By classical interpretation, a stock with an RSI score of 30 and below is considered oversold, while a stock with an RSI score of 70 and above is overbought. Read the article below to know more about the Relative Strength Index (RSI) indicator.

READ: Relative Strength Index (RSI): Finding Overbought and Oversold Stocks

In this article, I’ll show you the dominant prices and market sentiment ratings of bluechip stocks that are regarded oversold based on their RSI score.

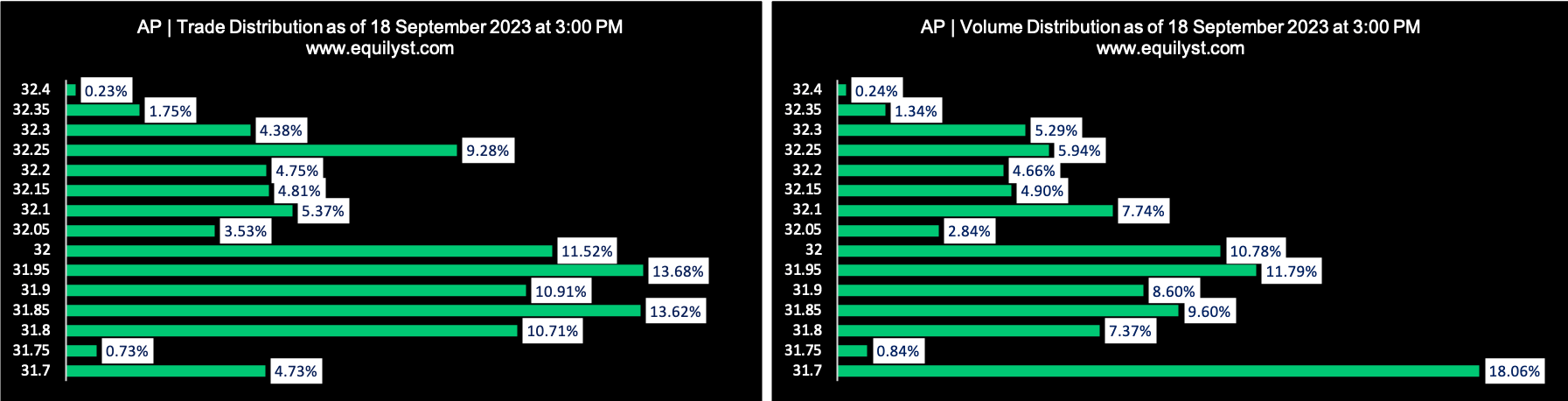

Aboitiz Power Corporation (AP): RSI Score – 25%

Dominant Range Index: BEARISH

Last Price: 31.7

VWAP: 31.96

Dominant Range: 31.7 – 31.95

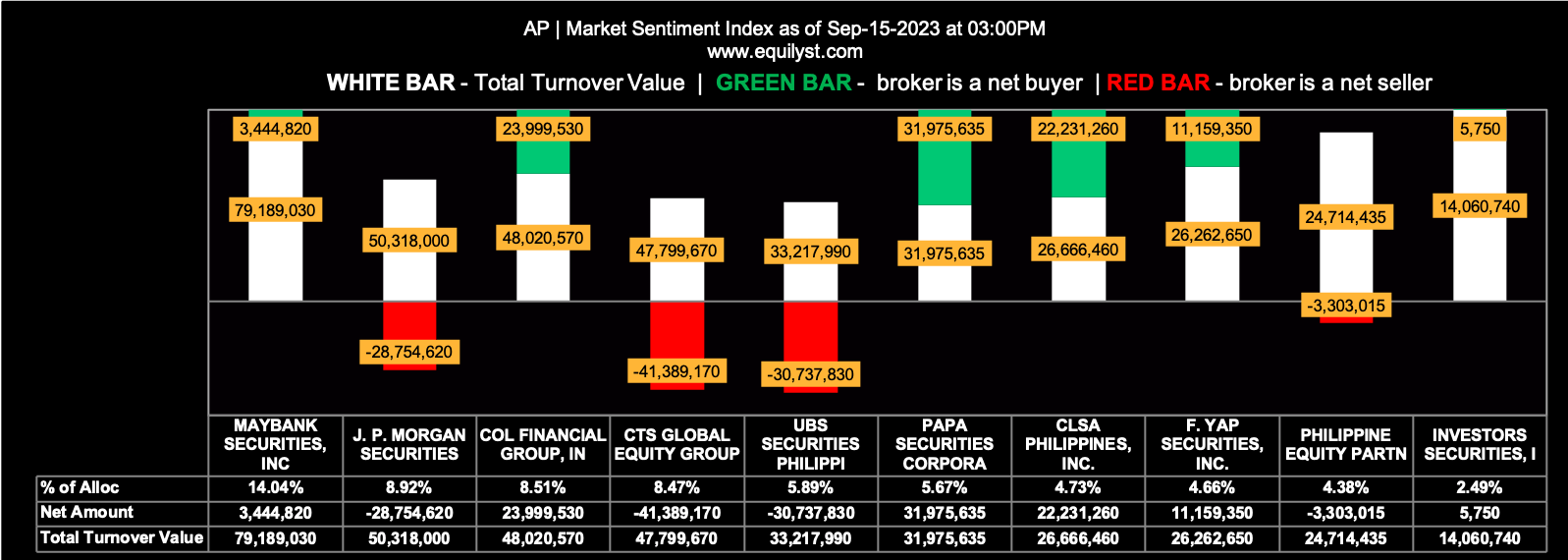

Market Sentiment Index: BULLISH

43 of the 68 participating brokers, or 63.24% of all participants, registered a positive Net Amount

38 of the 68 participating brokers, or 55.88% of all participants, registered a higher Buying Average than Selling Average

68 Participating Brokers’ Buying Average: ₱31.99001

68 Participating Brokers’ Selling Average: ₱32.00716

20 out of 68 participants, or 29.41% of all participants, registered a 100% BUYING activity

15 out of 68 participants, or 22.06% of all participants, registered a 100% SELLING activity

