To begin with, I want to be crystal-clear that this is NOT a stock recommendation. I am sharing my analysis with you, for free, to give you an example of how to be a data-driven stock trader or investor.

If you need me to send you an in-depth analysis with recommendations tailored fit to your entry price, average cost, risk tolerance percentage, and other matters pertinent to buying or selling the stock, you may subscribe to the PLATINUM package of the stock and crypto market consultancy service of Equilyst Analytics. You will get 10 stock or crypto analysis credits. Visit the home page to learn more about the PLATINUM package and the sample report.

If you want to know how to analyze coins or stocks as I do, subscribe to the TITANIUM package of Equilyst Analytics. You and I will have a one-on-one online training session via Zoom. You choose if you want to learn how I analyze Philippine stocks, US stocks, or cryptocurrencies. Go to the home page to know more about the TITANIUM package.

Inside Scoop on Synergy Grid and Dev’t Phils (PSE:SGP)

In May 2023, the fulfillment of obligations under the franchise agreement of the National Grid Corporation of the Philippines (NGCP) was announced by Synergy Grid and Development Philippines Inc.

NGCP, serving as the solitary operational asset of PSE:SGP, operates the transmission network in the country.

As disclosed by PSE:SGP to the Philippine Stock Exchange, NGCP believes it has complied with its obligations outlined in the franchise and concession agreement and intends to continue abiding by lawful directives while faithfully pursuing its mandate.

To counter allegations of violations, NGCP relies on its commendable overall performance and service track record, as mentioned by PSE:SGP.

With a 25-year concession and a 50-year Congressional franchise, NGCP holds the responsibility of expanding and managing the power transmission grid in the country.

NGCP exclusively operates the nationwide transmission network in the Philippines, connecting power generators and distribution utilities to deliver electricity to end-users across Luzon, Visayas, and Mindanao.

PSE:SGP observed that NGCP has made substantial investments to strengthen the transmission system, resulting in reduced transmission rates since assuming control in 2009.

Based on the Energy Regulatory Commission’s (ERC) findings regarding performance metrics, transmission services have significantly improved.

NGCP has doubled substation capacity and constructed extensive transmission lines across the country, including inter-island connection projects.

PSE:SGP’s report highlighted that NGCP has invested P300 billion to ensure the reliability of the country’s transmission infrastructure since taking over operations from the government.

In response to Malacañang’s statement about the potential need to regain control of the transmission firm, NGCP expressed its faith in the legal process and commitment to complying with all lawful directives while pursuing its mandate.

Malacañang expressed support for Senator Raffy Tulfo’s initiative to assess NGCP’s performance, including security concerns.

Acknowledging that its franchise is a privilege granted by the government, NGCP affirmed its readiness to address any inquiries related to its business practices.

The company conveyed confidence in receiving due recognition for the implemented improvements and the P300 billion investment made to strengthen the transmission system.

NGCP, under the leadership of majority shareholders and vice-chairmen of the board Henry Sy Jr. and Robert Coyiuto Jr., is a privately owned, Filipino-led company responsible for operating, maintaining, and developing the country’s electricity transmission grid.

Cracking the Stock Chart of Synergy Grid and Dev’t Phils (PSE:SGP)

