PLDT (TEL) Technical and Sentiment Analysis

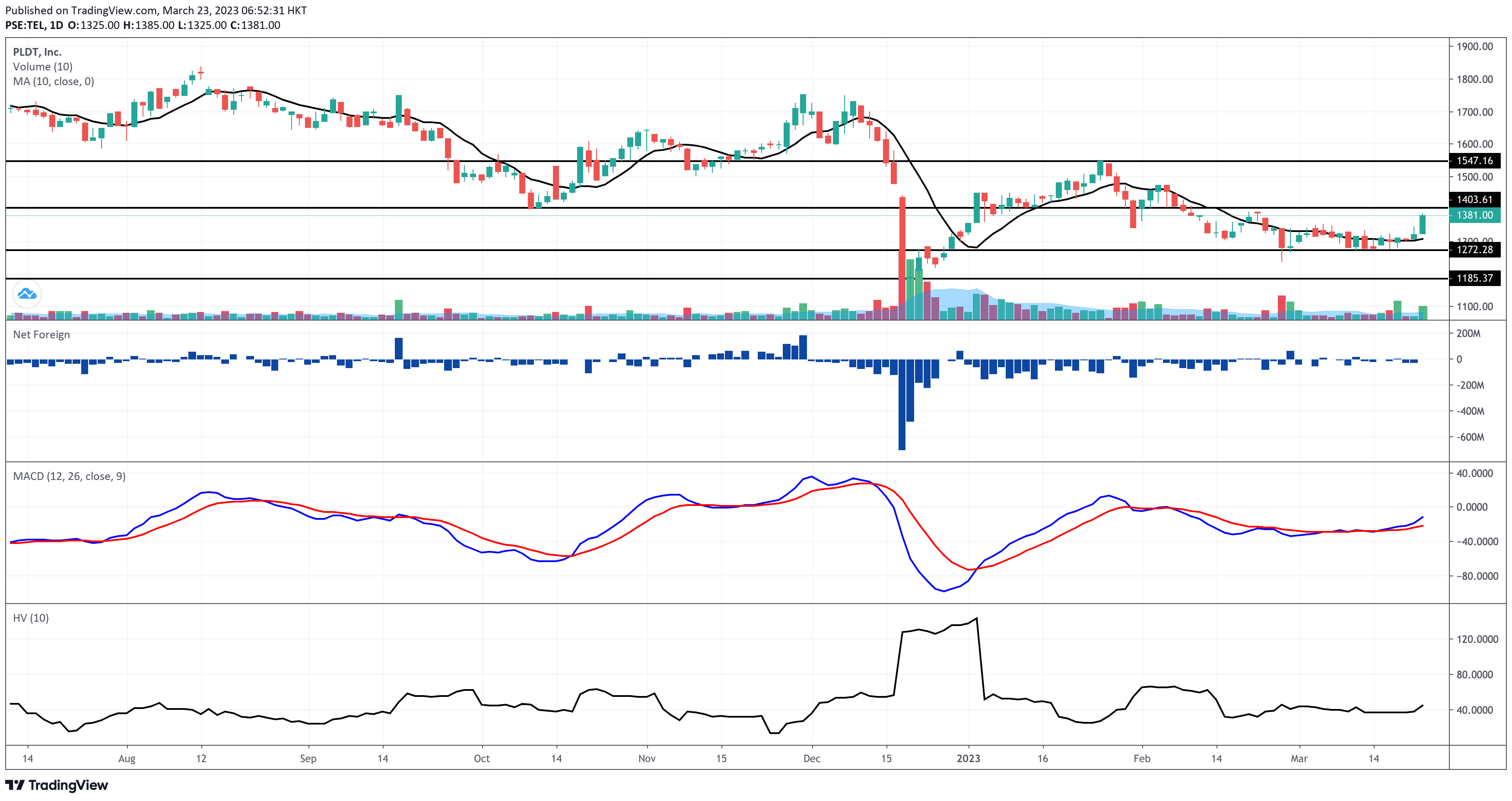

PLDT (PSE:TEL) closed at P1,381.00 per share, up by 4.46%, on March 22, 2023, Wednesday.

TEL’s immediate support sits near P1,272.00, while its immediate resistance is parked near P1,403.00. As of Wednesday’s closing, TEL is closer to its immediate resistance than its support. If and when the resistance is broken, I’m looking at P1,547.00 as the next resistance. But if TEL retracts from here and breaks below its immediate support, P1,185.00 will act as the next support.

The price increase was supported by a volume that’s higher than TEL’s 10-day volume average. If the price increase is supported by a volume at least above 50% of the stock’s 10-day volume average, I say that the intraday bullishness is more likely to continue. It’s just a matter of monitoring whether or not the traders and investors have the appetite to break the resistance or bounce away from it.

TEL continues to inch away from its 10-day simple moving average, indicating that the stock is bullish in the short term.

