Market Sentiment Score of the 14 MSCI Philippines Stocks

Read “MSCI Philippines: Which Philippine Stocks Are In It?” if you’re not familiar with what the MSCI Philippines is.

I found some free time this weekend to share what I know about the month-to-date market sentiment of the 14 stocks that compose the MSCI Philippines.

I’m going to use my proprietary Market Sentiment Index indicator to measure these stocks’ MTD market sentiment. Don’t look for this indicator on your broker’s charting tool. You won’t find it because it’s my own creation. It’s not available on any broker’s platform.

I created this Market Sentiment Index indicator to have a data-driven basis for measuring the strength of the buying and selling confidence of the brokers who actually traded the stock.

The objective method of temp-checking market’s sentiment toward any stock is by means of synthesizing the transactions of those who actually traded the name and not by asking Jane and John Does opinions on social media platforms. Facebook-born commentaries like “to the moon” and “piso ang usapan dyan mga ‘dre” are only entertaining for those who have a single-digit IQ.

Rant’s over. Let’s get started with what you’re here for!

How Do I Use Market Sentiment Index for Decision-Making?

My Market Sentiment Index indicator can have either a bearish or a bullish rating. No neutral.

My interpretation of its rating is always relative to the investor’s intent.

I’ll give you some situation-based examples.

Suppose the Market Sentiment Index rating is bullish. If my trailing stop is intact, its my top-up schedule, and the other indicators of my strategy are bullish, a bullish Market Sentiment Index acts as the confirmation of my methodology’s go signal to top up (average down or average up).

Another scenario: If the share price goes down, but my trailing stop remains intact, the bullish Market Sentiment Index gives me a data-driven reason to hold my position and not to pre-empt my trailing stop.

Another scenario: When the stock nears its support and the bullish Market Sentiment Index persists, it provides data-backed confidence in a potential rebound, as investors are buying dips with assurance against breaking below that level.

Let’s reverse the situation.

Suppose the Market Sentiment Index is bearish. If the share price has been going down for two or more trading days and its Market Sentiment Index is bearish each day, then, pre-empting my trailing stop becomes a more attractive option.

Another scenario: It’s my top-up schedule today. However, the prevailing Market Sentiment Index of my stock is bearish. I will postpone my top-up plan because a bearish Market Sentiment Index means the downtrend is likely to continue. It’s against my Law of Common Sense to buy when my data-driven method says the downtrend is likely to continue.

Another scenario: The stock registers a green day change after long periods of being in the red, but the Market Sentiment Index is bearish. That intraday bullishness could just be a dead cat bounce (temporary surge).

My Market Sentiment Index is not a single-dimensional oscillator like the RSI, where the stock is considered oversold when the score is 20 or lower, and overbought when the score is 80 or higher.

Obviously, I cannot exhaust every single possible scenario in this report. I have no plan to write an e-book this Saturday morning! If you want to pick my brains, avail yourself of my crypto and stock investment consulting service.

Here are the month-to-date (August 1 to 25) Market Sentiment Index charts and statistics for the 14 MSCI Philippines (EPHE) constituents:

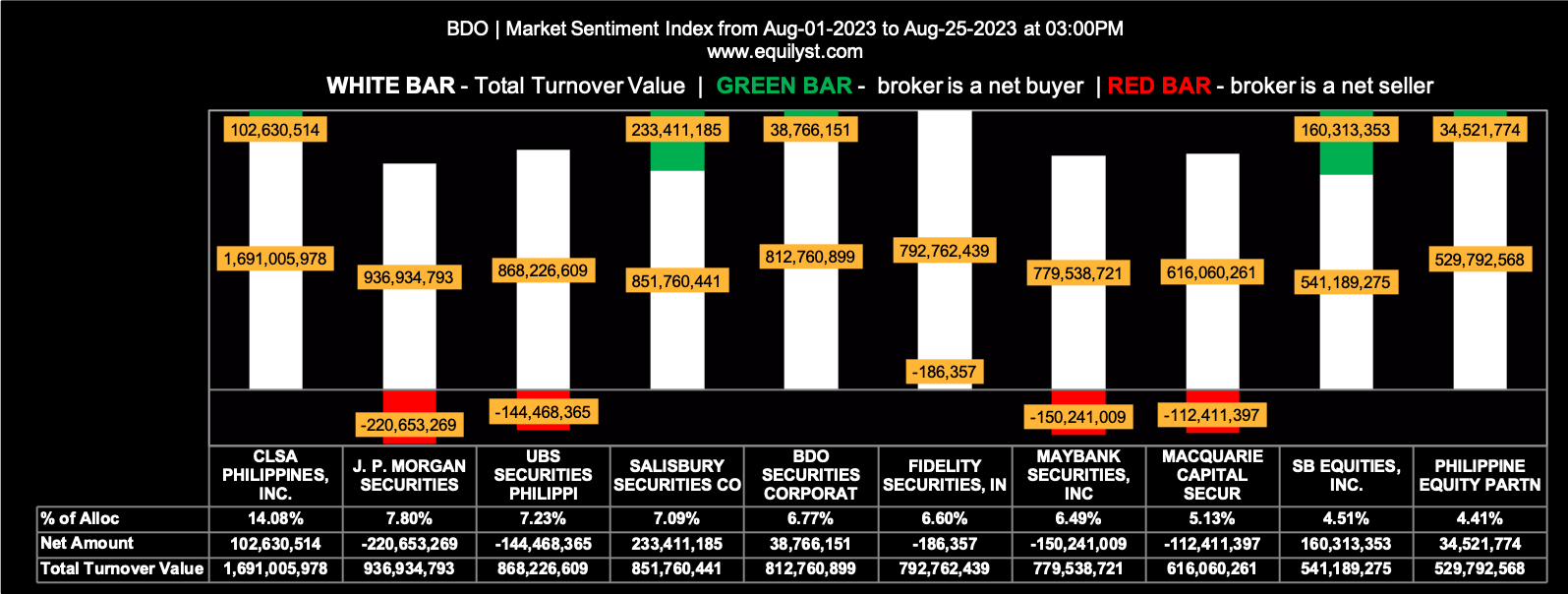

BDO Unibank (BDO)

Market Sentiment Index: BEARISH

48 of the 86 participating brokers, or 55.81% of all participants, registered a positive Net Amount

30 of the 86 participating brokers, or 34.88% of all participants, registered a higher Buying Average than Selling Average

86 Participating Brokers’ Buying Average: ₱141.35782

86 Participating Brokers’ Selling Average: ₱142.20374

9 out of 86 participants, or 10.47% of all participants, registered a 100% BUYING activity

8 out of 86 participants, or 9.30% of all participants, registered a 100% SELLING activity

