Oversold Philippine Stocks as of September 8, 2023

By the classical definition, a stock is considered oversold if its Relative Strength Index (RSI) score is below 30% or 20%. Conversely, a stock is regarded as overbought if its RSI score falls between 70% and 80%.

Please note that RSI is not a part of my proprietary methodology. However, for those of you who use RSI, I have decided to conduct an analysis of all stocks listed on the Philippine Stock Exchange to identify those with an RSI score of 30% or lower.

To assist you further, I have also chosen to indicate whether their dominant price range for September 8, 2023, is closer to the intraday low or the intraday high, as well as provide month-to-date market sentiment.

If you wish to understand the significance of knowing a stock’s dominant range and market sentiment, please click here and search for “dominant range” and “market sentiment.” Alternatively, if you would prefer me to explain it to you via a call and teach you my entire methodology, you can avail yourself of my stock investment consultancy service.

Please be informed that this article is for informational purposes only and does not constitute a recommendation to invest in these stocks. Your personal investment decision should be based on this data-driven analysis, taking into consideration your risk appetite and financial circumstances.

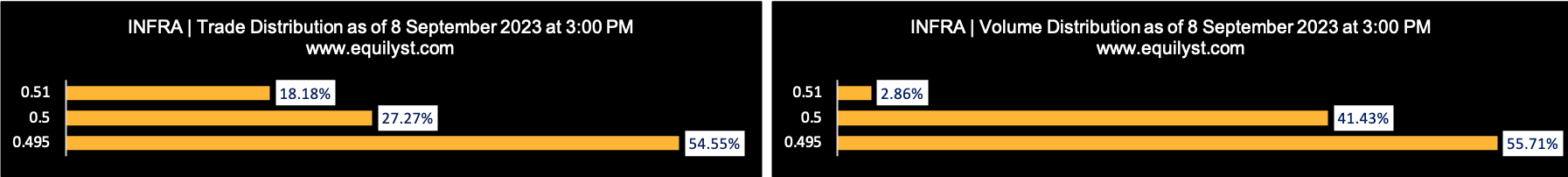

INFRA: 29% RSI

Dominant Range Index: BEARISH

Last Price: 0.495

VWAP: 0.50

Dominant Range: 0.495 – 0.495

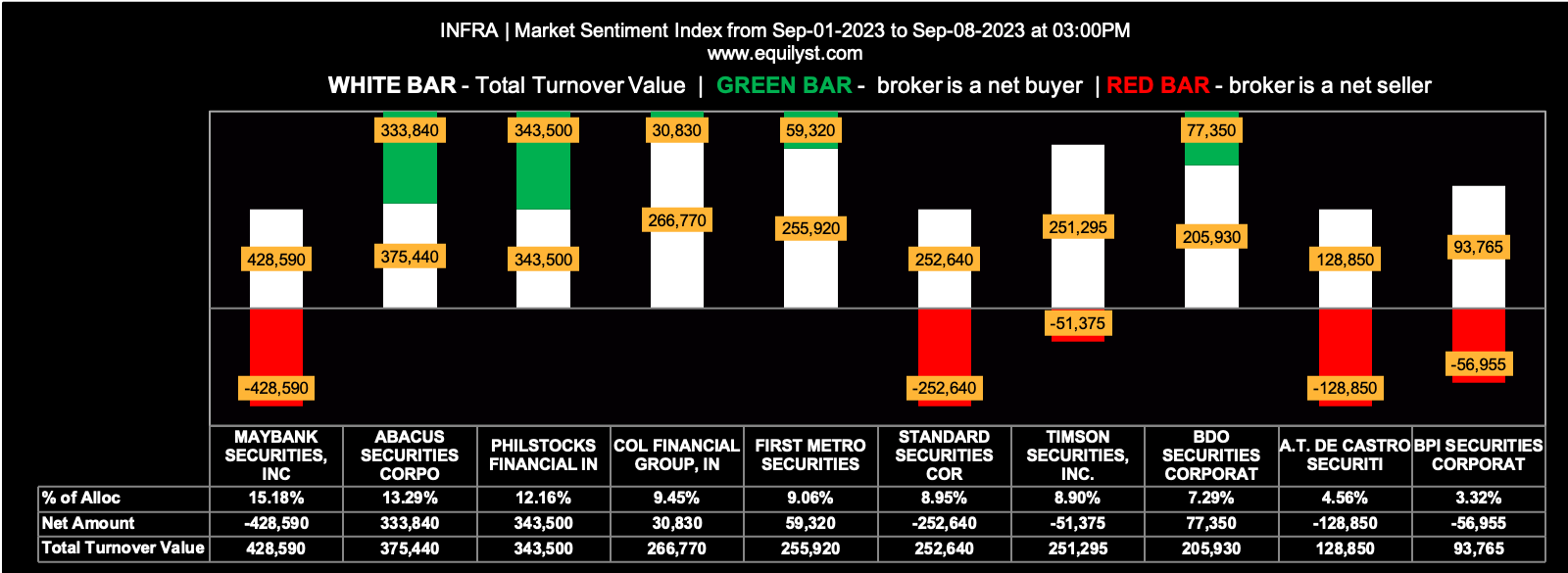

Market Sentiment Index: BEARISH

11 of the 20 participating brokers, or 55.00% of all participants, registered a positive Net Amount

9 of the 20 participating brokers, or 45.00% of all participants, registered a higher Buying Average than Selling Average

20 Participating Brokers’ Buying Average: ₱0.53296

20 Participating Brokers’ Selling Average: ₱0.52454

6 out of 20 participants, or 30.00% of all participants, registered a 100% BUYING activity

7 out of 20 participants, or 35.00% of all participants, registered a 100% SELLING activity