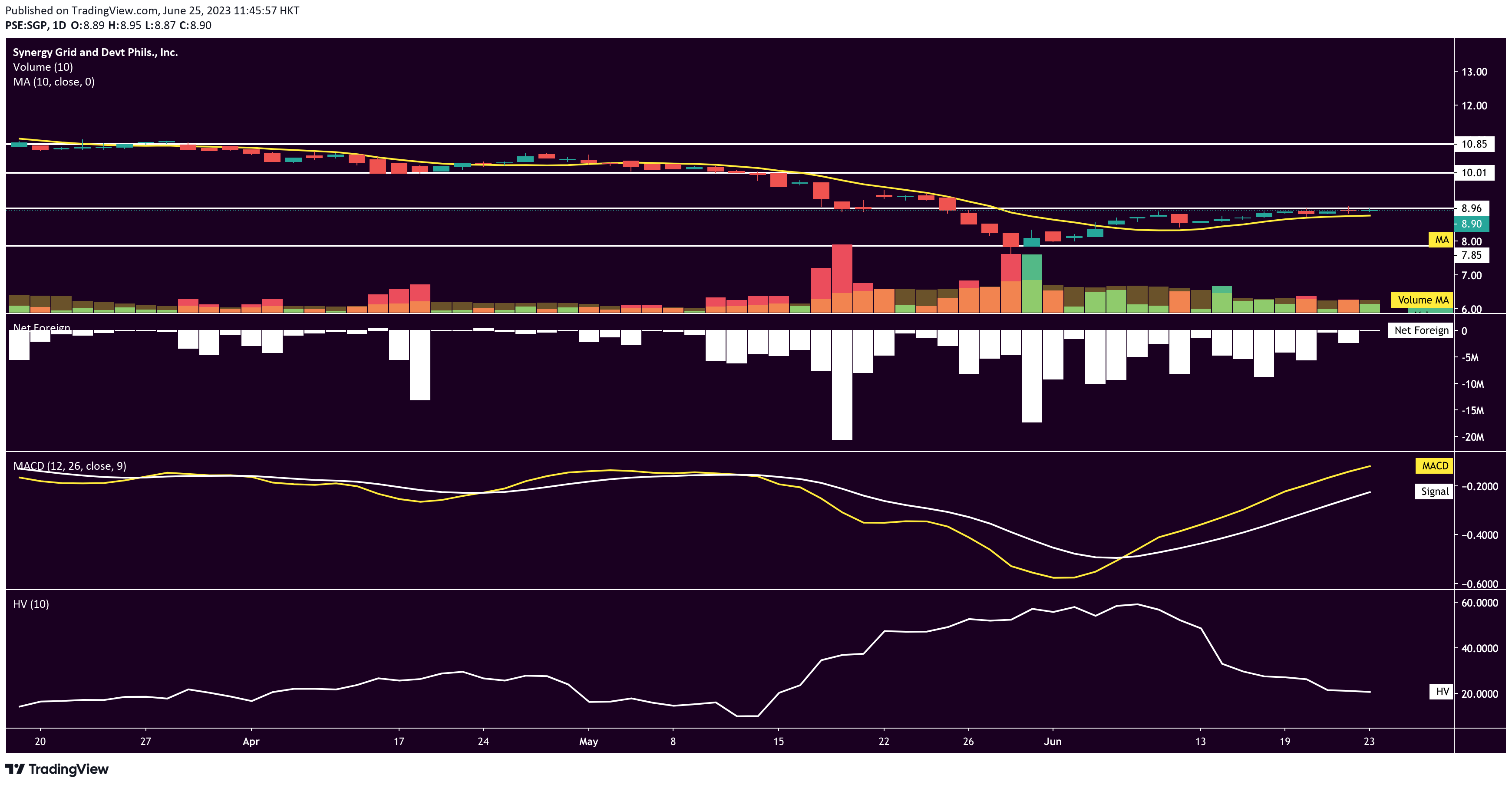

PSE:SGP closed on Friday at P8.90 per share, ascended by 0.11% and sustained its position above its 10-day simple moving average (SMA).

The daily chart looks good since the start of the second week of June, as the price has never descended below its 10-day SMA.

Support is between P7.80 and P7.85, while resistance is between P8.90 and P9.00.

PSE:SGP needs to sustain its volume above 50% of its 10-day volume average and preferably higher than 100% of its 10-day volume average to break the resistance with conviction.

If the volume plays below 50% of its 10-day average, the stock will likely continue to move sideways between the support and resistance.

Meanwhile, did you know that PSE:SGP is already on its 38th consecutive streak of Net Foreign Selling?

Don’t expect foreign investors to help push the price higher for PSE:SGP.

On the other hand, the moving average convergence divergence (MACD) of PSE:SGP consistently displays a bullish movement above the signal line.

