Out of 30 PSEi stocks, only 12 of them currently exhibit bullish trends above their respective 200-day simple moving averages.

By classical interpretation, it is believed that a stock is bullish in the long-term if its last price trades above its 200-day simple moving average (SMA).

In this report, I will not only reveal the names of these 12 PSEi stocks but also provide their month-to-date market sentiment data from September 1, 2023, to September 12, 2023.

Please note that the Market Sentiment Index indicator discussed in this report is my proprietary creation, and I am the sole authority on its methodology for determining bearish and bullish ratings, as well as the specific parameters it considers.

I have extensively explained my use of the Market Sentiment Index in decision-making in numerous articles on this website. You can easily access them by using the SEARCH box in the ANALYSES section and searching for “market sentiment.”

If you prefer a more tailored approach, you can take advantage of my stock investment consultancy service.

It’s important to clarify that this article about PSEi stocks is for informational purposes only, and I am not providing stock recommendations. I employ a proprietary methodology to identify confirmed buy signals, which I can further discuss if you are interested in gaining independent investment insights through my stock investment consultancy service.

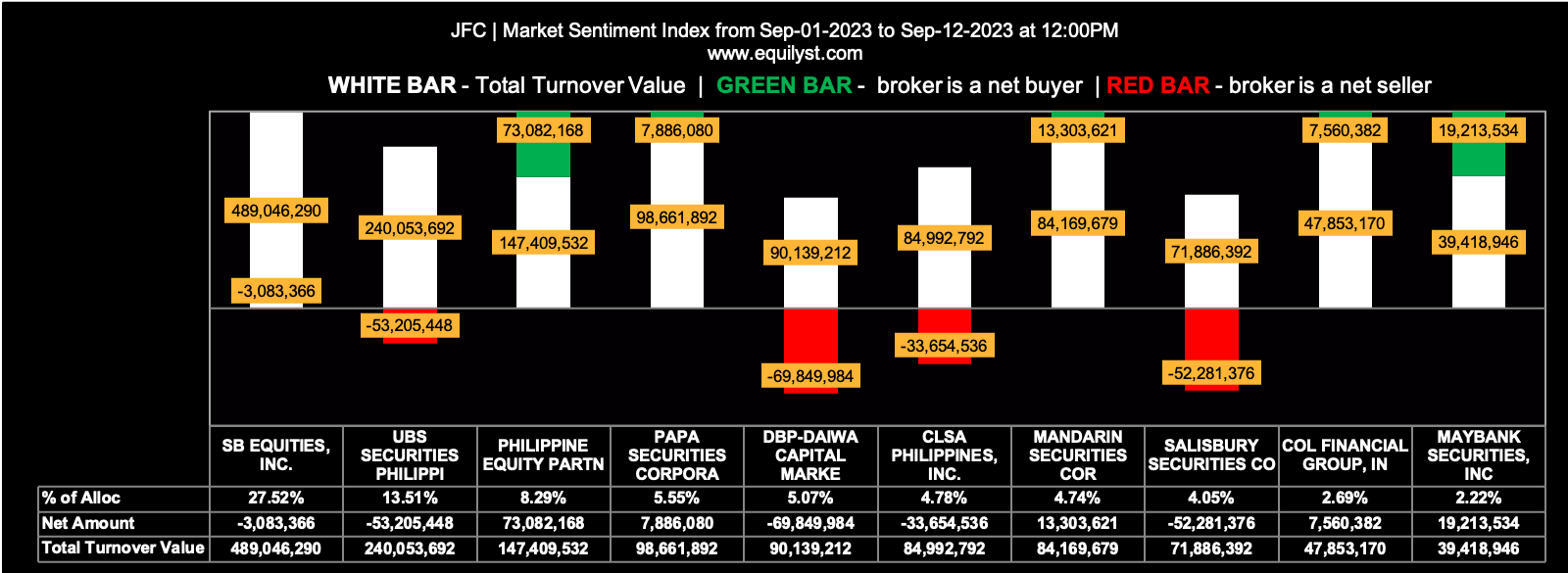

Jollibee Foods Corporation (JFC)

Last Price: P238.40

Distance of the Last Price Above the 200-day SMA: 0.46%

Market Sentiment Index: BULLISH

49 of the 69 participating brokers, or 71.01% of all participants, registered a positive Net Amount

40 of the 69 participating brokers, or 57.97% of all participants, registered a higher Buying Average than Selling Average

69 Participating Brokers’ Buying Average: ₱236.03732

69 Participating Brokers’ Selling Average: ₱236.46946

20 out of 69 participants, or 28.99% of all participants, registered a 100% BUYING activity

6 out of 69 participants, or 8.70% of all participants, registered a 100% SELLING activity

