Monde Nissin Corporation (MONDE) Technical Analysis

Monde Nissin Corporation (MONDE) has experienced higher daily volume compared to its 10-day volume average for the majority of trading days. However, during the second and third weeks of May 2023, the volume was below 50% of the 10-day volume average.

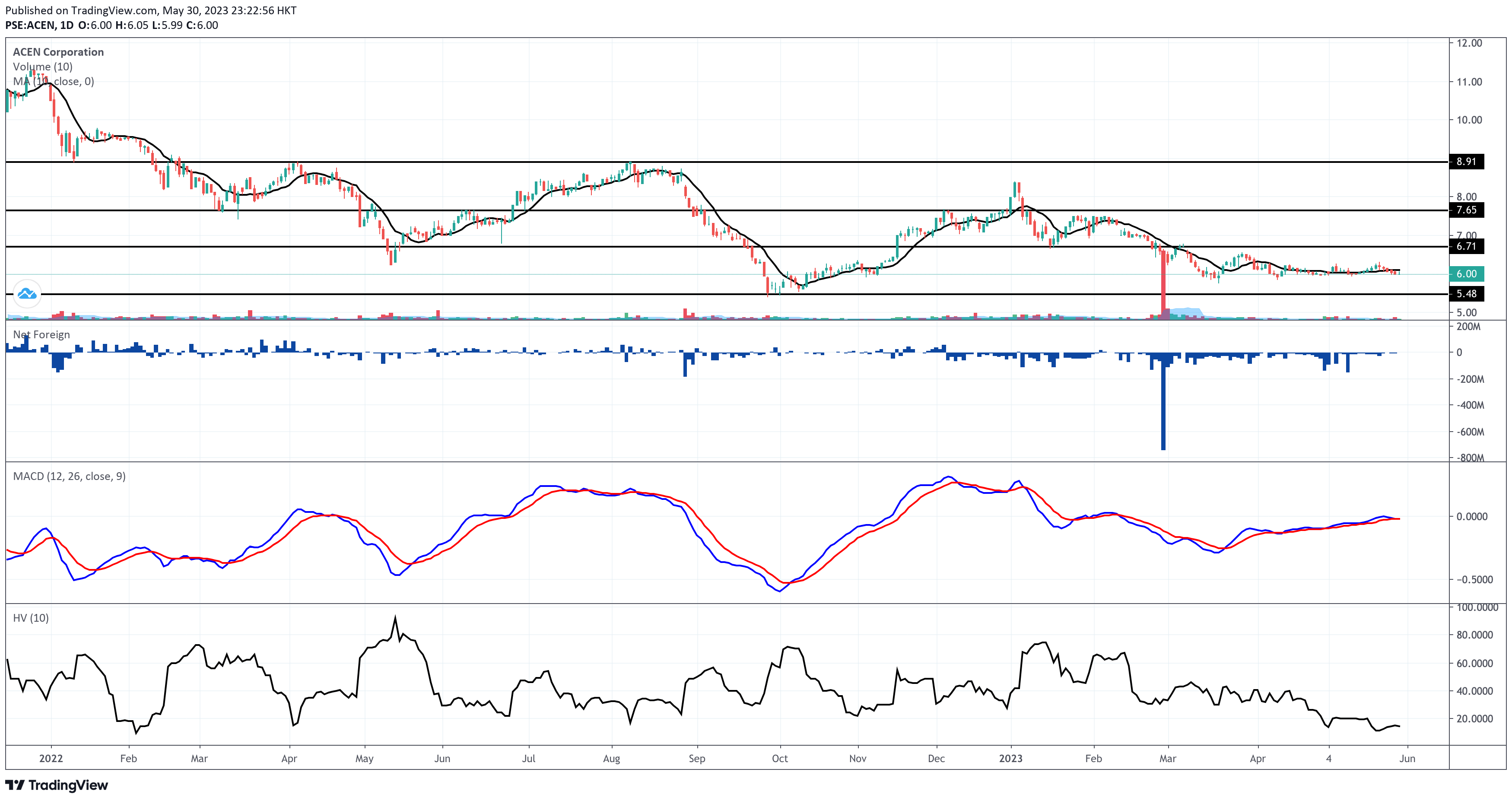

Since reaching its all-time high in October 2021, MONDE has been following a downtrend channel. Analyzing its daily chart from March to May, we observe a sideways movement in the short-term channel.

The continuous net foreign selling activities have contributed to the prevailing bearish sentiment surrounding MONDE. Both short-term traders and long-term investors are awaiting a significant catalyst that could drive the price upward.

