Nickel Asia Corp. (NIKL) Profited P1.7 Billion for H1 2023, Declined 55% YoY

Nickel Asia Corp. (NIKL) – a company specializing in developing natural resources – unveiled its unaudited financial and operational outcomes for the half-year concluding on June 30, 2023.

Throughout this period, the company documented a net income attributed to it (after considering minority interest) of P1.7 billion, which indicated a 55 percent decrease from P3.8 billion on a year-to-year basis.

NIKL’s net income (after considering minority interest) of P1.8 billion, excluding its stake in the Coral Bay and Taganito high-pressure acid leach (HPAL) ventures, experienced a 33 percent decline from P2.7 billion year-on-year. This reduction was attributed to diminished nickel ore prices, driven by the growing nickel production in Indonesia and the deceleration of the Chinese economy. The combined losses of the HPAL plants resulted from the lower prices of nickel and cobalt compared to the previous year.

Similarly, revenues dwindled by 8 percent, amounting to P10.9 billion in contrast to the P11.8 billion achieved during the corresponding phase of the prior year. The operational mines sold 7.52 million wet metric tons (WMT) of nickel ore, marking an 8 percent improvement from the preceding year.

The firm exported 3.66 million WMT of saprolite and limonite ore, achieving an average price of $28.22/WMT during this period, in contrast to 3.12 million WMT at $42.05/WMT from the previous year.

Moreover, the company supplied 3.86 million WMT of limonite ore to the Coral Bay and Taganito HPAL facilities, yielding an average price of $10.13 per pound of payable nickel in the year’s first half. This compares with 3.83 million WMT at $12.52 per pound of payable nickel during the same period of the previous year.

As a result, the average nickel ore sales price experienced a 26 percent contraction to $22.32/WMT from the previous year’s $30.03/WMT. The firm achieved P55.33 per US dollar from nickel ore sales, representing a 5-percent increase from P52.56 year-on-year.

The group’s consolidated Earnings before interest, taxes, depreciation, and amortization (EBITDA) totaled P4.79 billion, displaying a 25.7-percent descent from the analogous phase last year. NIKL experienced a loss from its combined stake in the two HPAL plants, amounting to P77.4 million, compared to the previous year’s profit of P1.1 billion.

According to Martin Antonio G. Zamora, President and CEO, the second quarter might have signaled this year’s nadir of nickel ore prices. China’s recent commitments to enhance its economy are anticipated to positively impact its economic landscape, augmenting the demand for Indonesia’s expanding nickel supply. The robust electric vehicle (EV) adoption trend remains steadfast. Furthermore, global governmental policies favor the EV sector, assuring consistent long-term support for the nickel industry.

Jobin-SQM Inc. (JSI), a subsidiary of Emerging Power, Inc. (EPI), bolstered its electricity generation by 54 percent, reaching 76,375-megawatt hours, while revenue surged by 81 percent to P390.6 million. This progress occurred after operating at 100-MWp since incorporating an additional 38-MWp in July 2022. JSI is presently constructing a supplementary 72-MWp solar farm in the existing Sta. Rita site, projected to commence operations by the fourth quarter of 2023.

Healthy revenues buoyed JSI’s EBITDA margin to 85 percent, with EBITDA rising by 86 percent to P330.8 million compared to last year. The Company also witnessed a 19-percent increase in net income, reaching P56.5 million, compared to P47.6 million the previous year.

Furthermore, EPI is currently involved in preliminary activities for its second long-term lease agreement with the Subic Bay Metropolitan Authority, laying the groundwork for the commencement of constructing a 145-MWp solar plant in early 2024.

Additionally, Greenlight Renewables Holdings, Inc., EPI’s collaboration with Shell Overseas Investments B.V., has initiated the construction of its inaugural project located in Leyte for the initial phase of a 120-MWp solar plant during the third quarter of 2023.

