SP New Energy Corporation (SPNEC) recently received approval from the Securities and Exchange Commission for various matters, including the increase in its authorized capital stock. The company’s capital stock will be raised from One Billion Pesos (Php1,000,000,000.00) to Five Billion Pesos (Php5,000,000,000.00), divided into common shares at par value of Php0.10 per share.

On February 24, 2022, SPNEC’s Board of Directors greenlit the acquisition of Solar Philippines Power Project Holdings, Inc. (SPPHI) and its assets. The acquisition involved an asset-for-share swap, with SPPHI subscribing to 24,373,050,000 SPNEC shares at Php 2.50 per share in exchange for the Solar Philippines Assets. SPNEC subsequently disclosed the board approval and execution of the Contract to Sell on May 8 and 16, 2023, respectively. The acquisition will be funded through cash payment, utilizing the proceeds from SPPHI’s subscription to SPNEC shares, instead of a tax-free share swap.

To comply with the Guidelines on Minimum Public Ownership Requirement, SPNEC is required to maintain a minimum public float of 20%. Unfortunately, due to recent developments, the company’s public ownership level has fallen below this requirement.

According to the Amended Rule on Minimum Public Ownership, companies that fail to meet the prescribed minimum public ownership will face a trading suspension of up to six (6) months and may be delisted if non-compliant after the suspension period.

In light of these circumstances and in accordance with the Amended Rule and relevant guidelines, the trading of SPNEC shares will be suspended effective June 2, 2023. Should SPNEC fail to meet the minimum public ownership requirement even after the six (6)-month suspension period from June 2, 2023, automatic delisting from the Official Registry of the Exchange will ensue.

The Exchange will provide Trading Participants and the investing public with further updates regarding this matter.

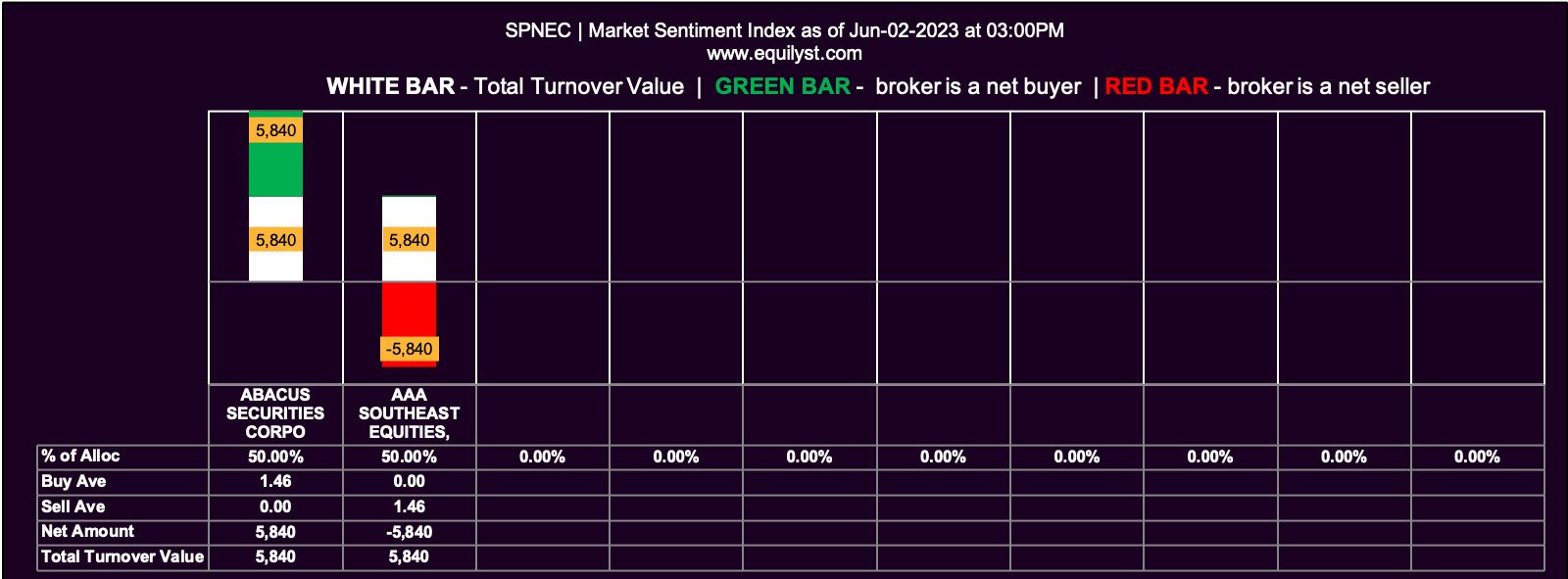

So, this is the reason why SPNEC only registered a total traded volume of 4,000 shares last Friday, June 2, 20223. Only Abacus Securities and AAA Southeast Equities had the chance to shake hands.

What’s Going to Happen Once the Trading Suspension Is Lifted for SPNEC?