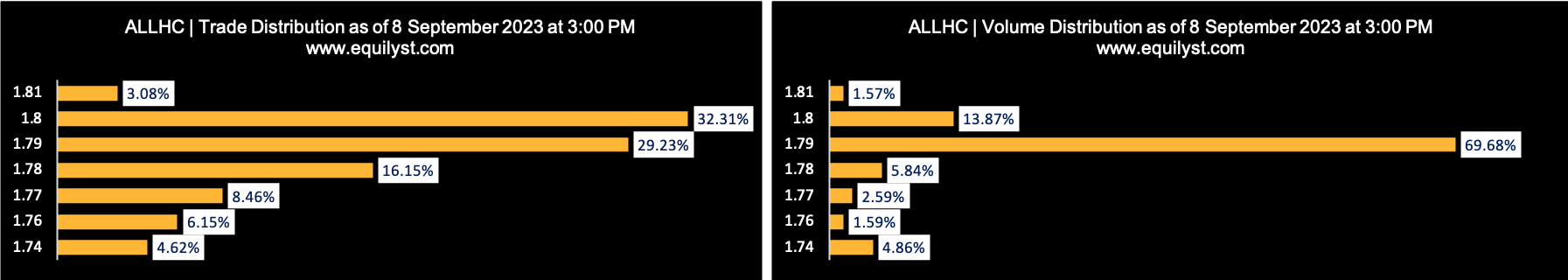

ALLHC: 29% RSI

Dominant Range Index: BULLISH

Last Price: 1.79

VWAP: 1.79

Dominant Range: 1.79 – 1.8

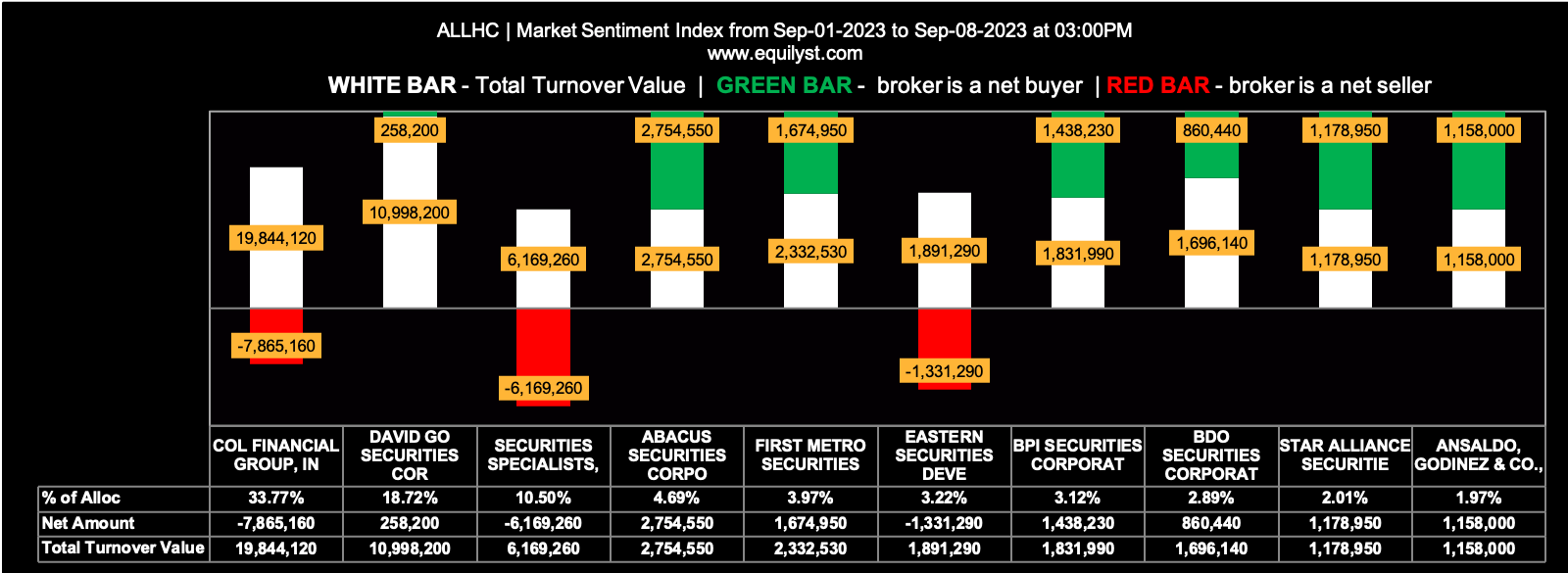

Market Sentiment Index: BULLISH

42 of the 47 participating brokers, or 89.36% of all participants, registered a positive Net Amount

40 of the 47 participating brokers, or 85.11% of all participants, registered a higher Buying Average than Selling Average

47 Participating Brokers’ Buying Average: ₱1.82350

47 Participating Brokers’ Selling Average: ₱1.82834

31 out of 47 participants, or 65.96% of all participants, registered a 100% BUYING activity

2 out of 47 participants, or 4.26% of all participants, registered a 100% SELLING activity