Despite engulfing last Tuesday’s ascent, the foreign investors were not impressed. The foreign fundies registered a Net Foreign Selling worth P116.4 million. This is not the first time deep-pocketed foreign investors have exhibited a distaste for TEL. They are net sellers year-to-date.

Meanwhile, TEL’s moving average convergence divergence (MACD) line continues northwardly. I see no formation of a bearish convergence on its MACD’s histogram.

The risk level of TEL remains low as it maintains a 10-day historical volatility score lower than 50%. However, this does not mean you can blindly enter a position on this stock. My risk level analysis is about the erraticity of the stock.

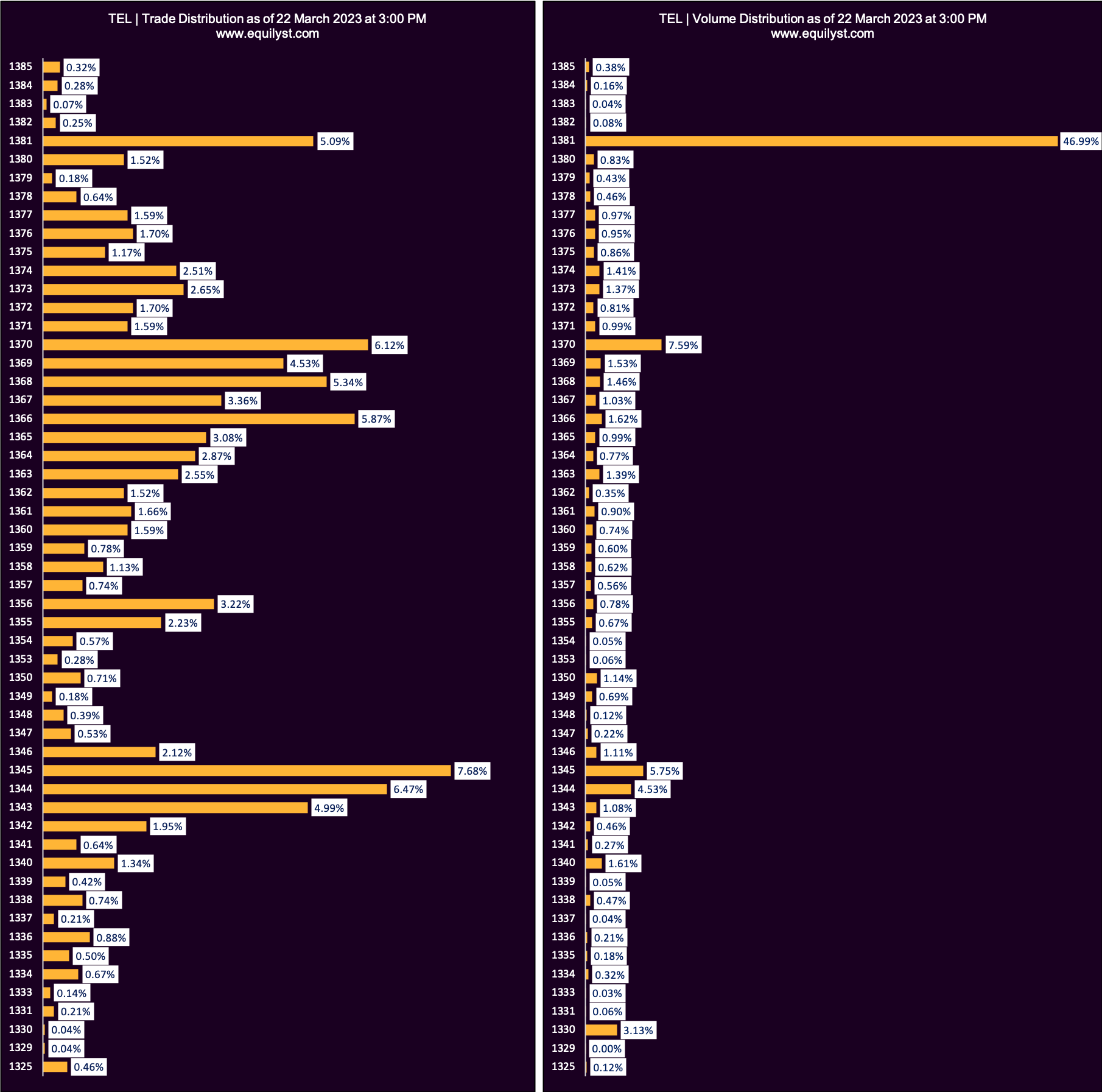

Dominant Range Index

Dominant Range Index: BULLISH

Last Price: 1381

VWAP: 1,368.68

Dominant Range: 1345 – 1381

Keep an eye on P1,381.00, the price that bagged the biggest volume and a relatively high number of trades on Wednesday. If TEL starts on Thursday lower than P1,381.00, note the bias of the dominant range. If the dominant range is closer to the intraday low than the intraday high, the descent in price is likely to continue. But if the dominant range remains closer to the intraday high than the intraday low, the current price will likely hustle above P1,381.00.

