SM Prime Holdings (SMPH) Technical and Sentiment Analysis

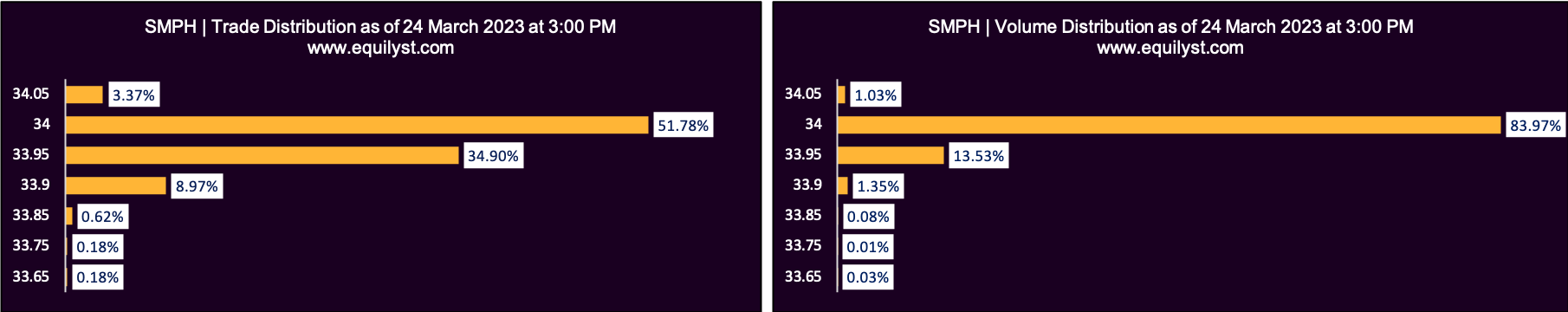

SM Prime Holdings, Inc. (PSE:SMPH) closed unchanged at P34.00 per share, with a total turnover value of nearly P294 million, on March 24, 2023. SMPH has been protecting P34.00 for more than a week now.