We can only do so much but speculate. This is a developing story. SPNEC has up to six months to comply with the mandatory requirements. If you want to get a good feel of how traders will translate these stories into transactions on the bid-ask spread on the day trading resumes for SPNEC shares, all you have to do is read related news and discussions on highly active and populated stock market-related Facebook Groups. You can also set up a Google Alert for the keyword “SPNEC” so you’ll receive instant notifications when an SPNEC-news is published on legit news portals.

But let’s not dwell that much on the future of SPNEC. We don’t even know if we’ll still be here tomorrow. That’s cliche, but it’s the truth. Since this is not a philosophy class, let’s talk about what transpired in the most recent historical data of SPNEC. Shall we?

Technical Analysis on SPNEC

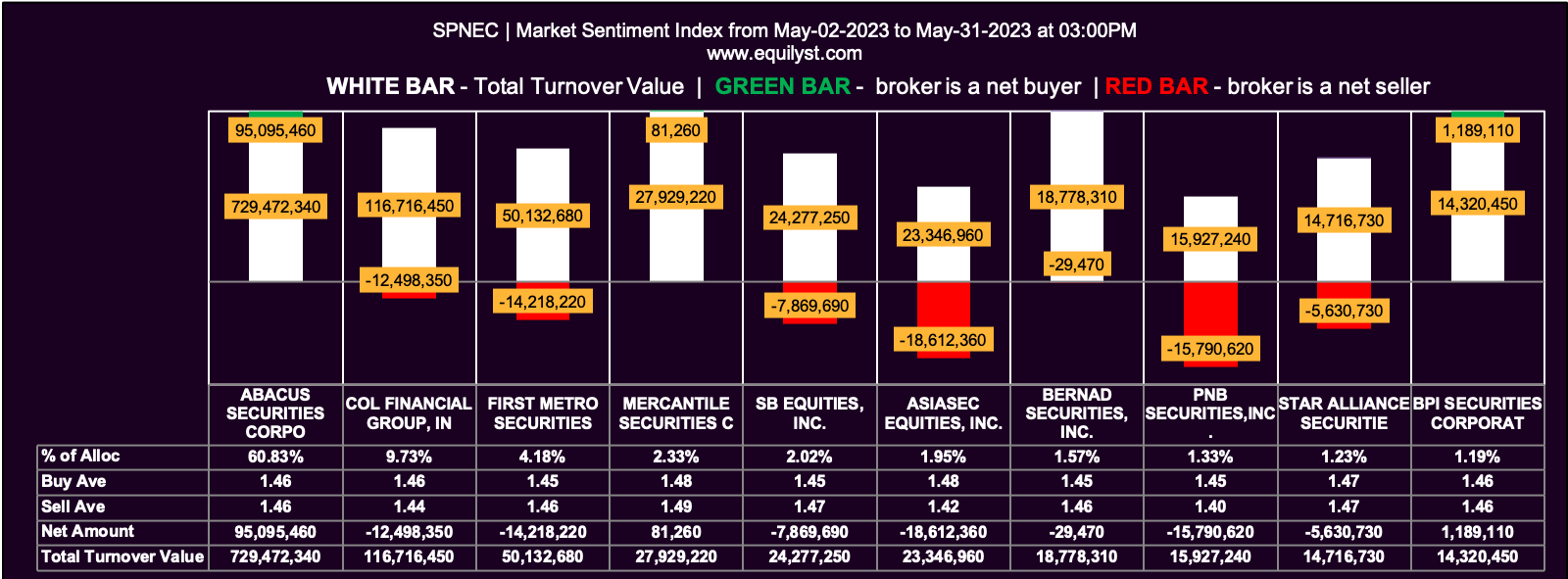

What you see below is the summary of market sentiment for the period of May 2 to May 31. This gives you an idea why SPNEC did not leave the P1.38-P1.50 (support-resistance) bond within that period.

Market Sentiment Analysis

Market Sentiment Index: BEARISH

33 of the 73 participating brokers, or 45.21% of all participants, registered a positive Net Amount

31 of the 73 participating brokers, or 42.47% of all participants, registered a higher Buying Average than Selling Average

73 Participating Brokers’ Buying Average: ₱1.44611

73 Participating Brokers’ Selling Average: ₱1.46224

11 out of 73 participants, or 15.07% of all participants, registered a 100% BUYING activity

9 out of 73 participants, or 12.33% of all participants, registered a 100% SELLING activity

