RL Commercial REIT Revenues Jump 10% to P2.74B: Cybergate Bacolod Spurs Growth

The total revenues of RL Commercial REIT (RCR) for the six months concluding on June 30, 2023, amounted to approximately P2,739.89 million. This signifies a growth of 10%, equivalent to P245.90 million, when juxtaposed with the corresponding span in the prior year. The surge in earnings is primarily accredited to the successful acquisition of Cybergate Bacolod in March 2022 and the property-for-share swap involving Cyberscape Gamma, which received approval from the Securities and Exchange Commission (SEC) in August 2022.

RL Commercial REIT’s (RCR) rental income, encompassing the aggregate earnings from rentals, achieved a sum of P2,372.50 million during the six months terminating on June 30, 2023. This indicates an increase of 10%, or P224.86 million, when weighed against the identical duration in 2022. This ascent can largely be ascribed to the amalgamation of recently incorporated assets, namely Cybergate Bacolod and Cyberscape Gamma.

The income acquired from dues, which represents reimbursements from occupants for shared facilities and air-conditioning amenities, gross of affiliated expenses, reached P444.50 million for the half-year spanning June 30, 2023. This is in comparison to the P405.67 million attained in the parallel phase of 2022. The upswing in this income category is also a result of the aforementioned inclusion of Cybergate Bacolod and Cyberscape Gamma.

The net value of dues income predominantly encompasses fees collected for utilization of the Common Use Service Area and air-conditioning services in the Condominium Units. RL Commercial REIT’s (RCR) role in this scenario is recognized as that of an intermediary for these services. In the time frame terminating on June 30, 2023, the net income from dues summed up to P32.58 million. This figure reflects a marginal reduction of 3%, or P0.90 million, in relation to the same period the prior year.

The assessment of the Company’s investment property fair value is carried out through the Income Approach, a method determined by an external evaluator. This valuation is adjusted by applying the straight-line approach to recognize rental revenue and lease commissions for the duration. During the six months closing on June 30, 2023, no significant gain or loss arose from the change in the fair value of investment properties. Conversely, adjustments for straight-line rental income and lease commissions constituted P129.94 million and P1.96 million, respectively.

Other sources of income of RL Commercial REIT (RCR) added up to P22.20 million for the six months culminating on June 30, 2023. This is in comparison to P8.61 million in the identical phase of 2022. Such additional revenue encompasses fines for delayed payments, forfeitures, and miscellaneous items.

Operational Costs Surge by 13% in 6 Months

The direct operating costs of RL Commercial REIT (RCR) encompass the direct operational expenditures of the company, inclusive of management fees, maintenance, contracted services, utilities, amortization of right-of-use assets, and the accrual of interest expenses. Over the six months extending to June 30, 2023, these costs accumulated to P369.35 million. This reflects a surge of 13%, equivalent to P41.64 million, in contrast to the equivalent period of the prior year. This increase can be primarily attributed to the operations of the two newly integrated assets in 2022, Cybergate Bacolod and Cyberscape Gamma.

On the other hand, general and administrative (G&A) expenses reached a total of P199.96 million during the half-year reaching June 30, 2023. This translates to an augmentation of P27.40 million or 16% compared to the corresponding span in 2022. The surge in these expenses can also be ascribed to the incorporation of the two new assets in 2022. These G&A expenses encapsulate diverse costs including land and building lease payments, taxes, licenses, insurance, advertising, promotions, and various general administrative outlays.

Furthermore, interest expenses of RL Commercial REIT (RCR) tied to lease liabilities amounted to P4.94 million for the six months concluding on June 30, 2023. This is in contrast to P4.80 million for the parallel period in the prior year. This expense pertains to the long-term land lease for Cyber Sigma.

Income Before Income Tax

Operating earnings for the six months ending on June 30, 2023, culminated at a total of P2,165.65 million, marking a 9% increase from the P1,988.92 million recorded in the equivalent period of 2022. This upswing can be chiefly attributed to the aforementioned integration of Cybergate Bacolod and Cyberscape Gamma.