Technical Analysis: NIKL Up 2.40% for H1 2023, Down 13.87% YTD

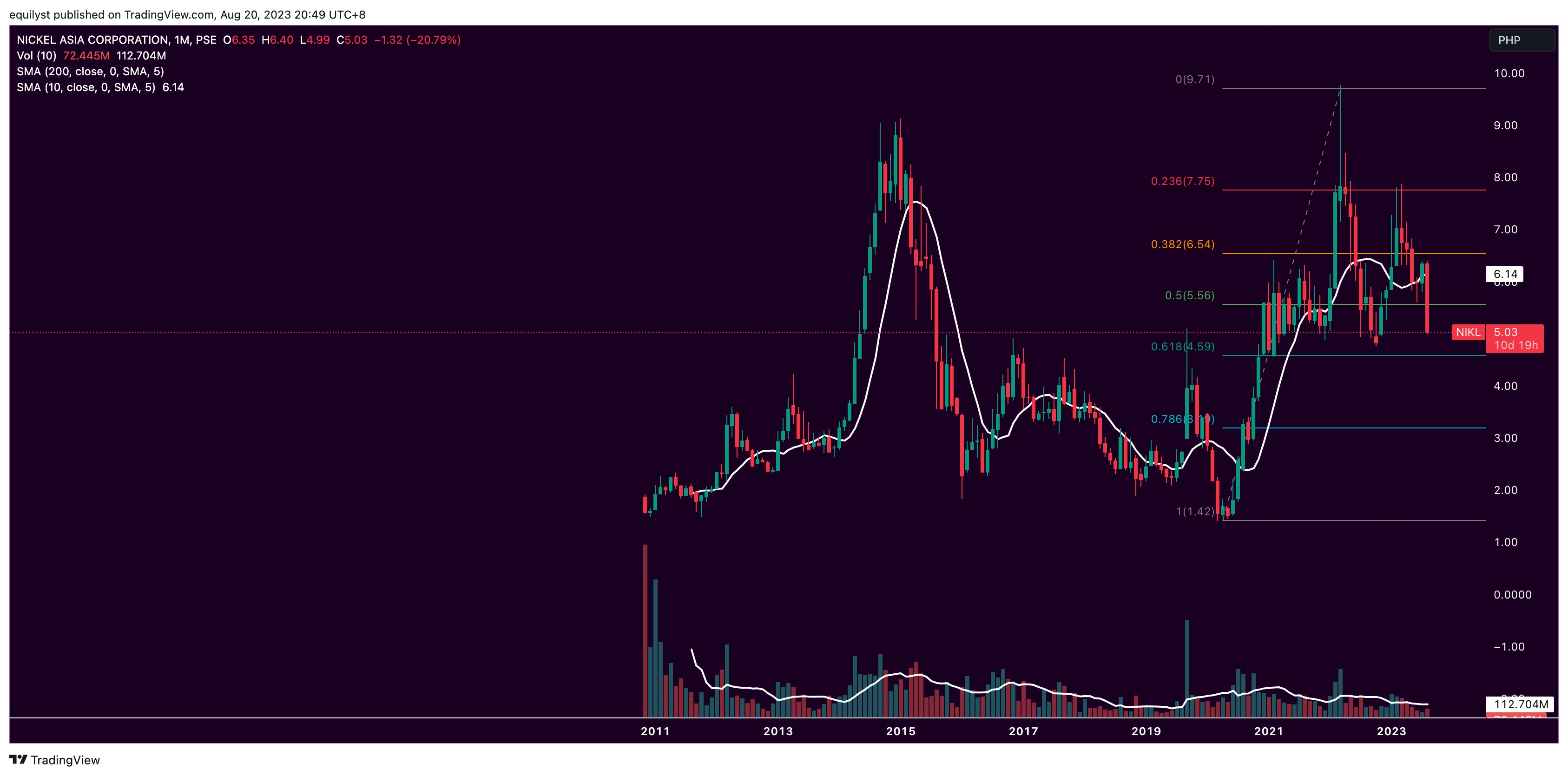

Nickel Asia Corp.’s (NIKL) stock price surged by 2.40% in the first half of 2023 from its closing price of P5.84 on December 29, 2022, to its last price of P5.98 on June 30, 2023. However, Nickel Asia Corp. (NIKL) is down 13.87% year-to-date to its current price of P5.03.