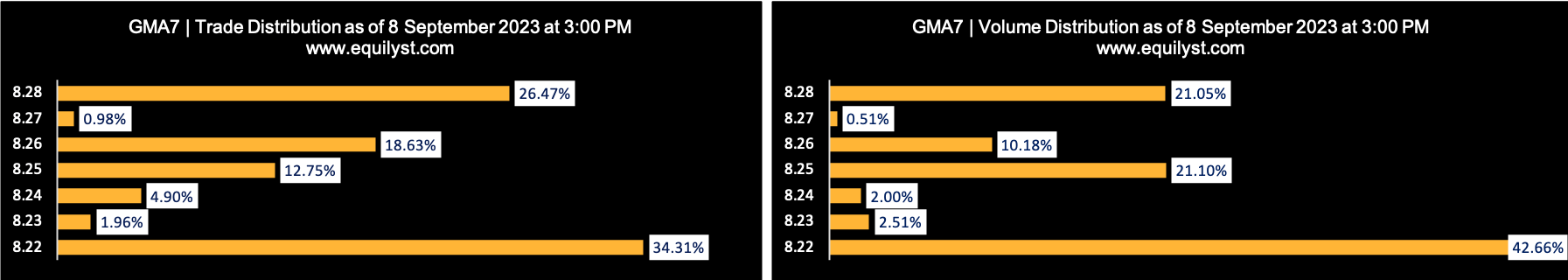

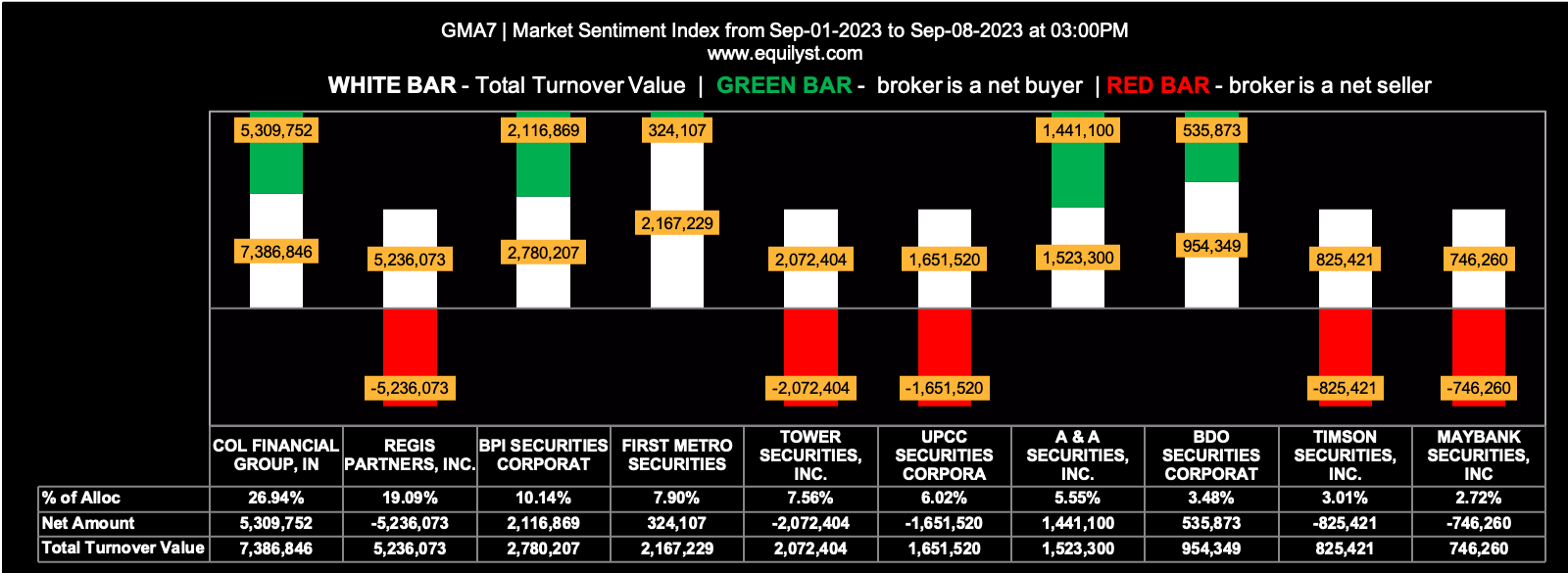

GMA7: 22% RSI

Dominant Range Index: BEARISH

Last Price: 8.22

VWAP: 8.24

Dominant Range: 8.22 – 8.22

Market Sentiment Index: BEARISH

17 of the 29 participating brokers, or 58.62% of all participants, registered a positive Net Amount

14 of the 29 participating brokers, or 48.28% of all participants, registered a higher Buying Average than Selling Average

29 Participating Brokers’ Buying Average: ₱8.23872

29 Participating Brokers’ Selling Average: ₱8.24157

9 out of 29 participants, or 31.03% of all participants, registered a 100% BUYING activity

10 out of 29 participants, or 34.48% of all participants, registered a 100% SELLING activity