Interest Income

RL Commercial REIT’s (RCR) interest income during the six months ending on June 30, 2023, reached a tally of P18.57 million, demonstrating a substantial upsurge of P17.45 million, or 1555%, compared to the preceding year. This increase can be attributed to the amplified placements in the money market conducted within the ongoing year.

Provision for Income Tax

The provision for income tax pertains to the final tax imposed on interest income. For the six months concluding on June 30, 2023, this provision amounted to P3.71 million, marking a substantial augmentation of 1555% or P3.49 million when juxtaposed with the parallel phase in 2022. This rise is a consequence of the elevated interest income accrued in the ongoing year. Additionally, the company benefited from income tax exemption by distributing an amount exceeding 90% of its distributable income to shareholders.

Net Income/Total Comprehensive Income

In consequence of the aforementioned dynamics, the net income for RL Commercial REIT (RCR) over the six months culminating on June 30, 2023, totaled P2,180.50 million. This reflects an increase of 10%, equivalent to P190.69 million, compared to the corresponding span in the preceding year.

The financial standing of the company as of June 30, 2023, remains robust and healthy, with the total assets expanding from P58,715.49 million as of December 31, 2022, to P59,132.17 million.

Cash

The company’s cash balance as of June 30, 2023, amounted to P1,774.33 million, a notable increase from the P1,014.71 million as of December 31, 2022. This escalation of P759.62 million, or 75%, primarily resulted from the operational cash flow of P2,865.35 million, partially offset by the disbursement of cash dividends for 4Q 2022 and 1Q 2023, which totaled P2,094.94 million, along with maintenance capital expenditures of P10.79 million.

Receivables

The receivables of RL Commercial REIT (RCR) as of June 30, 2023, concluded at P372.14 million, showcasing a decline from the P726.56 million as of December 31, 2022. This reduction was attributed to enhancements in collection efficiency during this period.

Other Current Assets

Other current assets totaled P154.13 million as of June 30, 2023, compared to P139.90 million as of December 31, 2022. The increment of P14.23 million, equivalent to 10%, primarily stemmed from the accumulation of creditable income tax, which remains untapped as a result of the company’s tax exemption due to the distribution of dividends amounting to over 90% of distributable income.

Investment Properties

RL Commercial REIT’s (RCR) investment properties amounted to P56,698.05 million as of June 30, 2023, in contrast to P56,701.82 million as of December 31, 2022. This decrease was mainly influenced by the amortization of the right-of-use asset associated with the land lease of Cyber Sigma. Nonetheless, this decline was offset by the additions to maintenance capital expenditures.

Other Noncurrent Assets

Other noncurrent assets totaled P133.52 million as of June 30, 2023, compared to P132.50 million as of December 31, 2022.

Liabilities

RCR maintains a debt-free status and retains the ability to employ leverage up to 35% of Deposited Property Value. Total liabilities reached P2,588.69 million and P2,257.56 million as of June 30, 2023, and December 31, 2022, respectively.

Accounts and Other Payables

Accounts and other payables amounted to P996.36 million as of June 30, 2023, up from P782.64 million as of December 31, 2022. This increase is attributed to heightened expenditures on utilities and other operational costs.

Deposits and Other Liabilities (Current and Noncurrent)

The company’s deposits and other liabilities totaled P1,330.03 million as of June 30, 2023, compared to P1,217.56 million as of December 31, 2022. The augmentation is attributed to additional deposits received from new contracts.

Lease Liability

RL Commercial REIT’s (RCR) lease liability amounted to P262.30 million as of June 30, 2023, and P257.37 million as of December 31, 2022. This increase is a result of the accrual of interest expenses on the lease liability.

Capital Stock

The capital stock concluded at P10,726.80 million as of both June 30, 2023, and December 31, 2022.

Additional Paid-In Capital

The company’s additional paid-in capital (APIC) amounted to P54,125.18 million as of both June 30, 2023, and December 31, 2022.

