What’s Price-to-Book Value and the Ideal P/BV?

The price-to-book value is a financial metric that compares a company’s market price per share to its book value per share. It is calculated by dividing the market price per share by the book value per share.

What’s the ideal price-to-book value (P/BV)?

There’s no universal or ideal price-to-book value, but a P/BV less than 1 typically suggests that the market values the company lower than its accounting value, which could indicate an undervalued stock. Conversely, a P/BV greater than 1 suggests the market values the company higher than its accounting value.

With that said, I’ve managed to filter the only three undervalued mining stocks listed in the Philippine Stock Exchange as of August 31, 2023.

In addition to ranking them, I’m also going to show you their month-to-date Market Sentiment Index and intraday Dominant Range Index so you’ll have a data-driven idea of the confidence level of market participants and the potential trajectory of each stock’s price.

3 Undervalued Mining Stocks in the PSE Based on P/BV Less Than 1

Rank: 3

Stock Code: PX

Company Name: Philex Mining Corporation

Price-to-Book Value: 0.52

Rank: 2

Stock Code: MARC

Company Name: Marcventures Holdings, Inc.

Price-to-Book Value: 0.46

Rank: 1

Stock Code: AT

Company Name: Atlas Consolidated Mining and Development Corporation

Price-to-Book Value: 0.24

Dominant Range of the 3 Undervalued Mining Stocks

The dominant price range is either a standalone price or a range of prices with the highest volume and the greatest number of trades.

Let me respond to that question with more questions.

Imagine you’re on the verge of buying the stock. If the dominant price range is closer to the intraday low than the intraday high, will you rush into buying, or will you wait a bit longer because the price is likely to continue moving downward?

Now, consider you’re about to realize your gains, even though your trailing stop is still in place. If the dominant price range is closer to the intraday high than the intraday low, will you rush into selling, or will you wait a bit longer because the price is likely to continue moving upward?

Picture this: it’s been 60 minutes since the opening bell. If the current price is at the intraday high itself, but the dominant price range includes the intraday low, wouldn’t that make you question the sustainability of the intraday bullishness?

I’ve only presented you with three scenarios where understanding the location of the dominant price range is useful in decision-making. There’s a lot more we can discuss in my stock investment consultancy service. Learn about the requirements here.

Here’s the dominant range of each of the 3 undervalued mining stocks.

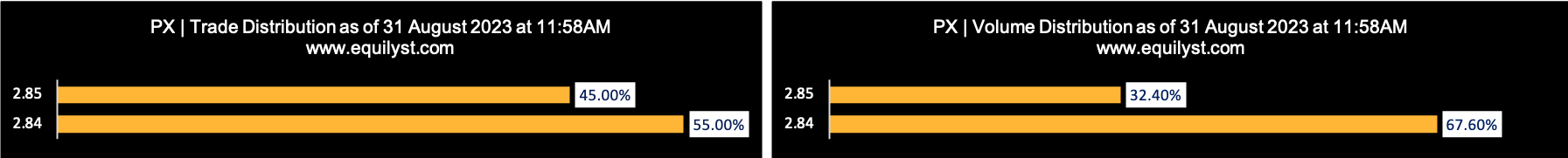

Undervalued Mining Stock (per P/BV): PX

Company Name: Philex Mining Corporation

Dominant Range Index: BEARISH

Last Price: 2.84

VWAP: 2.84

Dominant Range: 2.84 – 2.84

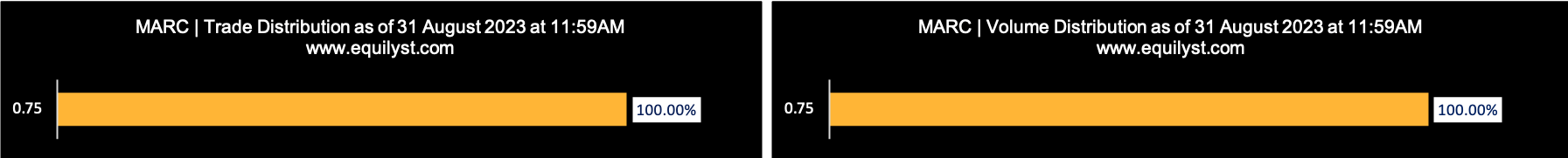

Undervalued Mining Stock (per P/BV): MARC

Company Name: Marcventures Holdings, Inc.