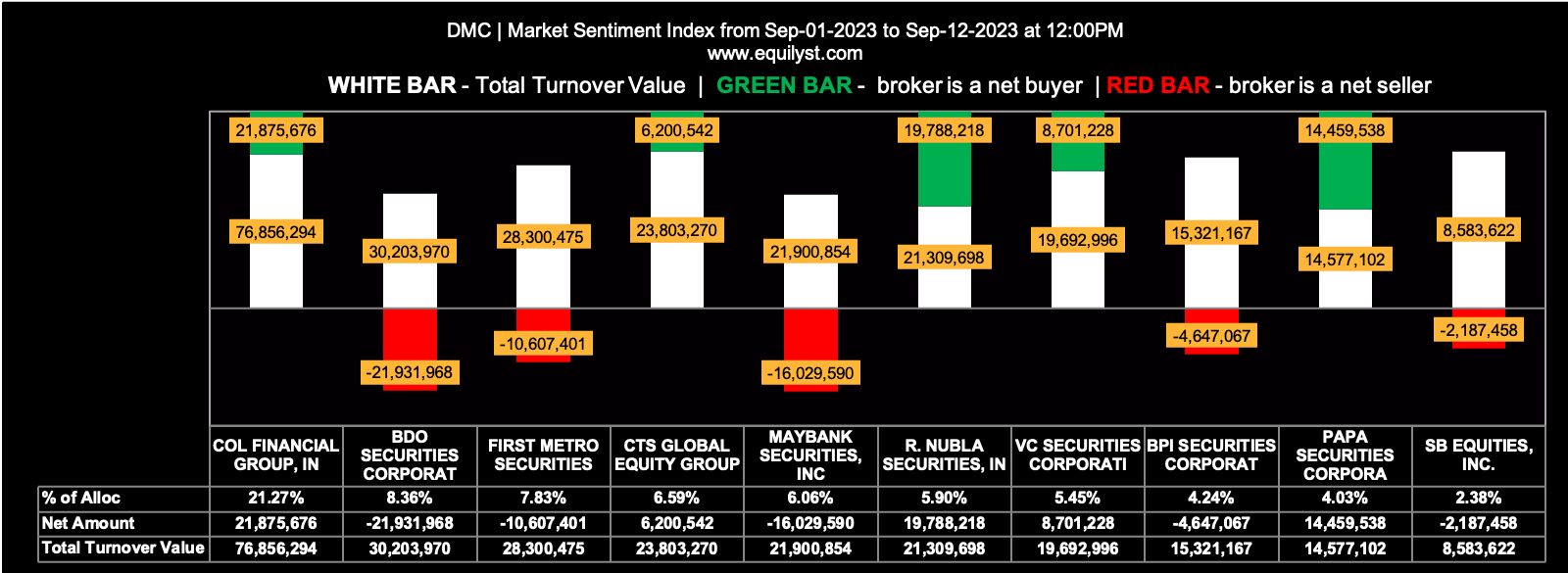

DMCI Holdings (DMC)

Last Price: P10.52

Distance of the Last Price Above the 200-day SMA: 0.96%

Market Sentiment Index: BEARISH

24 of the 82 participating brokers, or 29.27% of all participants, registered a positive Net Amount

36 of the 82 participating brokers, or 43.90% of all participants, registered a higher Buying Average than Selling Average

82 Participating Brokers’ Buying Average: ₱10.30407

82 Participating Brokers’ Selling Average: ₱10.25391

8 out of 82 participants, or 9.76% of all participants, registered a 100% BUYING activity

22 out of 82 participants, or 26.83% of all participants, registered a 100% SELLING activity

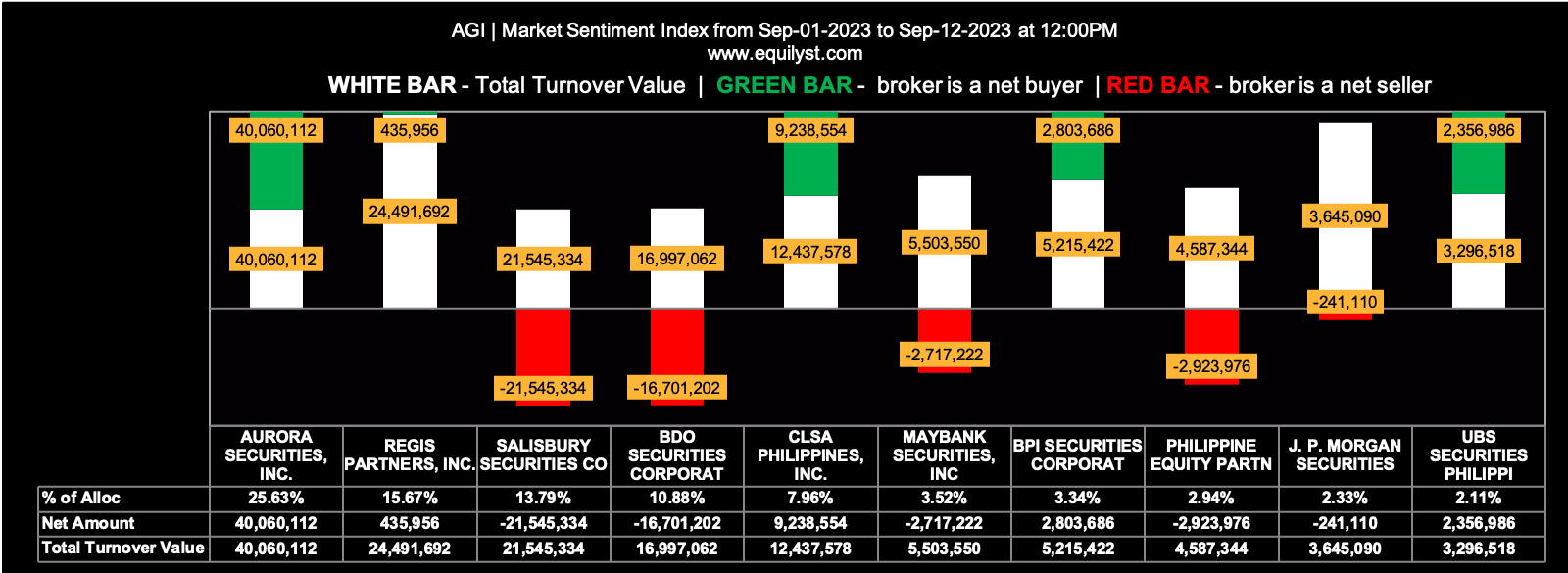

Alliance Global Group (AGI)