The tip of the MACD line has yet to stoop. That’s another bullish signal.

Concurrently, PSE:SGP displays a low risk level status due to its 10-day historical volatility (HV) score staying below 50 points. It’s currently at 20.78 points. Thanks to the absence of alarming engulfing candlesticks and price gaps for the past 10 trading days.

What’s my overall assessment for everything I’ve checked so far?

Bullish.

The situation looks good for those who already have SGP in their portfolio and those planning to enter a new position on this stock.

But don’t keep your hopes up because we’re not done with the trade-volume distribution and market sentiment analyses.

Trade-Volume Distribution Analysis

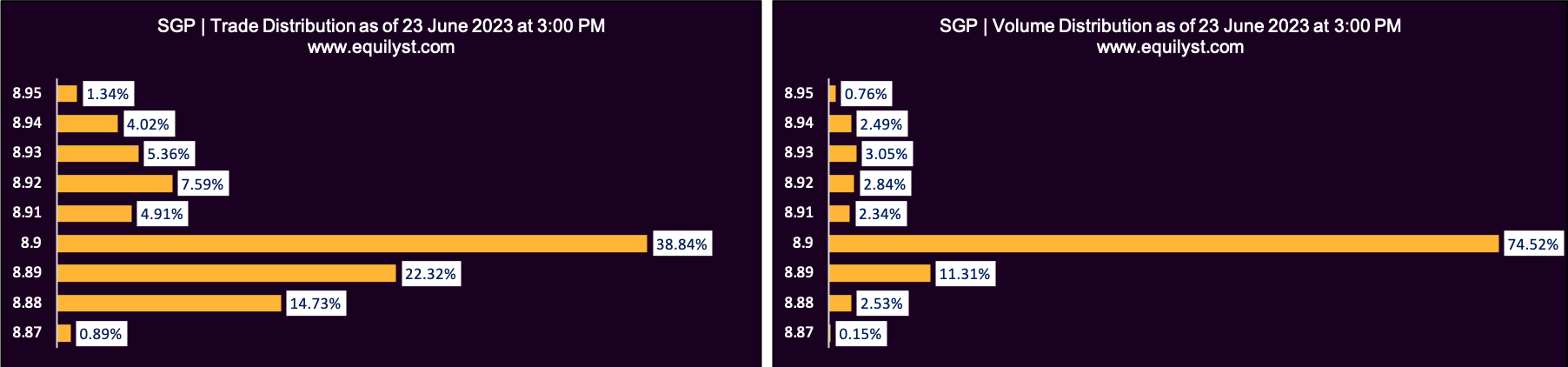

Dominant Range Index: BEARISH

Last Price: 8.9

VWAP: 8.90

Dominant Range: 8.9 – 8.9

I know. This is that one apple that spoils the whole bunch. I can almost hear you snapping your fingers.

The price with the biggest volume and highest trades were parked closer to the intraday low than the intraday high.

If the location of the dominant range won’t reverse on Monday, the share price of PSE:SGP might bounce off of the resistance once it’s hit.

The trade-volume distribution chart shows that some already locked in their profits or trimmed their losses at P8.90.

