The Only 4 Service Stocks With a Positive Net Foreign

If you haven’t read Impact of Foreign Investors in the Philippine Stock Market, I highly recommend that you read it first so you’ll understand the significance of the information I’m sharing with you.

As of market closing on September 4, 2023, only four Service stocks the Philippine Stock Exchange registered a positive net foreign.

In addition to mentioning the stocks, I’d also like to share with you the overall market sentiment of all participating brokers as of today’s closing per stock.

The market sentiment also helps me estimate if the prevailing direction of the share price is likely to continue or reverse.

For example, if the stock is in a downtrend and the prevailing market sentiment is bearish, it means the downtrend is likely to continue.

If the stock is in a downtrend, but the market sentiment turns bullish, it’s a sign that investors might see a bullish reversal.

Again, and again, notice the adverbs I’m using – “likely” and “might”. We’re still talking about probabilities and not certainties.

Still, it’s better to be data-driven and be proven wrong by the market than make decisions based on gut feeling alone. The former gives you the opportunity to optimize something while the latter doesn’t.

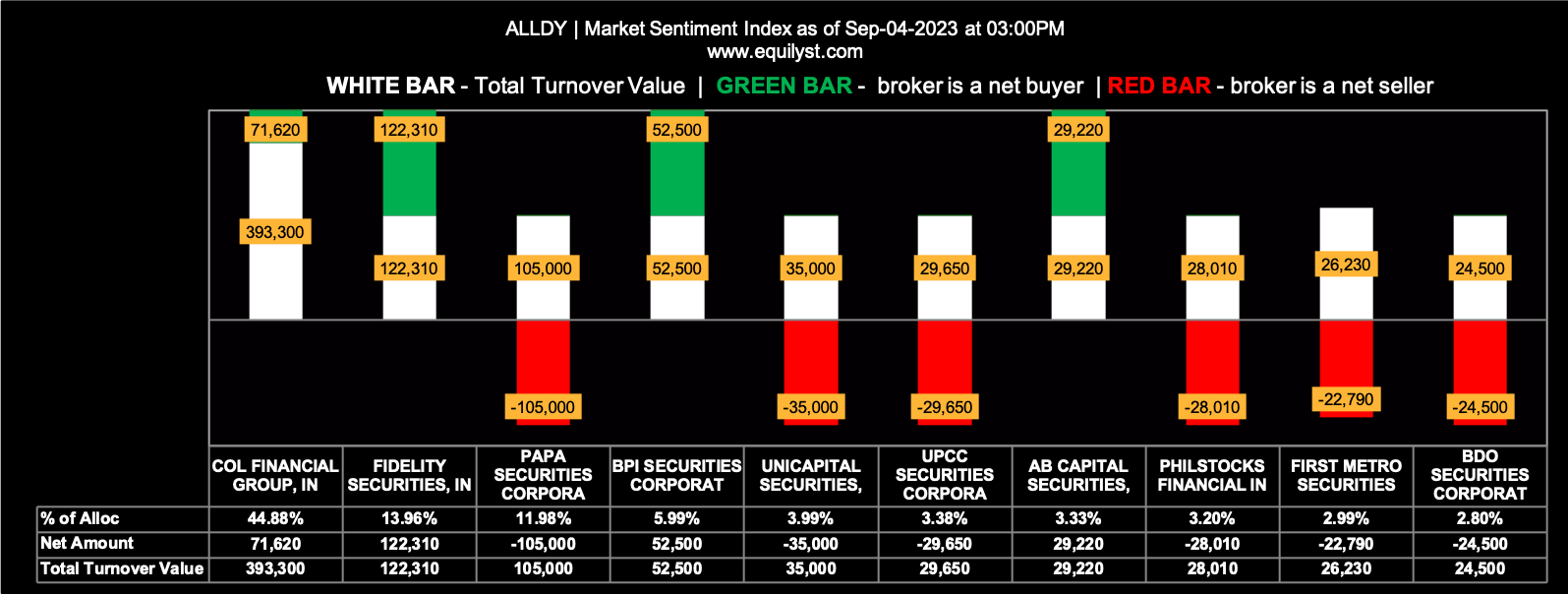

AllDay Marts (ALLDY)