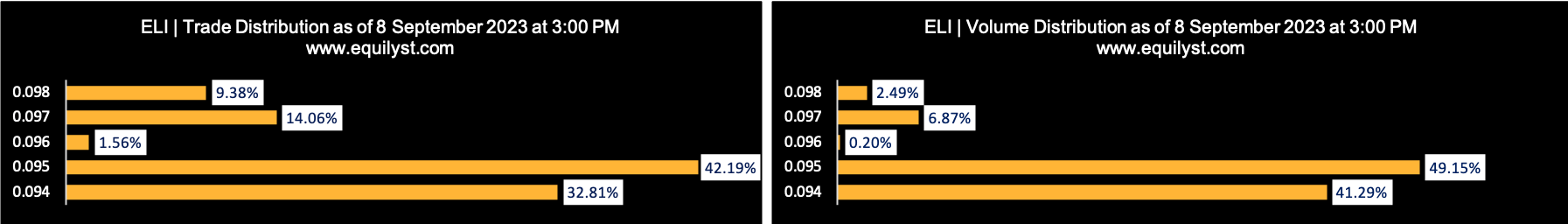

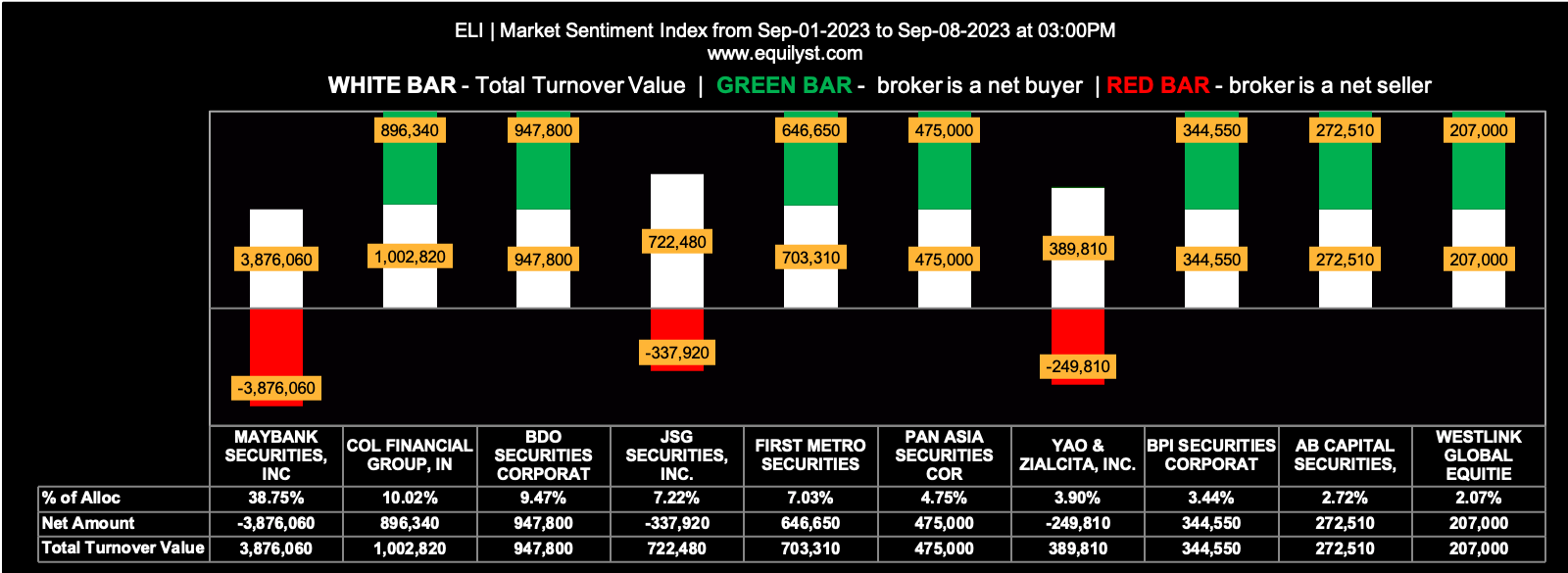

ELI: 14% RSI

Dominant Range Index: BEARISH

Last Price: 0.094

VWAP: 0.09

Dominant Range: 0.095 – 0.095

Market Sentiment Index: BULLISH

18 of the 25 participating brokers, or 72.00% of all participants, registered a positive Net Amount

18 of the 25 participating brokers, or 72.00% of all participants, registered a higher Buying Average than Selling Average

25 Participating Brokers’ Buying Average: ₱0.09953

25 Participating Brokers’ Selling Average: ₱0.09976

15 out of 25 participants, or 60.00% of all participants, registered a 100% BUYING activity

4 out of 25 participants, or 16.00% of all participants, registered a 100% SELLING activity