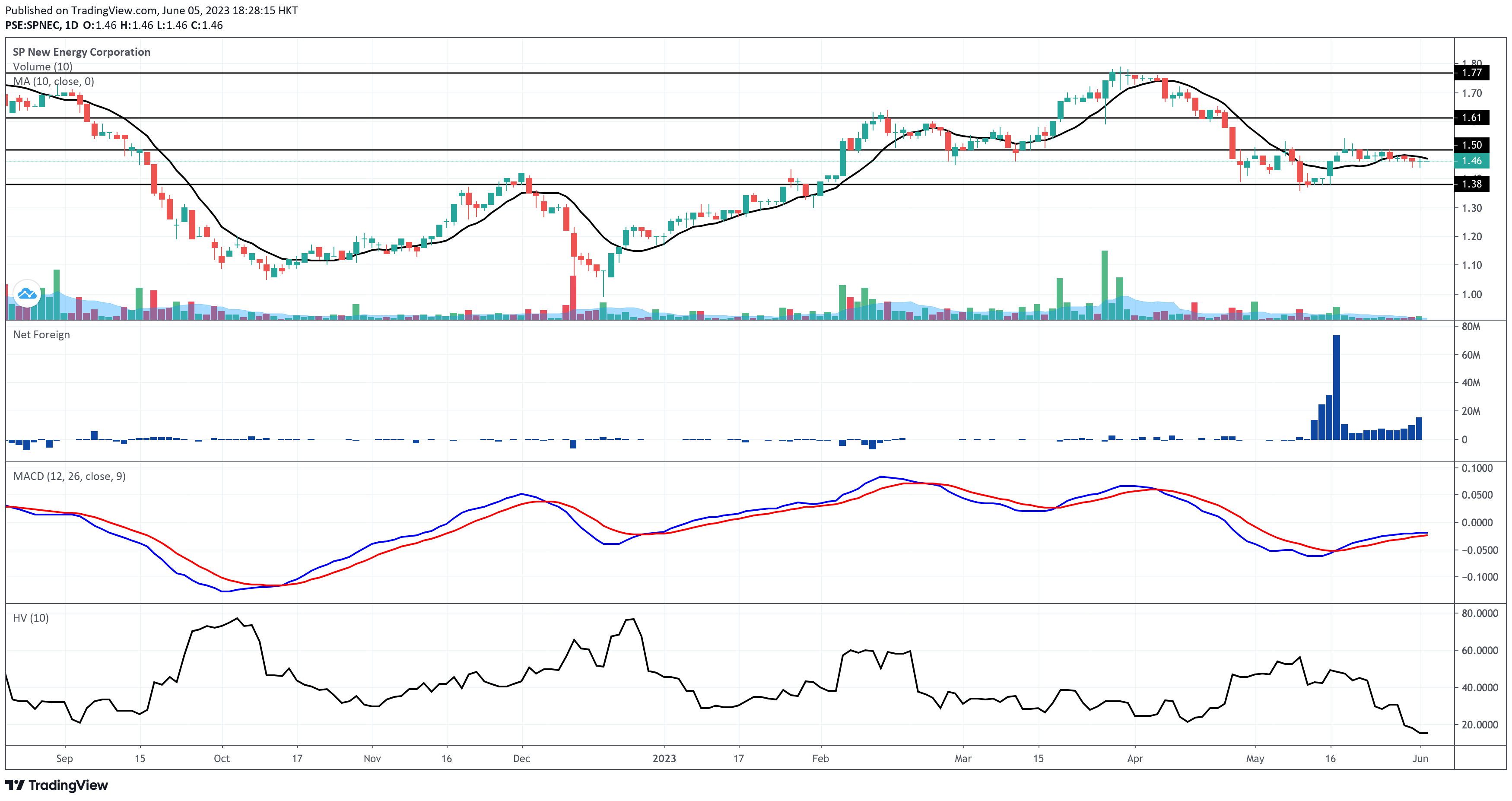

While the foreign investors registered relatively huge net foreign buying amounts between the second and third weeks of May, the momentum of that buying sentiment wasn’t sustained. SPNEC was already on the brink of piercing the resistance at P1.50.

While I still don’t see a formation of a bearish convergence between the moving average convergence divergence (MACD) and signal lines, I’m afraid we will see one if the price continues to move below its 10-day simple moving average. Once we see a death cross on the MACD’s histogram, it’s a logical time for SPNEC traders and investors to consider adjusting, if not pre-empting, the risk percentage applied on their trailing stop.

The only positive thing I see on SPNEC’s signals is its low risk rating as far as its 10-day historical volatility score is concerned. That only means no heart-stopping share price movements happened on SPNEC in the recent past.

What to Do if You Don’t Have SPNEC Yet?

Add SPNEC on your watchlist if you like, but don’t buy it yet. I see no confirmed buy signal based on my Evergreen Strategy’s algorithm as of closing on June 1, Thursday. If you’re one of my clients who availed of my stock market consultancy service and if you still have remaining Stock Analysis Request credits, you may use one credit so you can email me with my latest stock analysis request for SPNEC when trading resumes. This way, I can inform you if I already see a confirmed buy signal for SPNEC. I’ll also send you a tailored fit action plan relative to your risk tolerance.

What to Do If You Already Have SPNEC in Your Portfolio?

If your trailing stop is intact, you’re fine. It means your paper loss is still tolerable, at least for you.

The only problem is if you ask me, “What’s a trailing stop?”

My goodness. That means you bought SPNEC maybe because the acronym is cute but you failed to establish a buy case and you failed to remember what risk management is for.

A buy case is a collection of fundamental and/or technical reasons for buying the stock.

Risk management is knowing when and where to exit even before you enter a trade or an investment.

If you’re in that situation, you better stop trading or investing for now and start researching about Risk Management when trading and investing in the stock market.

Be mentored by someone who knows this. It can be me or any other person you trust. You already know that I offer a stock market consultancy service. You can see your options here.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025