In this report, I’ll show you the Dominant Range Index rating and the dominant prices (price range with the biggest volume and highest number of trades) for the 10 most traded stocks as of September 22, 2023.

The dominant prices are either a standalone price or a range of prices with the highest volume and the greatest number of trades.

Imagine you’re on the verge of buying the stock. If the dominant prices are closer to the intraday low than the intraday high, will you rush into buying, or will you wait a bit longer because the price is likely to continue moving downward?

Now, consider you’re about to realize your gains, even though your trailing stop is still in place. If the dominant prices are closer to the intraday high than the intraday low, will you rush into selling, or will you wait a bit longer because the price is likely to continue moving upward?

Picture this: it’s been 60 minutes since the opening bell. If the current price is at the intraday high itself, but the dominant prices include the intraday low, wouldn’t that make you question the sustainability of the intraday bullishness?

I’ve only presented you with three scenarios where understanding the location of the dominant prices is useful in decision-making. There’s a lot more we can discuss in my stock investment consultancy service. Learn about the requirements here.

At Equilyst Analytics, you can:

- hire me as your private stock investment consultant

- hire me as your crypto and stock investment content writer

- subscribe to my members-only stock analyses

- subscribe to my members-only stock screener so you’ll know which stocks I’m monitoring daily

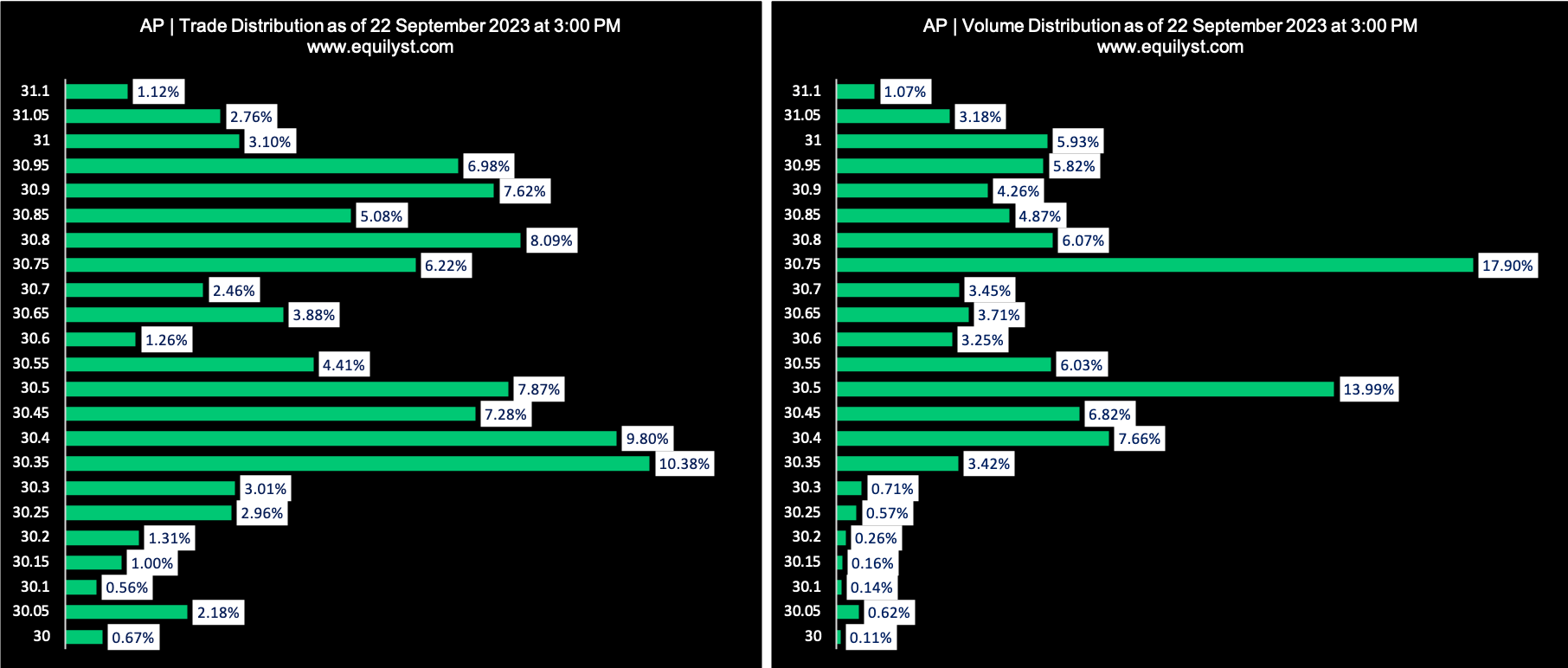

Aboitiz Power Corporation (AP)