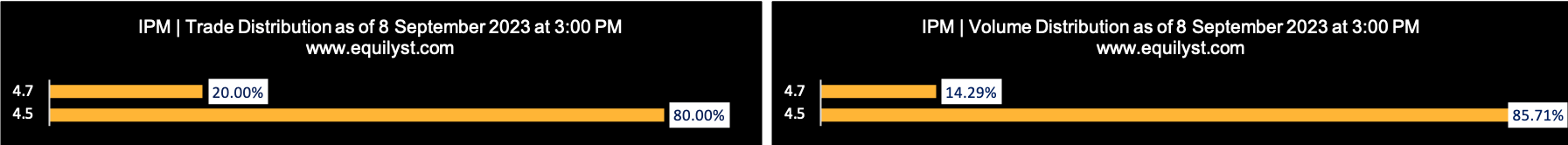

IPM: 9% RSI

Dominant Range Index: BEARISH

Last Price: 4.5

VWAP: 4.53

Dominant Range: 4.5 – 4.5

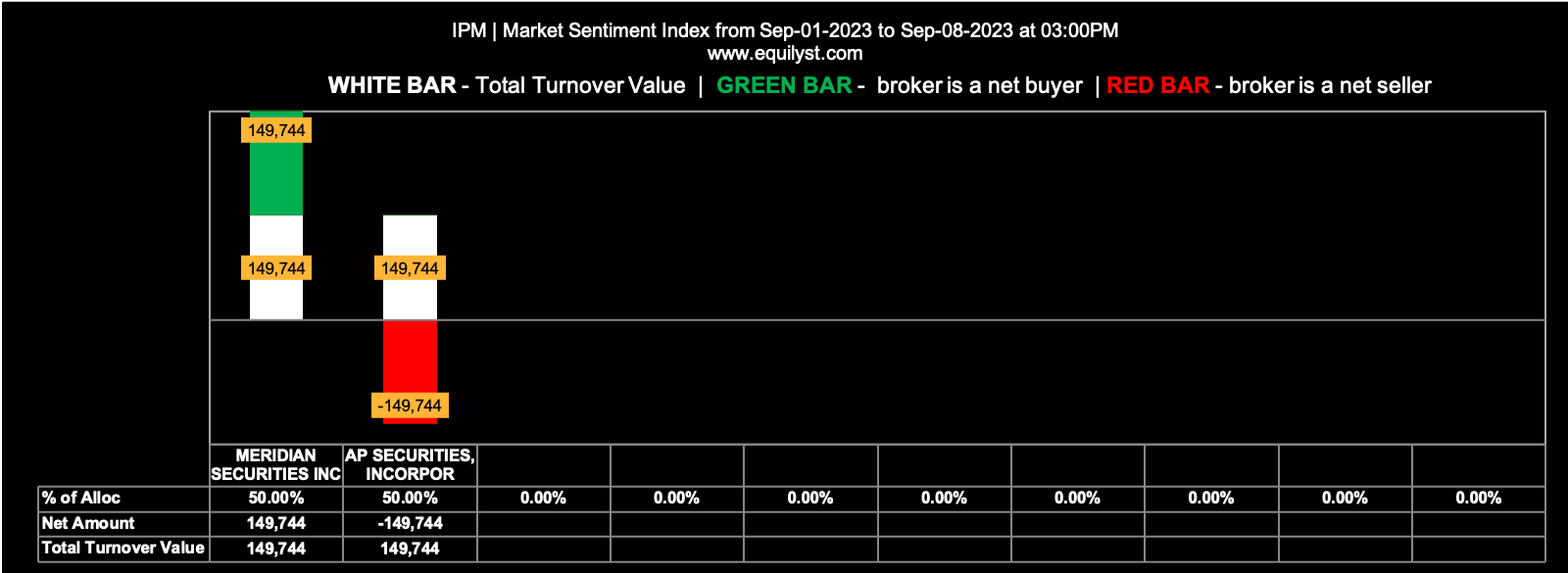

Market Sentiment Index: BEARISH

1 of the 2 participating brokers, or 50.00% of all participants, registered a positive Net Amount

1 of the 2 participating brokers, or 50.00% of all participants, registered a higher Buying Average than Selling Average

2 Participating Brokers’ Buying Average: ₱5.25420

2 Participating Brokers’ Selling Average: ₱5.25420

1 out of 2 participants, or 50.00% of all participants, registered a 100% BUYING activity

1 out of 2 participants, or 50.00% of all participants, registered a 100% SELLING activity

Which of These 5 Stocks Are In Your Portfolio?

What’s your decision now that you’ve known this information? Let me know in the comments.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025