Here are the top 10 Philippine stocks traded by First Metro Securities on September 25, 2023. I ranked the stocks according to their total turnover value from highest to lowest. I also included their respective end-of-day Market Sentiment Index rating as of closing on September 25, 2023.

Understanding Market Sentiment

Understand that the Market Sentiment Index indicator discussed in this report is my proprietary creation, and I am the sole authority on its methodology for determining bearish and bullish ratings, as well as the specific criteria it considers.

The market sentiment helps me estimate if the prevailing direction of the share price is likely to continue or reverse.

For example, if the stock is in a downtrend and the prevailing market sentiment is bearish, it means the downtrend is likely to continue.

If the stock is in a downtrend, but the market sentiment turns bullish, it’s a sign that investors might see a bullish reversal.

Again, and again, notice the adverbs I’m using – “likely” and “might”. We’re still talking about probabilities and not certainties.

Still, it’s better to be data-driven and be proven wrong by the market than make decisions based on gut feeling alone. The former gives you the opportunity to optimize something while the latter doesn’t.

It’s important to clarify that this article is for informational purposes only, and I am not providing stock recommendations. I employ a proprietary methodology to identify confirmed buy signals, which I can further discuss if you are interested in gaining independent investment insights through my stock investment consultancy service.

At Equilyst Analytics, you can:

- hire me as your private stock investment consultant

- hire me as your crypto and stock investment content writer

- subscribe to my members-only stock analyses

- subscribe to my members-only stock screener so you’ll know which stocks I’m monitoring daily

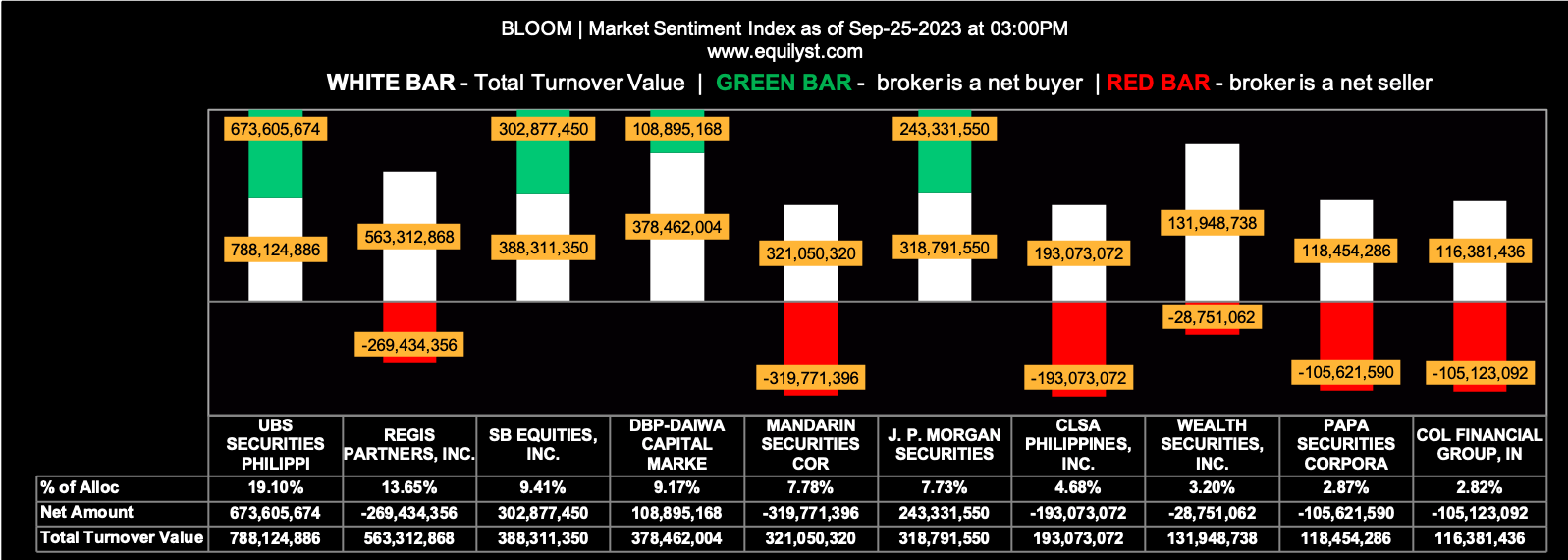

Bloomberry Resorts Corporation (BLOOM)

Market Sentiment Index: BEARISH

23 of the 69 participating brokers, or 33.33% of all participants, registered a positive Net Amount