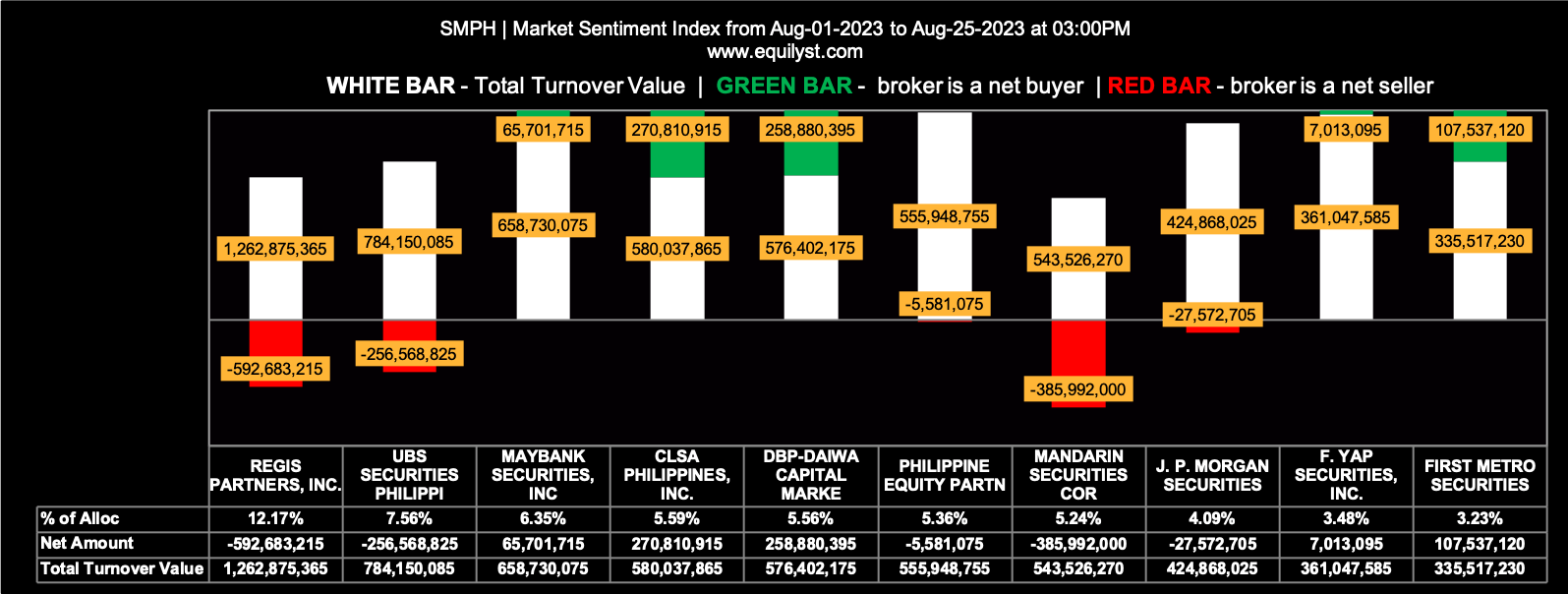

SM Prime Holdings (SMPH)

Market Sentiment Index: BEARISH

74 of the 94 participating brokers, or 78.72% of all participants, registered a positive Net Amount

44 of the 94 participating brokers, or 46.81% of all participants, registered a higher Buying Average than Selling Average

94 Participating Brokers’ Buying Average: ₱31.05016

94 Participating Brokers’ Selling Average: ₱31.41590

19 out of 94 participants, or 20.21% of all participants, registered a 100% BUYING activity

2 out of 94 participants, or 2.13% of all participants, registered a 100% SELLING activity

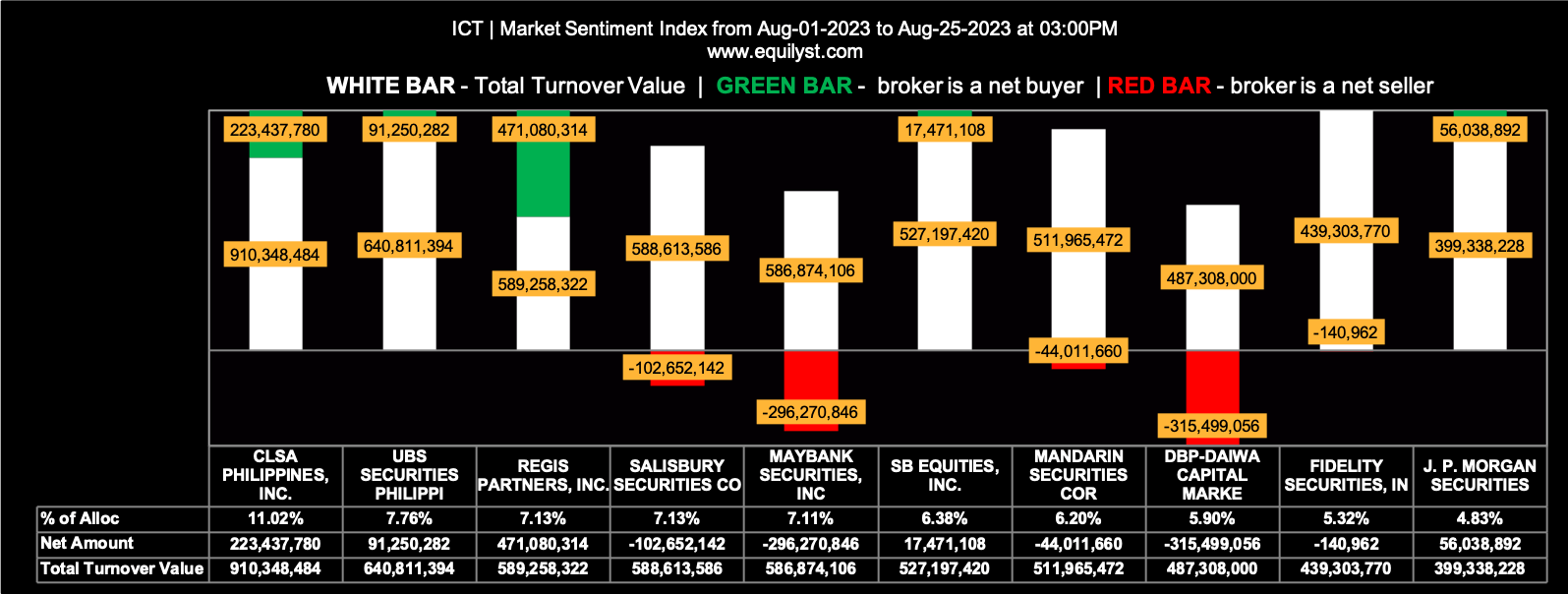

International Container Terminal Services (ICT)