Net Foreign: P14,070.00

Market Sentiment Index: BEARISH

4 of the 14 participating brokers, or 28.57% of all participants, registered a positive Net Amount

3 of the 14 participating brokers, or 21.43% of all participants, registered a higher Buying Average than Selling Average

14 Participating Brokers’ Buying Average: ₱0.17368

14 Participating Brokers’ Selling Average: ₱0.17351

3 out of 14 participants, or 21.43% of all participants, registered a 100% BUYING activity

9 out of 14 participants, or 64.29% of all participants, registered a 100% SELLING activity

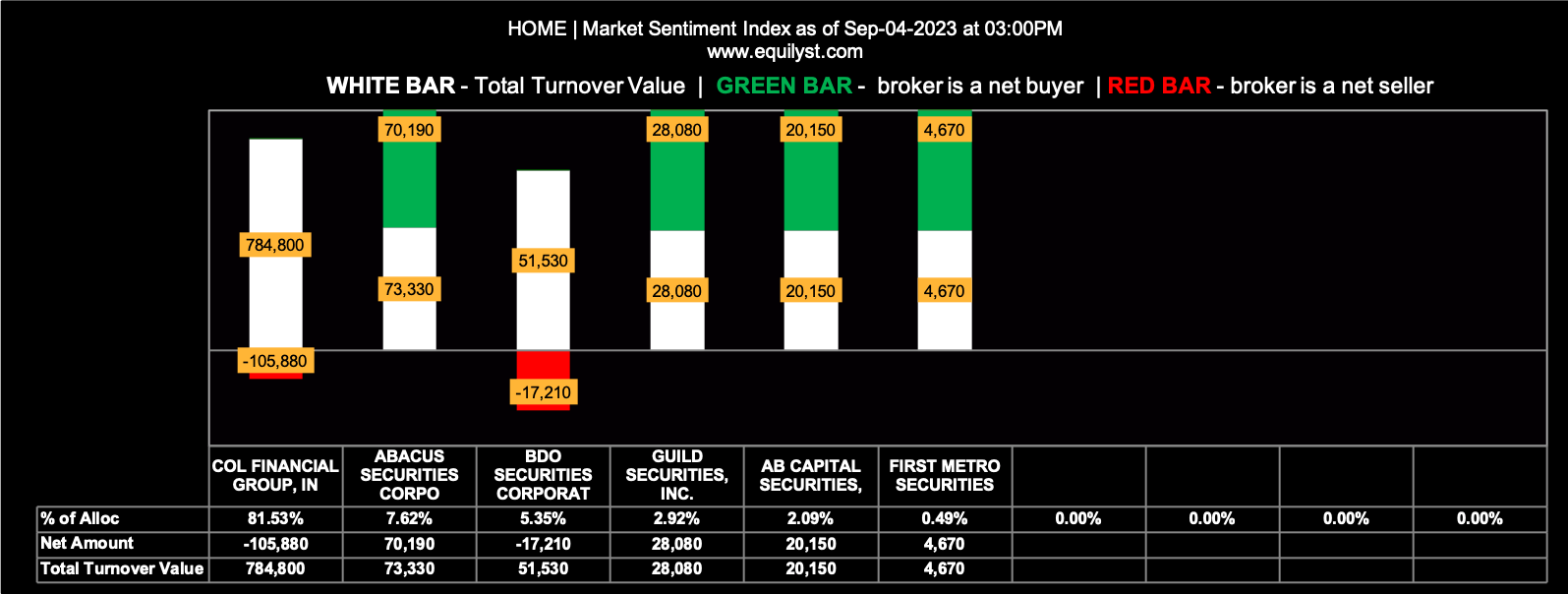

AllHome Corporation (HOME)