Dominant Range Index: BULLISH

Last Price: 30.75

VWAP: 30.67

Dominant Range: 30.35 – 31.00

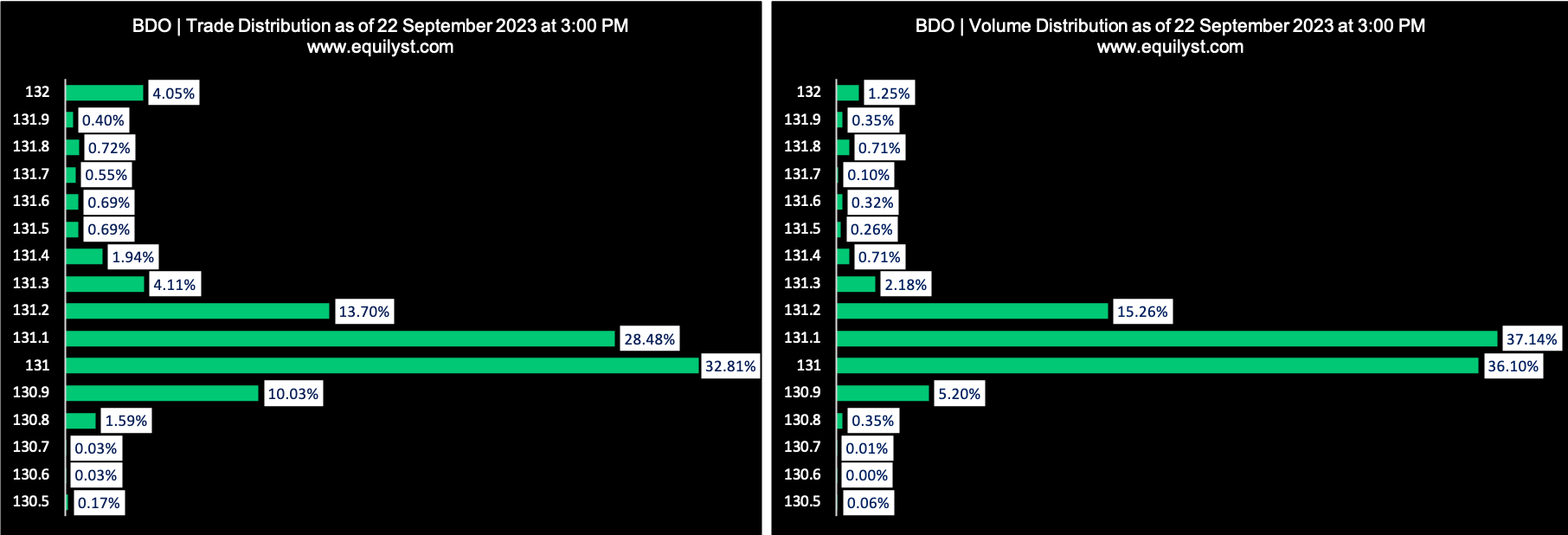

BDO Unibank (BDO)