Dominant Range Index: BULLISH

Last Price: 0.75

VWAP: 0.75

Dominant Range: 0.75 – 0.75

Undervalued Mining Stock (per P/BV): AT

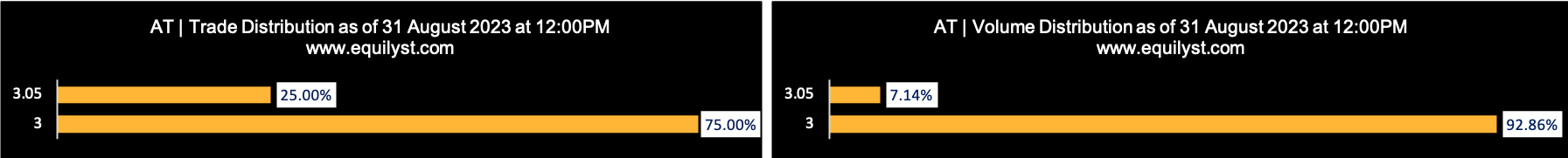

Company Name: Atlas Consolidated Mining and Development Corporation

Dominant Range Index: BEARISH

Last Price: 3.05

VWAP: 3.0

Dominant Range: 3 – 3

MTD Market Sentiment for the 3 Undervalued Mining Stocks

How do you gauge the market sentiment?

By running a survey or observing discussions on stock market-related Facebook Groups?

But how do you verify the integrity or objectivity of their comments? That’s the problem!

Occasionally, I run surveys on Facebook Groups, but not to check the market sentiment but to ask them which stock they’d like me to write about in my next article. That way, I maintain the objectivity of my stock selection process as far as when deciding which stock to feature in my articles.

I check the overall market sentiment rating of a stock to help me decide whether I should hold my position since my trailing stop is still intact or pre-empt it.

The market sentiment also helps me estimate if the prevailing direction of the share price is likely to continue or reverse.

For example, if the stock is in a downtrend and the prevailing market sentiment is bearish, it means the downtrend is likely to continue.

If the stock is in a downtrend, but the market sentiment turns bullish, it’s a sign that investors might see a bullish reversal.

Again, and again, notice the adverbs I’m using – “likely” and “might”. We’re still talking about probabilities and not certainties.

Still, it’s better to be data-driven and be proven wrong by the market than make decisions based on gut feeling alone. The former gives you the opportunity to optimize something while the latter doesn’t.

I have an extensive explanation about why I created my proprietary Market Sentiment Index indicator in some articles on my website. Use the SEARCH box on this website and type “Market Sentiment” to read my other articles where I talked about this subject.

Here’s the month-to-date market sentiment index of each of the 3 undervalued mining stocks.