Market Sentiment Index: BEARISH

32 of the 81 participating brokers, or 39.51% of all participants, registered a positive Net Amount

18 of the 81 participating brokers, or 22.22% of all participants, registered a higher Buying Average than Selling Average

81 Participating Brokers’ Buying Average: ₱206.96627

81 Participating Brokers’ Selling Average: ₱210.19104

5 out of 81 participants, or 6.17% of all participants, registered a 100% BUYING activity

15 out of 81 participants, or 18.52% of all participants, registered a 100% SELLING activity

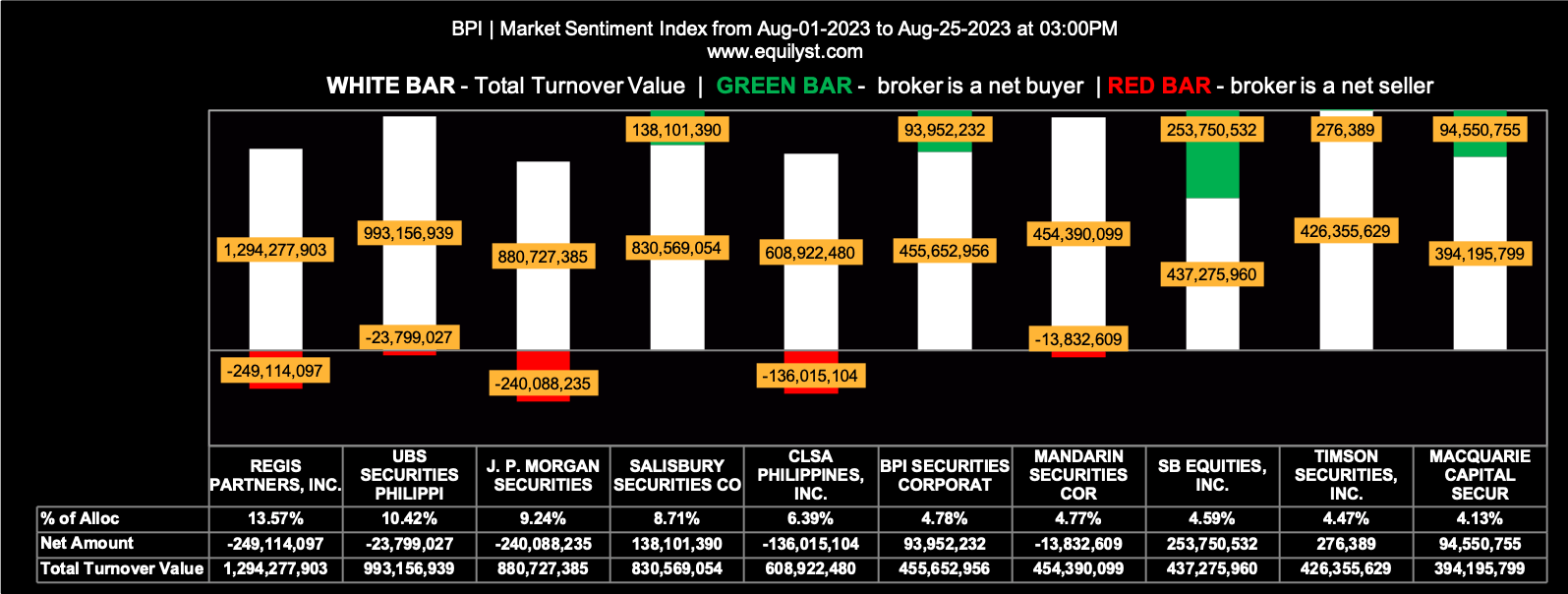

Bank of the Philippine Islands (BPI)

Market Sentiment Index: BEARISH

56 of the 86 participating brokers, or 65.12% of all participants, registered a positive Net Amount

26 of the 86 participating brokers, or 30.23% of all participants, registered a higher Buying Average than Selling Average

86 Participating Brokers’ Buying Average: ₱111.04700

86 Participating Brokers’ Selling Average: ₱113.62877

12 out of 86 participants, or 13.95% of all participants, registered a 100% BUYING activity

8 out of 86 participants, or 9.30% of all participants, registered a 100% SELLING activity

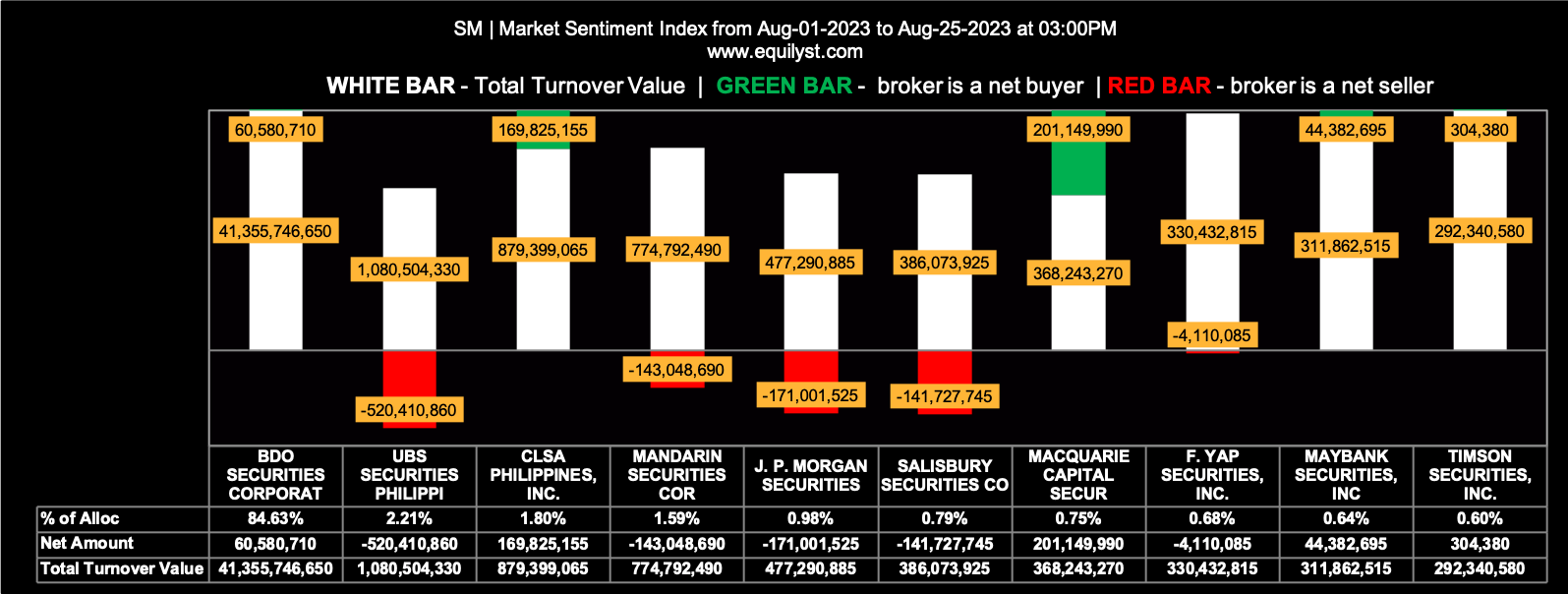

SM Investments (SM)