Net Foreign: P20,150.00

Market Sentiment Index: BULLISH

4 of the 6 participating brokers, or 66.67% of all participants, registered a positive Net Amount

4 of the 6 participating brokers, or 66.67% of all participants, registered a higher Buying Average than Selling Average

6 Participating Brokers’ Buying Average: ₱1.55850

6 Participating Brokers’ Selling Average: ₱1.56497

3 out of 6 participants, or 50.00% of all participants, registered a 100% BUYING activity

0 out of 6 participants, or 0.00% of all participants, registered a 100% SELLING activity

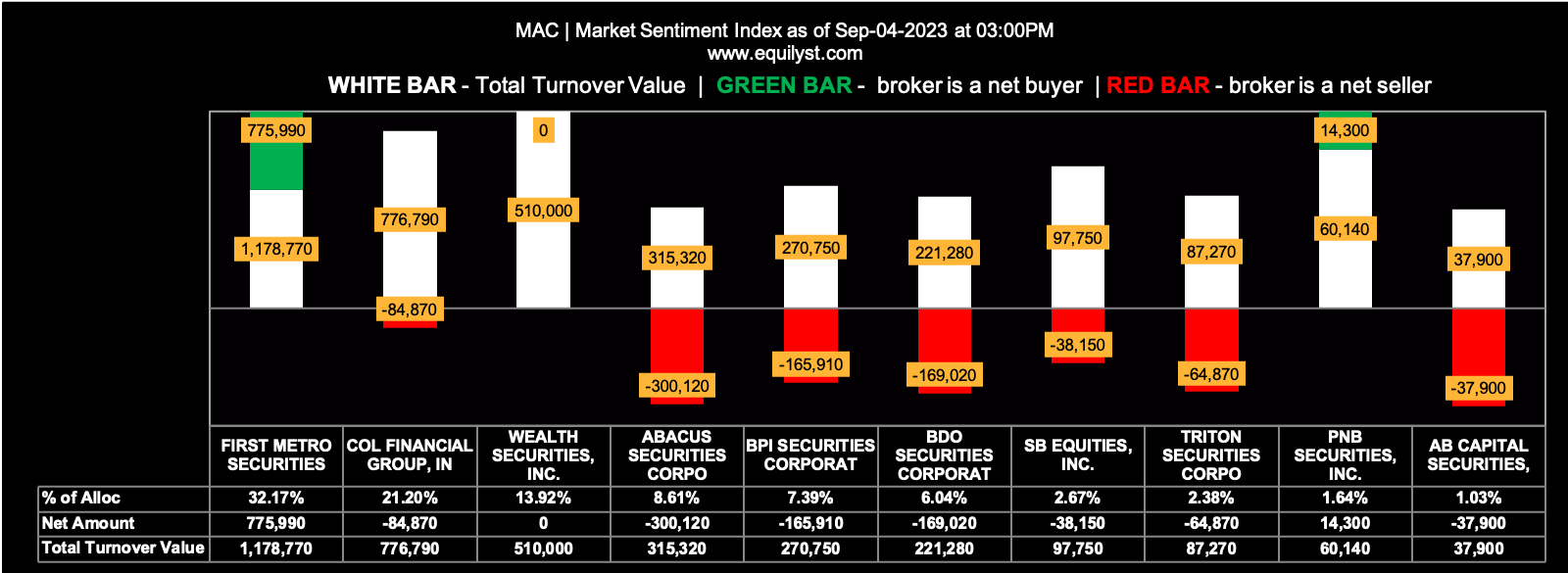

MacroAsia Corporation (MAC)

Net Foreign: P788,190.00

Market Sentiment Index: BEARISH

6 of the 15 participating brokers, or 40.00% of all participants, registered a positive Net Amount

4 of the 15 participating brokers, or 26.67% of all participants, registered a higher Buying Average than Selling Average