Dominant Range Index: BEARISH

Last Price: 131.00

VWAP: 131.10

Dominant Range: 130.90 – 131.20

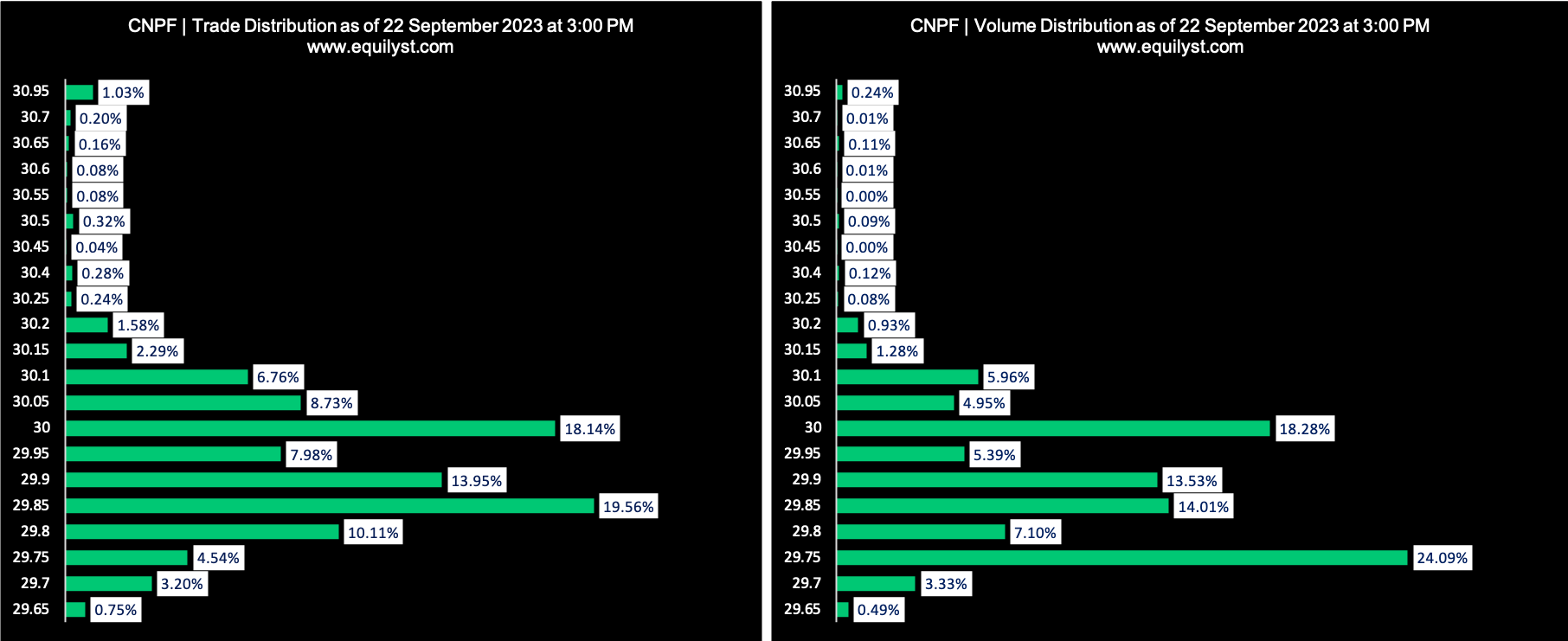

Century Pacific Food (CNPF)