Last Price: P12.56

Distance of the Last Price Above the 200-day SMA: 1%

Market Sentiment Index: BEARISH

11 of the 38 participating brokers, or 28.95% of all participants, registered a positive Net Amount

13 of the 38 participating brokers, or 34.21% of all participants, registered a higher Buying Average than Selling Average

38 Participating Brokers’ Buying Average: ₱12.61235

38 Participating Brokers’ Selling Average: ₱12.62086

2 out of 38 participants, or 5.26% of all participants, registered a 100% BUYING activity

12 out of 38 participants, or 31.58% of all participants, registered a 100% SELLING activity

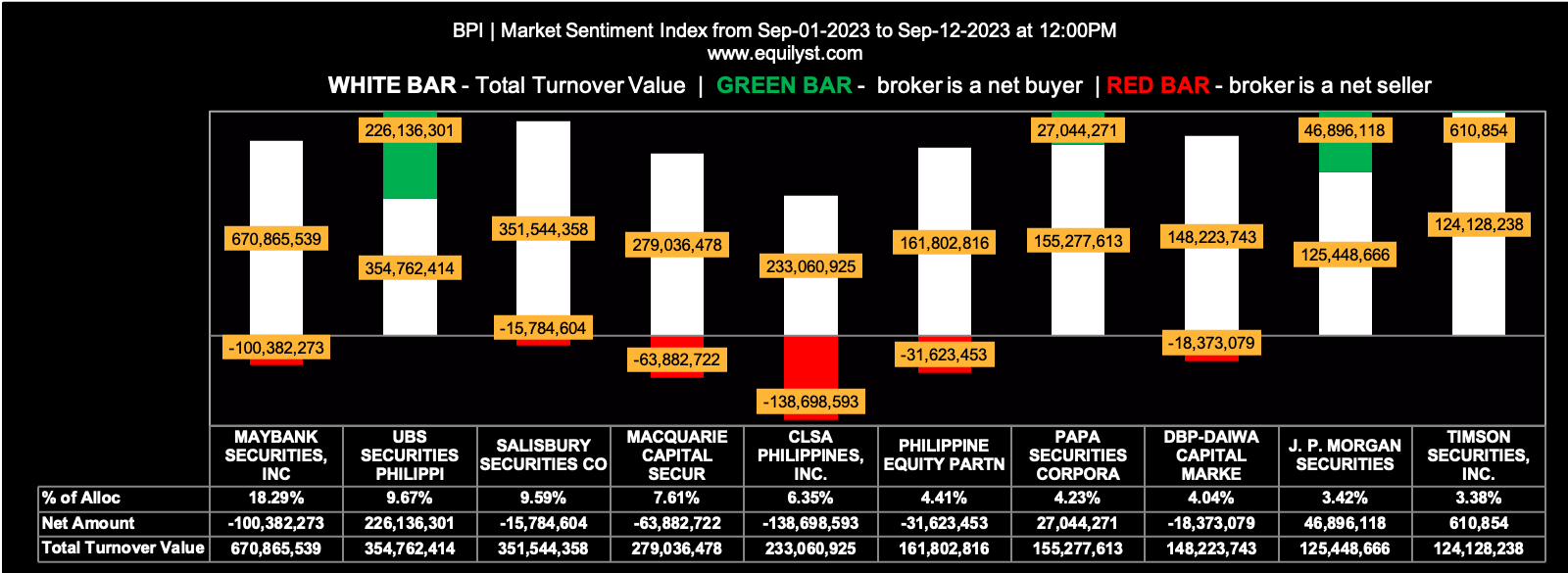

Bank of the Philippine Islands (BPI)

Last Price: P107.30

Distance of the Last Price Above the 200-day SMA: 1%

Market Sentiment Index: BULLISH

43 of the 66 participating brokers, or 65.15% of all participants, registered a positive Net Amount

37 of the 66 participating brokers, or 56.06% of all participants, registered a higher Buying Average than Selling Average

66 Participating Brokers’ Buying Average: ₱105.85276

66 Participating Brokers’ Selling Average: ₱106.27168

16 out of 66 participants, or 24.24% of all participants, registered a 100% BUYING activity

2 out of 66 participants, or 3.03% of all participants, registered a 100% SELLING activity