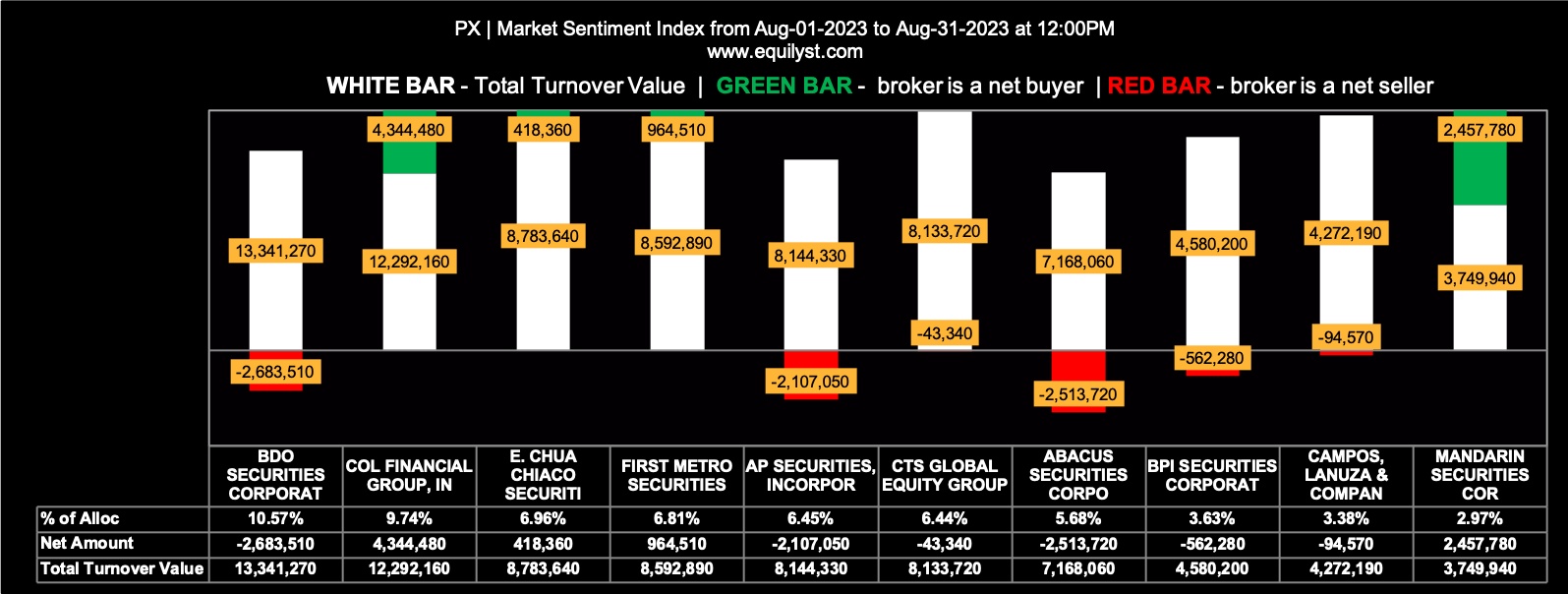

Undervalued Mining Stock (per P/BV): PX

Company Name: Philex Mining Corporation

Market Sentiment Index: BEARISH

29 of the 71 participating brokers, or 40.85% of all participants, registered a positive Net Amount

28 of the 71 participating brokers, or 39.44% of all participants, registered a higher Buying Average than Selling Average

71 Participating Brokers’ Buying Average: ₱2.80375

71 Participating Brokers’ Selling Average: ₱2.81251

10 out of 71 participants, or 14.08% of all participants, registered a 100% BUYING activity

20 out of 71 participants, or 28.17% of all participants, registered a 100% SELLING activity

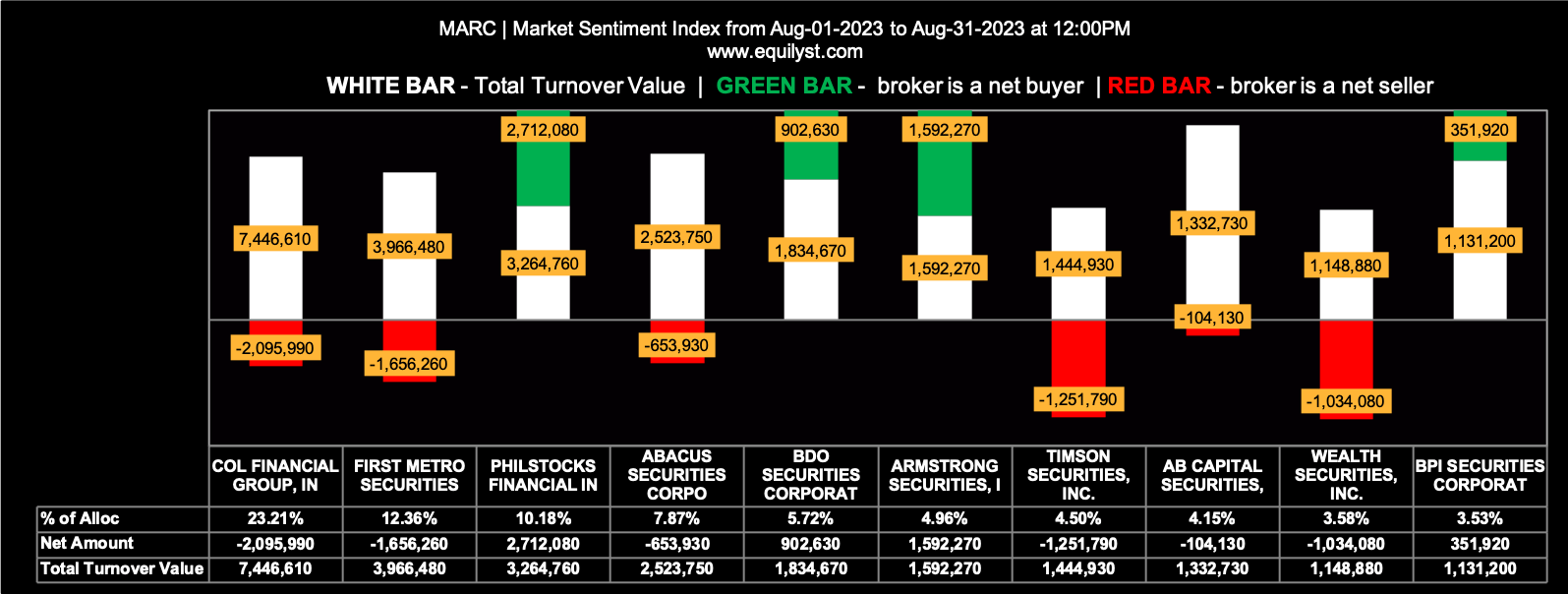

Undervalued Mining Stock (per P/BV): MARC

Company Name: Marcventures Holdings, Inc.