Dominant Range Index: BEARISH

Last Price: 29.75

VWAP: 29.89

Dominant Range: 29.75 – 30.10

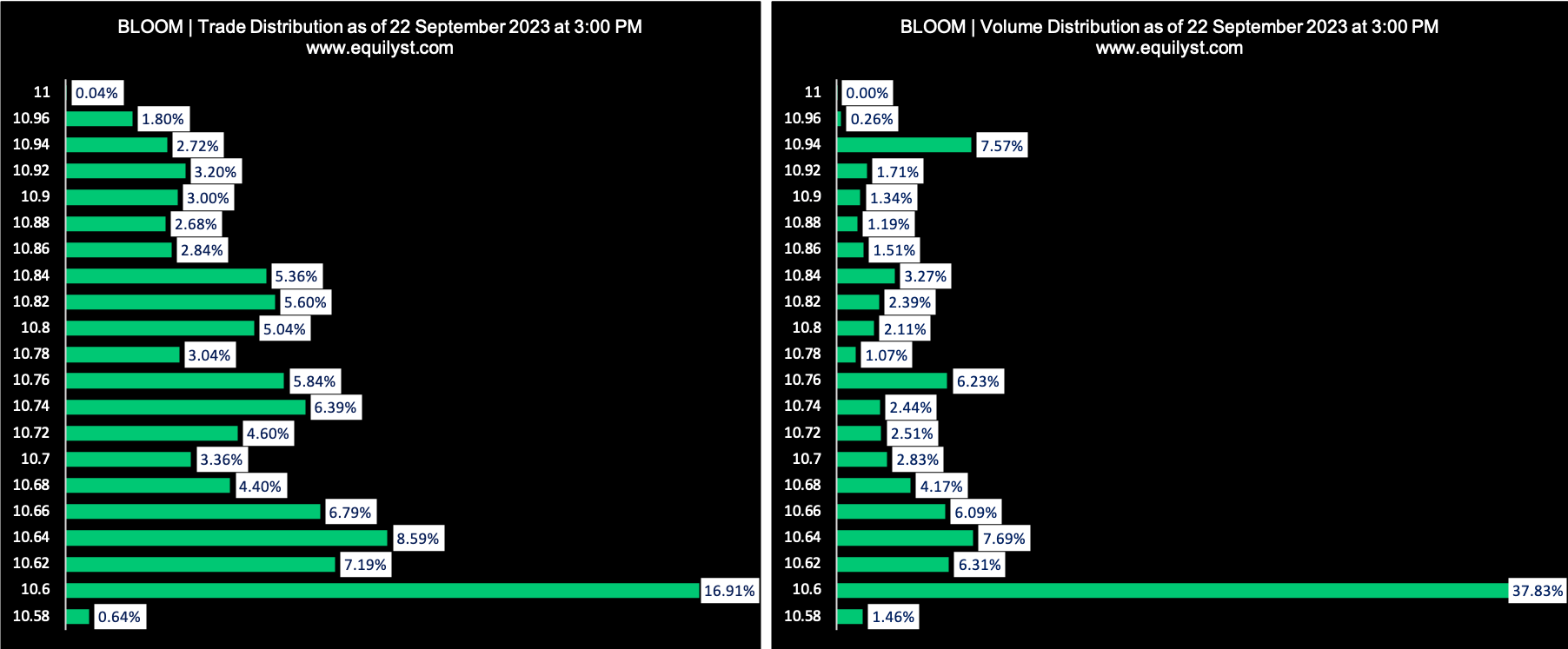

Bloomberry Resorts Corporation (BLOOM)