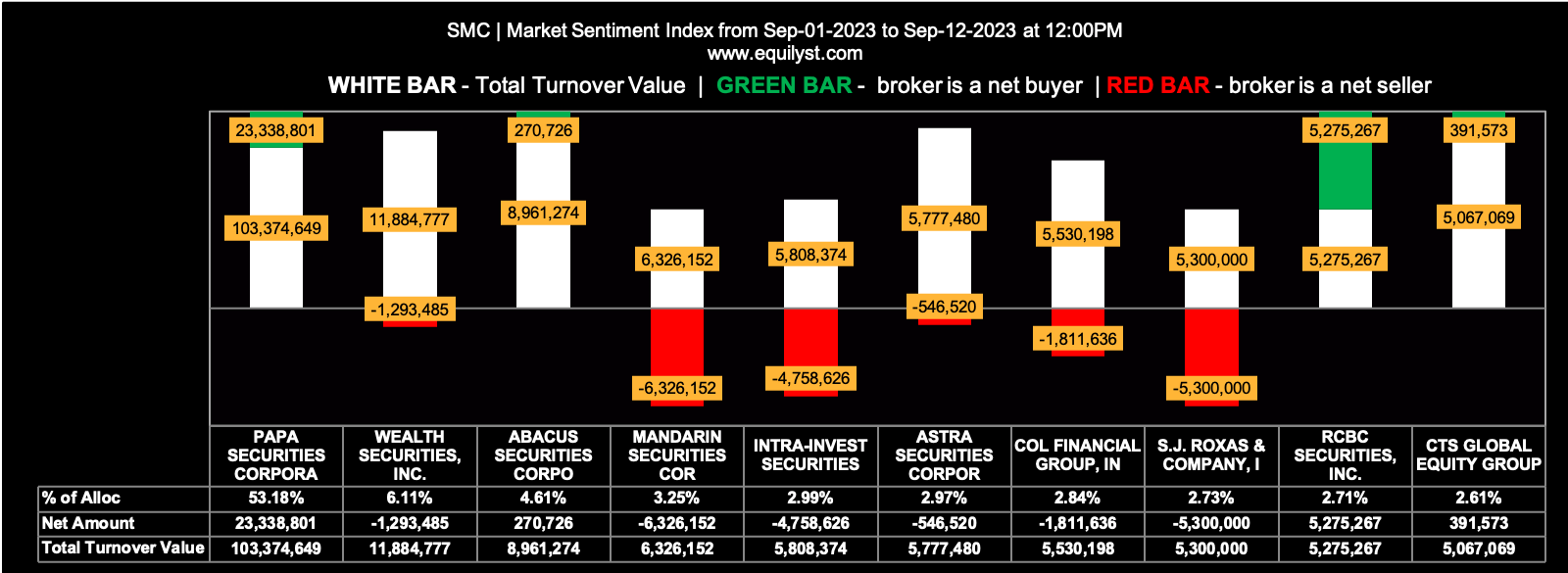

San Miguel Corporation (SMC)

Last Price: P104.90

Distance of the Last Price Above the 200-day SMA: 1%

Market Sentiment Index: BEARISH

19 of the 56 participating brokers, or 33.93% of all participants, registered a positive Net Amount

23 of the 56 participating brokers, or 41.07% of all participants, registered a higher Buying Average than Selling Average

56 Participating Brokers’ Buying Average: ₱105.15721

56 Participating Brokers’ Selling Average: ₱105.16532

11 out of 56 participants, or 19.64% of all participants, registered a 100% BUYING activity

21 out of 56 participants, or 37.50% of all participants, registered a 100% SELLING activity

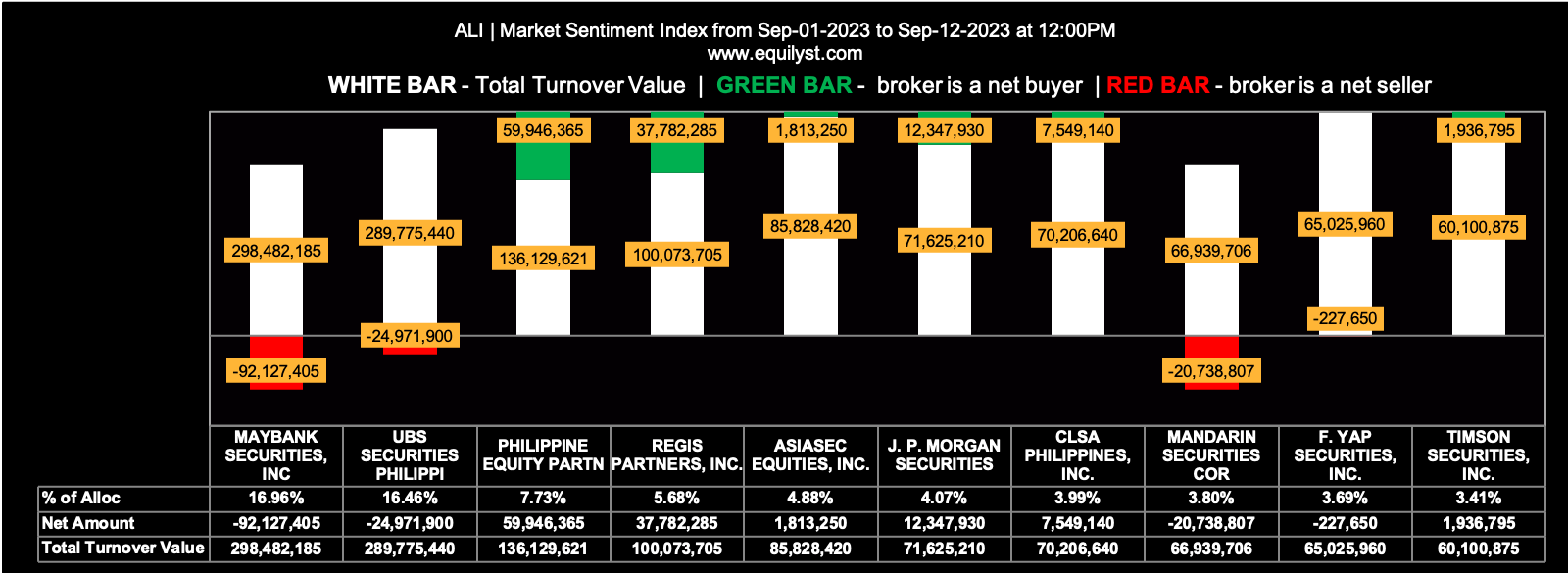

Ayala Land (ALI)

Last Price: P28.55

Distance of the Last Price Above the 200-day SMA: 2%

Market Sentiment Index: BEARISH

36 of the 80 participating brokers, or 45.00% of all participants, registered a positive Net Amount