On the daily chart, Nickel Asia Corp. (NIKL) is both bearish in the short-term (10 SMA) and long-term (200 SMA) periods, as its last price of P5.03 is below the said moving averages.

On the monthly chart you see above, Nickel Asia Corp. (NIKL) is on its way to testing the strength of its support at P4.60, aligned with the golden ratio (61.8%) of the Fibonacci retracement. The acting immediate resistance is P6.60, which lies at 50% of the Fibonacci retracement.

While the bearish volume on August 18 is no longer as towering as the daily volumes from August 10 to 17, I still recommend that you keep an eye on the price action of Nickel Asia Corp. (NIKL) on Tuesday, August 22.

While the volume on August 18 was less than 50% of Nickel Asia Corp’s (NIKL) 10-day volume average, that is not yet a clear tell-tale sign of selling exhaustion.

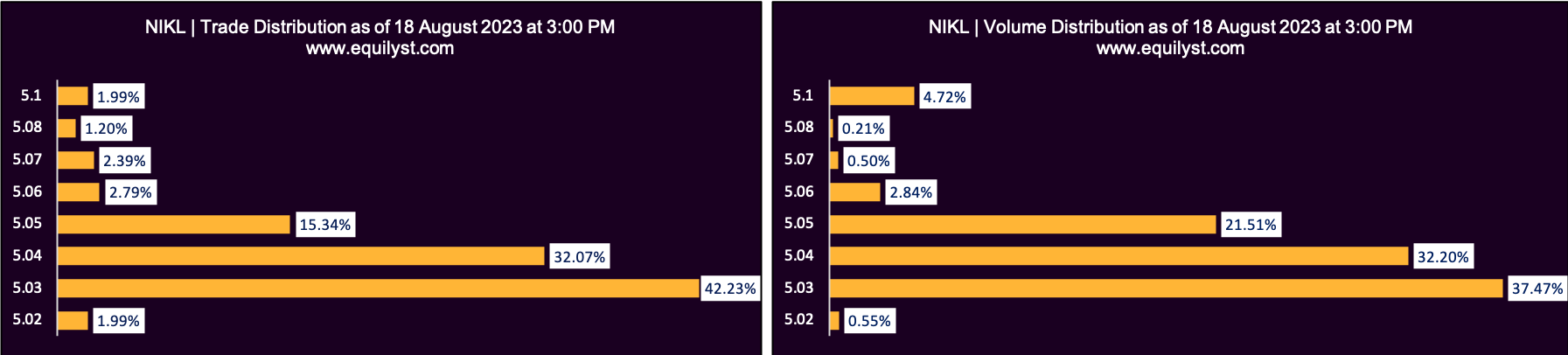

The volume-weighted average price (VWAP) of P5.04 on August 18 favored the bears of Nickel Asia Corp. (NIKL).

Add to the points of the bears the dominant range of P5.03 to P5.05, which is closer to the intraday low than the intraday high.

Those stats gave Nickel Asia Corp. (NIKL) a bearish Dominant Range Index rating.

