How’s the Financial Report of PSE:TEL for the 1H2023?

PLDT (PSE:TEL) reported a nearly 10% increase in its net income during the first half of 2023. This growth was primarily driven by gains from tower sales and higher revenues in the home broadband and enterprise sectors.

Despite a challenging business environment, PSE:TEL experienced a decline in subscribers, going from 74.12 million at January 2023 to 70.68 million at the end of June 2023.

In the January-June period, reported net income reached P18.45 billion, marking a 9.95% increase compared to P16.78 billion in 2022.

Excluding the impact of asset sales and unit Voyager Innovations’ losses, core income reached P17.6 billion, up 3% from P17.11 billion. Notably, PLDT’s share in Voyager’s losses decreased to P1.2 billion from P1.6 billion in 2022.

Aligning with their dividend policy, which involves paying out 60% of core earnings, PSE:TEL’s board declared an interim dividend of P49 per share for shareholders on record as of Aug. 17, 2023. The dividend is set to be paid out on Sept. 1, 2023.

This means every single PSE:TEL share you have BEFORE the Ex-Div Date is qualified for the cash dividend.

Consolidated earnings before interest, taxes, depreciation, and amortization (EBITDA) saw a 3% growth, rising to P52.1 billion from P50.5 billion in 2022. This was attributed to higher revenues and reduced operating expenses.

Service revenues in the first half increased by 1% to P94.5 billion, driven by improvements in the home and enterprise segments and positive trends in the individual mobile business. The data and broadband segments contributed significantly, accounting for 82% of consolidated service revenue and reaching P77.5 billion with a 4% growth.

During the first half, the firm’s capital expenditures (capex) totaled P40.8 billion, reflecting an 11% decrease from 2022. This move came after PSE:TEL disclosed a budget overrun in December 2022, leading to a commitment to cut capex.

As of the end of the first half, consolidated net debt stood at P253.3 billion, with gross debt at P270.3 billion. PSE:TEL stated that the maturities were well spread out.

Looking ahead, PSE:TEL foresees low single-digit growth in both service revenues and EBITDA. The consolidated EBITDA is expected to surpass the P100-billion mark for 2023.

For 2023, PSE:TEL aims for a core income of P33.5 to P34 billion and a capex range of P80 to P87 billion.

In a statement, company chairman Manuel Pangilinan emphasized the importance of innovation and continuous improvement to thrive in a challenging growth-focused industry. He cited the maxim “if it ain’t broke, don’t fix it” but stressed the need to avoid blindly following it.

Referring to the book ‘Legacy’ by James Kerr, Pangilinan pointed out that moments of being on top demand change, including exiting partnerships, personnel changes, tactical adjustments, and strategy recalibrations. He believes PSE:TEL is on the verge of such a leap and must adopt a mindset of continuous improvement in all endeavors to achieve ongoing and greater success.

Pangilinan highlighted the significance of anticipating growth prospects and quoted Wayne Gretzky, who said, “A good hockey player plays where the puck is. A great hockey player plays where the puck is going to be.”

How Did PSE:TEL Perform Last Friday?