30 of the 80 participating brokers, or 37.50% of all participants, registered a higher Buying Average than Selling Average

80 Participating Brokers’ Buying Average: ₱27.93022

80 Participating Brokers’ Selling Average: ₱28.30643

16 out of 80 participants, or 20.00% of all participants, registered a 100% BUYING activity

8 out of 80 participants, or 10.00% of all participants, registered a 100% SELLING activity

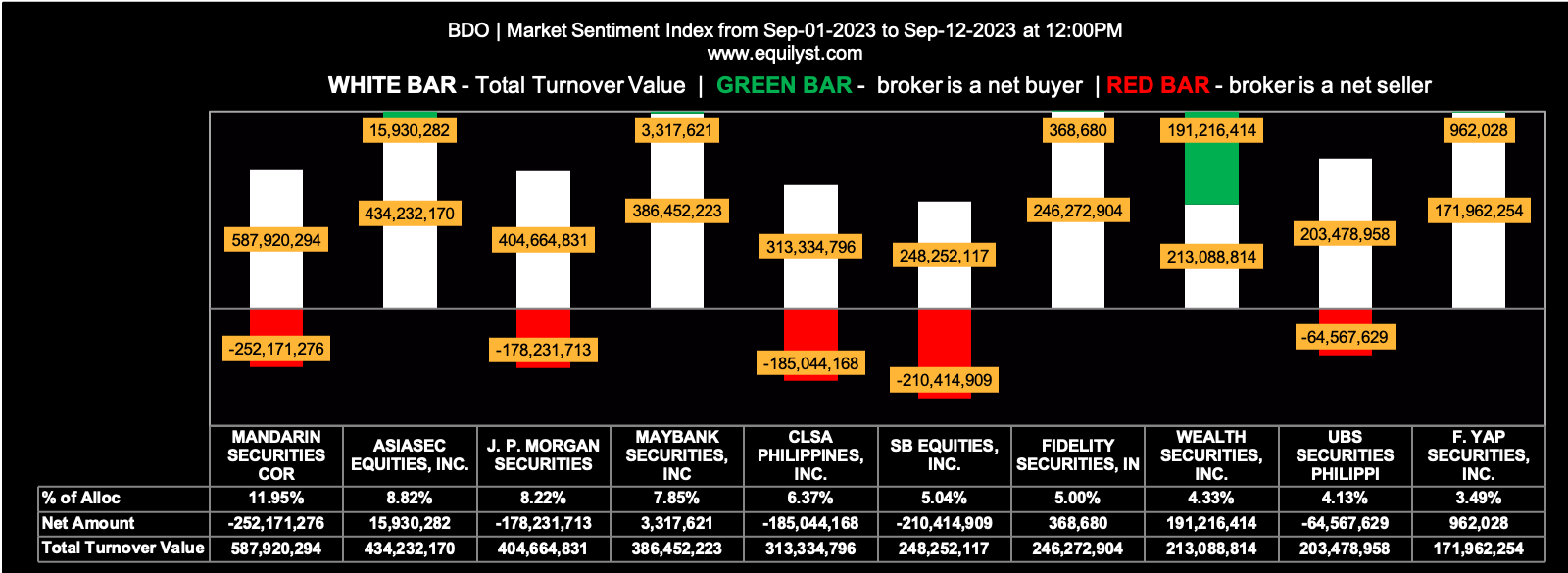

BDO Unibank (BDO)

Last Price: P133.60

Distance of the Last Price Above the 200-day SMA: 3%

Market Sentiment Index: BULLISH

72 of the 87 participating brokers, or 82.76% of all participants, registered a positive Net Amount

56 of the 87 participating brokers, or 64.37% of all participants, registered a higher Buying Average than Selling Average

87 Participating Brokers’ Buying Average: ₱134.28579

87 Participating Brokers’ Selling Average: ₱135.11470

33 out of 87 participants, or 37.93% of all participants, registered a 100% BUYING activity

2 out of 87 participants, or 2.30% of all participants, registered a 100% SELLING activity