17 of the 69 participating brokers, or 24.64% of all participants, registered a higher Buying Average than Selling Average

69 Participating Brokers’ Buying Average: ₱10.62821

69 Participating Brokers’ Selling Average: ₱10.79423

7 out of 69 participants, or 10.14% of all participants, registered a 100% BUYING activity

18 out of 69 participants, or 26.09% of all participants, registered a 100% SELLING activity

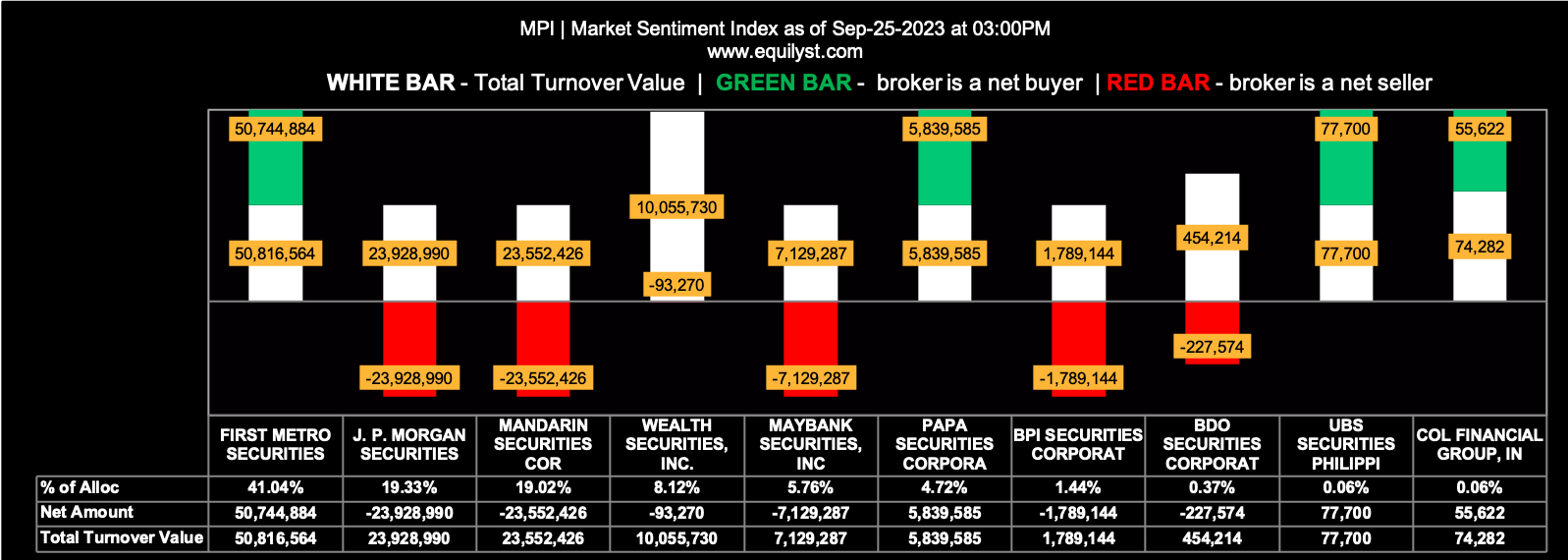

Metro Pacific Investments Corporation (MPI)

Market Sentiment Index: BEARISH

6 of the 14 participating brokers, or 42.86% of all participants, registered a positive Net Amount

6 of the 14 participating brokers, or 42.86% of all participants, registered a higher Buying Average than Selling Average

14 Participating Brokers’ Buying Average: ₱5.16278

14 Participating Brokers’ Selling Average: ₱5.16545

3 out of 14 participants, or 21.43% of all participants, registered a 100% BUYING activity

5 out of 14 participants, or 35.71% of all participants, registered a 100% SELLING activity