Retained Earnings (Deficit)

Before considering changes in the fair market values of investment properties, retained earnings reached P1,793.65 million and P1,576.19 million as of June 30, 2023, and December 31, 2022, respectively. However, accounting for these changes, retained earnings stood at negative P8,308.50 million and negative P8,394.06 million as of June 30, 2023, and December 31, 2022, respectively. This increase is mainly due to net income derived from operations during the six months ending on June 30, 2023, offset by dividends distributed for 4Q 2022 and 1Q 2023.

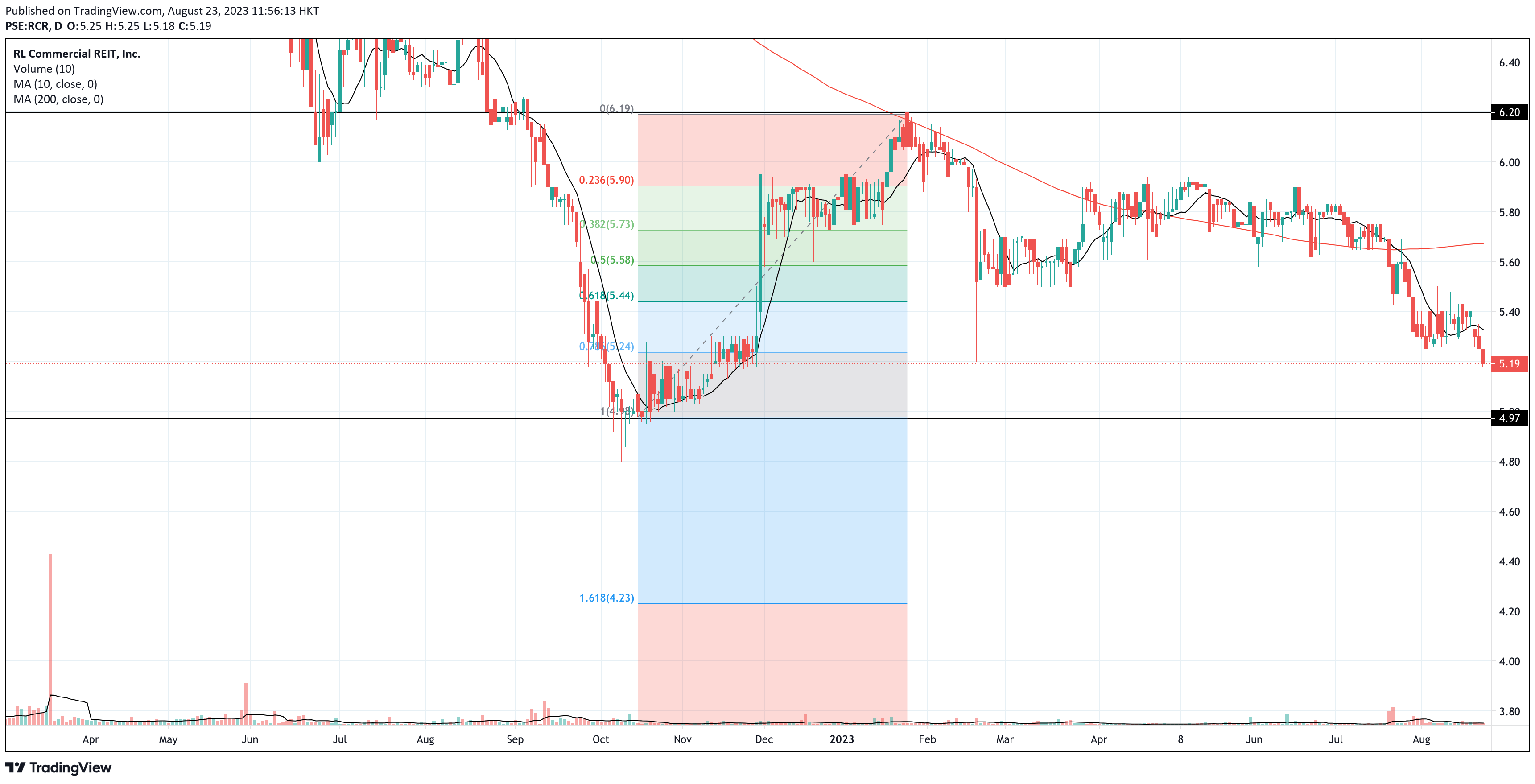

Technical Analysis: RL Commercial REIT Price Dropped 10.26% YTD

The stock price of RL Commercial REIT (RCR) decreased by 0.85% in the first half of 2023, moving from its price of P5.85 on December 29, 2022, to P5.80 on June 30, 2023. Its month-to-date change stands at a negative 0.94%, attributed to a drop from P5.30 on July 31, 2023, to P5.25 on August 22, 2023. Furthermore, RCR has extended its losses to 10.26% year-to-date, falling from P5.85 on December 31, 2022, to P5.25 on August 22, 2023.