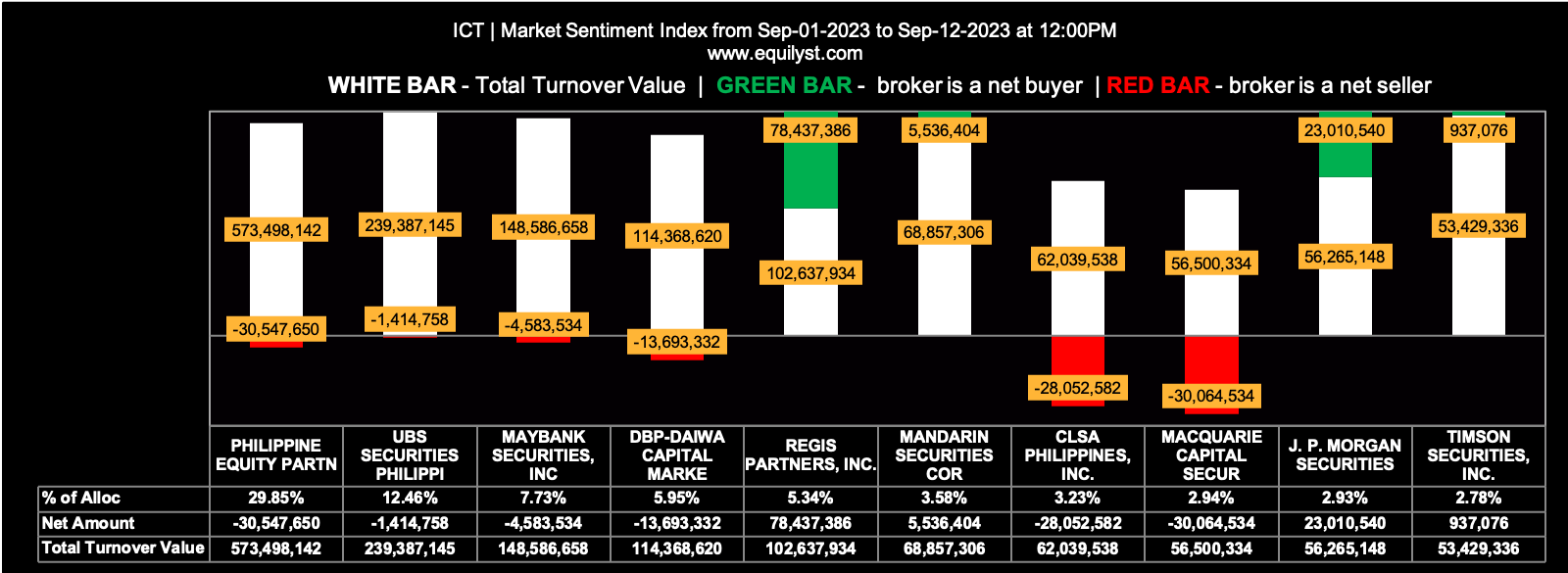

International Container Terminal Services (ICT)

Last Price: P210.40

Distance of the Last Price Above the 200-day SMA: 3%

Market Sentiment Index: BEARISH

33 of the 60 participating brokers, or 55.00% of all participants, registered a positive Net Amount

26 of the 60 participating brokers, or 43.33% of all participants, registered a higher Buying Average than Selling Average

60 Participating Brokers’ Buying Average: ₱207.62947

60 Participating Brokers’ Selling Average: ₱208.55784

14 out of 60 participants, or 23.33% of all participants, registered a 100% BUYING activity

4 out of 60 participants, or 6.67% of all participants, registered a 100% SELLING activity

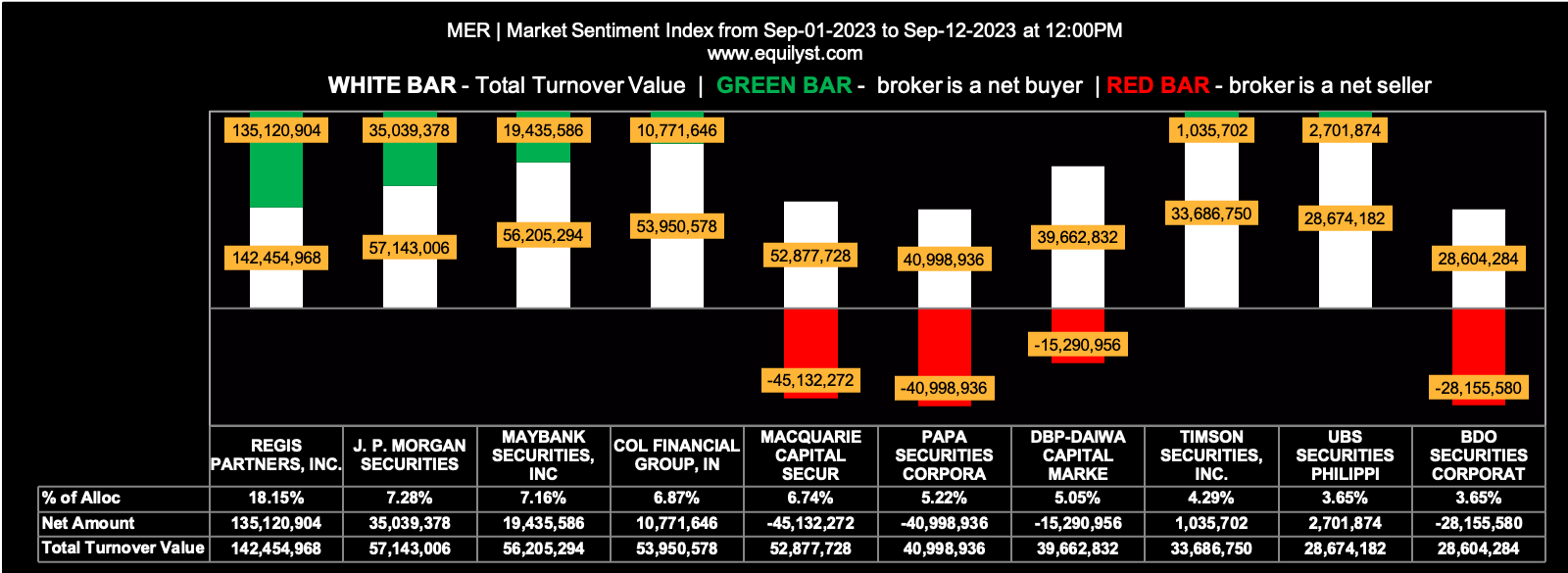

Manila Electric Company (MER)

Last Price: P356.60

Distance of the Last Price Above the 200-day SMA: 12%

Market Sentiment Index: BEARISH

19 of the 67 participating brokers, or 28.36% of all participants, registered a positive Net Amount

14 of the 67 participating brokers, or 20.90% of all participants, registered a higher Buying Average than Selling Average

67 Participating Brokers’ Buying Average: ₱349.79888

67 Participating Brokers’ Selling Average: ₱353.94647

5 out of 67 participants, or 7.46% of all participants, registered a 100% BUYING activity