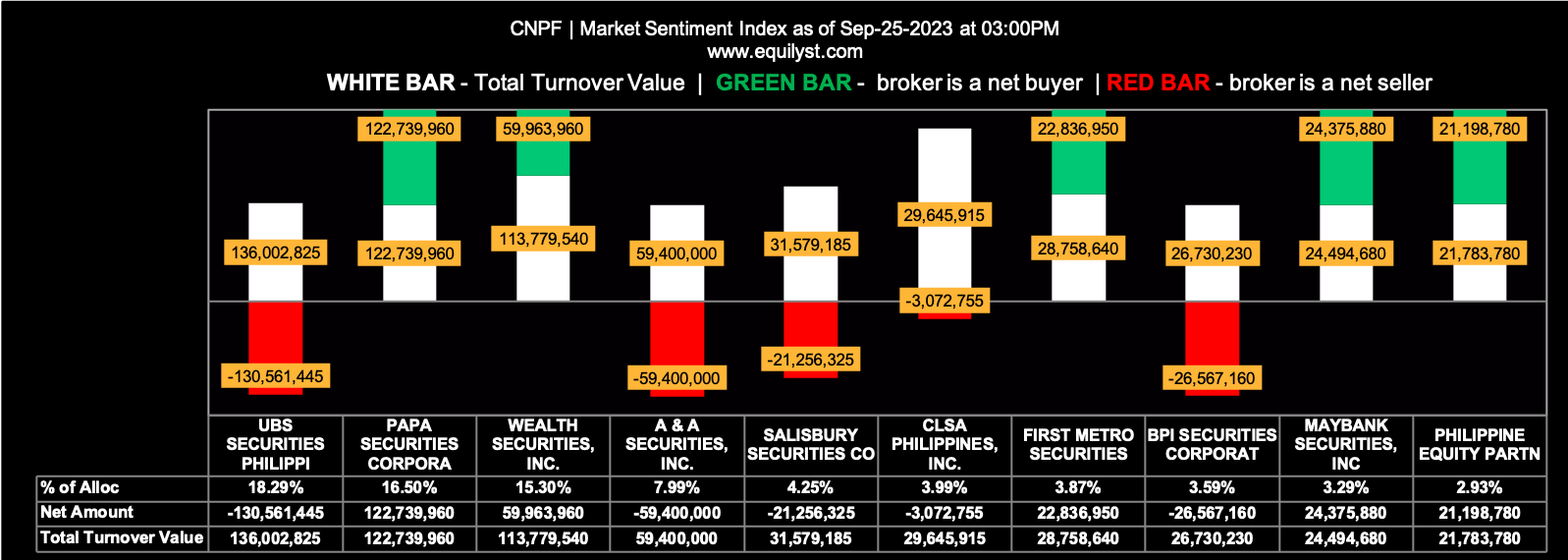

Century Pacific Food (CNPF)

Market Sentiment Index: BEARISH

17 of the 45 participating brokers, or 37.78% of all participants, registered a positive Net Amount

16 of the 45 participating brokers, or 35.56% of all participants, registered a higher Buying Average than Selling Average

45 Participating Brokers’ Buying Average: ₱29.36188

45 Participating Brokers’ Selling Average: ₱29.48555

7 out of 45 participants, or 15.56% of all participants, registered a 100% BUYING activity

9 out of 45 participants, or 20.00% of all participants, registered a 100% SELLING activity