As of the morning of August 23, 2023, RL Commercial REIT (RCR) has breached its previous support level at P5.24, which now acts as an immediate resistance point. The support has deepened to P5.00.

Both the shorter-term (10-day) and longer-term (200-day) simple moving averages indicate a bearish trend for RL Commercial REIT (RCR). This combination increases the likelihood of the price descending further toward the P5.00 support, unless selling exhaustion is reached around the midpoint.

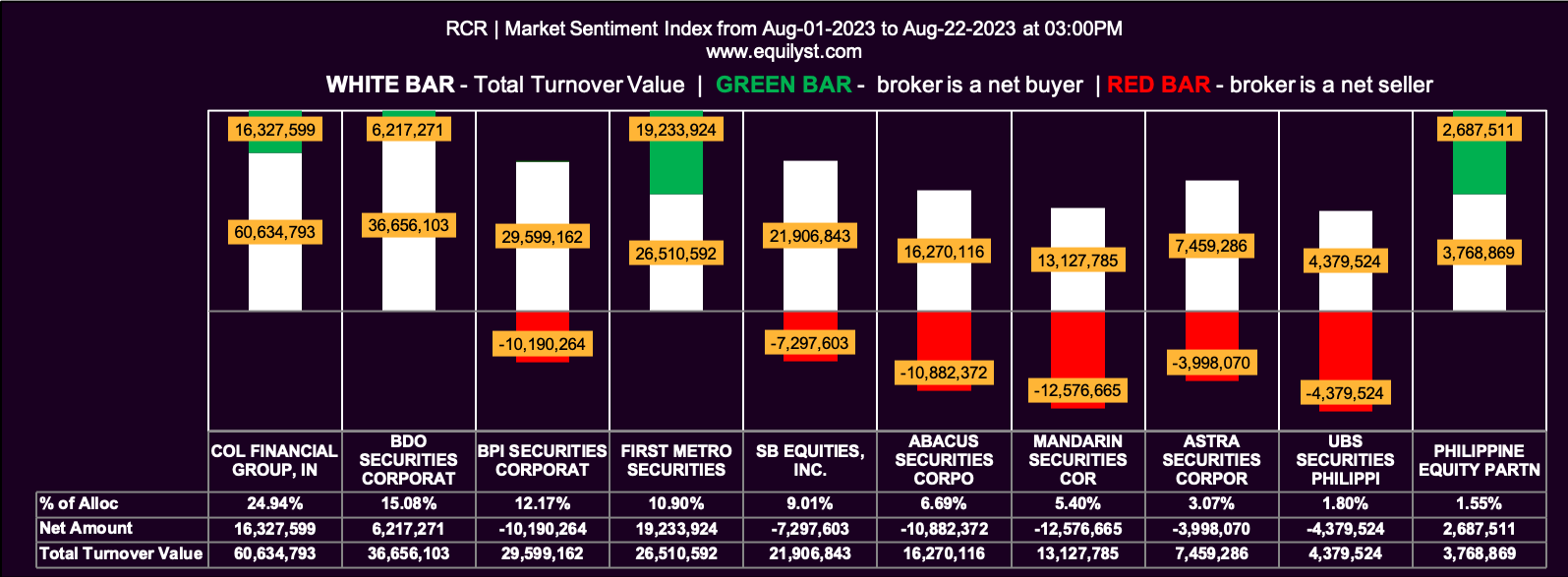

Despite these bearish signals, there’s an opposing perspective from the bulls. Between August 1 and August 22, 47 brokers engaged in trading this REIT stock. Among these, 29 brokers, or 61.70%, registered a positive net amount. Moreover, 55.32% recorded a higher buying average compared to the selling average.

