PLDT (TEL) Technical Analysis

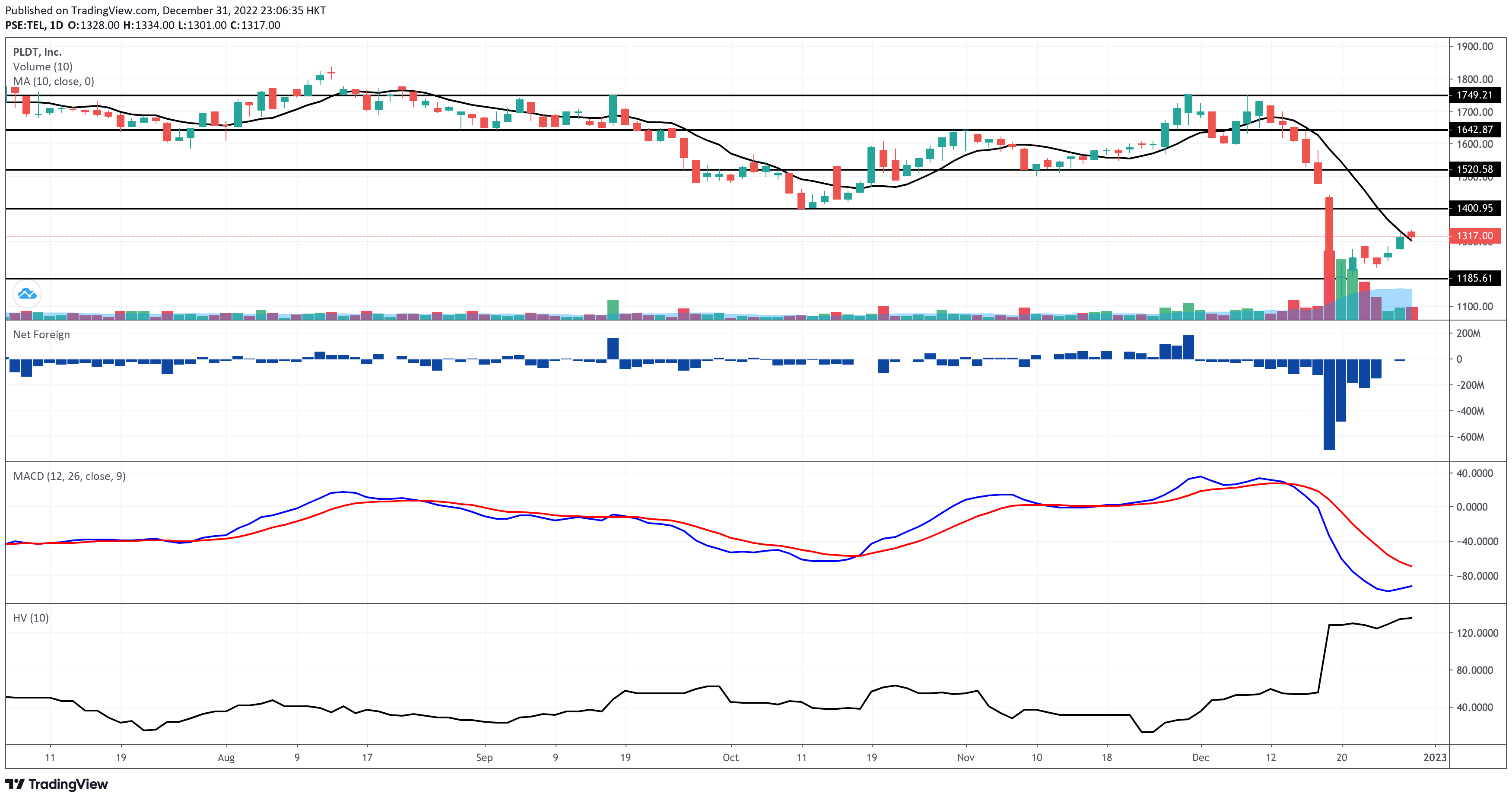

PLDT (TEL) rose above its 10-day simple moving average after trading below it for over two weeks. However, TEL closed in the red zone on December 29, 2022 at P1,317.00 per share since it closed at a price lower than its opening price of P1,328.00. The share price was up by P4.00 per share or 0.30%.

TEL is down by 27.32% year-to-date from the December 31, 2021 closing price of P1,812.00 to its December 29, 2022 closing price of P1,317.00.

The heaviest net foreign selling experienced by TEL was in December 2022. You can say that without calculating by merely looking at the Net Foreign histogram on the chart below.

Volume-wise, nothing’s alarming on TEL. That’s entirely expected already since this is a bluechip stock. Most of its daily volume is above 50% of its 10-day volume average except for the last three trading days of this year.