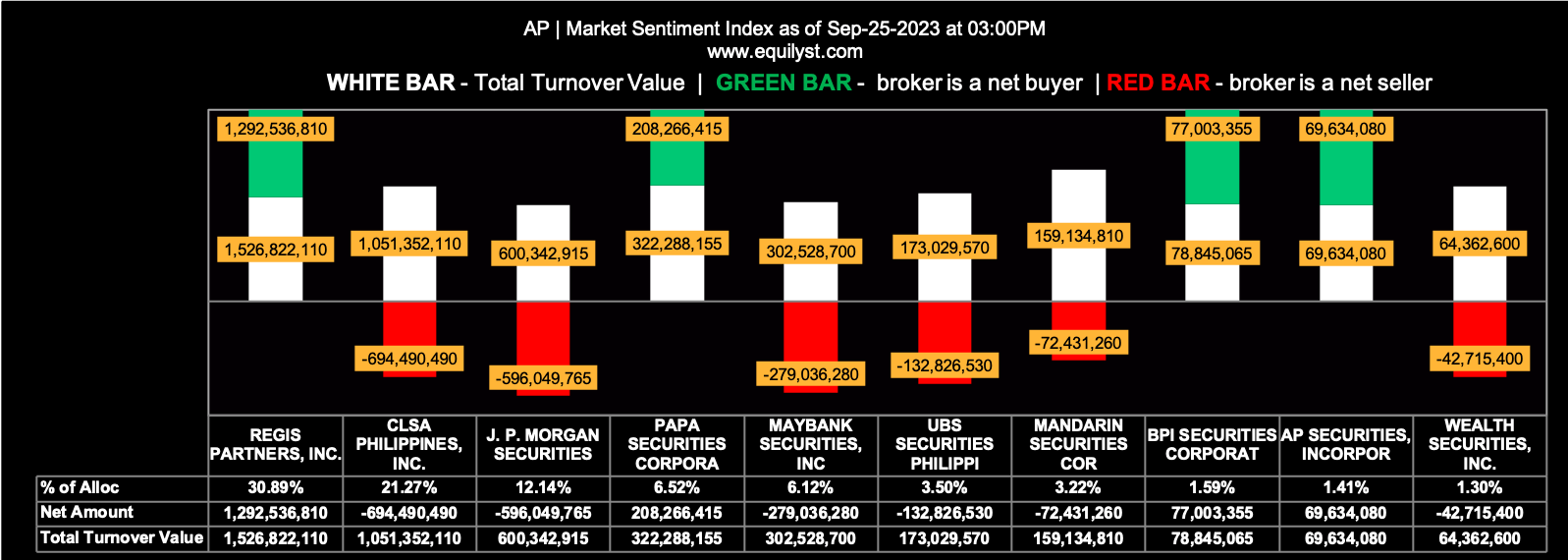

Aboitiz Power Corporation (AP)

Market Sentiment Index: BEARISH

27 of the 65 participating brokers, or 41.54% of all participants, registered a positive Net Amount

25 of the 65 participating brokers, or 38.46% of all participants, registered a higher Buying Average than Selling Average

65 Participating Brokers’ Buying Average: ₱31.53693

65 Participating Brokers’ Selling Average: ₱31.58045

12 out of 65 participants, or 18.46% of all participants, registered a 100% BUYING activity

15 out of 65 participants, or 23.08% of all participants, registered a 100% SELLING activity

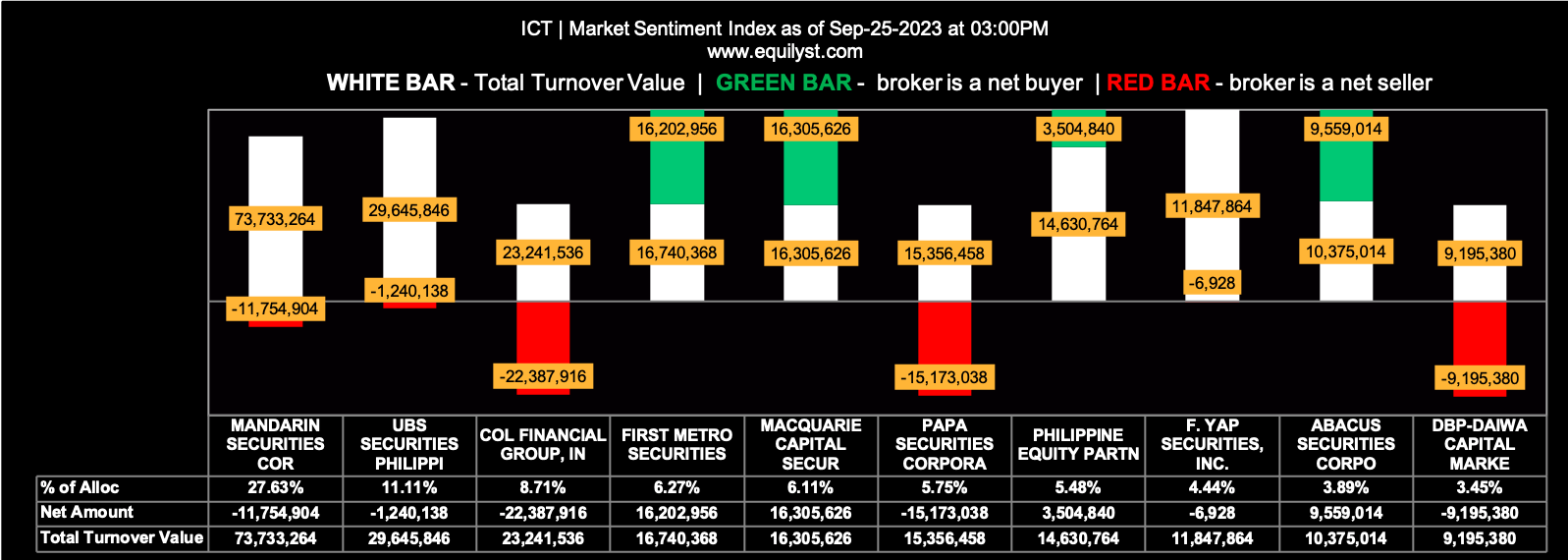

International Container Terminal Services (ICT)

Market Sentiment Index: BULLISH

30 of the 40 participating brokers, or 75.00% of all participants, registered a positive Net Amount

28 of the 40 participating brokers, or 70.00% of all participants, registered a higher Buying Average than Selling Average