21 out of 67 participants, or 31.34% of all participants, registered a 100% SELLING activity

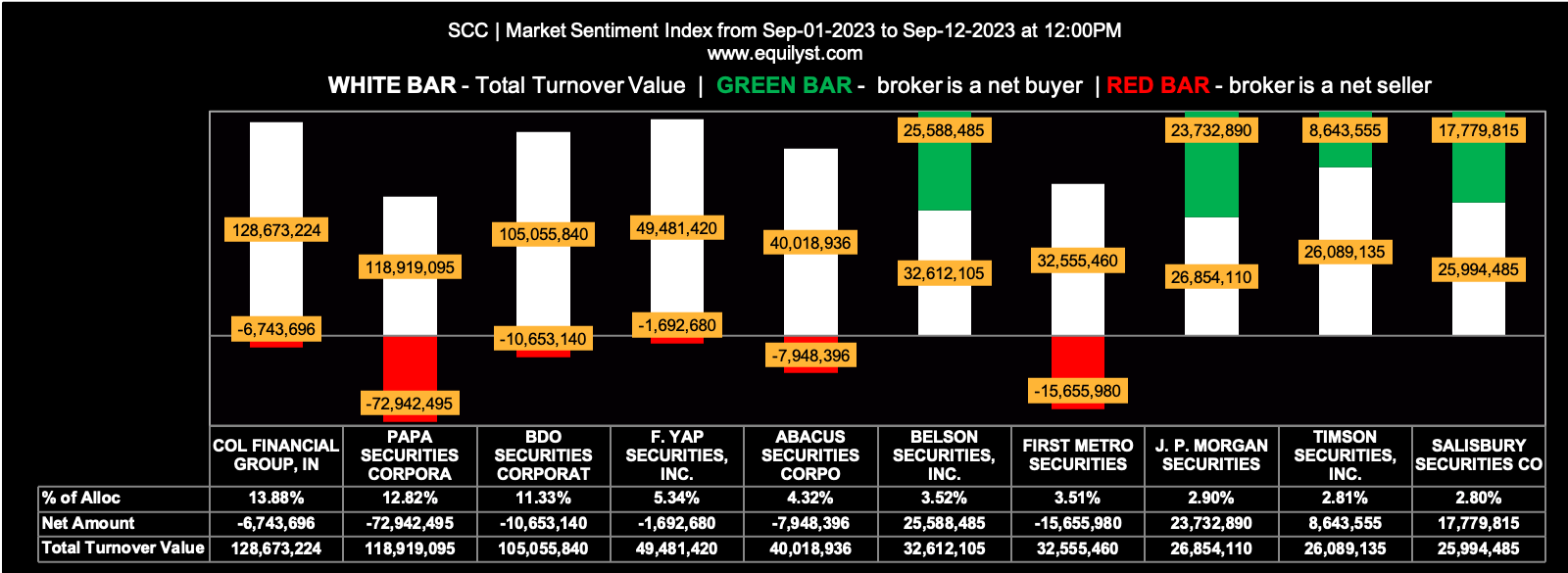

Semirara Mining and Power Corporation (SCC)

Last Price: P34.15

Distance of the Last Price Above the 200-day SMA: 12%

Market Sentiment Index: BEARISH

31 of the 86 participating brokers, or 36.05% of all participants, registered a positive Net Amount

27 of the 86 participating brokers, or 31.40% of all participants, registered a higher Buying Average than Selling Average

86 Participating Brokers’ Buying Average: ₱32.62967

86 Participating Brokers’ Selling Average: ₱33.16238

10 out of 86 participants, or 11.63% of all participants, registered a 100% BUYING activity

20 out of 86 participants, or 23.26% of all participants, registered a 100% SELLING activity