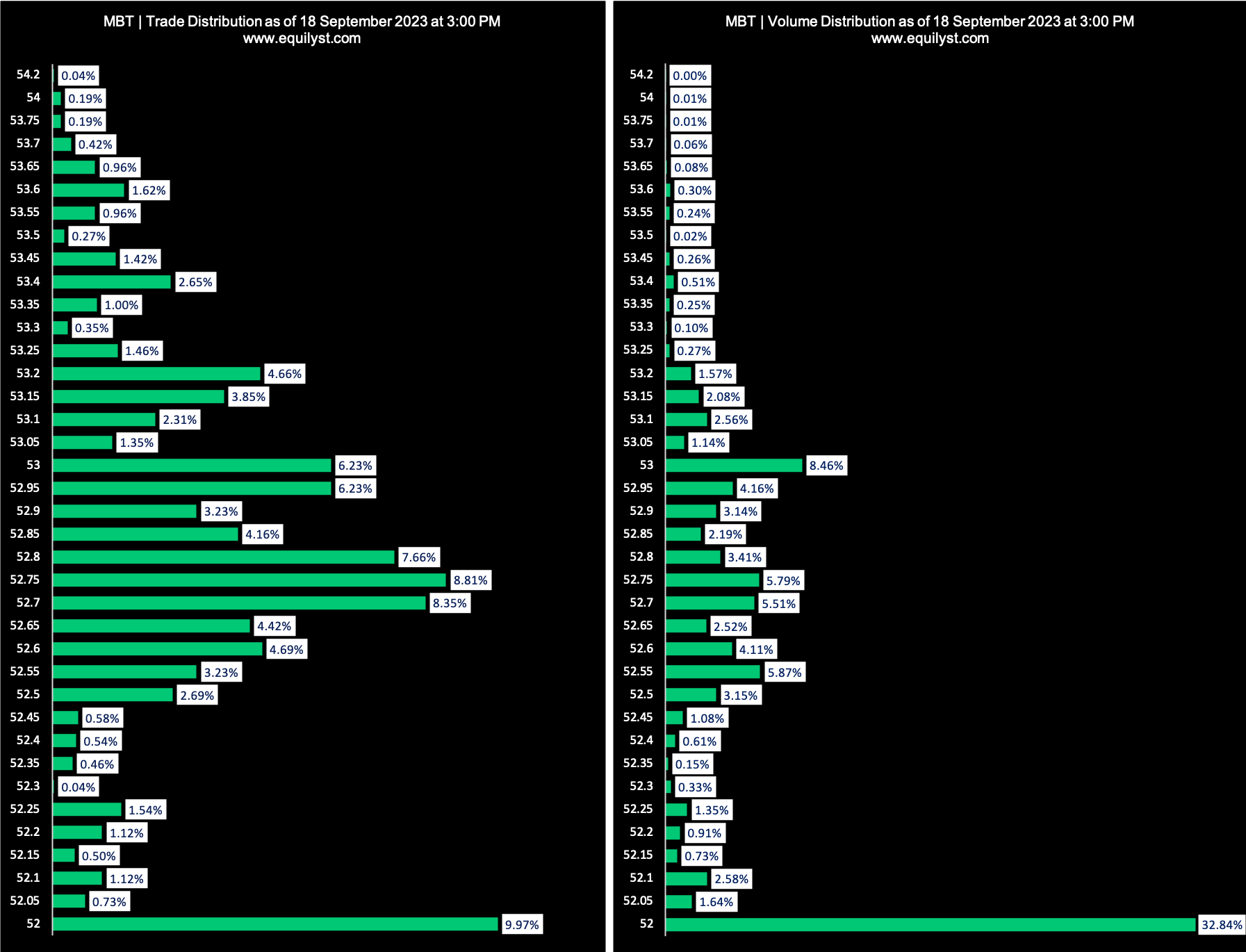

Metropolitan Bank & Trust Company (MBT): RSI Score – 27%

Dominant Range Index: BEARISH

Last Price: 52

VWAP: 52.50

Dominant Range: 52 – 52