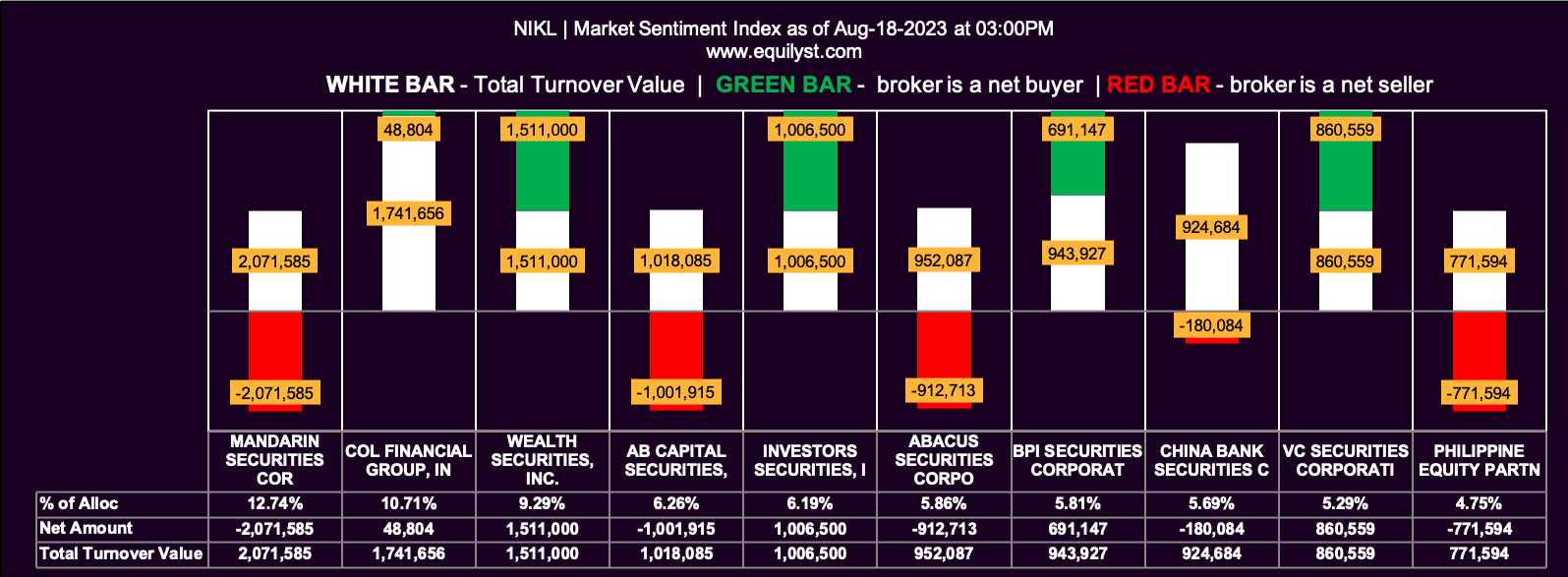

On the contrary, 62.96% of the 27 brokers that traded Nickel Asia Corp. (NIKL) on August 18 registered a positive net amount. Additionally, 59.26% of them recorded a higher buying average than their selling average.

Additionally, 33.33% of the participating brokers made a 100% buying activity, while only 22.22% made a 100% selling activity. I will consider those values insignificant since they’re less than 50%.

Meanwhile, the 27 brokers’ selling average of P5.045 is higher than their buying average of P5.042, negating some of the bullish points I mentioned above.

Nickel Asia Corp. (NIKL) gets a bullish Market Sentiment Index rating. This bullish Market Sentiment Index on August 18 is likely driven by new entrants and those who averaged down on Nickel Asia Corp. (NIKL).

NIKL: Price Forecast for August 22 to 25

My overall sentiment for Nickel Asia Corp. (NIKL) is bearish.

Watch out for its price action within the first 30 minutes of trading on Tuesday, August 22. If the price retreats below P4.90, Nickel Asia Corp. (NIKL) is likely to drive south near P4.60.

When your trailing stop gets hit, decide whether to trim your losses or sell everything simultaneously. After all, your trailing stop represents your bearable risk. There’s no point in computing your trailing stop if you’re going to pretend like it doesn’t exist when it’s hit.

How do you know if selling in tranches is logical if your trailing stop gets hit?

There’s no universal rule regarding how many tranches you should divide your total holdings.

I don’t bother splitting my holdings for a particular stock into X tranches if it’s less than 20% of my entire portfolio’s value.

It doesn’t mean you should do the same, however. The newer you are in stock investing, the more conservative you are. I know because that was my investment psychology more than a decade ago.

The probability is high that Nickel Asia Corp. (NIKL) might draw closer to P4.60 before the end of the next trading week.

But all probabilities, regardless of percentage, are subject to change when sentiments change.

Only fools would remain loyal to their past analysis even if the prevailing price action paints the exact opposite of the old synthesis.

Finally, feel free to use my reward-to-risk ratio calculator, support and resistance calculator, trailing stop calculator, trading fees calculator, and more in the CALCULATORS section.

If your portfolio is more than P1 million and you want to avail of my stock market consultancy service, please fill out this form.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025