Dominant Range Index: BEARISH

Last Price: 10.60

VWAP: 10.69

Dominant Range: 10.60 – 10.66

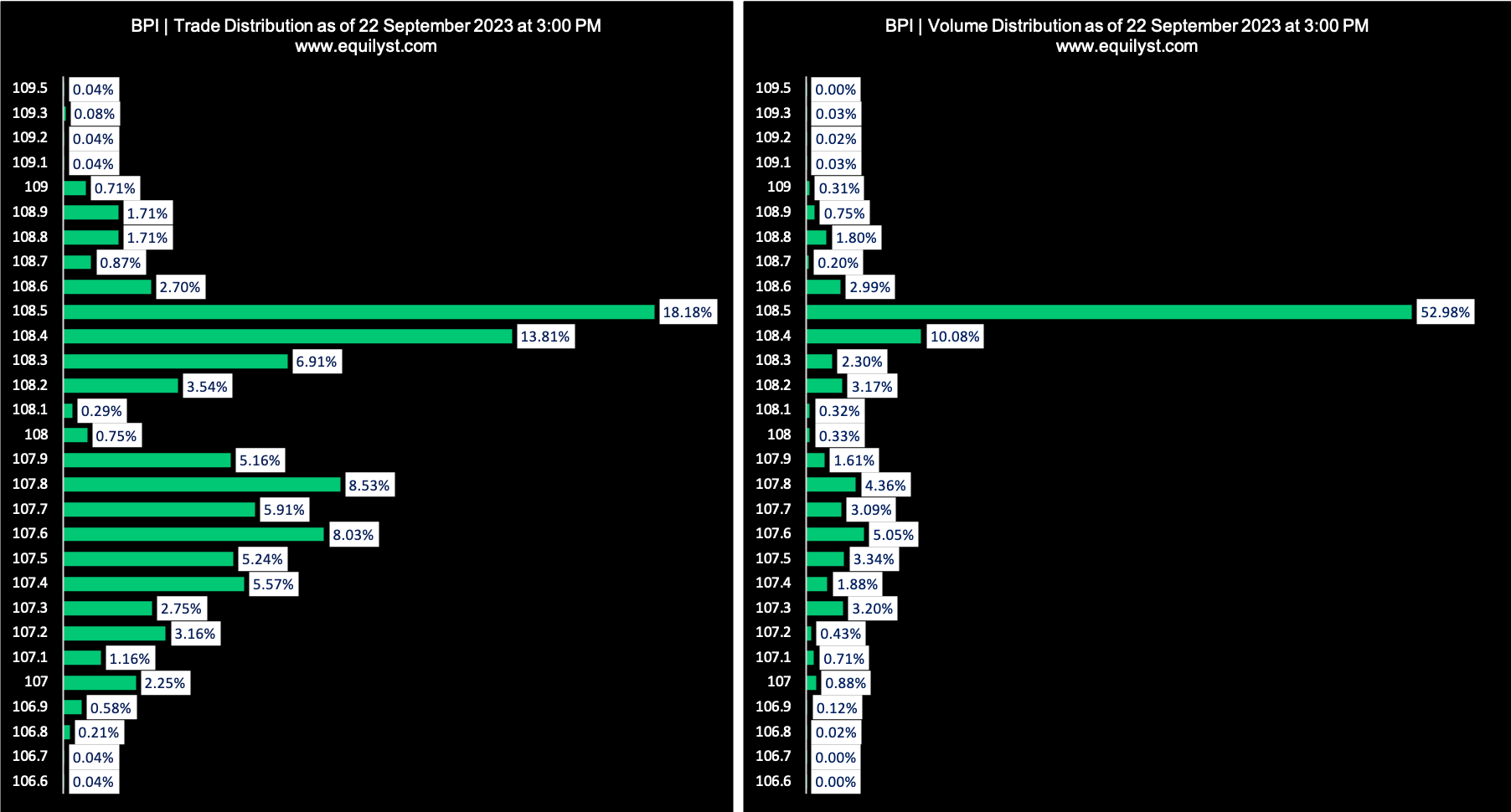

Bank of the Philippine Islands (BPI)

Dominant Range Index: BULLISH

Last Price: 108.50

VWAP: 108.25

Dominant Range: 108.30 – 108.50

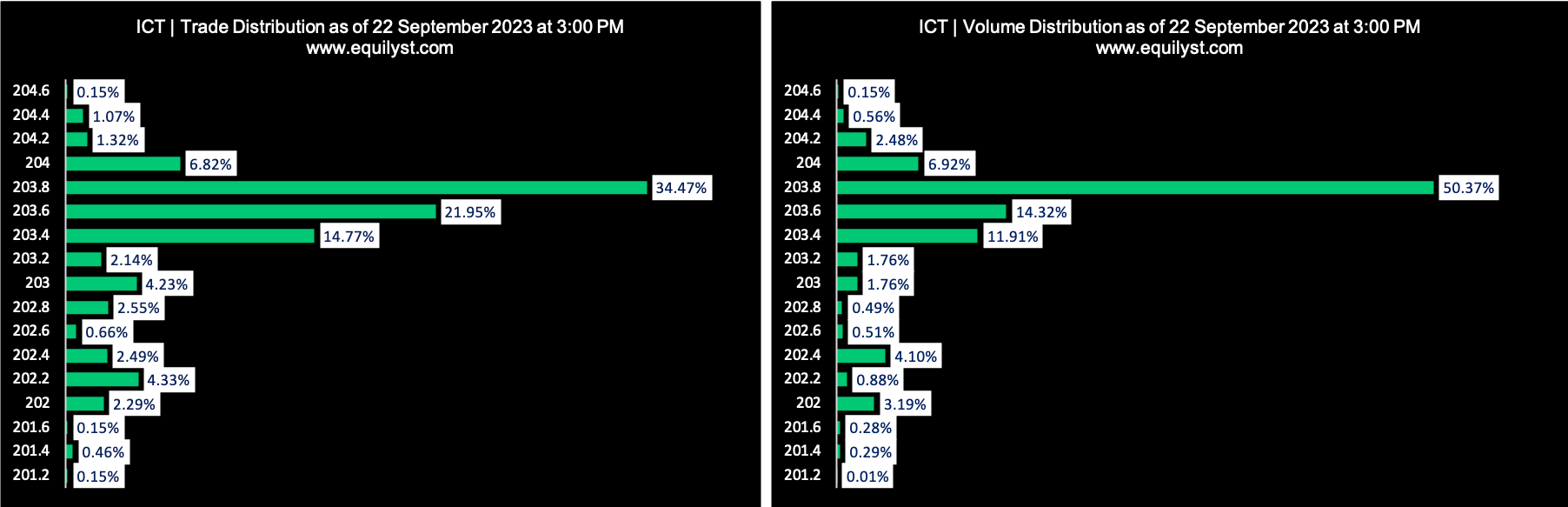

International Container Terminal Services (ICT)