15 Participating Brokers’ Buying Average: ₱3.73899

15 Participating Brokers’ Selling Average: ₱3.76775

2 out of 15 participants, or 13.33% of all participants, registered a 100% BUYING activity

2 out of 15 participants, or 13.33% of all participants, registered a 100% SELLING activity

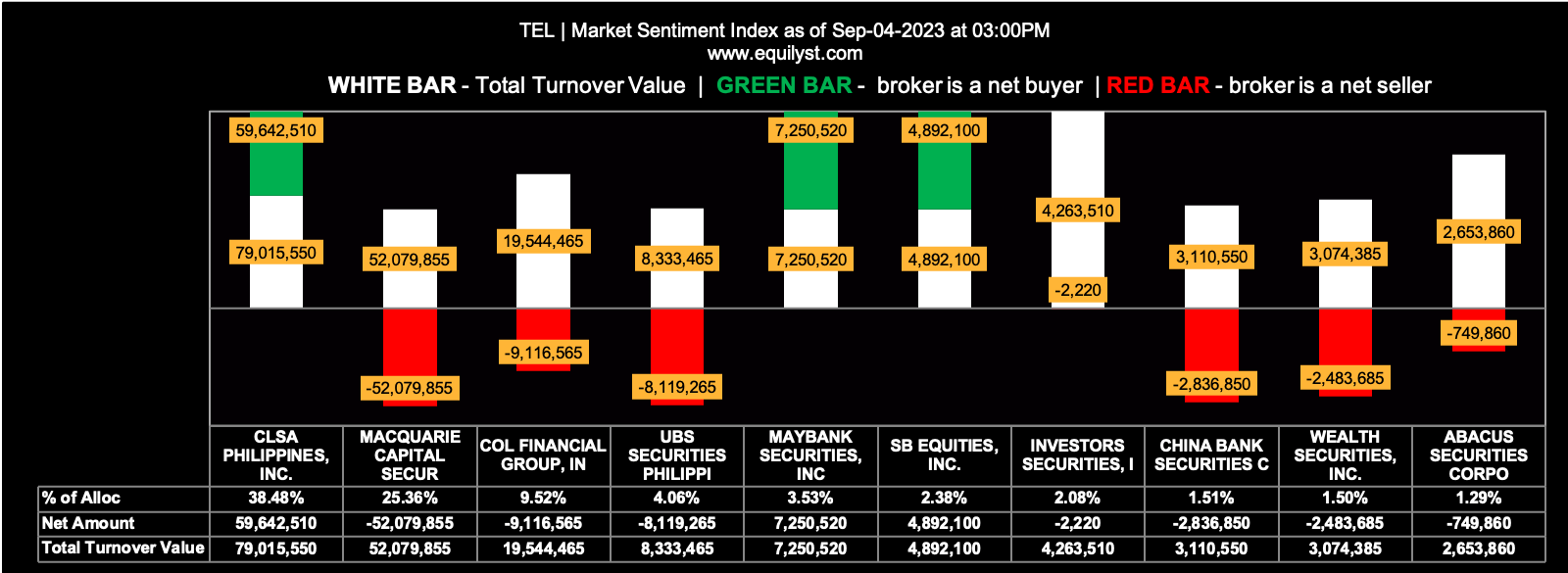

PLDT (TEL)

Net Foreign: P8,887,990.00

Market Sentiment Index: BULLISH

24 of the 37 participating brokers, or 64.86% of all participants, registered a positive Net Amount

22 of the 37 participating brokers, or 59.46% of all participants, registered a higher Buying Average than Selling Average

37 Participating Brokers’ Buying Average: ₱1186.14418

37 Participating Brokers’ Selling Average: ₱1187.47291

17 out of 37 participants, or 45.95% of all participants, registered a 100% BUYING activity

6 out of 37 participants, or 16.22% of all participants, registered a 100% SELLING activity

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025