Semirara Mining and Power Corporation (SCC) Technical and Sentiment Analysis

Semirara Mining and Power Corporation (SCC) got one of the most viewed disclosures on PSE Edge due to its declaration of P1.70 and P1.80 per share (common stocks only) cash dividend. The Ex-Dividend Date is on April 5, 2023. I know you’d like to know if you are entitled to receive dividends if you buy or sell before, on, or after the Ex-Dividend Date. So, I wrote this informational article in the vernacular almost four years ago for this purpose.

Kailan Makakatanggap at Hindi Makakatanggap ng Dividends?

Before you conclude that the stock is worthy of being bought just because it’s a generous dividend-issuing company, you should check its Dividend Yield each year relative to its price per share.

If the stock is generous in issuing dividends, would you still buy it if its price has plummeted like there’s no bottom? A winner in dividends but a loser in capital appreciation? I’m not saying that’s the case for SCC. I said that as food for thought when you’re torn between buying shares of a stock because of its dividend history and historical price movement.

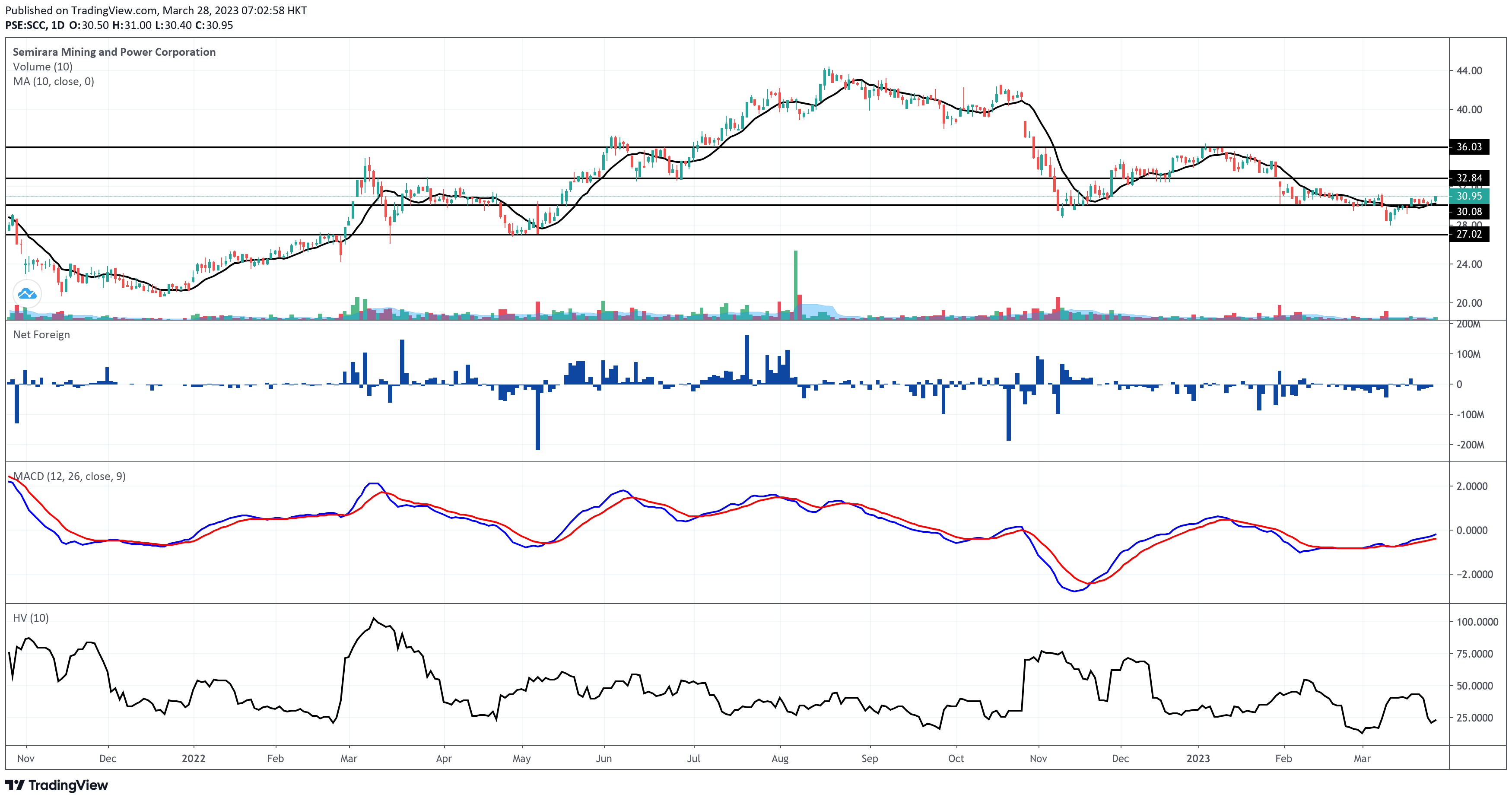

Semirara Mining and Power Corporation closed on March 27, 2023 at P30.95 per share, up by 2.31% with a volume higher than 100% of the stock’s 10-day volume average.

I spot the immediate support at P30.00, while the resistance is at P32.80. If the stock retreats below the immediate support, P27.00 will resurface as its support level.

SCC continues to rise above its 10-day simple moving average. This is the 9th trading day it has maintained its position above the short-term moving average.

On the other hand, this mining company remains unattractive to foreign investors as they remain net sellers year-to-date.

Despite the unfavorable sentiment coming from foreign investors, the moving average convergence divergence (MACD) of SCC issues a bullish signal.

The fluctuation of SCC is considered normal. This is seconded by the “low risk” rating of the 10-day historical stock volatility at 22.84%.

From here, the first four indicators of my proprietary Evergreen Strategy When Trading and Investing in the Philippine Stock Market are bullish. According to my proprietary algorithm, the last two indicators must be bullish for SCC to have a confirmed buy signal.