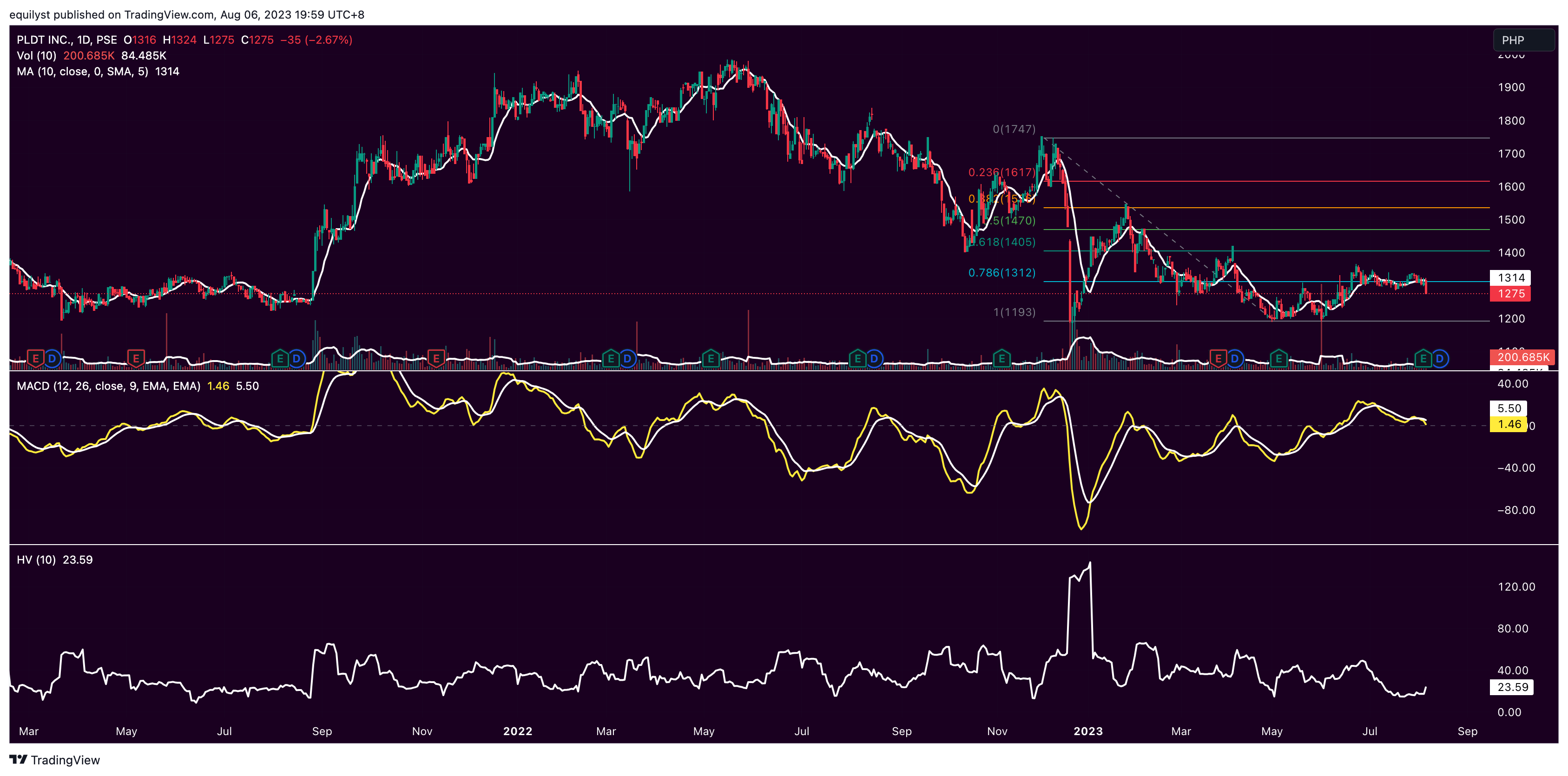

PSE:TEL dove below its 10-day simple moving average (SMA) on Friday at P1,275.00 per share, down 2.67%.

Resistance is at P1,312, confluent with 78.6% Fibonacci retracement, while support is at P1,200.