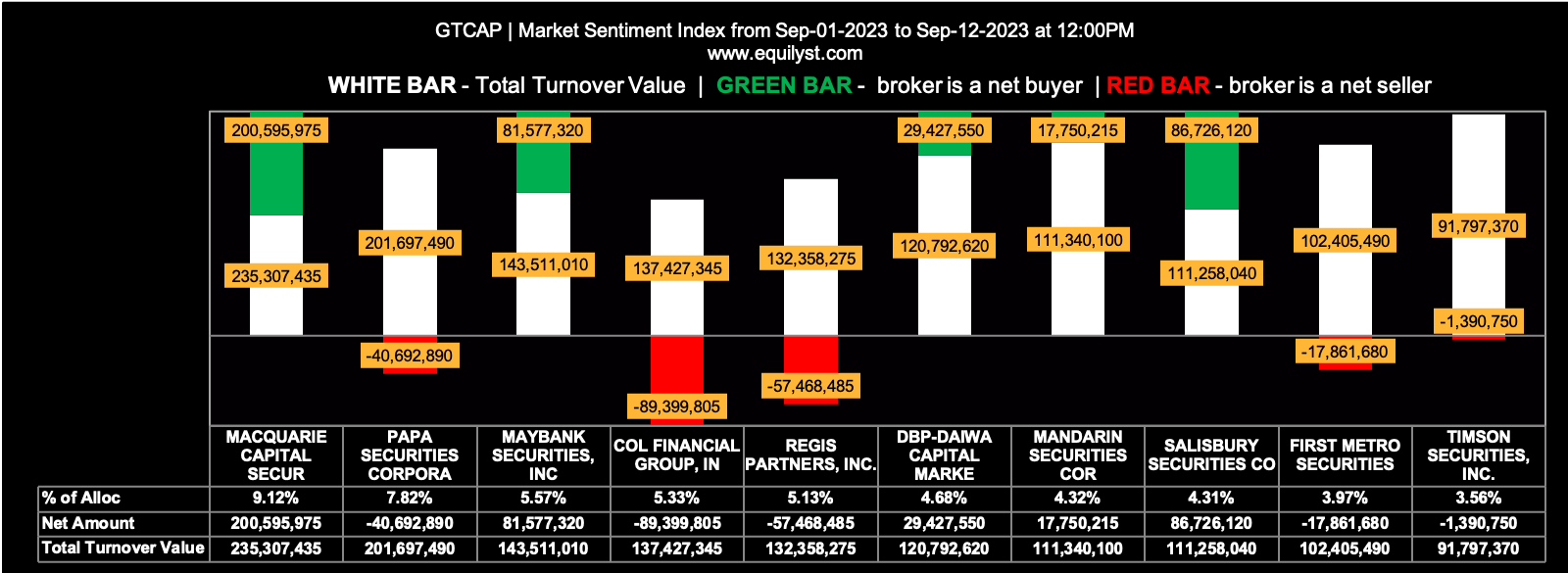

GT Capital Holdings (GTCAP)

Last Price: P590.00

Distance of the Last Price Above the 200-day SMA: 19%

Market Sentiment Index: BEARISH

23 of the 77 participating brokers, or 29.87% of all participants, registered a positive Net Amount

21 of the 77 participating brokers, or 27.27% of all participants, registered a higher Buying Average than Selling Average

77 Participating Brokers’ Buying Average: ₱578.20923

77 Participating Brokers’ Selling Average: ₱581.06778

6 out of 77 participants, or 7.79% of all participants, registered a 100% BUYING activity

22 out of 77 participants, or 28.57% of all participants, registered a 100% SELLING activity

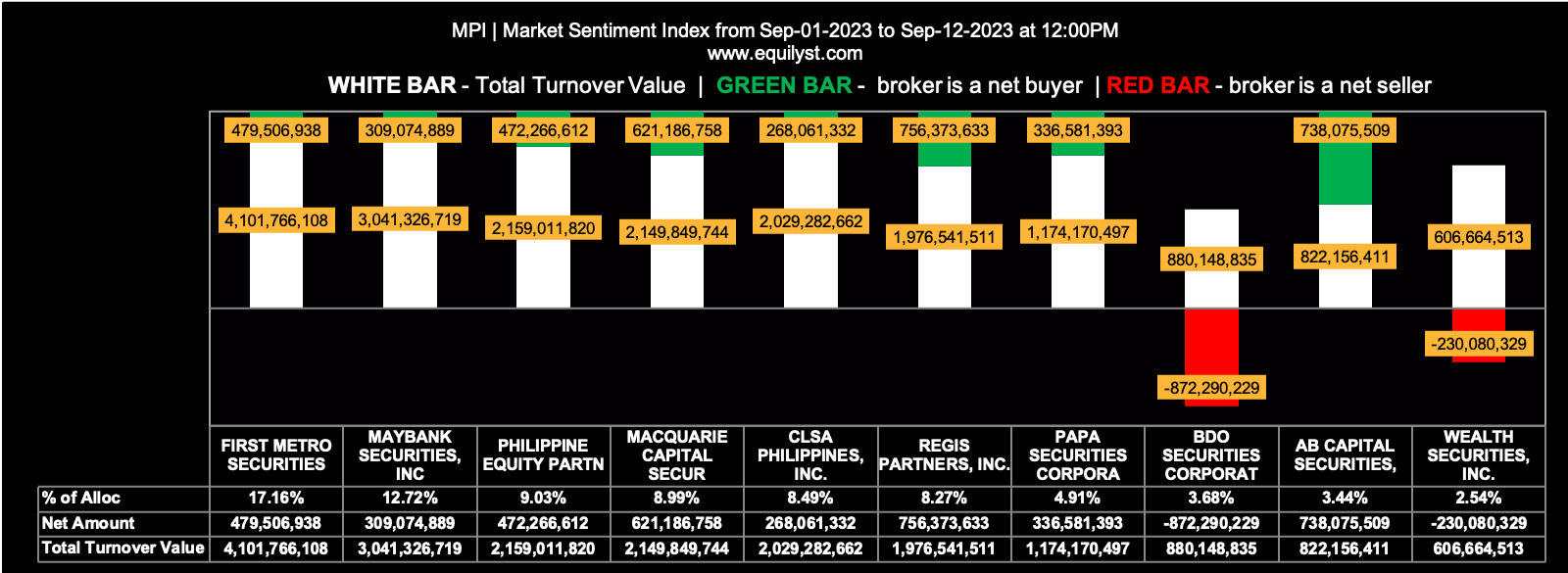

Metro Pacific Investments Corporation (MPI)

Last Price: P5.18

Distance of the Last Price Above the 200-day SMA: 22%

Market Sentiment Index: BEARISH

16 of the 83 participating brokers, or 19.28% of all participants, registered a positive Net Amount

16 of the 83 participating brokers, or 19.28% of all participants, registered a higher Buying Average than Selling Average

83 Participating Brokers’ Buying Average: ₱5.11480

83 Participating Brokers’ Selling Average: ₱5.17688

4 out of 83 participants, or 4.82% of all participants, registered a 100% BUYING activity

36 out of 83 participants, or 43.37% of all participants, registered a 100% SELLING activity

Which of These 12 PSEi Stocks Do You Already Have?

What’s your decision now that you’ve known this information? Let me know in the comments.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025