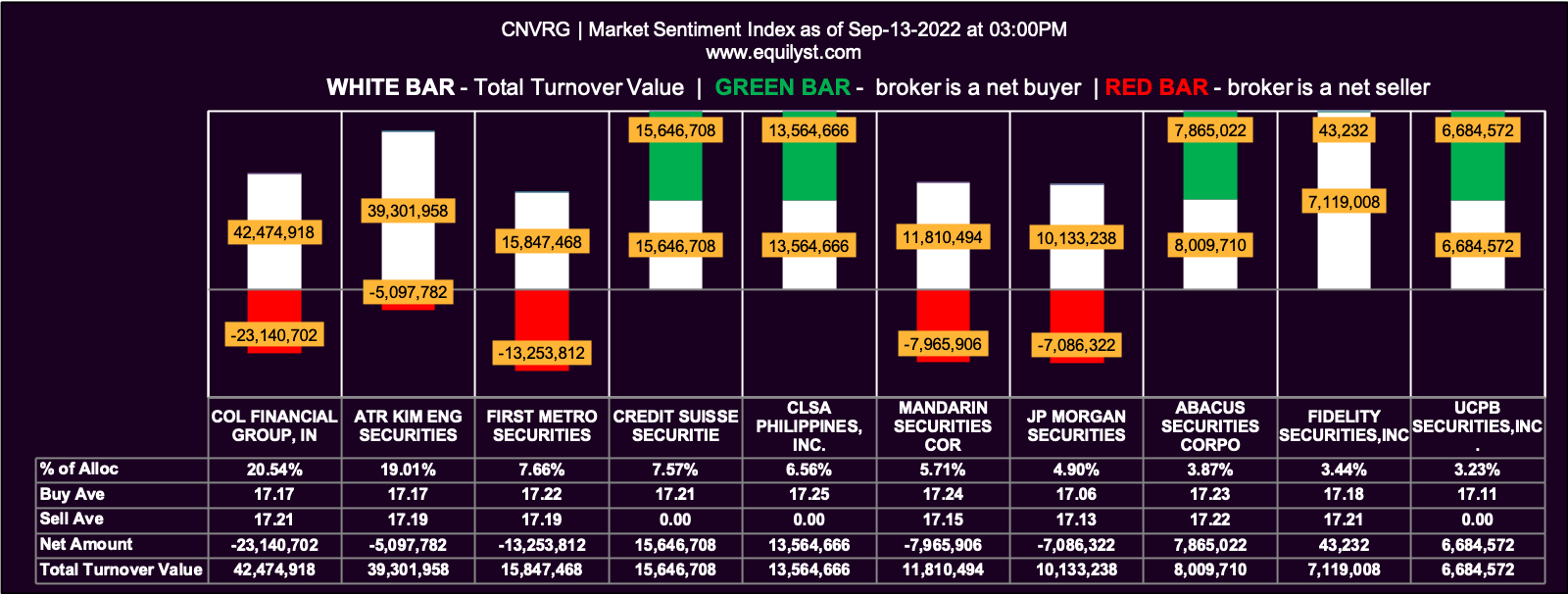

Market Sentiment Index: BULLISH

34 of the 50 participating brokers, or 68.00% of all participants, registered a positive Net Amount

30 of the 50 participating brokers, or 60.00% of all participants, registered a higher Buying Average than Selling Average

50 Participating Brokers’ Buying Average: ₱17.15847

50 Participating Brokers’ Selling Average: ₱17.19092

24 out of 50 participants, or 48.00% of all participants, registered a 100% BUYING activity

3 out of 50 participants, or 6.00% of all participants, registered a 100% SELLING activity

The dominant range is closer to the intraday low than the intraday high. But since the Market Sentiment Index is bullish, the next trading day’s projected trend is sideways with a bearish bias.

What I’m going to say next is what I would do if I were in your situation. I would either stick with my prevailing trailing stop at 16.83 or reduce the percentage of risk I applied to my trailing stop.

If I choose to stick with my prevailing trailing stop, that means I won’t prematurely sell my shares unless and until my trailing stop at 16.83 is hit.

If I choose to reduce the risk percentage of my trailing to, let’s say, 14%, it means my adjusted trailing stop is now at 17.03. I’ll keep an eye on this adjusted trailing stop since it’s just 3 ticks away from today’s closing price of 17.06.

Feel free to use my calculators at https://www.equilyst.com/resources/#calculators.

At the end of the day, you should make a conscious decision according to YOUR financial circumstances and risk tolerance.

Even if 1 million analysts, including all of us who commented on your post, have an ultra bullish sentiment for any stock, if you’re in a situation that gives you no choice but to liquidate what you can liquidate ASAP, do you think those 1 million analysts’ sentiment will influence your final decision? Although “yes” is not an impossible answer you can give, you’re less likely to give that answer if your situation’s idea of liquidating your funds is more of a command than a suggestion.

The same thing goes for when those 1 million analysts have an ultra bearish forecast for your stock. Even if their bearish assessment is the “mother of all bearishness in the world”, if your trailing stop is not hit, you can afford to just shrug your shoulder and stick to your trailing stop.

If you have your own methodology that is anchored to your risk appetite and financial psychology, you can make an independent, strategic, and, hopefully, profitable investment decision.

—

Need my help?

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025