Market Sentiment Index: BULLISH

25 of the 37 participating brokers, or 67.57% of all participants, registered a positive Net Amount

25 of the 37 participating brokers, or 67.57% of all participants, registered a higher Buying Average than Selling Average

37 Participating Brokers’ Buying Average: ₱0.76548

37 Participating Brokers’ Selling Average: ₱0.78080

15 out of 37 participants, or 40.54% of all participants, registered a 100% BUYING activity

5 out of 37 participants, or 13.51% of all participants, registered a 100% SELLING activity

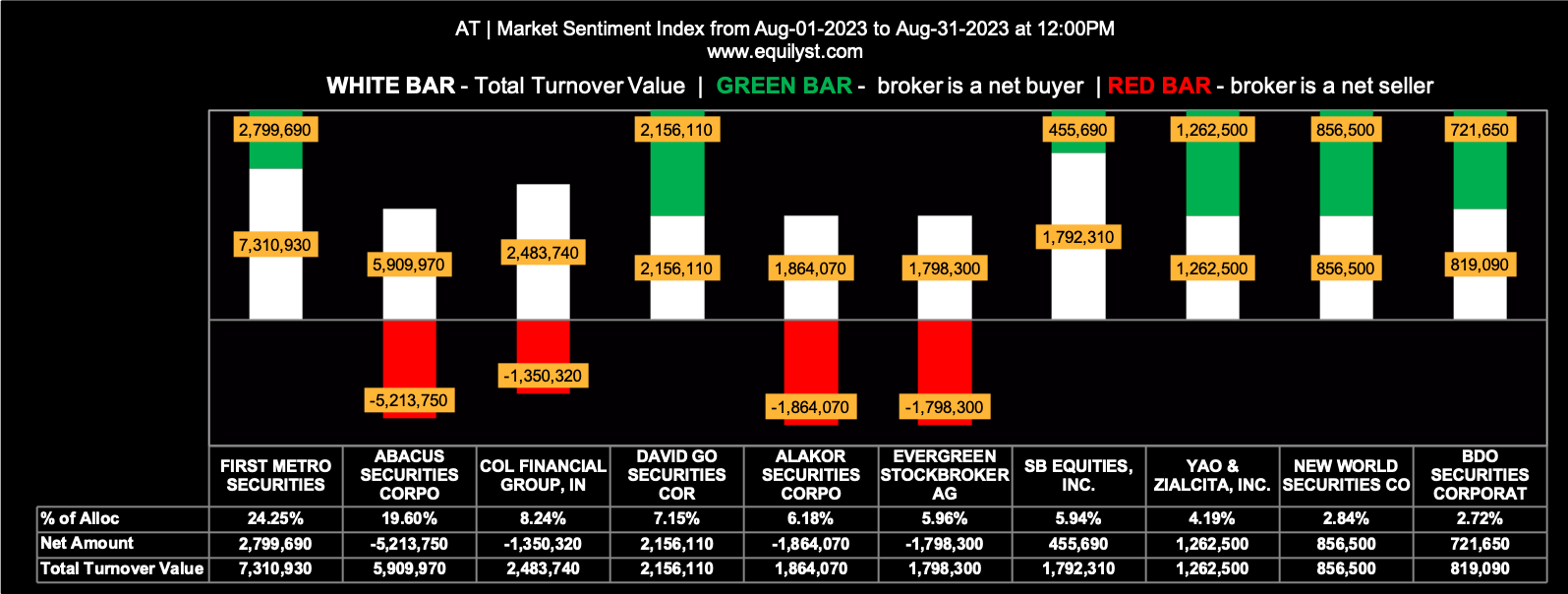

Undervalued Mining Stock (per P/BV): AT

Company Name: Atlas Consolidated Mining and Development Corporation

Market Sentiment Index: BEARISH

20 of the 35 participating brokers, or 57.14% of all participants, registered a positive Net Amount

17 of the 35 participating brokers, or 48.57% of all participants, registered a higher Buying Average than Selling Average

35 Participating Brokers’ Buying Average: ₱3.26938

35 Participating Brokers’ Selling Average: ₱3.35063

13 out of 35 participants, or 37.14% of all participants, registered a 100% BUYING activity

10 out of 35 participants, or 28.57% of all participants, registered a 100% SELLING activity

Which Among the 3 Undervalued Mining Stocks Will You Buy?

I’ve presented to you some pieces of information vital in making a data-driven stock investment decision. After synthesizing this stuff with your methodology relative to your risk tolerance, which one will you buy and why? Let me know in the comments below.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025