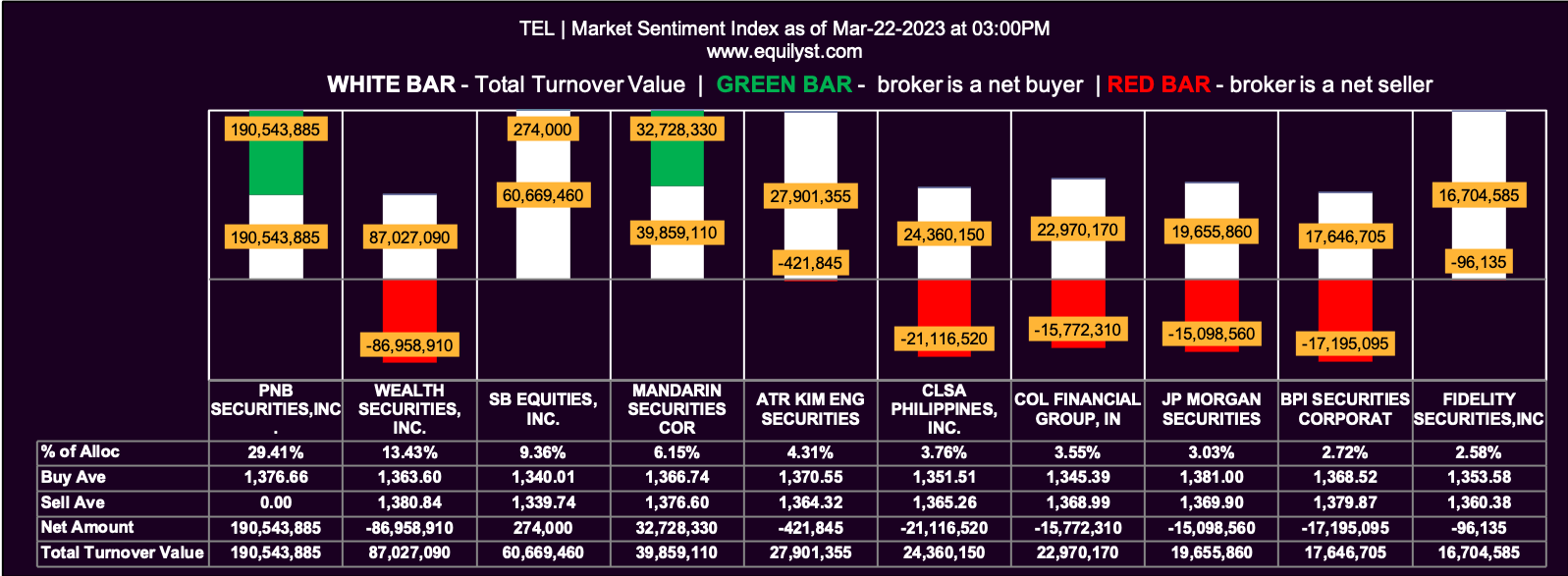

Market Sentiment Index

Market Sentiment Index: BEARISH

9 of the 61 participating brokers, or 14.75% of all participants, registered a positive Net Amount

9 of the 61 participating brokers, or 14.75% of all participants, registered a higher Buying Average than Selling Average

61 Participating Brokers’ Buying Average: ₱1358.31175

61 Participating Brokers’ Selling Average: ₱1365.00765

3 out of 61 participants, or 4.92% of all participants, registered a 100% BUYING activity

30 out of 61 participants, or 49.18% of all participants, registered a 100% SELLING activity

This contrarian sentiment of my Market Sentiment Index tames all the excitement. Did you see that nearly half of all trading participants on Wednesday were interested in nothing but selling? They pressed the “let’s lock in our profits or trim our losses by selling on strength” button.

When all indicators are in a yippee/yehey mode, and the Market Sentiment Index feels otherwise, you can’t help but tame your data-driven sentiment. Take risks but err on the side of caution. Do otherwise if your pocket is bottomless.

Verdict

Remember to watch your trailing stop if you already have a position on TEL with a green position. Do an upward adjustment whenever necessary. If you had a one-on-one workshop with me on my Evergreen Strategy When Trading and Investing in the Philippine Stock Market, remember when and how you should do an upward adjustment on your trailing stop. Top up if, and only if, all six indicators are bullish. Otherwise, save your buying power for later.

If you already have TEL but are in the red, it’s all the more that you should keep an eye on your trailing stop. Avoid buying the dips if there’s no confirmed buy signal from my Evergreen Strategy. Why buy the dips if and when the downtrend is more likely to continue? If that doesn’t make sense to you, I don’t know what will.

If you don’t have a position on TEL yet and you’re itching to do a test buy, check if my Evergreen Strategy gives you a confirmed buy signal. Remember all the lessons I taught you during our one-on-one workshop.

Need My Help?

I’ll teach you how to PRESERVE your capital, PROTECT your gains, and PREVENT unbearable losses through my Evergreen Strategy When Trading and Investing in the Philippine stock market.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025