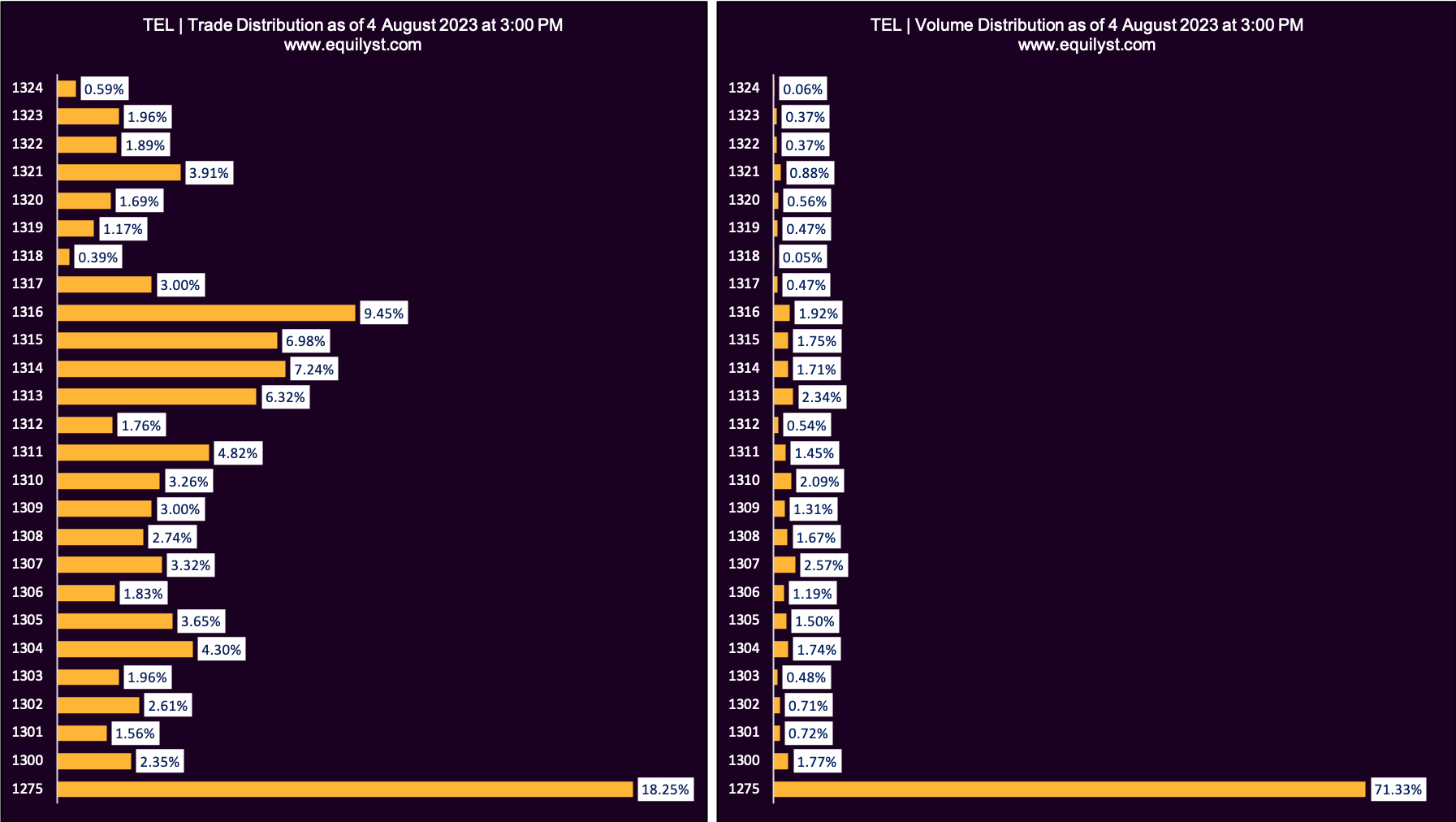

Last Friday’s bearish price action came with a bearish volume that is greater than 100% of its 10-day volume average. That means sellers really had a huge appetite for selling. This is so evident on PSE:TEL’s volume-weighted average price of P1,285.05 that is higher than its closing price.

PSE:TEL’s dominant range of P1,275 is closer to its intraday low than the intraday high, which led to a bearish Dominant Range Index. This means the downtrend is likely to continue.