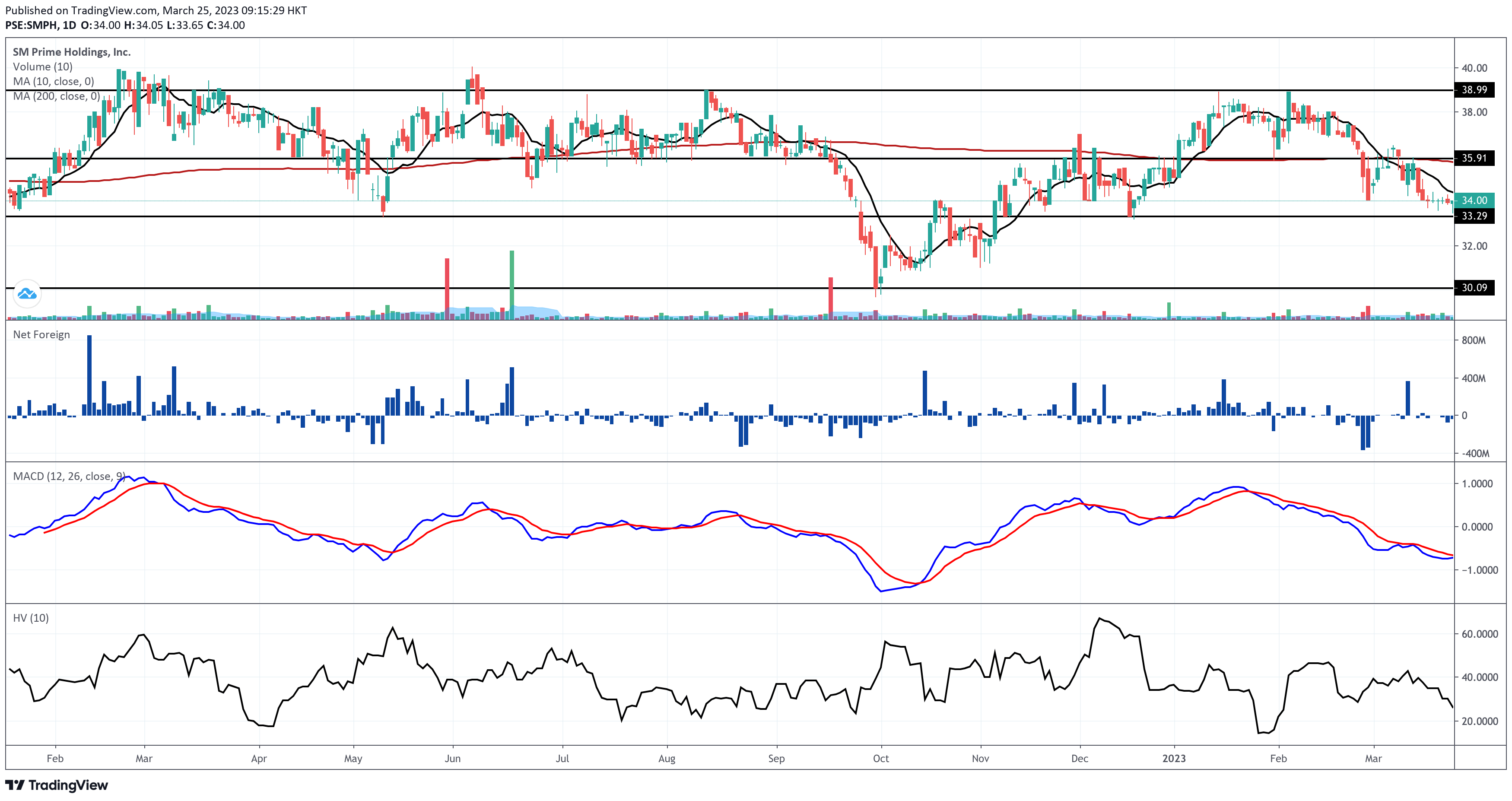

SMPH is bearish in the short- and long-term as it continues to dance below the 10-day and 200-day simple moving averages (SMAs).

Its immediate support is pegged near P33.30, while its resistance is near P35.90. The resistance is confluent with the position of its 200-day simple moving average.

SMPH’s moving average convergence divergence (MACD) agrees with the bearish signals coming from the SMAs. When you zoom in on the MACD’s histogram, you’ll notice a bullish convergence between the MACD and the signal line. However, a golden cross above the signal line will likely happen once the price of SMPH breaches the median between its immediate support and resistance.

It was a Net Foreign Buying worth P62 million on March 24, 2023. However, the foreign investors are still net sellers year-to-date at almost half a billion pesos.

Volume-wise, I see no pressing concern about the size of the daily volume of SMPH. Its daily volume is almost always above 50% of the stock’s 10-day average. There’s no volatility issue at all.

Those hoping to see SMPH inch further above P34.00 must also hope to see a consistent daily volume, preferably higher than 100% of the stock’s 10-day volume average. A bullish volume must back the bullish price. That’s the simple correlation between the two.

Dominant Range Index: BULLISH

Last Price: 34

VWAP: 33.99

Dominant Range: 34 – 34

Not all of the first four indicators of my Evergreen Strategy (my proprietary algorithm/strategy when trading and investing in the Philippine stock market) are bullish. It’s surprising to see the Dominant Range and Market Sentiment Indexes of SMPH bullish. This means most holders of SMPH would want to protect the price from going lower than P34.00 apiece.