Dominant Range Index: BULLISH

Last Price: 203.80

VWAP: 203.57

Dominant Range: 203.40 – 204.00

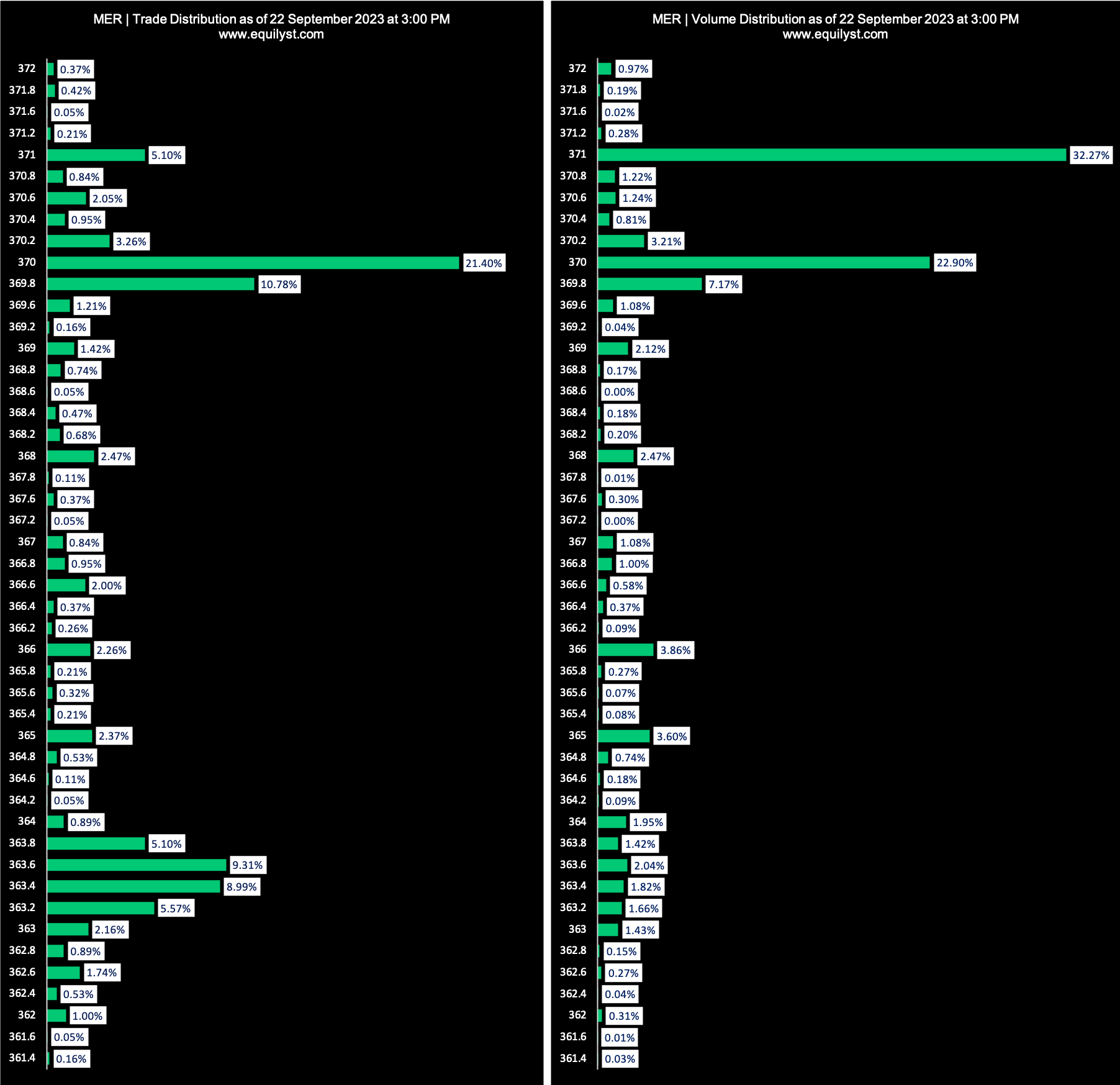

Manila Electric Company (MER)