Market Sentiment Index: BULLISH

65 of the 83 participating brokers, or 78.31% of all participants, registered a positive Net Amount

44 of the 83 participating brokers, or 53.01% of all participants, registered a higher Buying Average than Selling Average

83 Participating Brokers’ Buying Average: ₱873.09704

83 Participating Brokers’ Selling Average: ₱878.04501

19 out of 83 participants, or 22.89% of all participants, registered a 100% BUYING activity

1 out of 83 participants, or 1.20% of all participants, registered a 100% SELLING activity

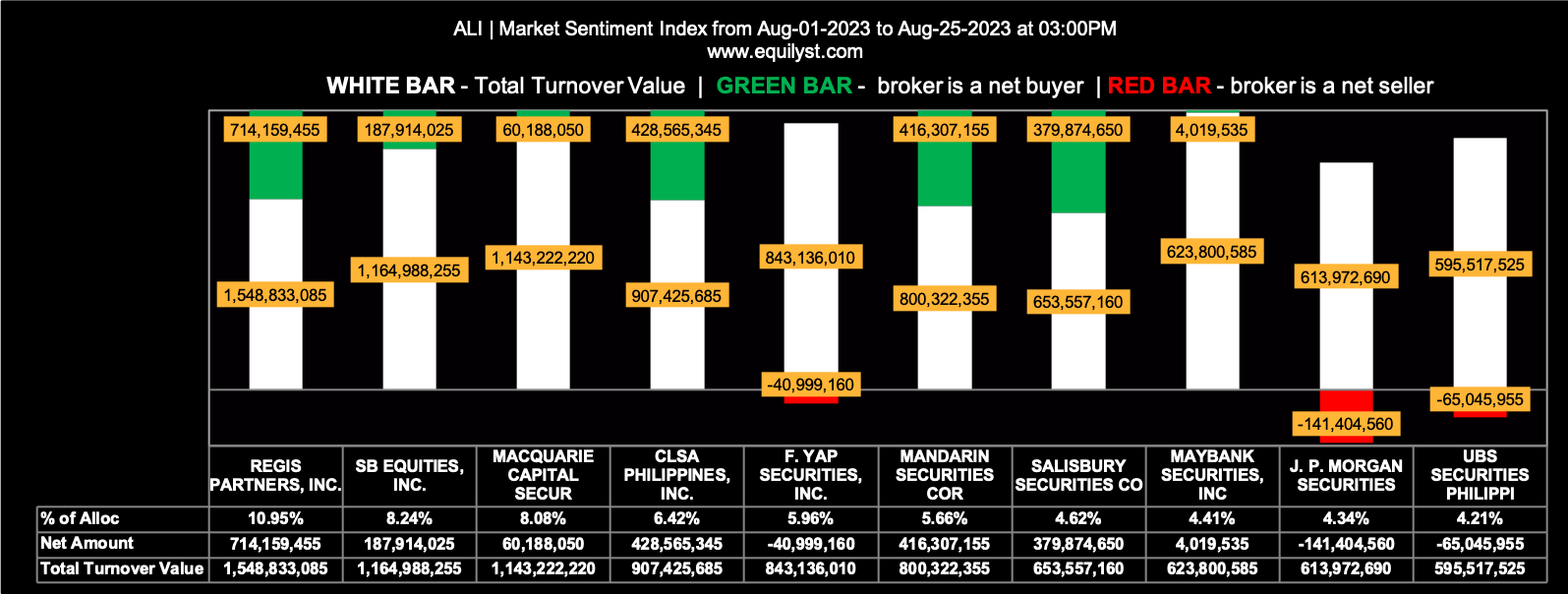

Ayala Land (ALI)

Market Sentiment Index: BEARISH

13 of the 106 participating brokers, or 12.26% of all participants, registered a positive Net Amount

25 of the 106 participating brokers, or 23.58% of all participants, registered a higher Buying Average than Selling Average

106 Participating Brokers’ Buying Average: ₱28.74850

106 Participating Brokers’ Selling Average: ₱29.00709

1 out of 106 participants, or 0.94% of all participants, registered a 100% BUYING activity

29 out of 106 participants, or 27.36% of all participants, registered a 100% SELLING activity

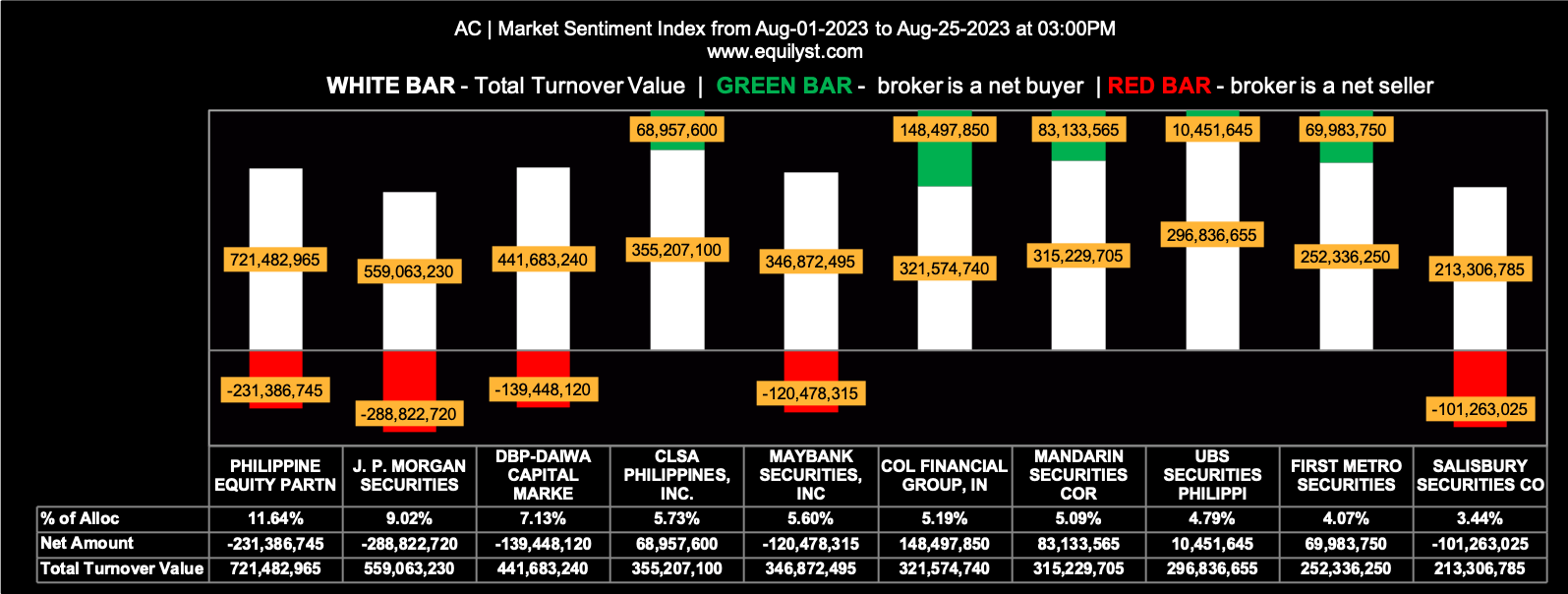

Ayala Corporation (AC)