TEL’s moving average convergence divergence is trading below its signal line. I am seeing a formation of a bullish convergence between the two lines. However, we might only see a golden cross above the signal line once the price breaks above P1,600/sh per share.

This is the first time since March 2020 that I’ve seen TEL’s 10-day historical volatility score soar above 100% again. That’s expected again due to the gap-down in price last December 19, 2022. At this point, TEL has an extremely high risk level regarding the erraticity of its share price. TEL is not a newbie-friendly stock. For newbies, wait for TEL’s 10-day HV to go below 50% before you consider trading or investing in this name as far as technical analysis is concerned.

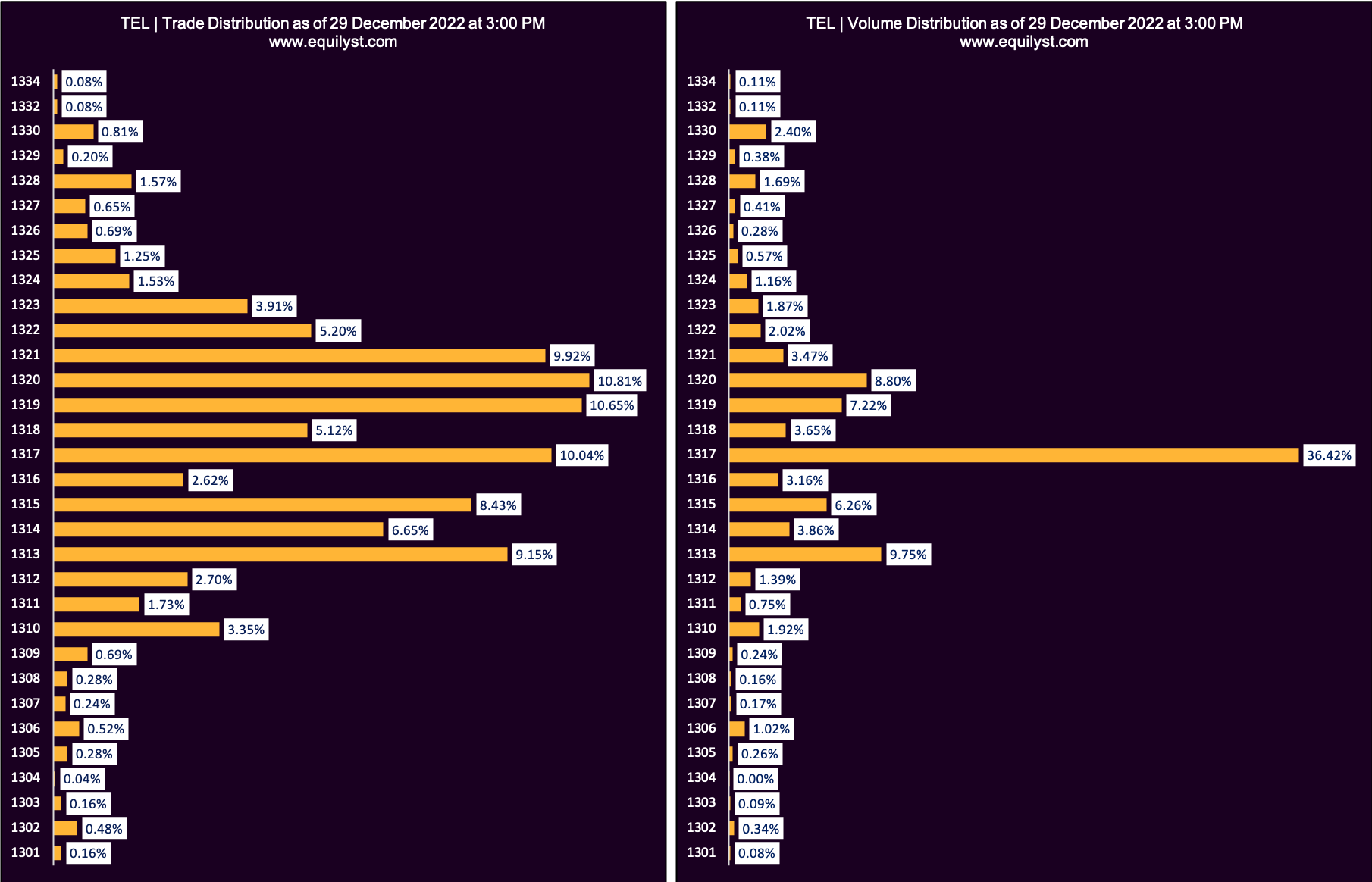

Even though TEL’s Dominant Range Index (DRI) is bullish, its volume-weighted average price (VWAP) is higher than the closing price. I prefer to see a closing price higher than the VWAP.