40 Participating Brokers’ Buying Average: ₱203.54011

40 Participating Brokers’ Selling Average: ₱203.85448

20 out of 40 participants, or 50.00% of all participants, registered a 100% BUYING activity

2 out of 40 participants, or 5.00% of all participants, registered a 100% SELLING activity

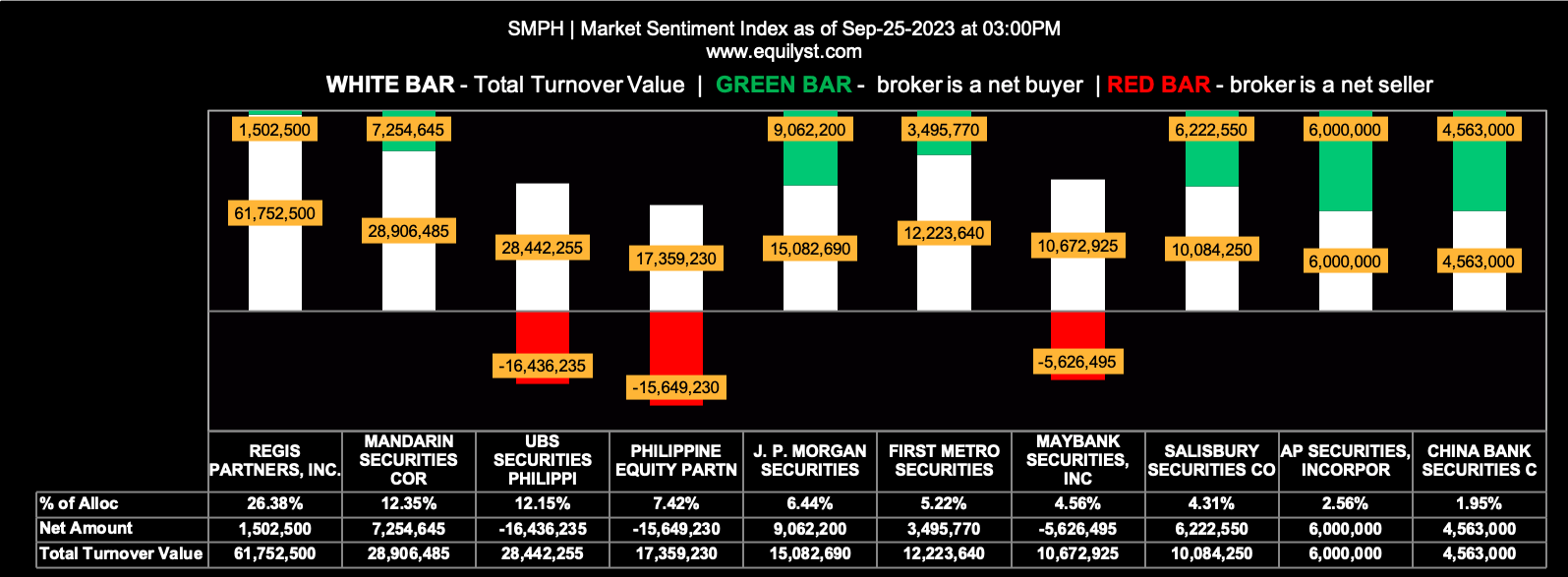

SM Prime Holdings (SMPH)

Market Sentiment Index: BEARISH

21 of the 37 participating brokers, or 56.76% of all participants, registered a positive Net Amount

11 of the 37 participating brokers, or 29.73% of all participants, registered a higher Buying Average than Selling Average

37 Participating Brokers’ Buying Average: ₱30.00376

37 Participating Brokers’ Selling Average: ₱30.05621

6 out of 37 participants, or 16.22% of all participants, registered a 100% BUYING activity

8 out of 37 participants, or 21.62% of all participants, registered a 100% SELLING activity