Market Sentiment Index: BEARISH

68 of the 92 participating brokers, or 73.91% of all participants, registered a positive Net Amount

44 of the 92 participating brokers, or 47.83% of all participants, registered a higher Buying Average than Selling Average

92 Participating Brokers’ Buying Average: ₱602.98529

92 Participating Brokers’ Selling Average: ₱606.60880

19 out of 92 participants, or 20.65% of all participants, registered a 100% BUYING activity

2 out of 92 participants, or 2.17% of all participants, registered a 100% SELLING activity

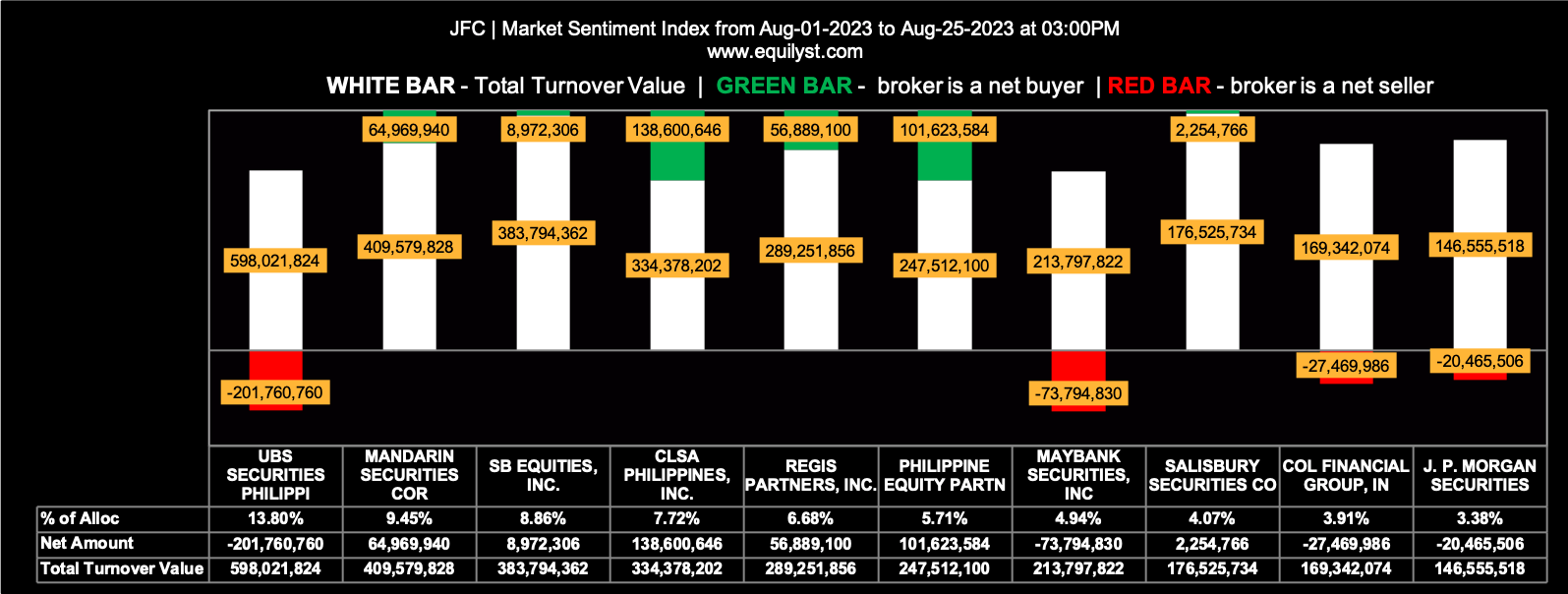

Jollibee Foods Corporation (JFC)

Market Sentiment Index: BEARISH

39 of the 81 participating brokers, or 48.15% of all participants, registered a positive Net Amount

26 of the 81 participating brokers, or 32.10% of all participants, registered a higher Buying Average than Selling Average

81 Participating Brokers’ Buying Average: ₱248.30695

81 Participating Brokers’ Selling Average: ₱251.73836

9 out of 81 participants, or 11.11% of all participants, registered a 100% BUYING activity

13 out of 81 participants, or 16.05% of all participants, registered a 100% SELLING activity