A bearish signal is evident as the last price of MONDE falls below the 10-day simple moving average, accompanied by the moving average convergence divergence (MACD) line crossing below its signal line.

Although MONDE maintains a low level of volatility, with no significant price fluctuations or engulfing price gaps over the past 10 trading days, this factor provides limited relief and fails to mitigate the existing paper losses.

The primary level of support for MONDE is observed around P5.50. On the other hand, the immediate resistance level is approximately P6.70. These key price levels play a crucial role in determining potential buying and selling opportunities for investors.

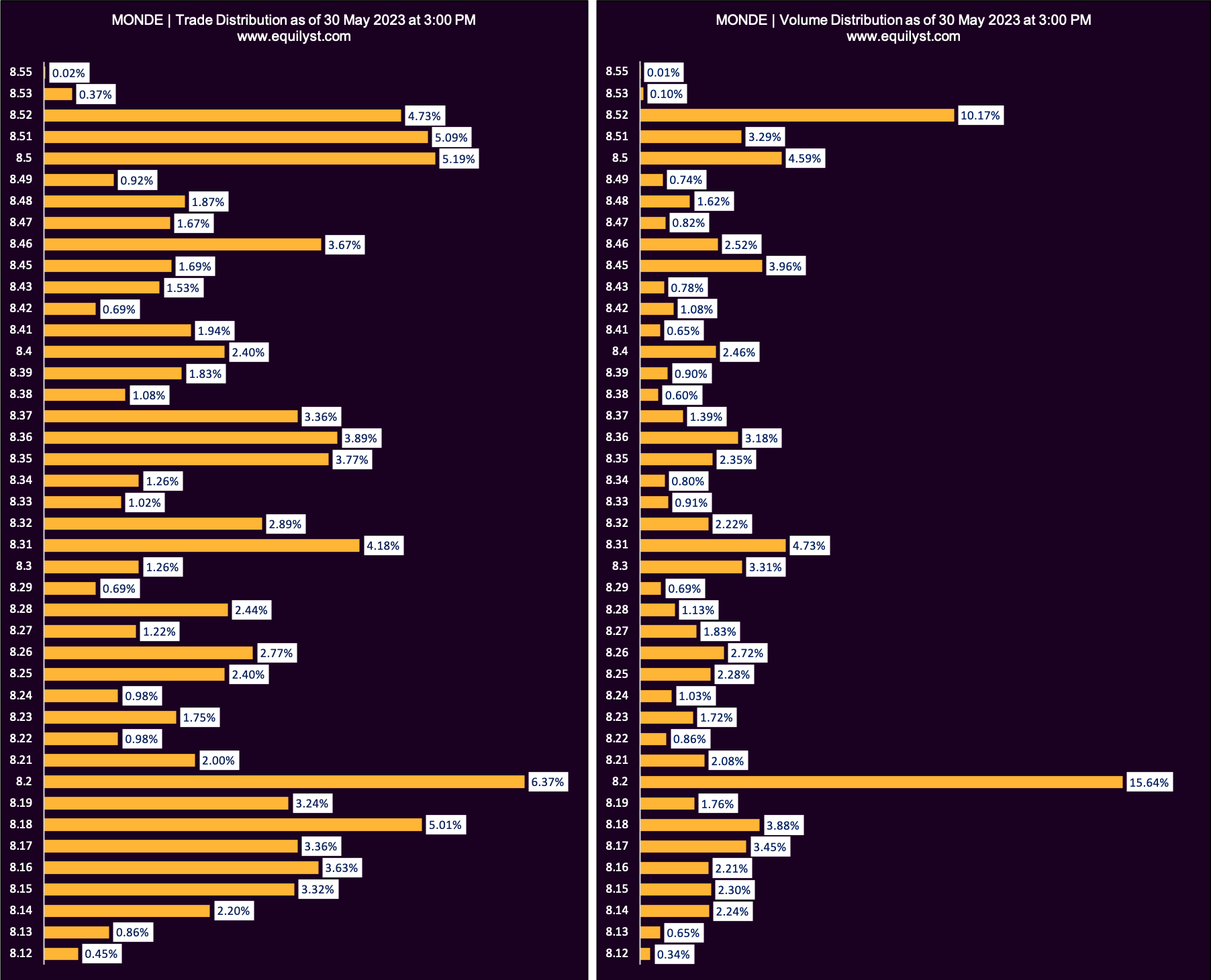

Trade and Volume Analysis

Dominant Range Index: BEARISH

Last Price: 8.2

VWAP: 8.32

Dominant Range: 8.2 – 8.2

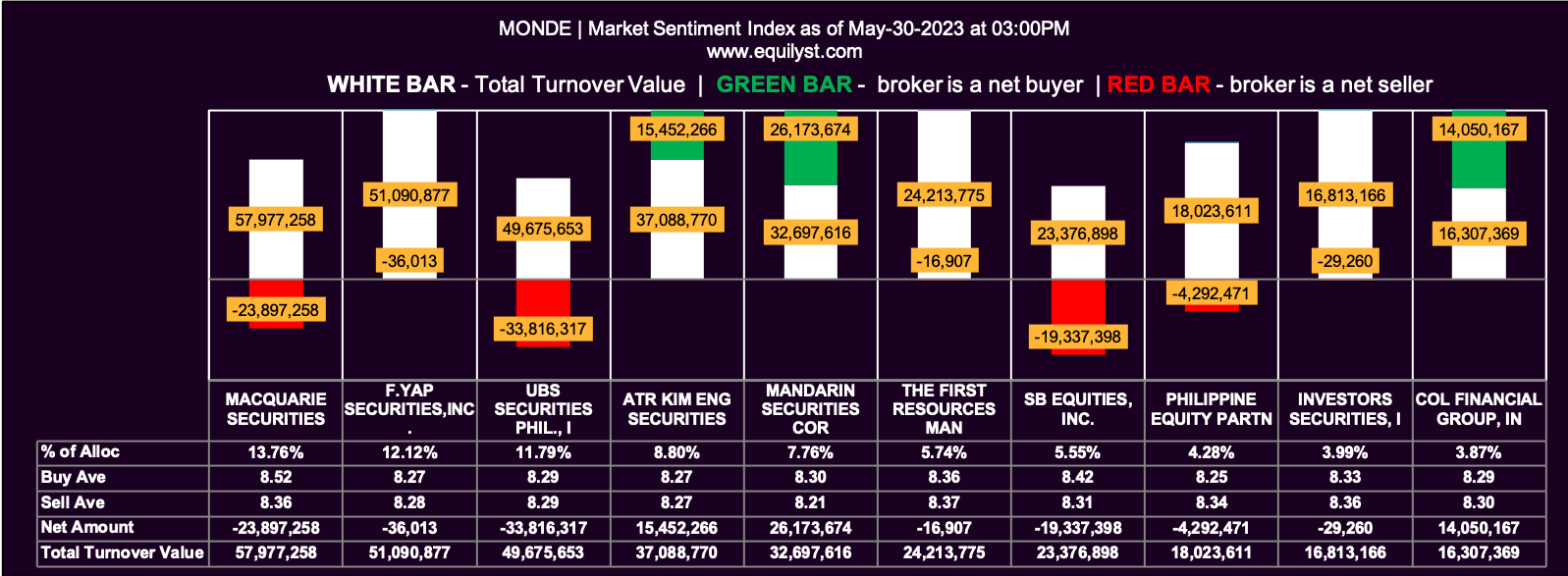

Market Sentiment Analysis

Market Sentiment Index: BULLISH

42 of the 59 participating brokers, or 71.19% of all participants, registered a positive Net Amount

37 of the 59 participating brokers, or 62.71% of all participants, registered a higher Buying Average than Selling Average

59 Participating Brokers’ Buying Average: ₱8.30448

59 Participating Brokers’ Selling Average: ₱8.32721

28 out of 59 participants, or 47.46% of all participants, registered a 100% BUYING activity

2 out of 59 participants, or 3.39% of all participants, registered a 100% SELLING activity

The contrarian sentiments arising from my trade-volume and market sentiment analysis indicate a growing presence of bearish investors.

Verdict

If you currently hold MONDE, it is advisable to evaluate whether your trailing stop is still intact. If it is, maintaining your position without adding more shares is recommended. Consider preemptively adjusting your trailing stop if both the Dominant Range Index and Market Sentiment Index display consecutive bearish signals for 2 to 3 trading days. If you have not calculated your trailing stop, I suggest using my trailing stop calculator.

On the other hand, if MONDE is not yet a part of your portfolio, it is preferable to wait for all 6 indicators of my Evergreen Strategy to exhibit bullish signals. Once these indicators align, it is crucial to calculate the reward-to-risk ratio and determine its suitability. If the ratio meets your satisfaction, then consider buying within the prevailing dominant range.

Seeking Additional Assistance?

To gain comprehensive knowledge on preserving capital, protecting gains, and minimizing losses using the methodology of my Evergreen Strategy, I recommend registering for my GOLD package. This package will provide you with valuable insights and guidance.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025