Market Sentiment Analysis

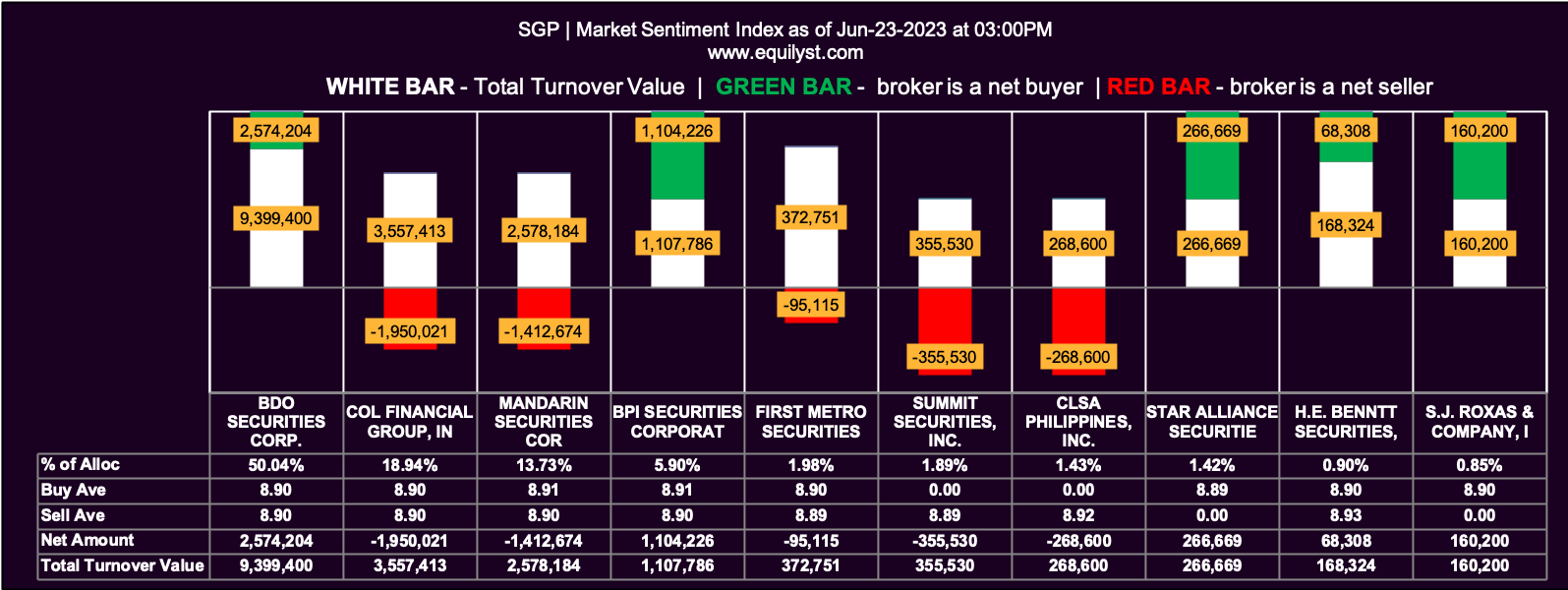

Market Sentiment Index: BULLISH

11 of the 20 participating brokers, or 55.00% of all participants, registered a positive Net Amount

11 of the 20 participating brokers, or 55.00% of all participants, registered a higher Buying Average than Selling Average

20 Participating Brokers’ Buying Average: ₱8.89993

20 Participating Brokers’ Selling Average: ₱8.90138

8 out of 20 participants, or 40.00% of all participants, registered a 100% BUYING activity

5 out of 20 participants, or 25.00% of all participants, registered a 100% SELLING activity

This is the ray of sunshine you hope to see if you already have a position on PSE:SGP and your trailing stop is still far from getting hit.

This means you have a data-driven reason to hold your position. Do not top up, however.

Remember, the Dominant Range Index is a fly in the ointment as of Friday’s closing.

But, but, but, you still need to see my month-to-date market sentiment analysis for PSE:SGP.

If you’re a PLATINUM client, use one of your analysis credits to know my month-to-date market sentiment analysis for PSE:SGP and to get my recommendation tailored to your entry price, average cost, and risk tolerance percentage.

Does PSE:SGP Have a Signal for Monday’s Trading?

My analysis suggests postponing all plans to buy the stock until the prevailing Dominant Range Index turns bullish. Hopefully, when that happens, all other indicators will still be bullish.

If you have a position on PSE:SGP at the moment, keep an eye on your trailing stop. Do not top up yet. You want to see first if there’s an appetite to push the price higher than its immediate resistance before you top up.

Again, as trading happens on Monday, you can use your remaining analysis credits for all PLATINUM clients to ask for my latest analysis.

Visit our home page to learn how to become a TITANIUM, PLATINUM, or GOLD client of Equilyst Analytics. You may also send us a message through our CONTACT page.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025