Furthermore, 38.30% displayed a 100% buying activity, while only 17.02% conducted a 100% selling activity. The bulls outweigh the bears in this regard.

However, all 47 brokers had a larger selling average (P5.328) than their buying average (P5.323) during the aforementioned period.

Overall, RL Commercial REIT (RCR) has managed to maintain a bullish Market Sentiment Index rating month-to-date.

Does this bullish Market Sentiment Index rating for the month-to-date period provide enough justification to consider purchasing more shares of RL Commercial REIT (RCR)?

Price Forecast for RL Commercial REIT (RCR): August 23 to 25

The bears of RL Commercial REIT (RCR) are persistently driving the price towards the support at P5.00. Currently, I observe no signs of selling exhaustion. Given this, would you consider averaging down if data indicates that the downtrend is likely to continue? Perhaps it’s more logical to allow the stock to dig deeper and deeper until it shows signs of fatigue.

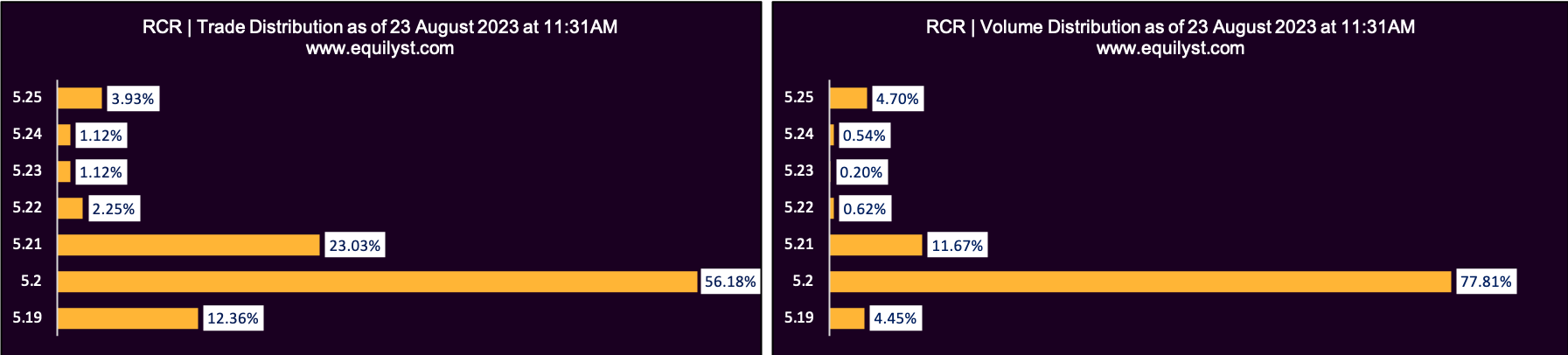

It’s worth noting that both the current price and the volume-weighted average price (VWAP) of RL Commercial REIT (RCR) are aligned at P5.20, still favoring the bears. Furthermore, the dominant range of P5.19 to P5.21 leans closer to the intraday low than the intraday high. As seen on the chart, the intraday low of P5.19 is part of the dominant range, boasting the highest volume and trade count.

Conversely, the bulls are hoping for RL Commercial REIT (RCR) to maintain a bullish Market Sentiment Index to counteract the price decline.

Considering all these data points, my overall sentiment for RL Commercial REIT (RCR) is bearish for the remainder of the trading week. Given RCR’s average daily changes this August 2023, there’s a likelihood that its price might touch P5.10 on or before the end of the trading week.

As I always say, sentiments change as data changes. Always conduct a fresh analysis before making any buy or sell decisions. The analysis provided in this article might remain accurate or become outdated within a matter of seconds or minutes.

If you want a tailored-fit recommendation relative to the size of your portfolio and risk tolerance, please complete this form to avail yourself of my crypto and stock market consulting service.

Fill out this form if you want to hire me to write for your website in the blockchain, crypto, Web3, or stock market space.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025