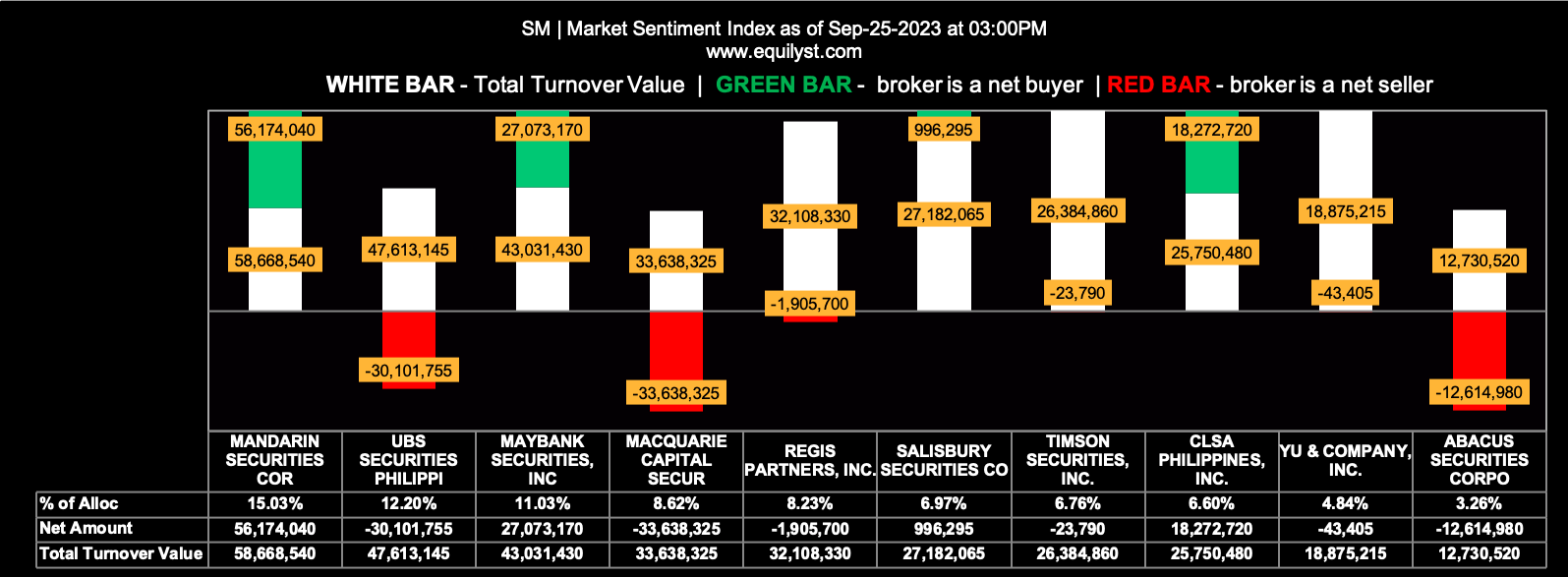

SM Investments Corporation (SM)

Market Sentiment Index: BEARISH

11 of the 44 participating brokers, or 25.00% of all participants, registered a positive Net Amount

12 of the 44 participating brokers, or 27.27% of all participants, registered a higher Buying Average than Selling Average

44 Participating Brokers’ Buying Average: ₱826.40939

44 Participating Brokers’ Selling Average: ₱825.39928

3 out of 44 participants, or 6.82% of all participants, registered a 100% BUYING activity

21 out of 44 participants, or 47.73% of all participants, registered a 100% SELLING activity