Dominant Range Index: BULLISH

Last Price: 371.00

VWAP: 369.03

Dominant Range: 369.80 – 371.00

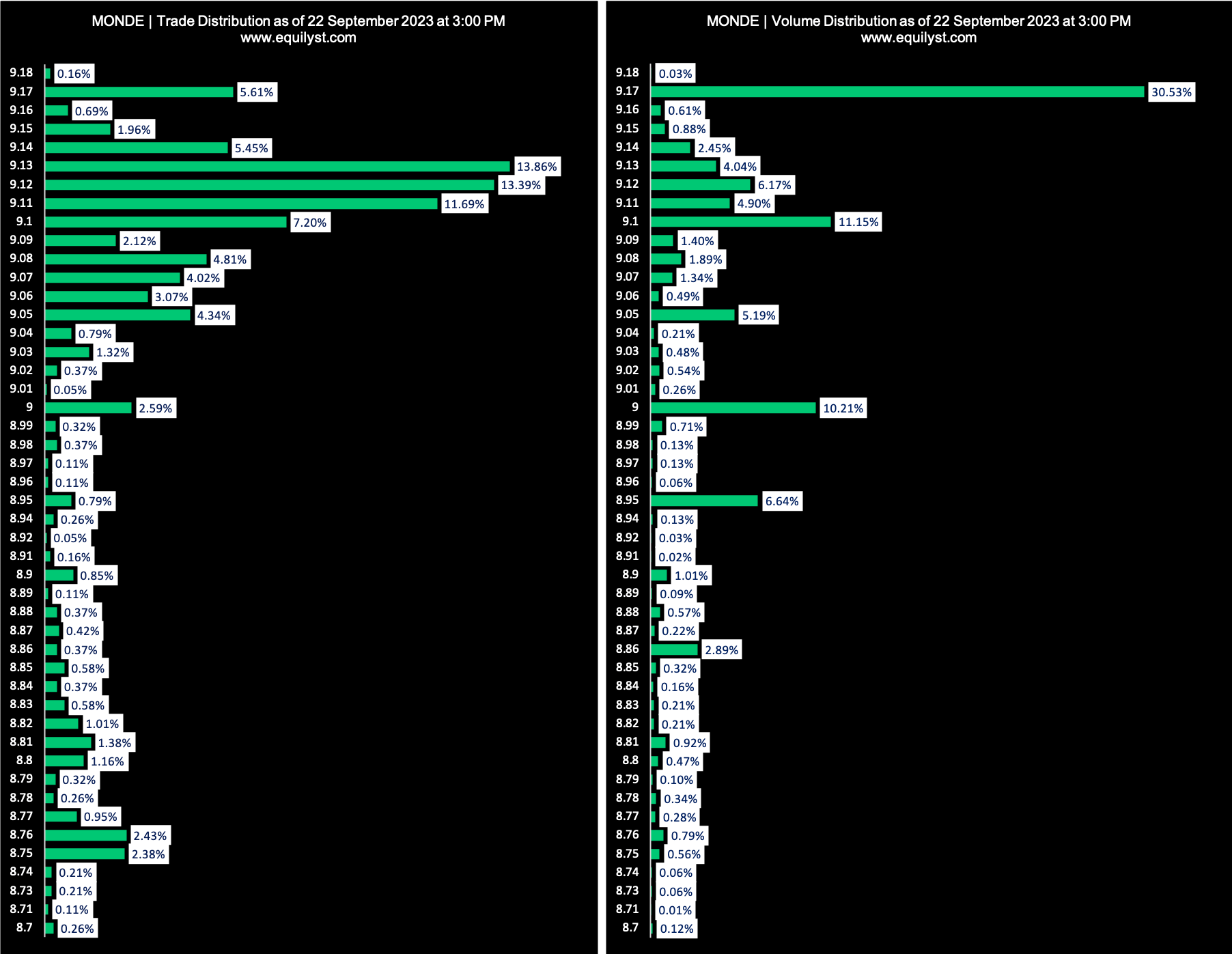

Monde Nissin Corporation (MONDE)