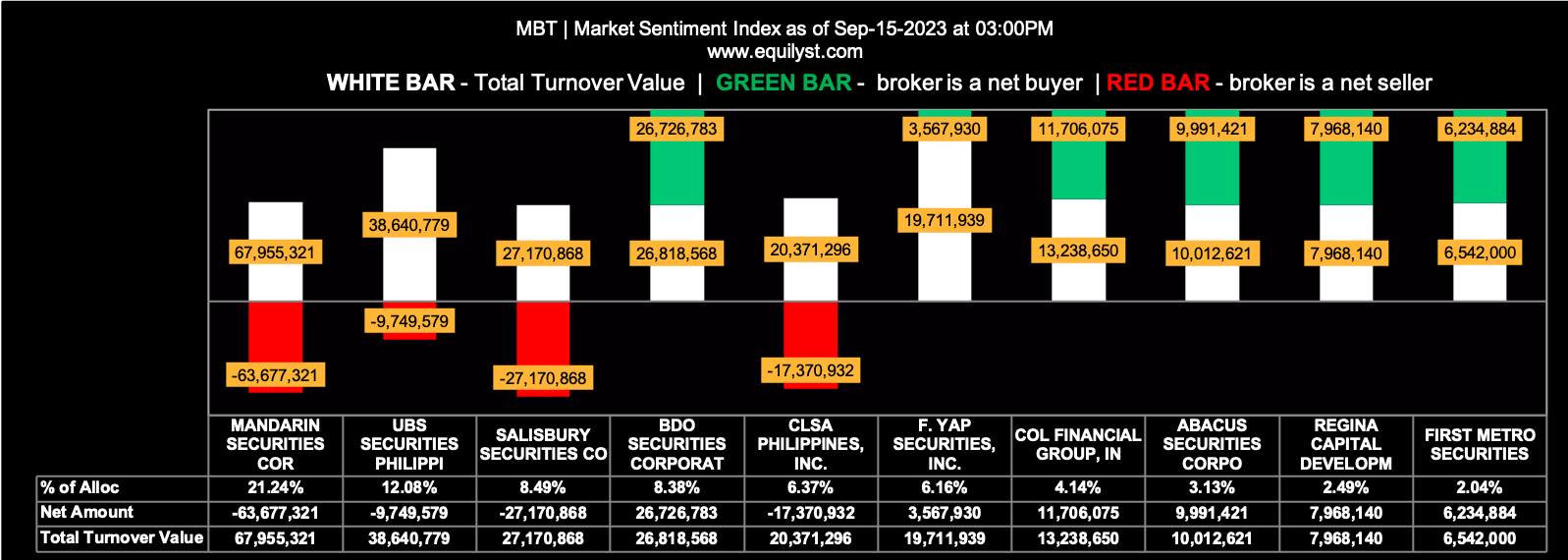

Market Sentiment Index: BULLISH

50 of the 59 participating brokers, or 84.75% of all participants, registered a positive Net Amount