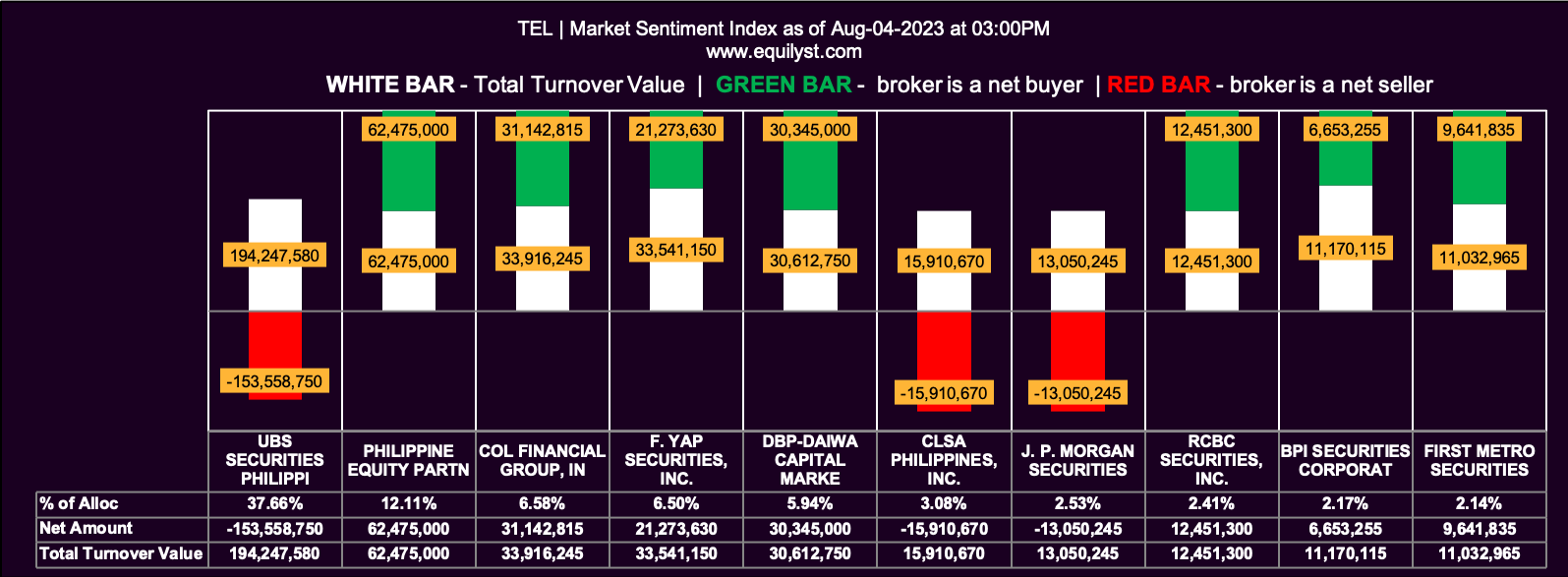

Meanwhile, new entrants or dividend players seemed to have bought the nearly 3% dip last Friday since nearly 76% of the 58 trade participants registered a a positive net amount and almost 64% of them printed a higher buying than selling average. Cumulatively speaking, about 53% of the trade participants had confidently registered a 100% buying activity on PSE:TEL.

The bearish component I see on the statistics generated by my Market Sentiment Index indicator is that all 58 trade participants registered a cumulative selling average of P1,301.47 while their buying average is only P1,295.35. Overall, that’s a bullish Market Sentiment Index.

My proprietary Market Sentiment Index indicator is not a trend forecaster but an interpreter of the past and prevailing market sentiment.

Wrapping It Altogether

Some new entrants loved the dips last Friday. Is that a bad thing? No, as long as the trader did that in alignment with his trade or investment strategy. The bad thing is if you bought the stock but you were as clueless as Blue’s Clues on your exit strategy. If your analysis tells you that PSE:TEL is likely to rebound somewhere before it hits your trailing stop, then, it’s up to you if you’d like to play this name on Monday.

As far as my methodology is concerned, I won’t enter a new position on PSE:TEL yet because the downtrend is likely to continue. I prefer to see signs of selling exhaustions first. Also, I want to see a bullish Dominant Range Index and Market Sentiment Index. It would also give me a boost of confidence to trade the name if the price regains its position above its 10-day SMA and if the moving average convergence divergence (MACD) crosses above the signal line.

How about you? Feel free to share your data-driven overall sentiment in the comments.

For the meantime, follow the social media accounts of Equilyst Analytics so you’ll be updated when I publish an update.

Need Help on How to Decide Based on your Risk Tolerance?

Optimize your stock portfolio for maximum returns with our Stock Portfolio Rehabilitation Program.

Become a TITANIUM client to gain knowledge on capital preservation, protecting gains, and minimizing losses while trading and investing in the Philippine stock market.

Become a PLATINUM client to receive comprehensive technical analysis and personalized recommendations based on your entry price, average cost, investment goals, and risk tolerance.

Become a GOLD client to engage in teleconsultations with our team while trading occurs, providing real-time guidance over the phone.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025