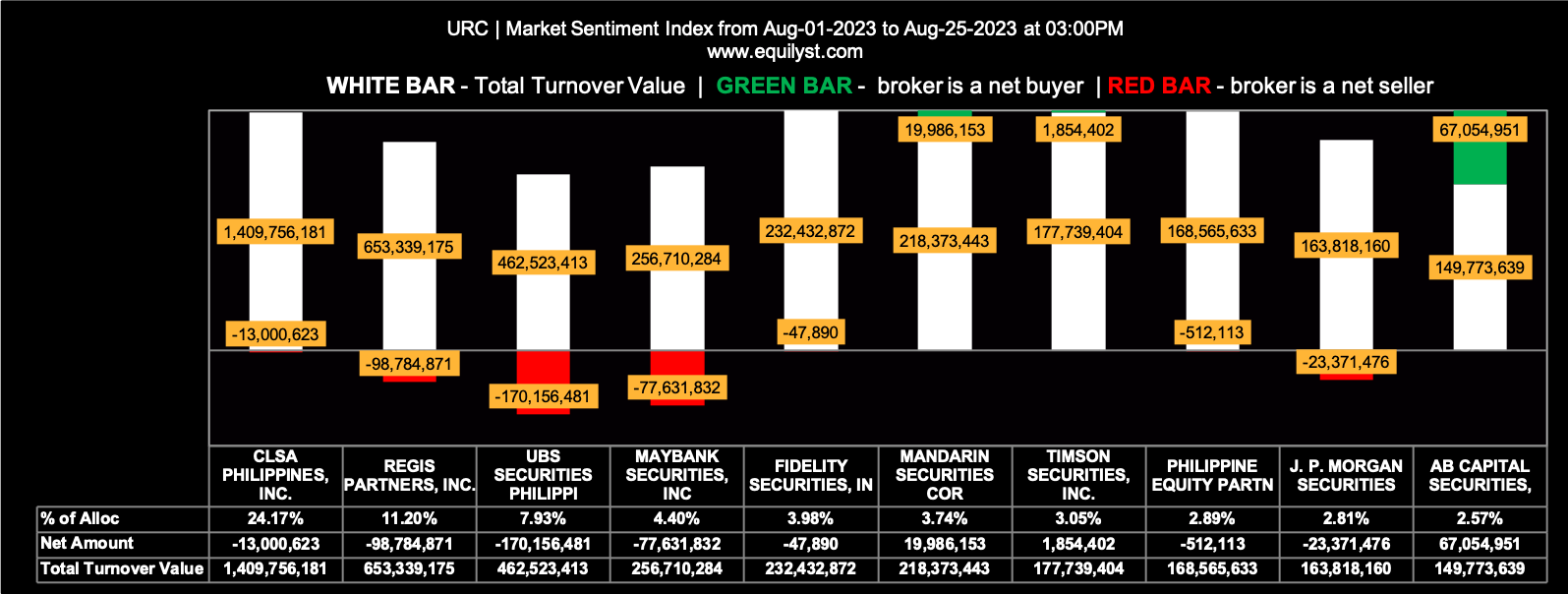

Universal Robina Corporation (URC)

Market Sentiment Index: BULLISH

63 of the 90 participating brokers, or 70.00% of all participants, registered a positive Net Amount

46 of the 90 participating brokers, or 51.11% of all participants, registered a higher Buying Average than Selling Average

90 Participating Brokers’ Buying Average: ₱119.07344

90 Participating Brokers’ Selling Average: ₱120.83322

25 out of 90 participants, or 27.78% of all participants, registered a 100% BUYING activity

2 out of 90 participants, or 2.22% of all participants, registered a 100% SELLING activity

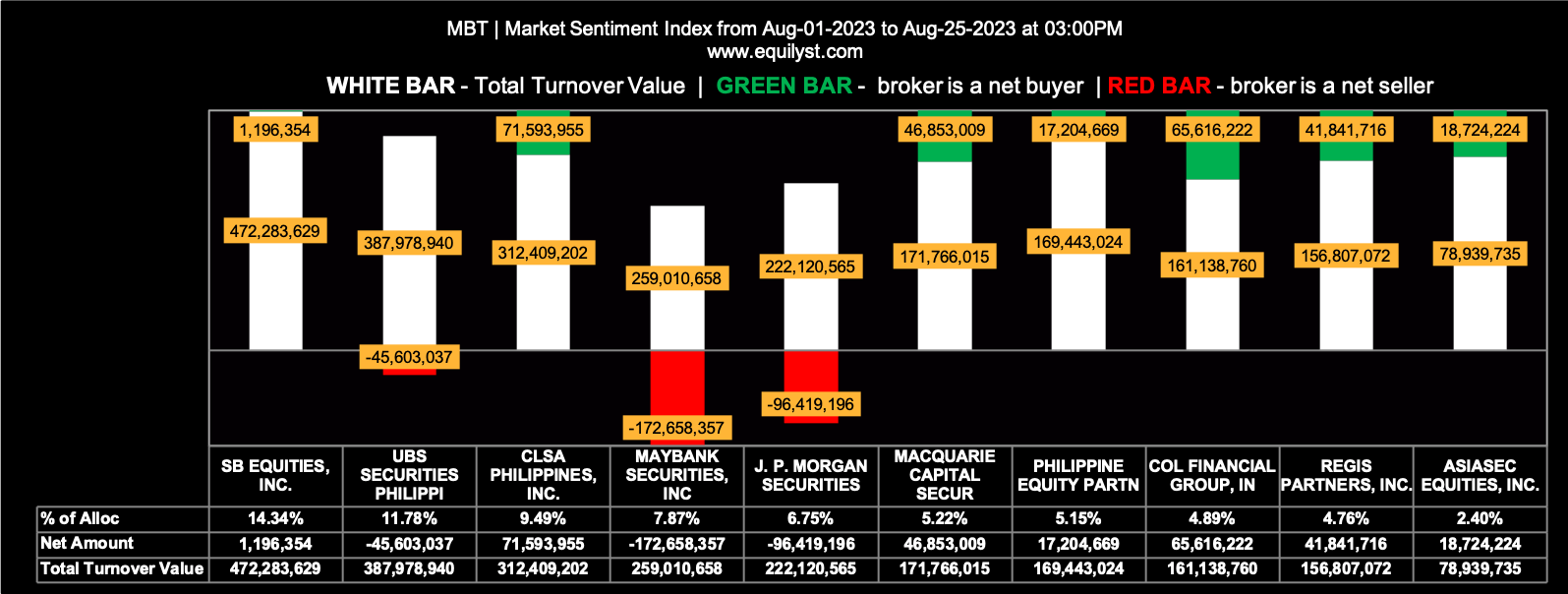

Metropolitan Bank and Trust (MBT)

Market Sentiment Index: BEARISH

58 of the 88 participating brokers, or 65.91% of all participants, registered a positive Net Amount

26 of the 88 participating brokers, or 29.55% of all participants, registered a higher Buying Average than Selling Average

88 Participating Brokers’ Buying Average: ₱55.98499

88 Participating Brokers’ Selling Average: ₱56.90722

12 out of 88 participants, or 13.64% of all participants, registered a 100% BUYING activity

8 out of 88 participants, or 9.09% of all participants, registered a 100% SELLING activity