40 of the 59 participating brokers, or 67.80% of all participants, registered a higher Buying Average than Selling Average

59 Participating Brokers’ Buying Average: ₱52.52677

59 Participating Brokers’ Selling Average: ₱52.81038

36 out of 59 participants, or 61.02% of all participants, registered a 100% BUYING activity

1 out of 59 participants, or 1.69% of all participants, registered a 100% SELLING activity

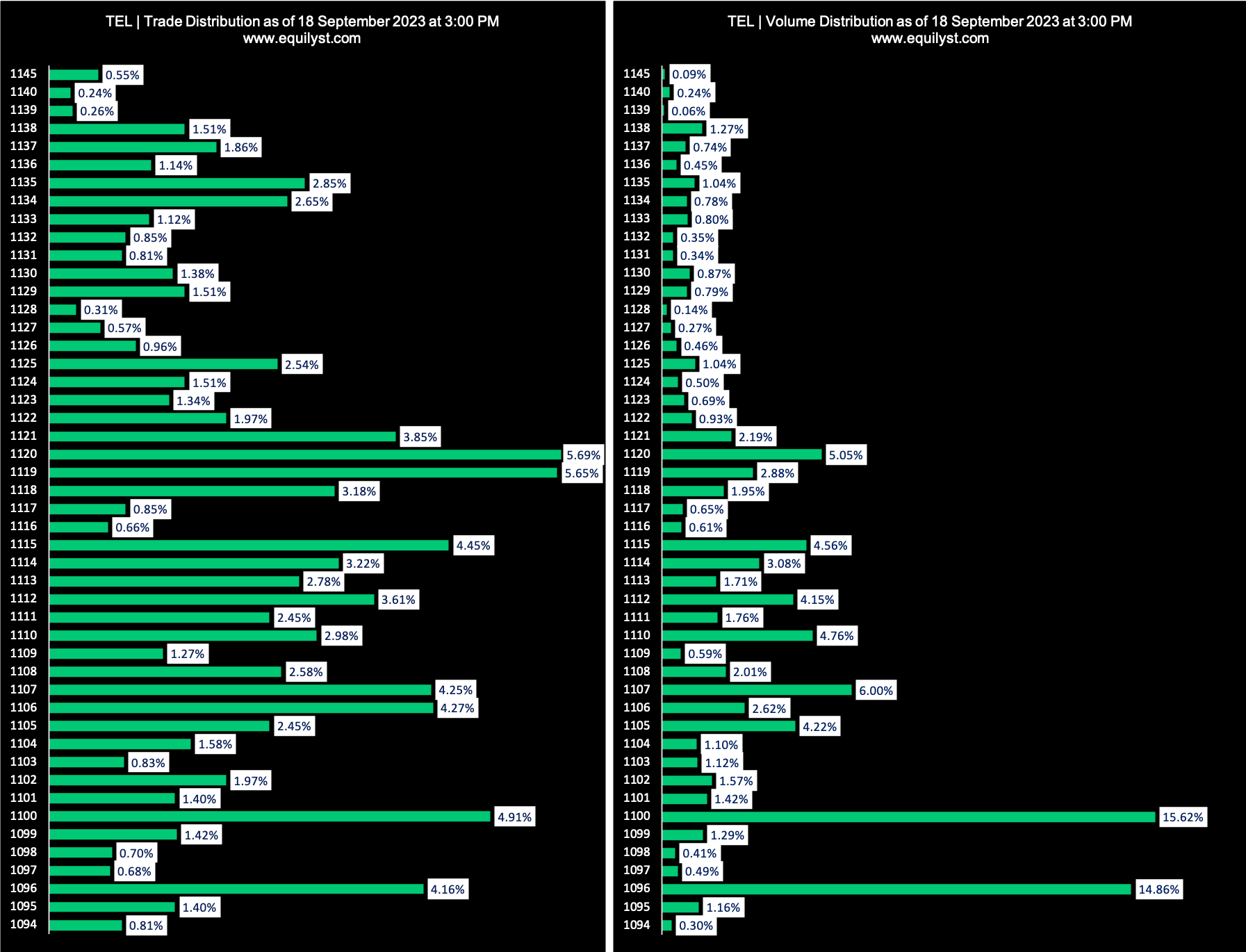

PLDT (TEL): RSI Score – 27%

Dominant Range Index: BEARISH

Last Price: 1096

VWAP: 1,109.16

Dominant Range: 1100 – 1120

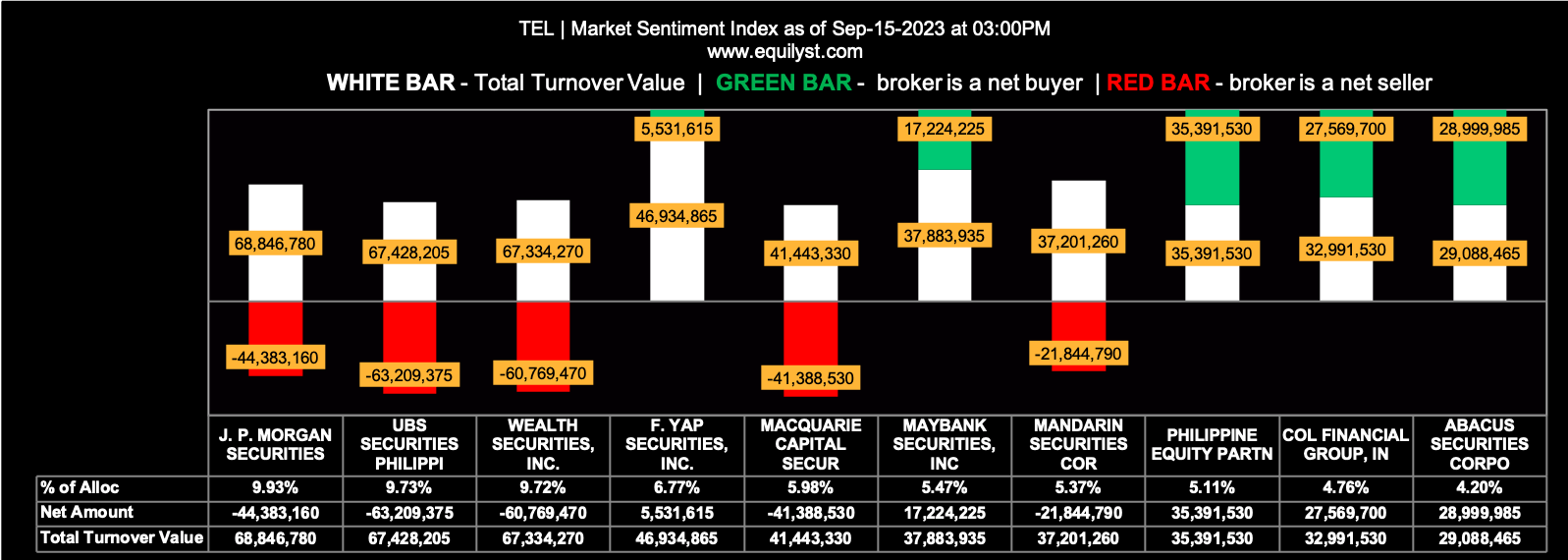

Market Sentiment Index: BULLISH

62 of the 74 participating brokers, or 83.78% of all participants, registered a positive Net Amount

54 of the 74 participating brokers, or 72.97% of all participants, registered a higher Buying Average than Selling Average

74 Participating Brokers’ Buying Average: ₱1111.78790

74 Participating Brokers’ Selling Average: ₱1115.69017

45 out of 74 participants, or 60.81% of all participants, registered a 100% BUYING activity

3 out of 74 participants, or 4.05% of all participants, registered a 100% SELLING activity

Which of These Stocks Do You Already Have?

What’s your decision now that you’ve known this information? Let me know in the comments.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025