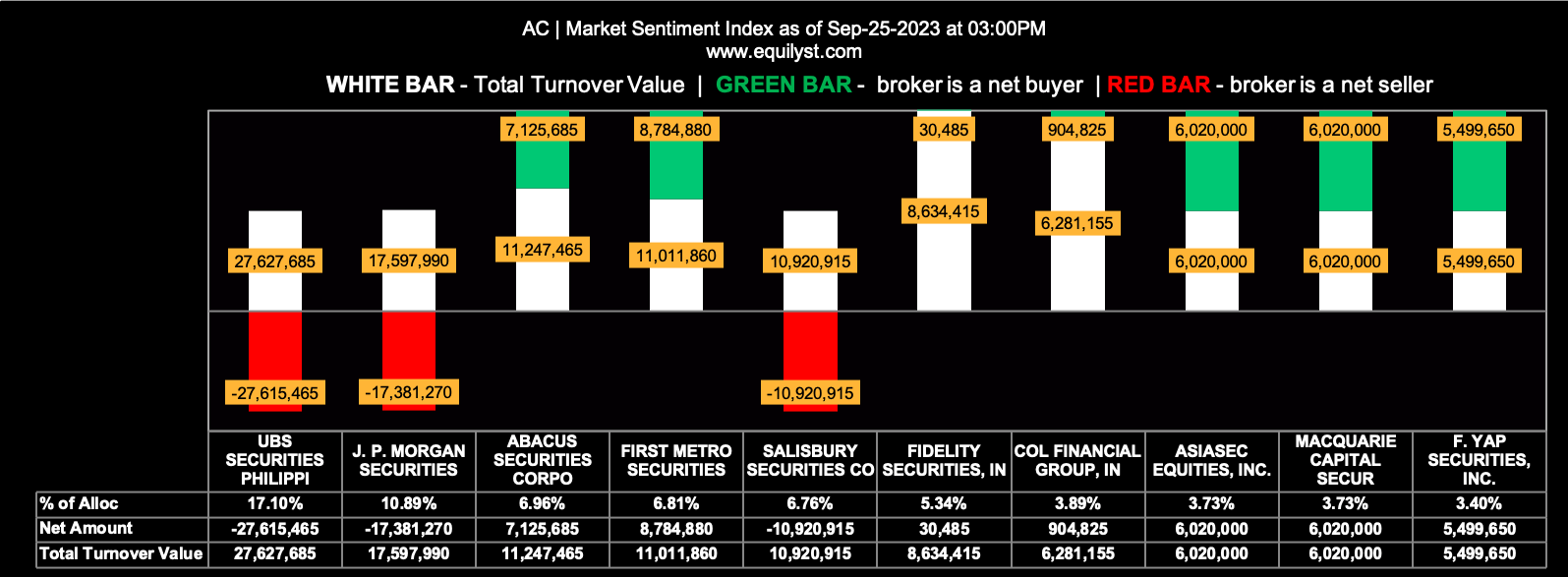

Ayala Corporation (AC)

Market Sentiment Index: BULLISH

33 of the 44 participating brokers, or 75.00% of all participants, registered a positive Net Amount

27 of the 44 participating brokers, or 61.36% of all participants, registered a higher Buying Average than Selling Average

44 Participating Brokers’ Buying Average: ₱606.12632

44 Participating Brokers’ Selling Average: ₱608.20025

23 out of 44 participants, or 52.27% of all participants, registered a 100% BUYING activity

3 out of 44 participants, or 6.82% of all participants, registered a 100% SELLING activity

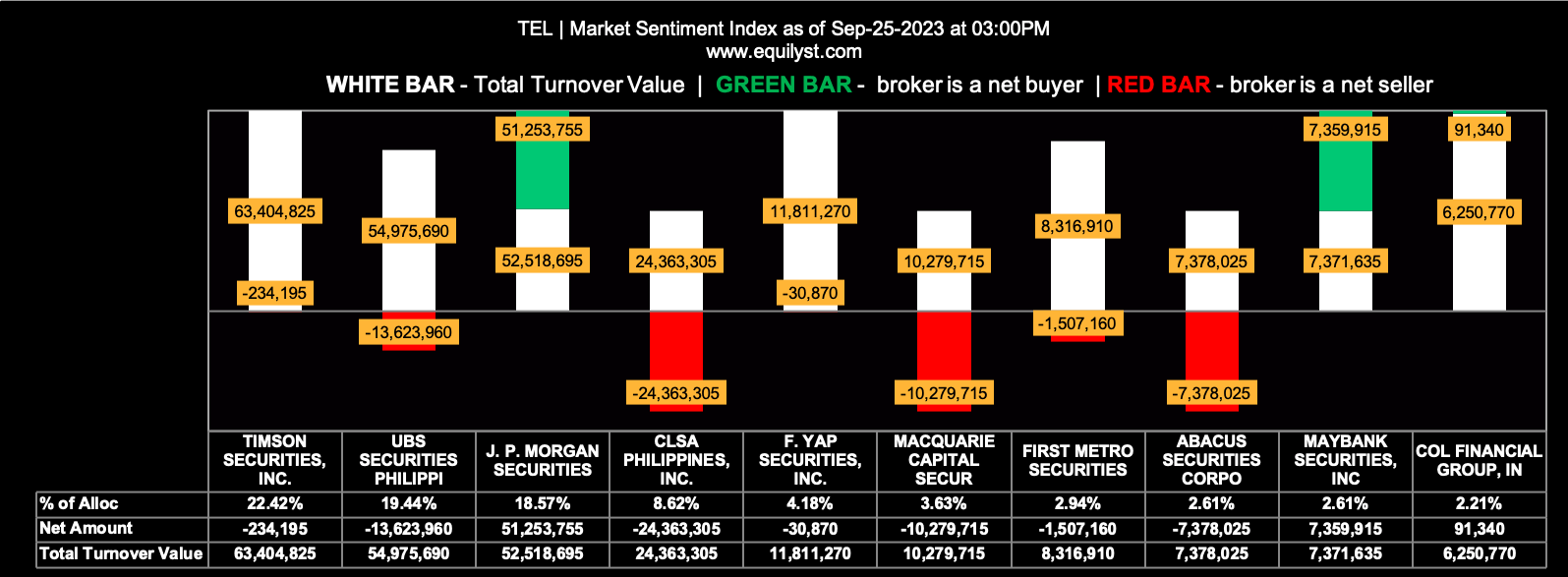

PLDT (TEL)