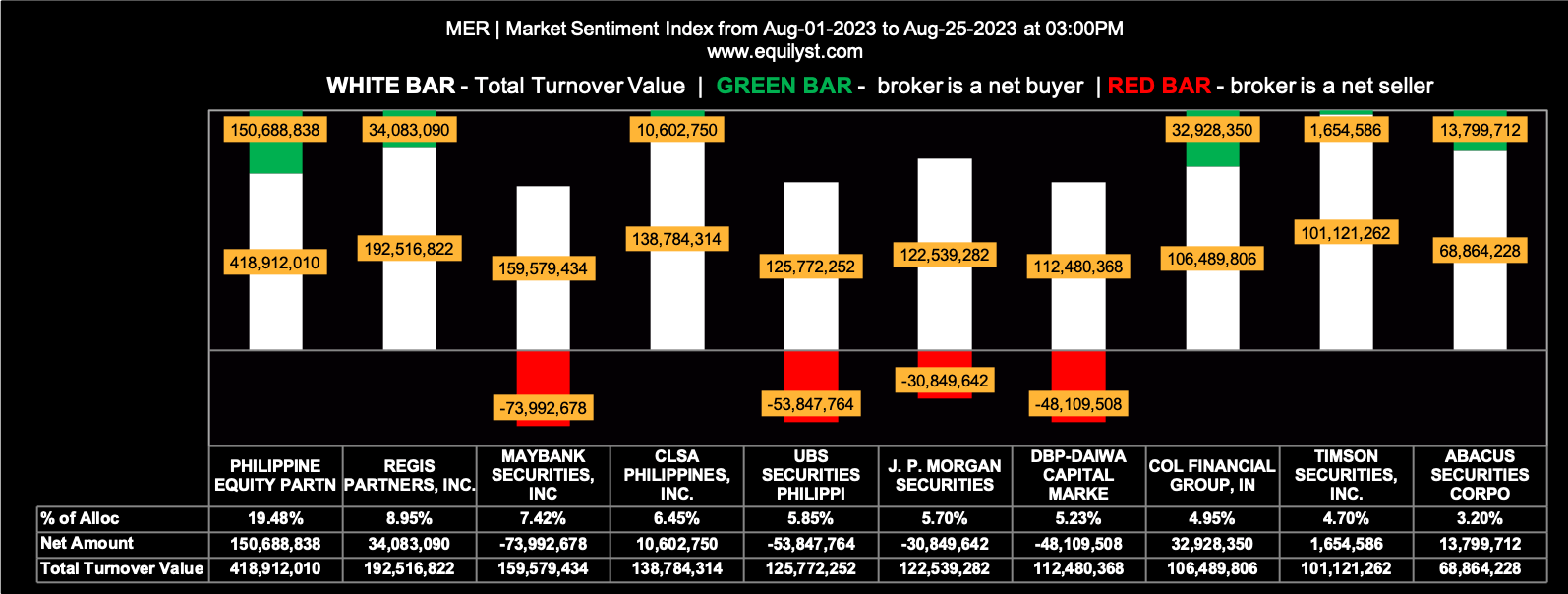

Manila Electric Company (MER)

Market Sentiment Index: BEARISH

35 of the 83 participating brokers, or 42.17% of all participants, registered a positive Net Amount

27 of the 83 participating brokers, or 32.53% of all participants, registered a higher Buying Average than Selling Average

83 Participating Brokers’ Buying Average: ₱341.75721

83 Participating Brokers’ Selling Average: ₱344.72406

5 out of 83 participants, or 6.02% of all participants, registered a 100% BUYING activity

17 out of 83 participants, or 20.48% of all participants, registered a 100% SELLING activity

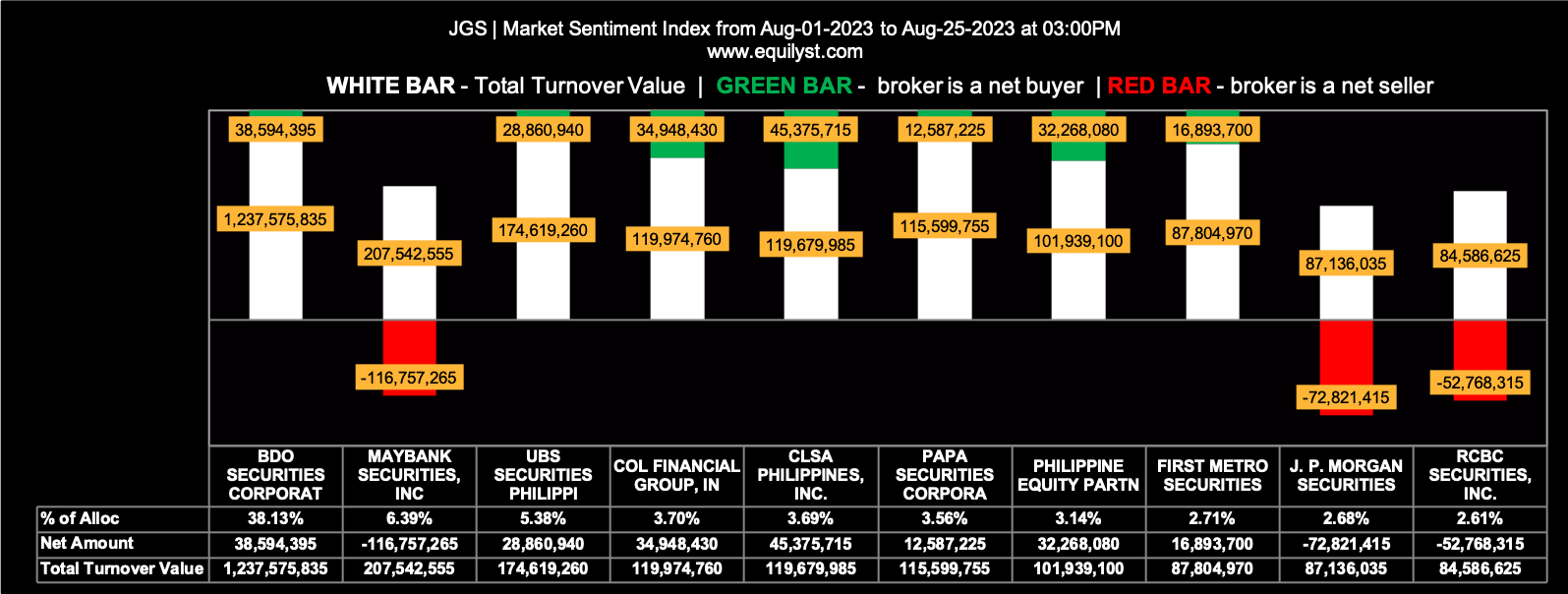

JG Summit Holdings (JGS)

Market Sentiment Index: BULLISH

69 of the 84 participating brokers, or 82.14% of all participants, registered a positive Net Amount

52 of the 84 participating brokers, or 61.90% of all participants, registered a higher Buying Average than Selling Average

84 Participating Brokers’ Buying Average: ₱39.07157

84 Participating Brokers’ Selling Average: ₱39.18847

21 out of 84 participants, or 25.00% of all participants, registered a 100% BUYING activity

2 out of 84 participants, or 2.38% of all participants, registered a 100% SELLING activity

