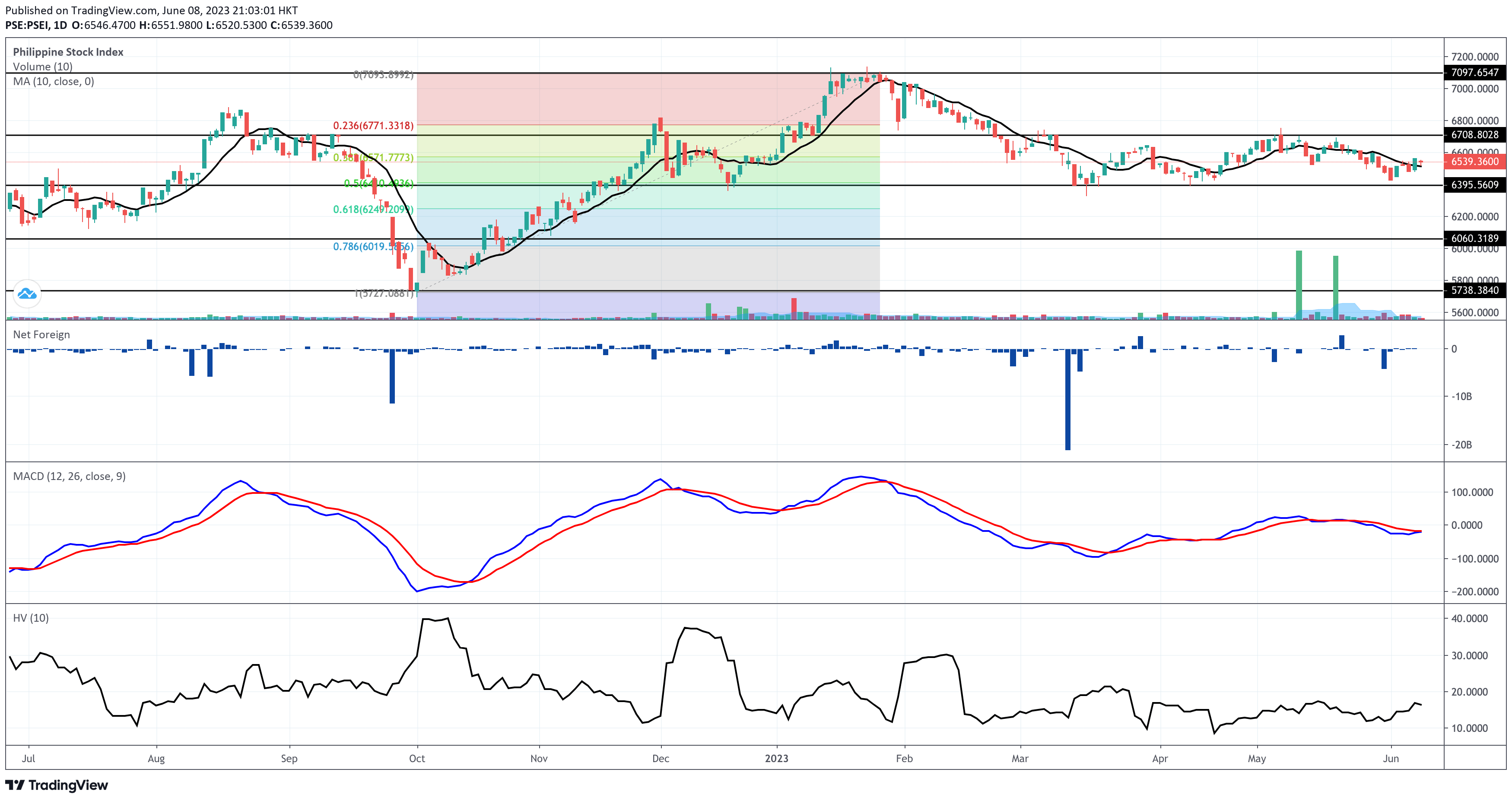

The Philippine Stock Exchange Index (PSEi) closed on June 8, 2023 at 6,539.36, down by 25.34 points or 0.39%.

The main index printed a total turnover value worth P3.39 billion, which is relatively small due to its low volume, below 50% of its 10-day volume average.

Sixty percent of that turnover value came from foreign investors. The foreign investors registered a net foreign selling worth P420 million. They are net sellers year-to-date. The monthly Net Foreign Buying month it registered was April 2023 (and it didn’t even reach half a billion pesos).

The market breadth is seen at 1.52 in favor of the losers.

All sub-indices are painted in red, with the Properties and Mining and Oil sectors as the biggest losers at 0.67% and 0.55%, respectively.

The top-traded stocks are BPI, BDO, AC, MBT, and URC, while the most active stocks are AC, URC, SMPH, BPI, and BDO.

On the other hand, the five worst losers are SFI, EEI, SGI, PHR, and ALCO, while the 5 top gainers are CEI, GERI, DELM, IDC, and MA.

The immediate support level is near 6,400, aligned with the 50% retracement of the Fibonacci. On the other hand, the immediate resistance is near 6,700, which is very close to the 6,780 where the 38.2% retracement of the Fibonacci is plotted.

It’s been almost four months since the main bellwether index has traded within the support-resistance range.

Even though the last candlestick of the PSEi is moving above its 10-day simple moving average, know that the index has been moving sideways for nearly four months already.

Where will the PSEi Go from here?

Suppose the lack of domestic or international positive catalysts continues. In that case, I won’t be surprised if the main index continues to move in a wobbly fashion between the support and resistance bond I mentioned above.

Stay tuned to the following channels of Equilyst Analytics for more updates:

- Analysis & News

- YouTube

- Facebook Page

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025