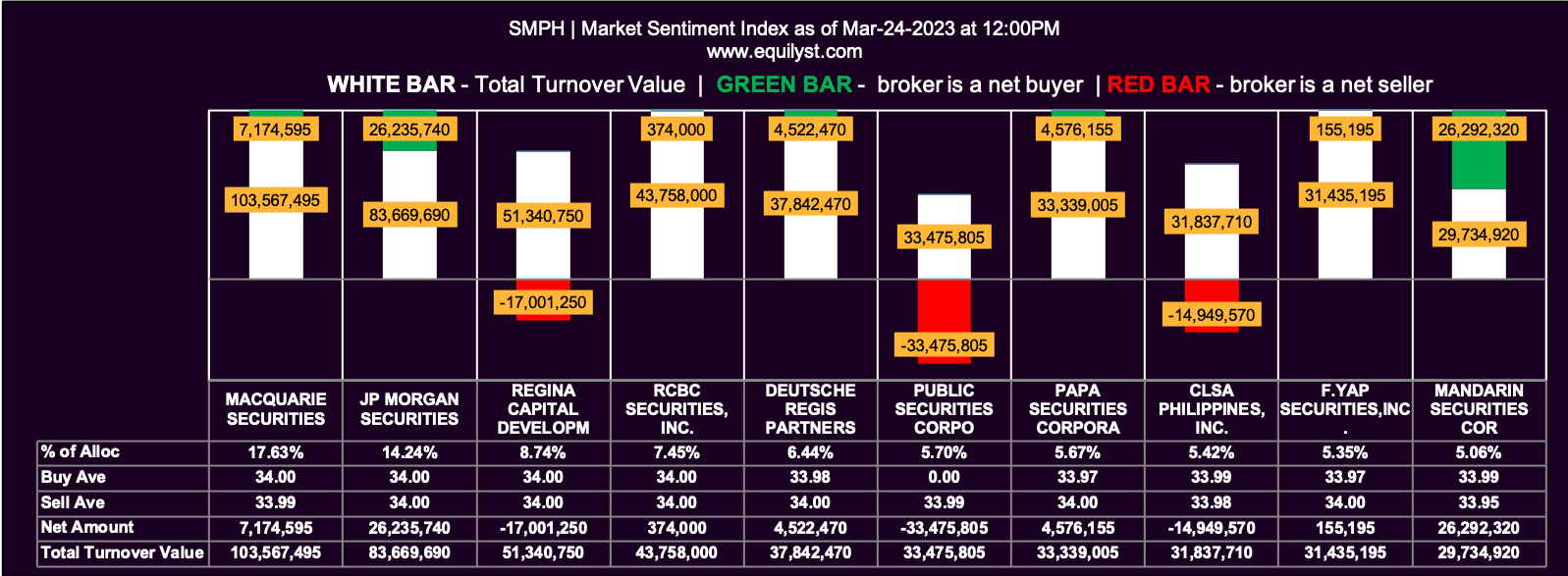

Market Sentiment Index: BULLISH

25 of the 39 participating brokers, or 64.10% of all participants, registered a positive Net Amount

22 of the 39 participating brokers, or 56.41% of all participants, registered a higher Buying Average than Selling Average

39 Participating Brokers’ Buying Average: ₱33.97498

39 Participating Brokers’ Selling Average: ₱33.98061

9 out of 39 participants, or 23.08% of all participants, registered a 100% BUYING activity

6 out of 39 participants, or 15.38% of all participants, registered a 100% SELLING activity

It was a close fight between the net sellers and net buyers of SMPH as of March 24, 2023 as can be seen by the difference between all trading participants’ buying and selling averages.

Verdict

If you already have SMPH in your portfolio and your trailing stop is intact, you may still hold your position since Dominant Range and Market Sentiment Indices are bullish. Consider pre-empting your trailing stop (selling even if your trailing stop is not hit yet) if and when both indices have become bearish for 2 to 3 consecutive trading days. Also, only top up for as long as my Evergreen Strategy issues no confirmed buy signal. Remember the lessons during our 1-on-1 workshop with my Evergreen Strategy.

If your trailing stop is already hit, selling your shares is the only logical thing to do. Don’t blindly hold onto a losing position, especially if the losses are already beyond your tolerable risk. Having an exit plan only to ignore it when it gets hit doesn’t make sense.

If you don’t have a position on SMPH yet, wait for all six indicators of my Evergreen Strategy to give you a confirmed buy signal. You may use one of your credits to request my latest technical and sentiment analysis for SMPH via email so I can guide you.

Need Help?

Avail of my private stock market consultancy service so you’ll learn how to preserve your capital, protect your gains, and prevent unbearable losses when trading and investing in the Philippine stock market. We’ll have a one-time 1-on-1 online workshop on my Evergreen Strategy When Trading and Investing in the Philippine Stock Market. You’ll also get 10 stock analysis request credits. For each credit, you can email me your request for my stock analysis. Contact me here.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025