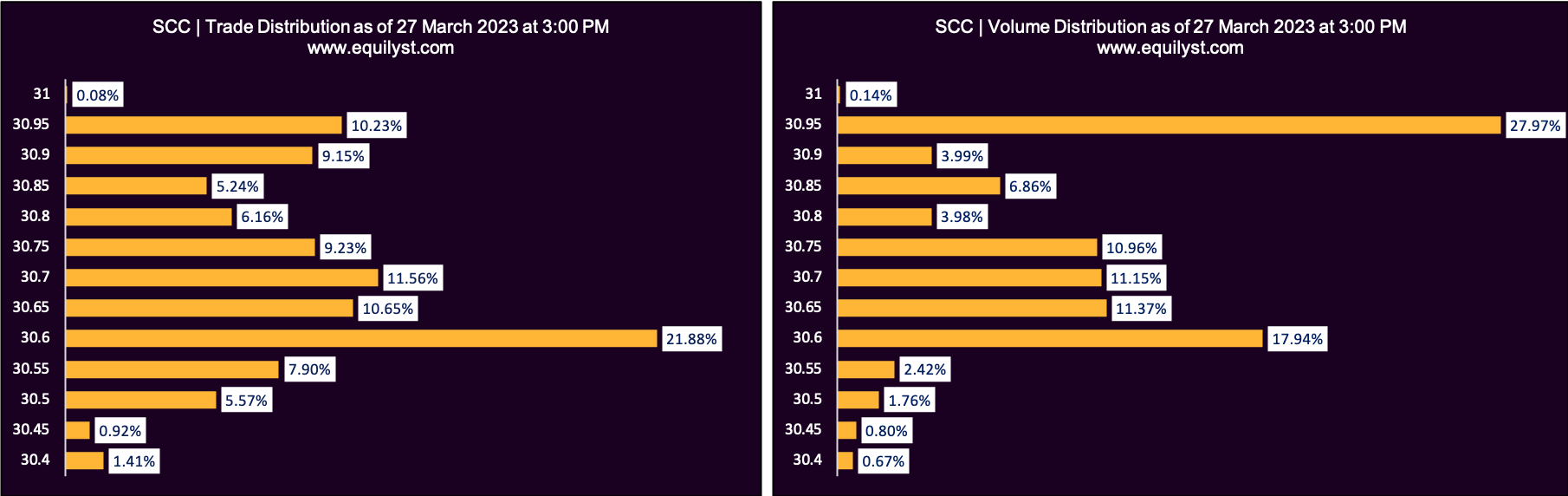

Dominant Range Index: BULLISH

Last Price: 30.95

VWAP: 30.76

Dominant Range: 30.6 – 30.95

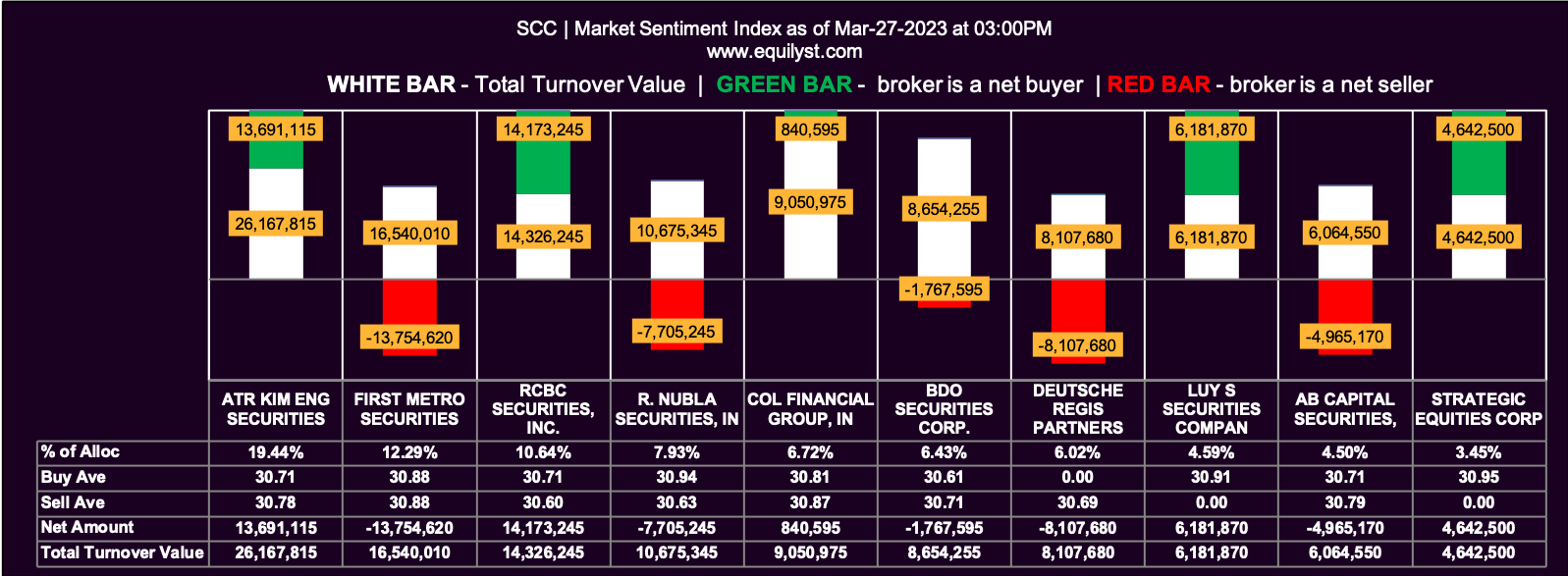

Market Sentiment Index: BULLISH

18 of the 46 participating brokers, or 39.13% of all participants, registered a positive Net Amount

18 of the 46 participating brokers, or 39.13% of all participants, registered a higher Buying Average than Selling Average

46 Participating Brokers’ Buying Average: ₱30.77595

46 Participating Brokers’ Selling Average: ₱30.75314

14 out of 46 participants, or 30.43% of all participants, registered a 100% BUYING activity

20 out of 46 participants, or 43.48% of all participants, registered a 100% SELLING activity

Verdict

Semirara Mining and Power Corporation has a confirmed buy signal according to my Evergreen Strategy. All six indicators are bullish.

If you are yet to enter a new position on SCC, there are two additional steps you MUST do.

1. Compute your initial trailing stop.

2. Compute your reward-to-risk ratio. Buy if, and only if, you are happy with the ratio you got. There’s no universal score that deems a specific reward-to-risk ratio acceptable. It’s all up to you. What’s the ratio that satisfies you. Don’t ask me. Don’t ask your neighbor. Don’t ask the people from Facebook Groups because they don’t know your financial DNA and circumstances. The only person you need to ask is the one you see in the mirror.

On the other hand, you have a data-driven reason to top up on your present position if you already have SCC in your portfolio. Buy within the prevailing dominant range. Remember to do an upward adjustment on your trailing stop if needed. How do you know if it’s time to adjust your trailing stop upward? Remember what I taught you during our 1-on-1 online workshop on my Evergreen Strategy.

If you are not yet my client and you’re lost about my methodology, you can hire me as your private stock analyst and consultant. Click here to read what I can help you with.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025