Dominant Range Index: BULLISH

Last Price: 9.17

VWAP: 9.07

Dominant Range: 9.10 – 9.17

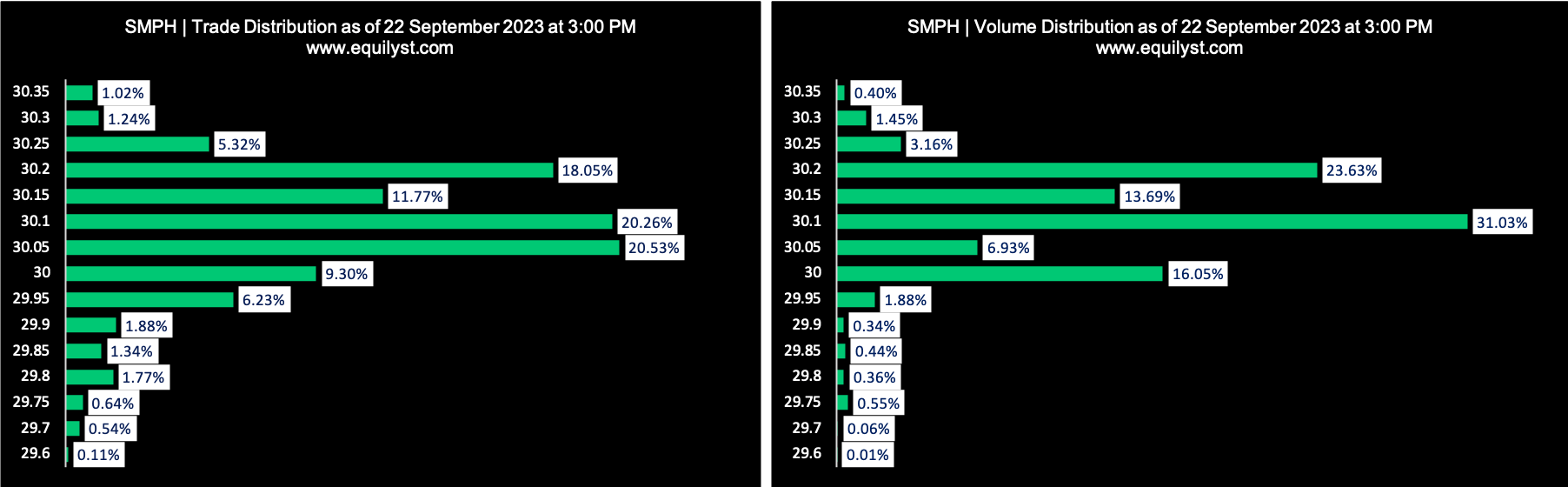

SM Prime Holdings (SMPH)

Dominant Range Index: BULLISH

Last Price: 30.20

VWAP: 30.11

Dominant Range: 30.00 – 30.20

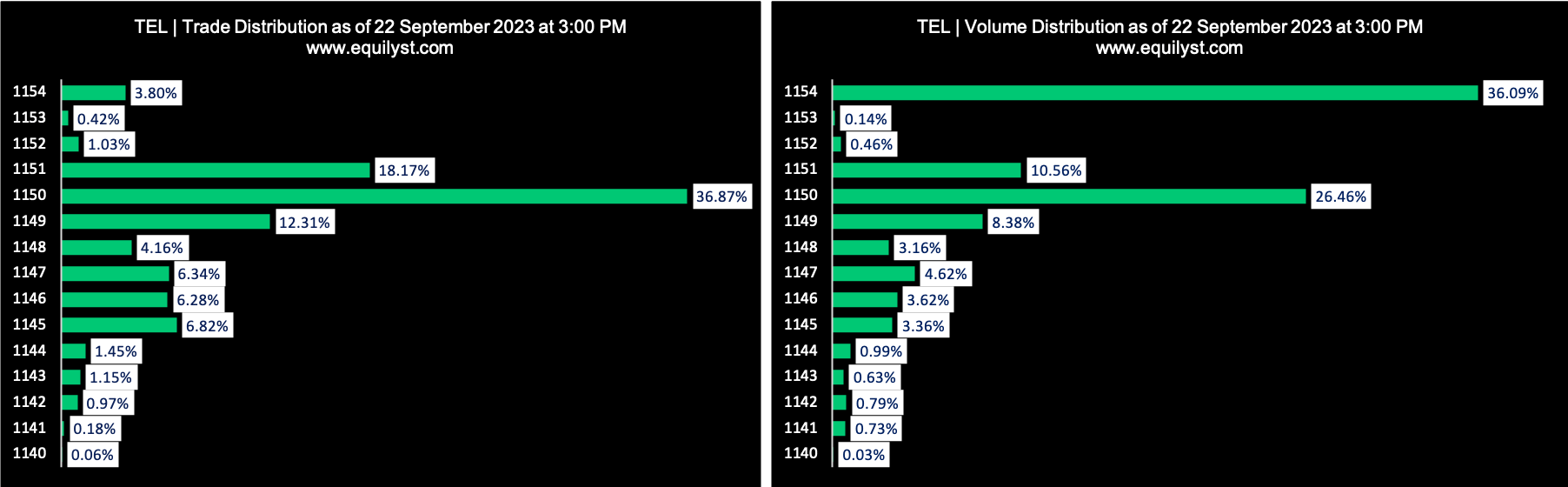

PLDT (TEL)

Dominant Range Index: BULLISH

Last Price: 1,154.00

VWAP: 1,150.73

Dominant Range: 1,149.00 – 1,154.00

At Equilyst Analytics, you can:

- hire me as your private stock investment consultant

- hire me as your crypto and stock investment content writer

- subscribe to my members-only stock analyses

- subscribe to my members-only stock screener so you’ll know which stocks I’m monitoring daily

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025