Market Sentiment Index: BEARISH

25 of the 48 participating brokers, or 52.08% of all participants, registered a positive Net Amount

21 of the 48 participating brokers, or 43.75% of all participants, registered a higher Buying Average than Selling Average

48 Participating Brokers’ Buying Average: ₱1155.41759

48 Participating Brokers’ Selling Average: ₱1161.36710

16 out of 48 participants, or 33.33% of all participants, registered a 100% BUYING activity

10 out of 48 participants, or 20.83% of all participants, registered a 100% SELLING activity

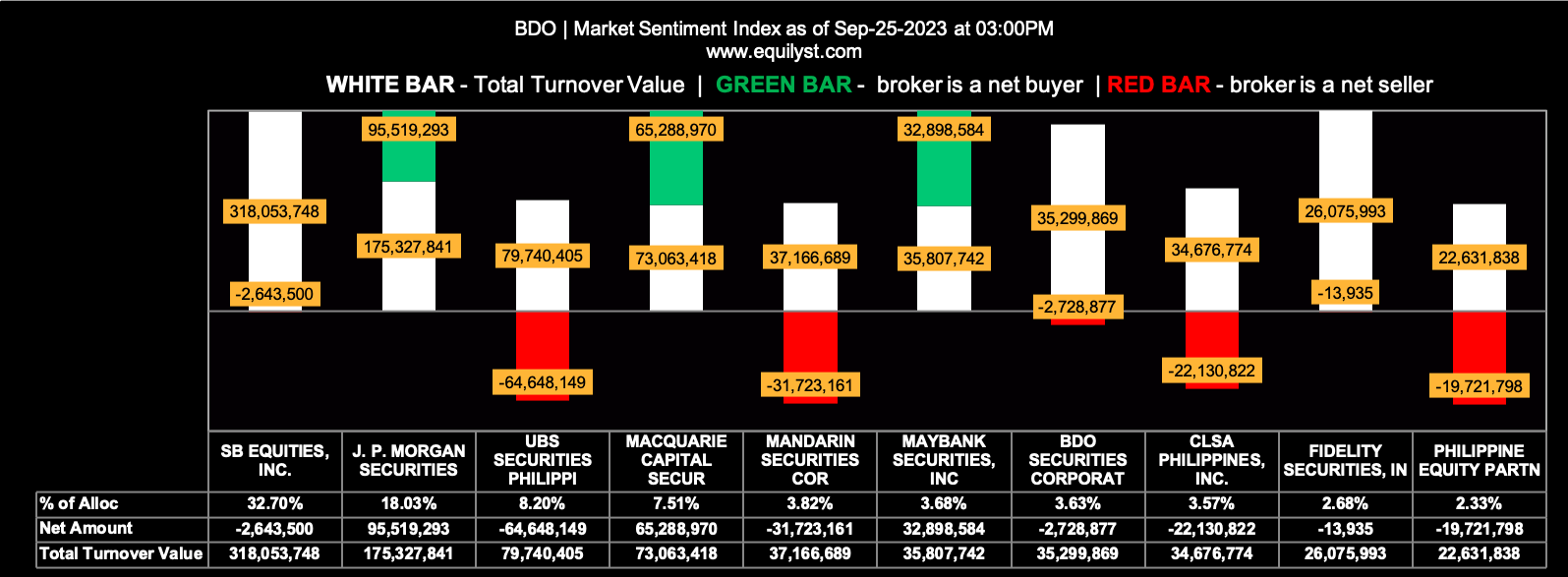

BDO Unibank (BDO)

Market Sentiment Index: BEARISH

16 of the 44 participating brokers, or 36.36% of all participants, registered a positive Net Amount

18 of the 44 participating brokers, or 40.91% of all participants, registered a higher Buying Average than Selling Average

44 Participating Brokers’ Buying Average: ₱132.22016

44 Participating Brokers’ Selling Average: ₱132.45016

7 out of 44 participants, or 15.91% of all participants, registered a 100% BUYING activity

10 out of 44 participants, or 22.73% of all participants, registered a 100% SELLING activity

At Equilyst Analytics, you can:

- hire me as your private stock investment consultant

- hire me as your crypto and stock investment content writer

- subscribe to my members-only stock analyses

- subscribe to my members-only stock screener so you’ll know which stocks I’m monitoring daily

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025