Dominant Range Index: BULLISH

Last Price: 1317

VWAP: 1,317.39

Dominant Range: 1317 – 1320

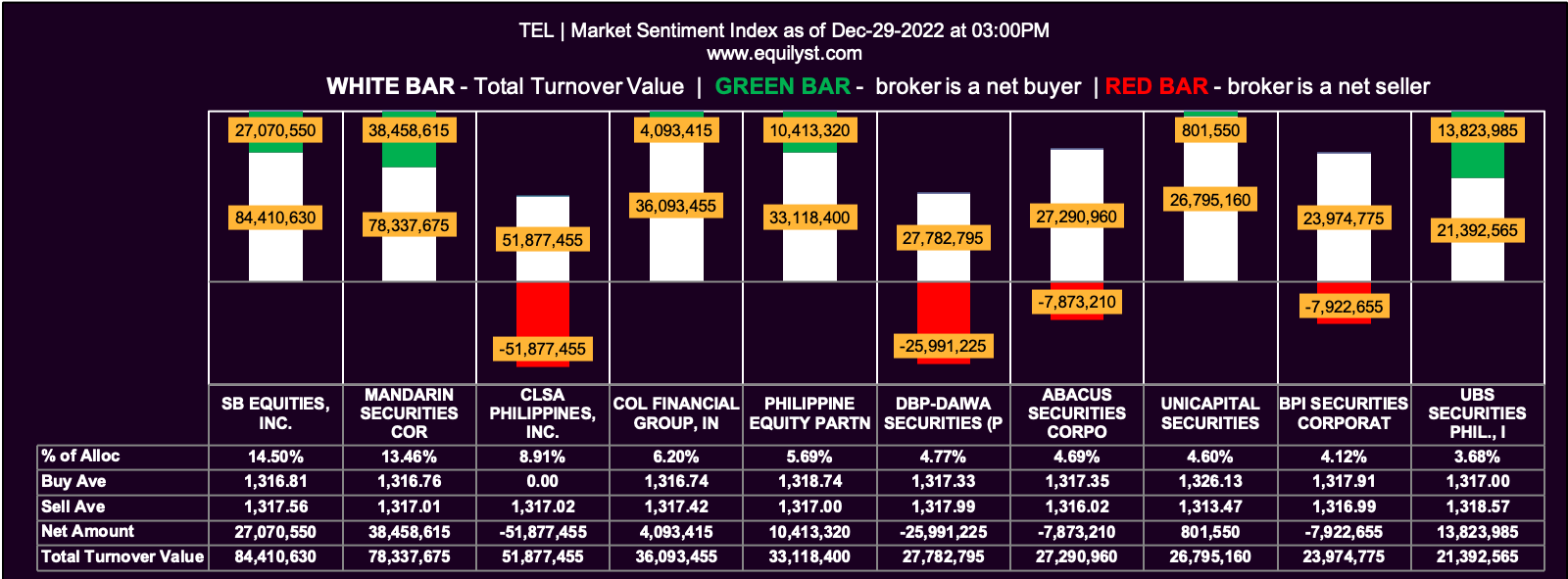

While TEL’s Market Sentiment Index (MSI) is bullish, only less than a quarter of all trade participants last December 29, 2022 registered a 100% buying confidence in this stock. This is still a wait-and-see game for TEL as far as my proprietary trading method is concerned.

Market Sentiment Index: BULLISH

33 of the 65 participating brokers, or 50.77% of all participants, registered a positive Net Amount

26 of the 65 participating brokers, or 40.00% of all participants, registered a higher Buying Average than Selling Average

65 Participating Brokers’ Buying Average: ₱1316.41592

65 Participating Brokers’ Selling Average: ₱1318.24045

14 out of 65 participants, or 21.54% of all participants, registered a 100% BUYING activity

16 out of 65 participants, or 24.62% of all participants, registered a 100% SELLING activity

Buy or Sell PLDT (TEL)?

Regarding my Evergreen Strategy in Trading and Investing in the Philippine Stock Market, I’m better off not having TEL in my portfolio yet. I need to get a bullish rating for all six indicators of my strategy so I can buy shares of this stock.

Let’s say I already have a position on TEL, and my trailing stop remains intact. If that’s the case, I can still afford to hold my position since TEL’s Dominant Range and Market Sentiment Indices are still bullish. I can sell all my shares in one go or tranches once both indicators turn bearish.

Want to Learn My Evergreen Strategy?

Subscribe to my stock market consultancy service. We’ll then have a 1-on-1 online seminar where I’ll teach you my strategy. Plus, I’ll give you 50 stock analysis credits. That means you can email up to 50 stock analysis requests for any stock listed on the Philippine Stock Exchange.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025