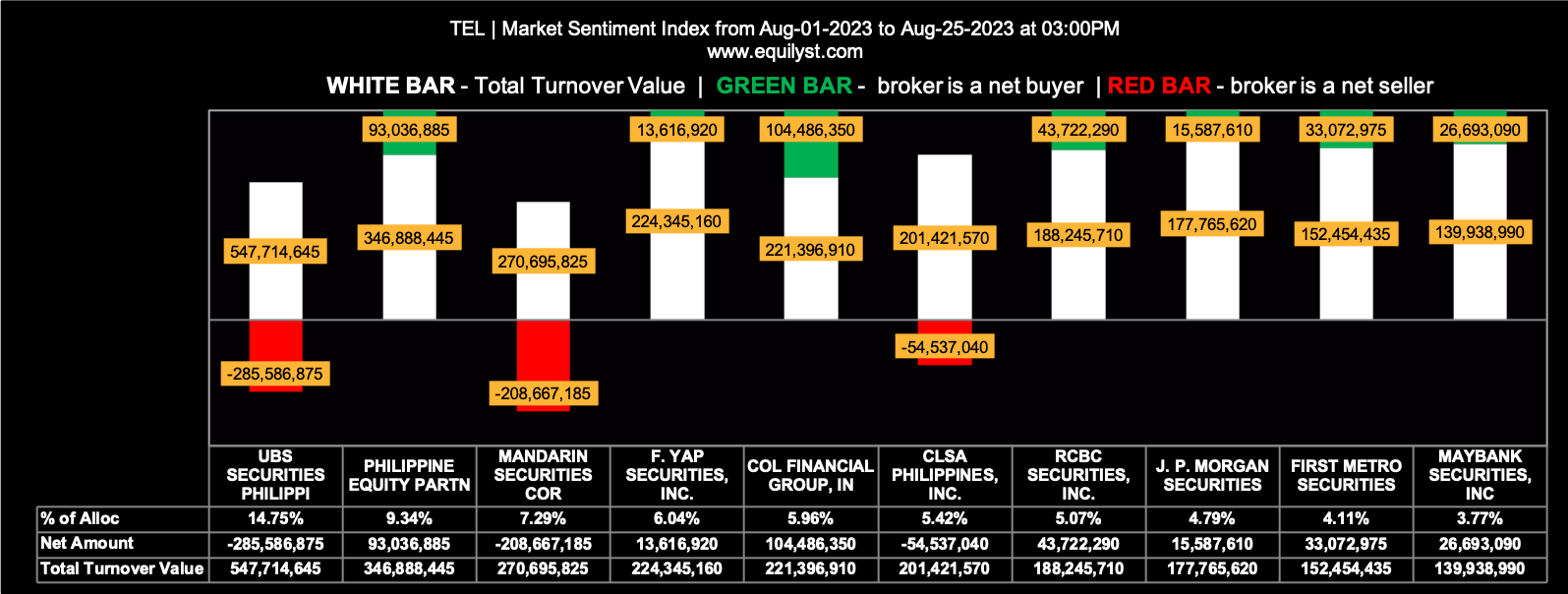

PLDT (TEL)

Market Sentiment Index: BEARISH

74 of the 95 participating brokers, or 77.89% of all participants, registered a positive Net Amount

44 of the 95 participating brokers, or 46.32% of all participants, registered a higher Buying Average than Selling Average

95 Participating Brokers’ Buying Average: ₱1258.45943

95 Participating Brokers’ Selling Average: ₱1287.89157

28 out of 95 participants, or 29.47% of all participants, registered a 100% BUYING activity

1 out of 95 participants, or 1.05% of all participants, registered a 100% SELLING activity

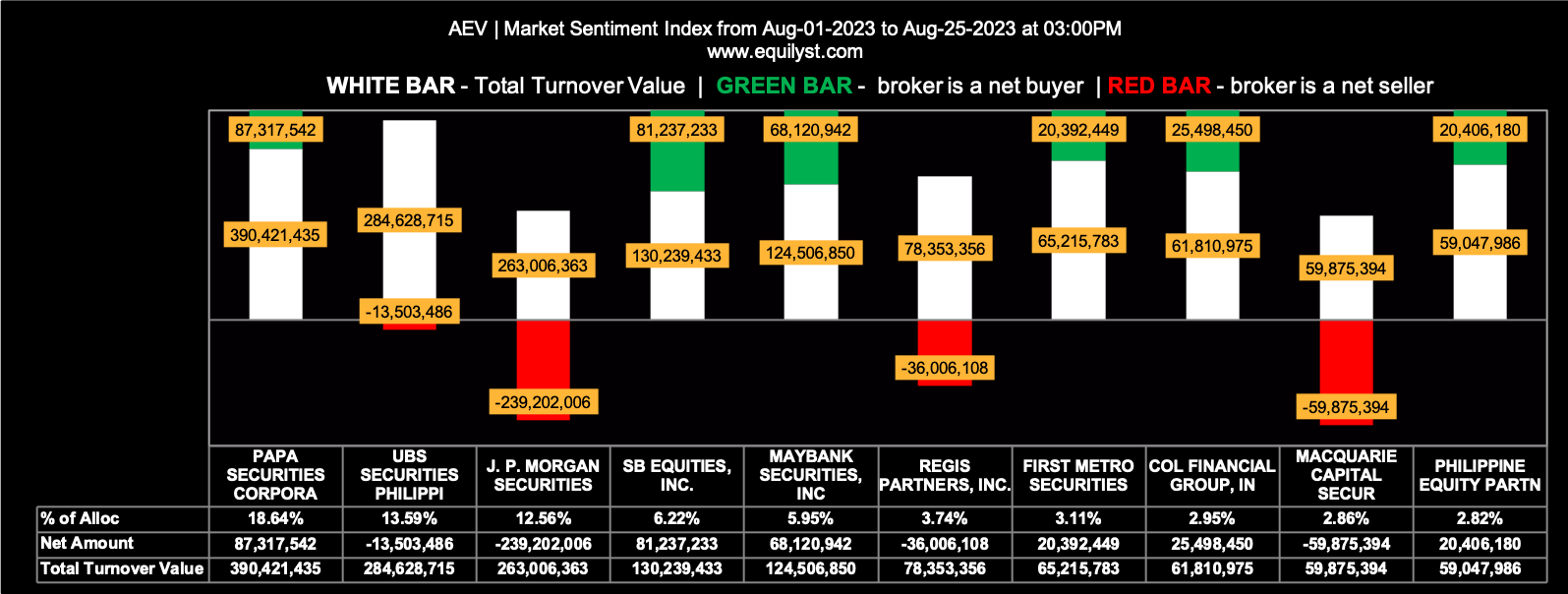

Aboitiz Equity Ventures (AEV)

Market Sentiment Index: BULLISH

61 of the 80 participating brokers, or 76.25% of all participants, registered a positive Net Amount

46 of the 80 participating brokers, or 57.50% of all participants, registered a higher Buying Average than Selling Average

80 Participating Brokers’ Buying Average: ₱49.16813

80 Participating Brokers’ Selling Average: ₱49.34531

20 out of 80 participants, or 25.00% of all participants, registered a 100% BUYING activity

3 out of 80 participants, or 3.75% of all participants, registered a 100% SELLING activity

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025